Consensys Prepares IPO with JPMorgan and Goldman

MegaETH $1.39B Token Sale Oversubscribed 28x | Strategy’s Q3 Profit Falls to $2.8B

📢Sponsor | 💡Telegram | 📰Past Editions

Good Morning.

Strategy’s hot streak cooled this quarter. Profit plunged as BTC lost steam, squeezing the firm’s once-lofty premium. The company still beat estimates, but it’s clear the BTC treasury boom is starting to feel the weight of gravity.

In Today's Email:

What Matters: Consensys Prepares IPO with JPMorgan and Goldman 👀

Founders Highlight: Isla Perfito of Dare Market 👩

Deal Flows: MegaETH $1.39B Token Sale Oversubscribed 28x 💰️

You read and share. We listen and improve. Send us feedback at [email protected].

Narratives: Bitcoin Treasury Cooldown

For daily market updates and airdrop alphas, check out our telegram!

WHAT MATTERS

Consensys Prepares IPO with JPMorgan and Goldman

State of play: Consensys, the Ethereum-focused software company behind MetaMask, has reportedly hired JPMorgan and Goldman Sachs to lead its upcoming IPO, according to Axios.

The move positions Consensys alongside other crypto firms like Circle and Bullish that have gone public in 2025 amid favorable market conditions.

MetaMask is leveraging strong momentum from upcoming MASK token, its new perpetual futures, rewards features, and a planned integration with Polymarket.

Beyond MetaMask, Consensys also operates Infura and Linea, and has investments in Ethereum treasury firms like SharpLink.

Why it matters: The move tests whether investor optimism toward listed crypto companies can extend beyond exchanges and stablecoin issuers to infrastructure builders like Consensys.

Our take: An IPO would push Consensys into a new phase of accountability. The challenge lies in proving that MetaMask, Linea, and Infura can deliver consistent revenue without relying on market cycles.

For builders and investors: We should watch how Consensys transitions from a developer-driven ethos to a public-market structure while proving that MetaMask and its ecosystem can generate sustainable, transparent revenue.

BUILDER-INVESTOR HIGHLIGHT

Isla Perfito of Dare Market

Intro: Isla Perfito is the Founder of Dare Market, a platform where anyone can post, accept, or fund dares with cash or crypto.

Previous background: Before founding Dare Market, Isla was CEO and Co-Founder of Sator, a blockchain entertainment startup. She previously worked at Chainalysis as a software engineer and at Credit Suisse as a data scientist and blockchain engineer.

She holds a Computer Science degree from NYU, where she was active in women-in-tech initiatives.

The big idea: Isla through Dare Market aims to turn viral internet stunts into a monetized, onchain economy.

Take a peek at our referral reward at the bottom of this issue. Share this newsletter and receive our list of 500 crypto VC individuals 👇

INSIGHTS

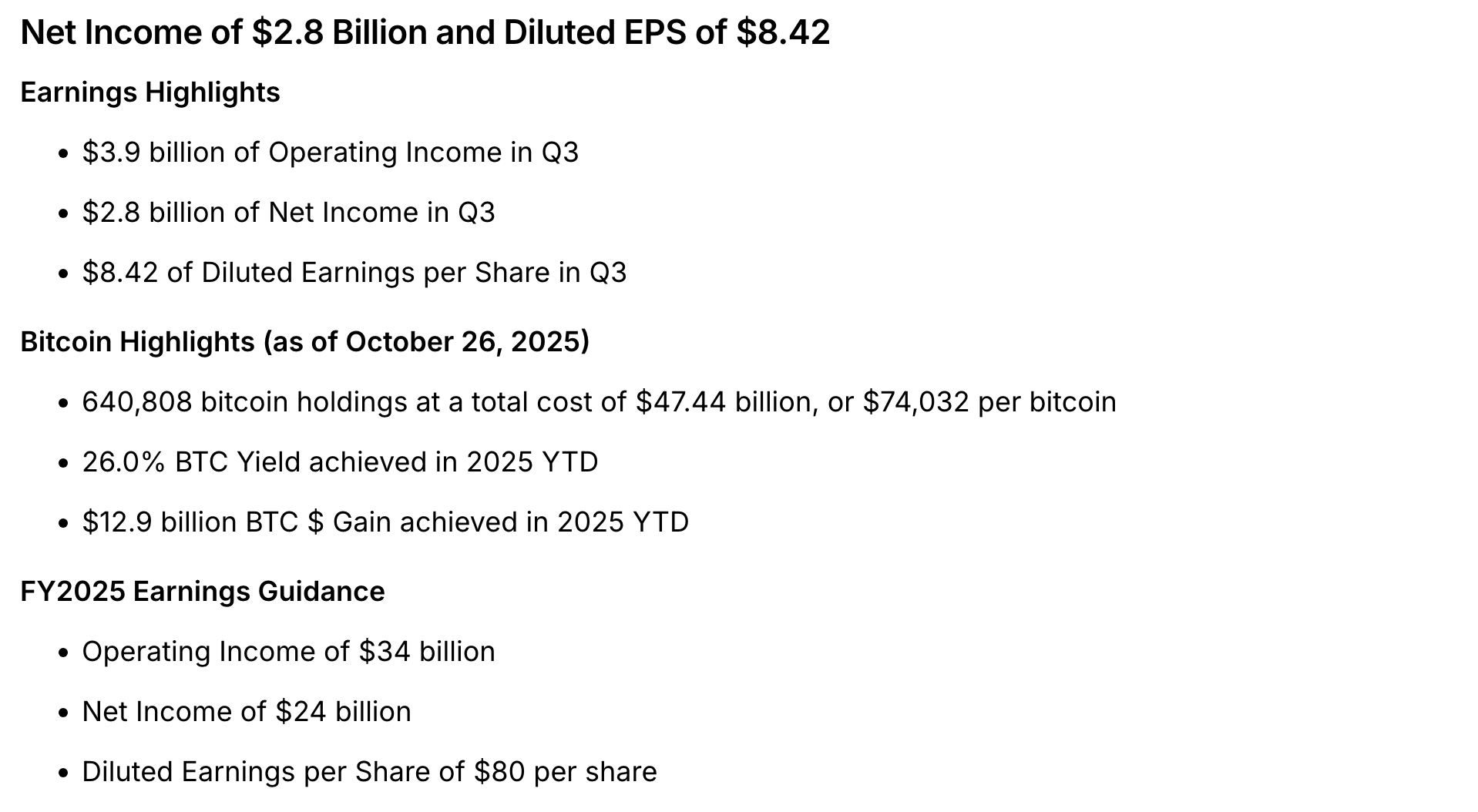

Strategy’s Q3 Profit Falls to $2.8B

Bitcoin treasury firm Strategy (MSTR) reported a Q3 profit of $2.8B, down sharply from last quarter’s record $10B, as BTC’s rally cooled and its market premium hit an 18-month low. Despite the decline, results slightly beat analyst forecasts with $8.42 in EPS.

Strategy’s mNAV multiple dropped to 1.2×, its weakest since early 2023, reflecting reduced investor enthusiasm after BTC fell ~15% from October highs.

Strategy added 43,000 BTC in the quarter, bringing total holdings to ~640,800 BTC valued near $69B.

To sustain capital inflows, Strategy raised the dividend on its STRC preferred stock to 10.5%, leveraging higher yields to attract investors.

DEAL FLOWS

MegaETH $1.39B Token Sale Oversubscribed 28x

The $MEGA Public Sale is Closed.

Total Bidders: Over 50k

Total Committed: $1.39b

Oversubscription: 27.8xThanks to everyone who participated. Now we allocate.

— MegaETH (@megaeth)

1:09 PM • Oct 30, 2025

Deal flows slowed down this week - we saw $136M+ in deals 💼

MegaETH’s public token sale closed at a capped clearing price of $0.0999, attracting more than $1.39B in bids and making the auction 27.8x oversubscribed.

The sale, structured as an English auction with a $50M cap, implies a “hypothetical” fully diluted valuation above $27.8B.

Over 50,000 participants joined the sale, which sold out at its minimum $1M baseline valuation within minutes.

MegaETH said it will refund bids below the cap price while reviewing max bids for allocation, with final results expected by November 5.

The project’s bimodal process aimed to balance ecosystem contributors with broad community access.

Deal flows in the past week:

Marina Protocol, $1.68M Seed Round

DeepSafe, $3M Seed Round

Standard Economics, $9M Seed Round

Kite AI, Series A Round

Aria Protocol, $0.5M Strategic Round

Pieverse, $7M Strategic Round

DepinSim, $8M Strategic Round

Capybobo, $8M Funding Round

Paystream, $0.75M Public Token Sale

MegaETH, $49.95M Public Token Sale

Hercle, $10M Equity Round

ME3, $3M Unknown Round

Accountable, $7.5M Unknown Round

ZAR, $12.9M Unknown Round

Bron, $15M Unknown Round

QUICK BITES

NY judge grants relief to Multichain liquidators.

dYdX plans to enter US market by end of 2025.

MegaETH’s public token sale oversubscribed by 27.8x.

JPMorgan says USDC outpaces USDT in onchain growth.

Grayscale spot Solana ETF sees $1.4M inflows on debut.

Strategy's Q3 profit drops to $2.8B as bitcoin rally fades.

Ethereum devs officially target Dec. 3 for Fusaka upgrade.

Hong Kong's top regulator flags digital asset treasury risks.

Core Scientific shareholder vote sinks $9B CoreWeave deal.

Standard Chartered sees tokenized RWA reaching $2T by 2028.

Coinbase Q3 revenue surges 37% as Ethereum trading share climbs.

SBF says FTX was solvent, blames bankruptcy team for 'decimating' firm.

NOTEWORTHY READS & MEME

Mfers who spent 3 years grinding on Discord to get a $10 Monad airdrop

— le.hl (@0xleegenz)

4:37 PM • Oct 30, 2025

If you enjoy reading this issue, please consider subscribing. It takes 1 minute of your time, but it would mean the world to us 🙇

Disclaimer: All the information presented in this publication and its affiliates is strictly for educational purposes only. It should not be construed or taken as financial, legal, investment, or any other form of advice.