UAE Sheikh Bought 49% of WLFI Pre Inauguration

Lido Launches stVaults on Mainnet | Tether Clears $10B Profit in 2025

📢Sponsor | 💡Telegram | 📰Past Editions

Good Morning,

A quiet UAE backed stake in a Trump linked crypto project raised governance questions, Tether posted another $10B year by monetizing Treasuries, and Bitcoin dropped below $80K as ETF flows turned sharply risk off.

Check out our latest podcast episode!

In Today's Email:

What Matters: UAE Sheikh Bought 49% of WLFI Pre Inauguration 👀

Product of the Week: Lido Launches stVaults on Mainnet 🚀

Charts: Tether Clears $10B Profit in 2025, Bitcoin Drops 📊

You read and share. We listen and improve. Send us feedback at [email protected].

Narratives: Liquidity Reality Check

For daily market updates and airdrop alphas, check out our telegram!

WHAT MATTERS

UAE Sheikh Bought 49% of WLFI Pre Inauguration

IMG: Tahnoon bin Zayed & Donald Trump

State of play: A Wall Street Journal investigation says an Abu Dhabi investment vehicle backed by Sheikh Tahnoon bin Zayed quietly bought a 49% stake in World Liberty Financial for $500M just four days before Donald Trump inauguration.

The deal was never disclosed publicly, about half the money was paid upfront, with $187M going to Trump family entities.

$31M linked to the family of Steve Witkoff, a co-founder of the project who later became US Middle East envoy. Eric Trump signed the agreement.

The transaction explains why Trump linked firm DT Marks DeFi quietly reduced its ownership from 75% to about 40% in early 2025.

Executives from G42, the AI group chaired by Tahnoon, also took board seats, making the UAE backed vehicle the project’s largest outside shareholder.

Months after the deal, the Trump administration approved large scale sales of advanced AI chips to the UAE, including to G42.

Another Tahnoon led firm also used World Liberty’s USD1 stablecoin for a $2B Binance investment, helping USD1 grow past $5B in circulation.

Democratic lawmakers have called for investigations into possible conflicts of interest.

Why it matters: This links a Trump tied crypto project with foreign money right as US policy on AI and crypto was moving. Even if it is clean, the timing invites scrutiny.

Our take: The issue is not illegality, it is incentives. Foreign capital gaining influence before major policy decisions creates perception risk, which can be just as damaging as real conflicts.

For builders and investors: Political exposure is now a real risk factor. Model it like regulatory risk. Who owns the cap table, when they entered, and what policy levers they care about all matter.

PRODUCT OF THE WEEK

Lido Launches stVaults on Mainnet

Lido has launched stVaults on Ethereum mainnet, completing its Lido V3 upgrade and shifting from a single staking product to a modular staking platform.

stVaults are non custodial, customizable staking vaults that let institutions, protocols, and L2s build purpose specific staking setups while still accessing Lido’s shared liquidity via stETH.

Day 1 users include Linea, which uses stVaults to auto stake bridged ETH at the infrastructure level, and Nansen, which launched its first ETH staking product using the vault framework.

Teams can customize validators, fees, risk profiles, and compliance controls without building staking infrastructure from scratch.

Other cool products:

Take a peek at our referral reward at the bottom of this issue. Share this newsletter and receive our list of 500 crypto VC individuals 👇

CHARTS OF THE WEEK

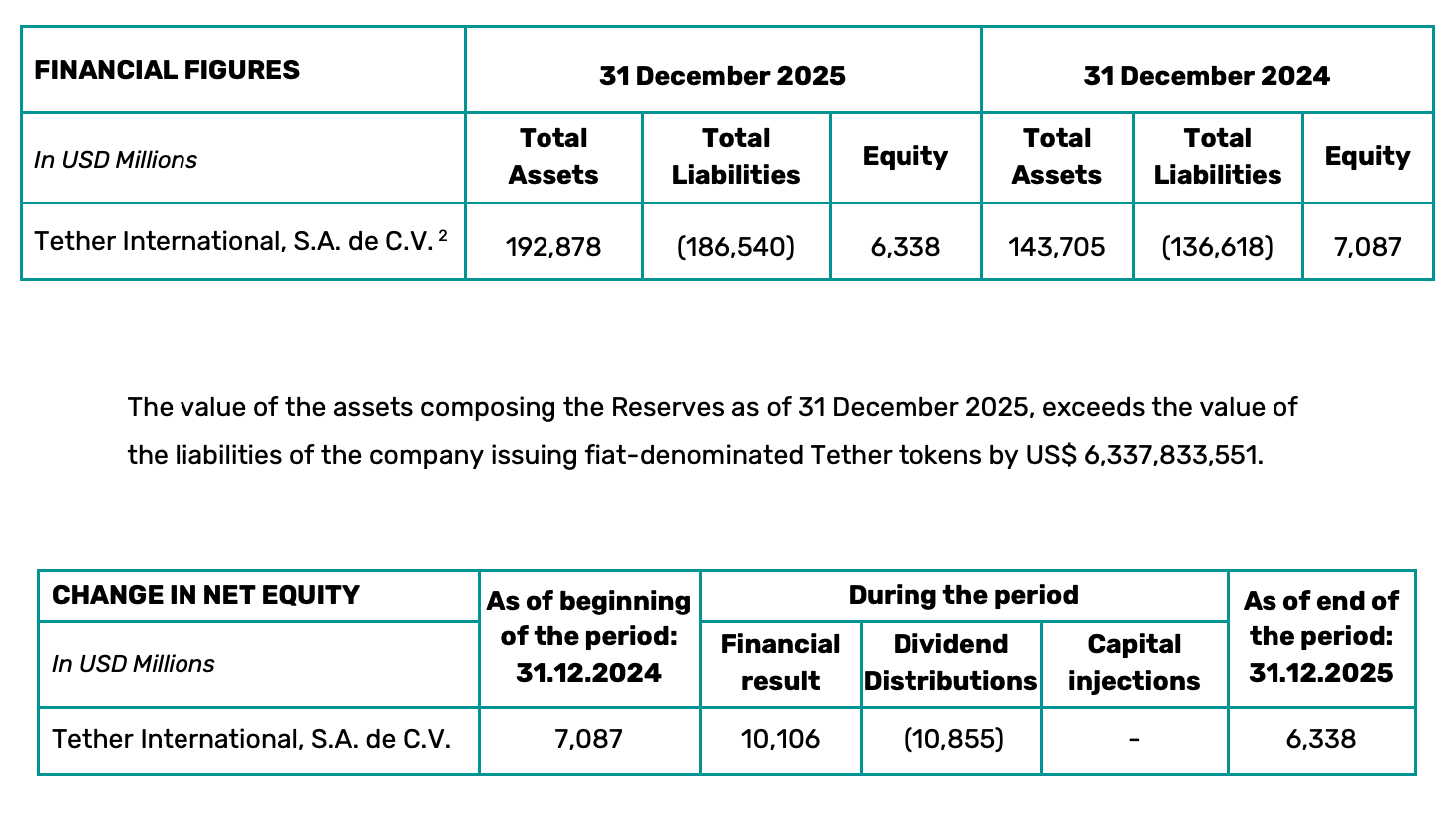

Tether Clears $10B Profit in 2025

Source: Tether

State of play: Tether reported over $10B in net profit for 2025, according to its latest attestation by BDO, confirming another massive year for the stablecoin giant.

USDT supply grew by more than $50B during the year, marking Tether’s second largest annual issuance ever.

Total USDT in circulation now sits above $186B, backed by $193B in assets, giving Tether $6.3B in excess reserves.

Most of the backing comes from US Treasuries, totaling around $122B, which effectively makes Tether one of the largest holders of US government debt.

The firm also holds about 140 tons of gold, supporting both reserves and its gold backed token XAUT.

In 2025, it also launched a US subsidiary and rolled out USAT, its fully US regulated stablecoin.

Our take: Tether is basically a high margin dollar liquidity machine. The profits come from scale and Treasuries, not complexity, and zero yield paid to users keeps margins huge.

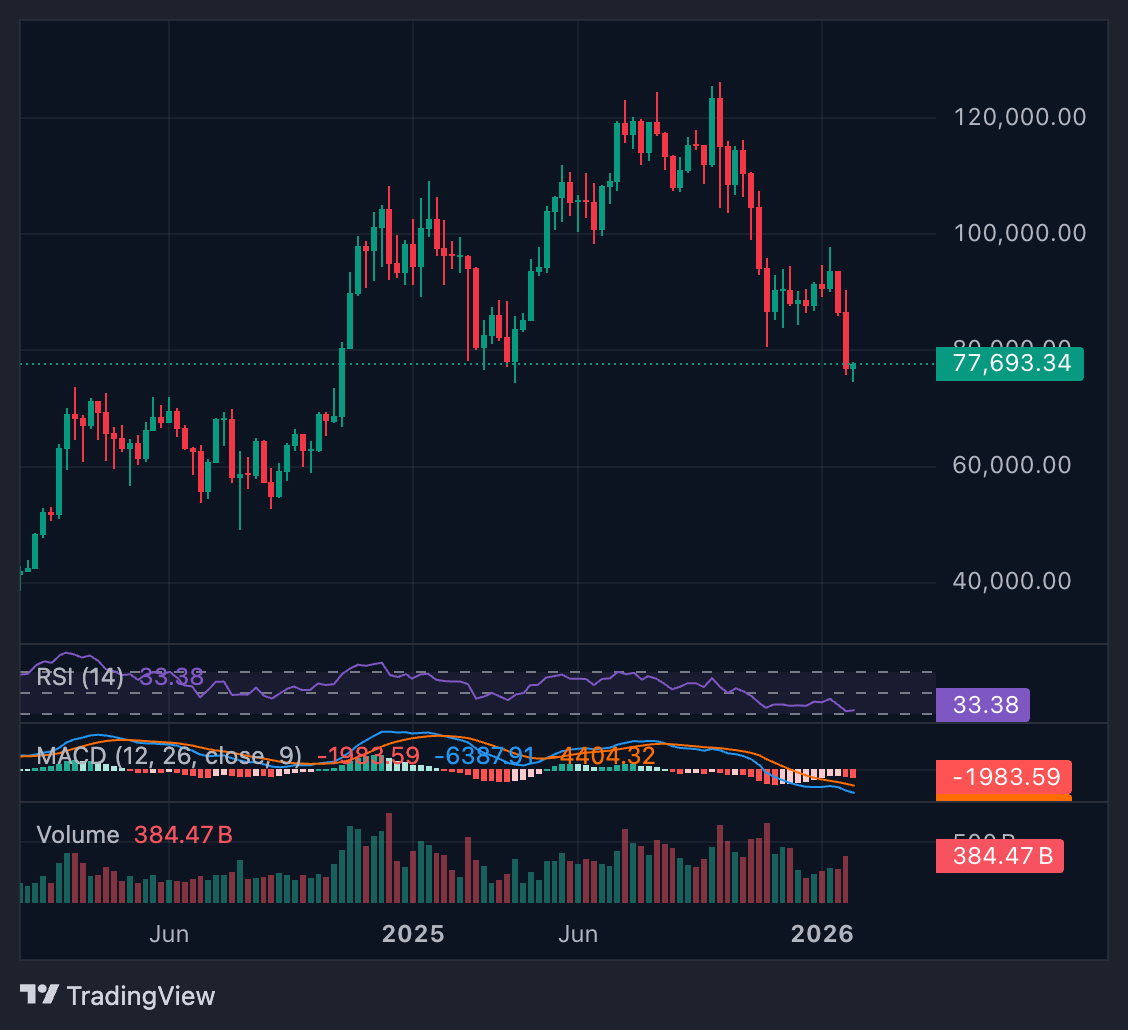

Bitcoin Drops Below $80K as ETF Outflows Surge

BItcoin Price Chart

State of play: Bitcoin dropped below $80,000 for the first time since April 2025 after US spot BTC ETFs recorded about $1.6B in net outflows in January 2026, the third-worst month on record.

Selling intensified late in the month, with $1.49B leaving in the final week alone, including an $818M single-day outflow.

BTC is now trading near $77,800, briefly dipping below MicroStrategy’s average cost basis.

Ether ETFs also saw heavy redemptions, losing roughly $353M for the month, while ETH briefly fell below $2,300.

In contrast, SOL & XRP ETFs showed relative strength, with SOL funds posting around $105M in net inflows and XRP ETFs ending January slightly positive.

Despite the drawdown, institutional interest remains, with Morgan Stanley filing to launch new Bitcoin and Solana ETFs.

Our take: The move appears macro-driven rather than crypto-specific. A risk-off shift followed the appointment of a more hawkish Fed chair and rising geopolitical tensions.

QUICK BITES

Crypto thieves, scammers plunder $370M in January.

Crypto funding rebounds as institutions test onchain finance.

Japan's Nomura cuts down crypto exposure following Q3 losses.

BTC drops below $80,000 following $1.6B in monthly ETF outflows.

BitMine Immersion faces $6B paper loss as Ether sell-off deepens.

UAE Sheikh secretly acquired 49% of Trump's World Liberty Financial.

Tether rakes in over $10B net profit in 2025 as excess reserves top $6.3B.

Crypto exchanges sanctioned alongside Iranian officials in Iran crackdown.

NOTEWORTHY READS & MEME

If you enjoy reading this issue, please consider subscribing. It takes 1 minute of your time, but it would mean the world to us 🙇

Disclaimer: All the information presented in this publication and its affiliates is strictly for educational purposes only. It should not be construed or taken as financial, legal, investment, or any other form of advice.