USDC Making $100M+/month in Revenue 💰

Instagram-Like Web3 Wallet | SushiSwap Exploit

GM folks 👋🏻 — Happy Monday,

FTX new management released a 45-page report. It once again highlight SBF’s shenanigans at his old firm. SBF literally said: “Alameda is unauditable. We’re only able to ballpark what its balances are, let alone something like a comprehensive transaction history.”

What an exciting start to the week.

In Today's Email:

What Matters: SushiSwap can't catch a break 🍣

Products: Easy, social crypto wallet 📱

Charts: ETH validators withdrawal, USDC making money 📈

Check out our weekend issue, Breaking Down Businesses, covering Aave, here.

Reply to this email to let us know what protocols/companies you want us to cover!

Narratives: With ETH withdrawal update coming in 2 days, get ready for new DeFi products around liquid staking derivatives.

WHAT MATTERS

SushiSwap Exploited: Revoke All Chains

State of play: DeFi protocol Sushi was exploited. The vulnerability revolves around an approve-related bug that allows the attacker to steal tokens without proper approval from the token owner.

Prominent DeFi figure 0xSifu lost more than $3M.

The protocol has since claimed that it's safe to trade again on Sushi.

You should revoke your approval with Sushi. Here are some sources to do so:

Built a website to check if any of your addresses got impacted by sushi hack, tells you which tokens need revoking

- It will never ask you to sign anything

- Even if it reports nothing you could still be impacted, my api keys will get rate-limited0xngmi.github.io/sushi-test-hac…

— 0xngmi (llamazip arc) (@0xngmi)

5:52 AM • Apr 9, 2023

What’s next: Sushi just can't catch a break. There's without a doubt that this exploit will be questioned by the SEC amidst its ongoing subpoena of Sushi and its CEO, Jared Grey.

Our take: How Sushi handles all of its problems will determine the future of a truly decentralized protocol.

Unlike other larger DAOs such as Maker or Lido, Sushi is arguably one of the most decentralized protocols without significant involvement from the original founder or team members.

If Sushi fails to solve all these problems, it would give an example that truly decentralized governance is extremely hard and inefficient.

For builders: Regaining users' trust after an exploit is key. Founders should read and practice good crisis management skills — and if your product directly touches users' funds, never compromise safety for speed.

For investors: Practice good hot wallet hygiene. Use multiple hot wallets for multiple different purposes, and constantly check your approvals using tools such as revoke.cash.

Take a peek at our new referral reward at the bottom of this issue. Share this newsletter and receive our list of 100 smart crypto investors' wallet addresses 👇

BROUGHT TO YOU BY

Bulla Network

Making crypto transactions is easy. Tracking and managing them is a different story.

When was that airdrop? What chain did I make that payment on? Sound familiar? And when it’s time for financial reporting, it gets even more complicated.

Enter Bulla Network, the most advanced all-in-one native web3 solution for making, tracking and organizing transactions. Simply connect your wallet to start, no onboarding necessary. Our source-of-truth protocol means transactions are updated automatically for all parties.

With our latest tool, the Transaction Importer, you can also scan and upload past transactions onto your dashboard, giving a comprehensive 360-degree view. Multi-tagging and categorizing features allows for fully customized reporting and planning.

Why not free up time and hassle so you can manage and scale your web3 business or DAO with Bulla!

PRODUCTS OF THE WEEK

Easy: Web3 Social Wallet

What is Easy: Easy is a crypto wallet with social elements. Users can curate NFT collections, join various communities, and conduct on-chain searches. The goal is to make a product that's not too technical and allows for the creation of web3 social identity.

Easy has a UI layout that's similar to social media apps such as Instagram.

Easy raised a $14.2M Seed Round in January 2023.

Investors in the round include Lobby Capital, Relay Ventures, 6th Man Ventures, and many more.

Other cool products:

Holograph, a tool to deploy, mint, and bridge multichain NFTs.

Surfaceboard, a dashboard for Polygon NFTs.

Easy, a web3 native social media feeds.

Metla, an all-in-one crypto portfolio analytics panels.

Mest, an AI-powered crypto wallet tracker.

CHARTS OF THE WEEK

ETH Validators Withdrawal Pace

First, staking rewards and the original 32 ETH deposited in order to become a validator and participate in Proof-of-Stake are different.

Staking rewards can be withdrawn immediately post Shapella upgrade.

Validators 32 ETH withdrawals will be limited to 1,800 validators per day.

Our take: Most validators won’t withdraw their original pool of 32 ETH, they will simply test if they can withdraw their staking rewards.

To watch: New DeFi financial products that will emerge once people get the comfort that Ethereum staking is truly safe-and-sound.

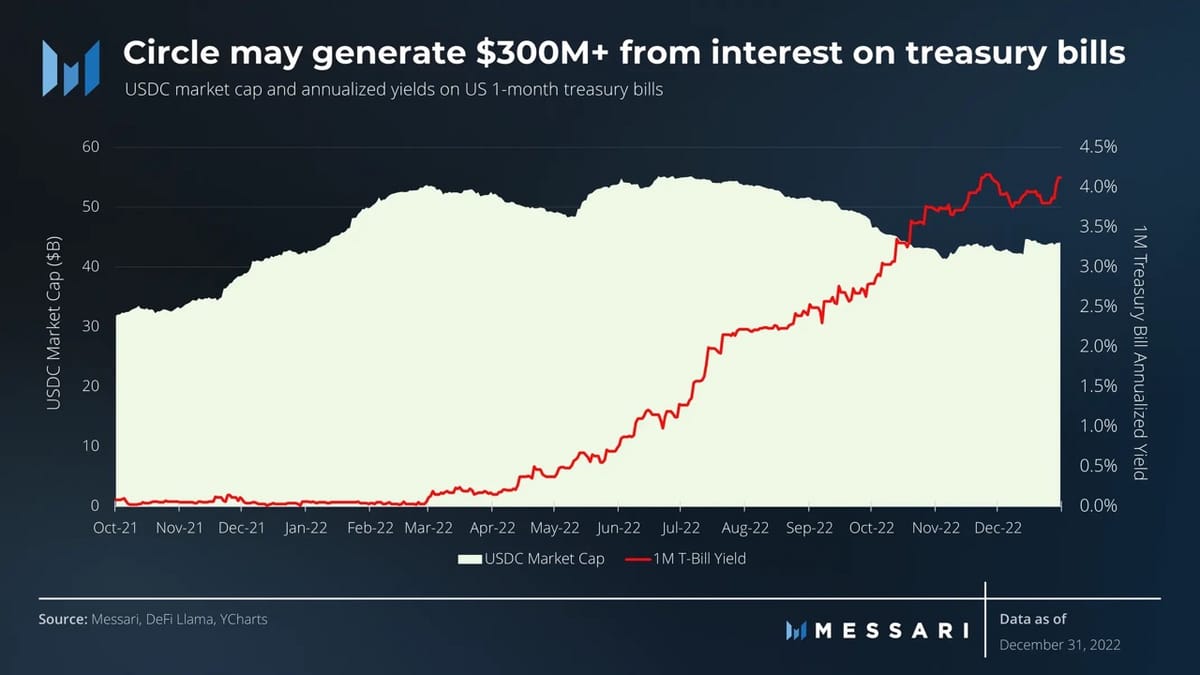

USDC Making Money

State of Play: Circle, the issuer of USDC is predicted to have made $300M+ from US T-Bills in Q4 2022 alone.

Alas, USDC is increasingly contributing to the top line revenue for Coinbase, who is Circle’s partner in the Centre Consortium, the entity responsible behind USDC.

Our take: DeFi will continue to find innovative ways to translate these real-world yield on-chain. We’re seeing new projects emerging that provides DeFi participants exposure to emerging markets debt, US T-Bills, and many more.

QUICK BITES

Binance US struggles to find a bank.

BitGet starts a $100M Asia-focused web3 fund.

SushiSwap exploited for over $3M.

Bank of England targets a 30 people team for CBDC development.

dYdX exits Canadian market, citing regulatory concerns.

OpenSea Pro overtakes rival Blur in key metrics.

FTX releases a new report highlighting control failures when SBF led the firm.

Arbitrum mulls returning 700M in ARB tokens after the community speaks up.

MEME & NOTEWORTHY READS

Interesting point, but an example might make it clearer. Can you think of a prominent person who's currently wasting his talents in software when he could be working on manufacturing and heavy industries?

— Paul Graham (@paulg)

4:52 PM • Apr 9, 2023

If you enjoy reading this issue, please consider subscribing. It takes 1 minute of your time but it would mean the world to us 🙇

Disclaimer: All the information presented in this publication and its affiliates is strictly for educational purposes only. It should not be construed or taken as financial, legal, investment, or any other form of advice.