Trump Pardons Binance Founder CZ

Polymarket & Kalshi Race Toward $15B Valuations | MegaETH's MiCA Whitepaper

📢Sponsor | 💡Telegram | 📰Past Editions

Good Morning.

President Donald Trump’s pardon of former Binance CEO Changpeng “CZ” Zhao has shaken up the crypto world. The White House framed it as the end of the Biden-era “war on crypto,” calling Zhao a victim of overreach. Supporters see it as a fresh start for the industry, while critics say it blurs the line between innovation and political favoritism.

In Today's Email:

What Matters: Trump Pardons Binance Founder CZ 👀

Founders Highlight: Ophelia Synder & Hany Rashwan of 21Shares 👨 👩

Deal Flows: Polymarket & Kalshi Race Toward $15B Valuations 📈

You read and share. We listen and improve. Send us feedback at [email protected].

Narratives: Crypto Power Politics

For daily market updates and airdrop alphas, check out our telegram!

WHAT MATTERS

Trump Pardons Binance Founder CZ

State of play: President Donald Trump has pardoned Changpeng “CZ” Zhao, a move that the White House press secretary framed as a sign of the administration’s support for the crypto industry and a sharp break from the Biden-era enforcement stance.

White House Press Secretary Karoline Leavitt announced the pardon, calling Zhao a victim of the previous administration’s “war on cryptocurrency.”

She said there were “no allegations of fraud or victims” in Zhao’s case.

Zhao thanked Trump on X, pledging to “make America the Capital of Crypto.”

Binance and its current CEO Richard Teng hailed the pardon as the start of a new era for the industry, focused on rebuilding trust and global access.

Zhao may now regain influence over Binance despite a previous lifetime management ban.

The decision reignites questions about Trump’s growing links to crypto interests. Earlier reports tied his Trump-backed DeFi project, World Liberty Financial, to talks with Binance, though both sides denied any political dealmaking.

Critics, including Senator Elizabeth Warren, blasted the move as “corruption in plain sight,” warning it could weaken efforts to regulate the sector.

Trump dismissed those claims, saying Zhao had “a lot of support” and that “what he did is not even a crime.”

The pardon boosted crypto markets, with Binance’s BNB up about 5% and Trump-linked WLFI rising more than 15%.

Why it matters: The White House is presenting it as an end to the Biden administration’s “war on crypto,” but it also blurs the line between financial innovation and political favoritism.

Our take: This pardon sets a dangerous precedent. It sends a message that regulatory accountability in crypto can be overridden by political loyalty or influence.

For builders and investors: In the long run, politicizing enforcement could make the environment even less predictable.

BUILDER-INVESTOR HIGHLIGHT

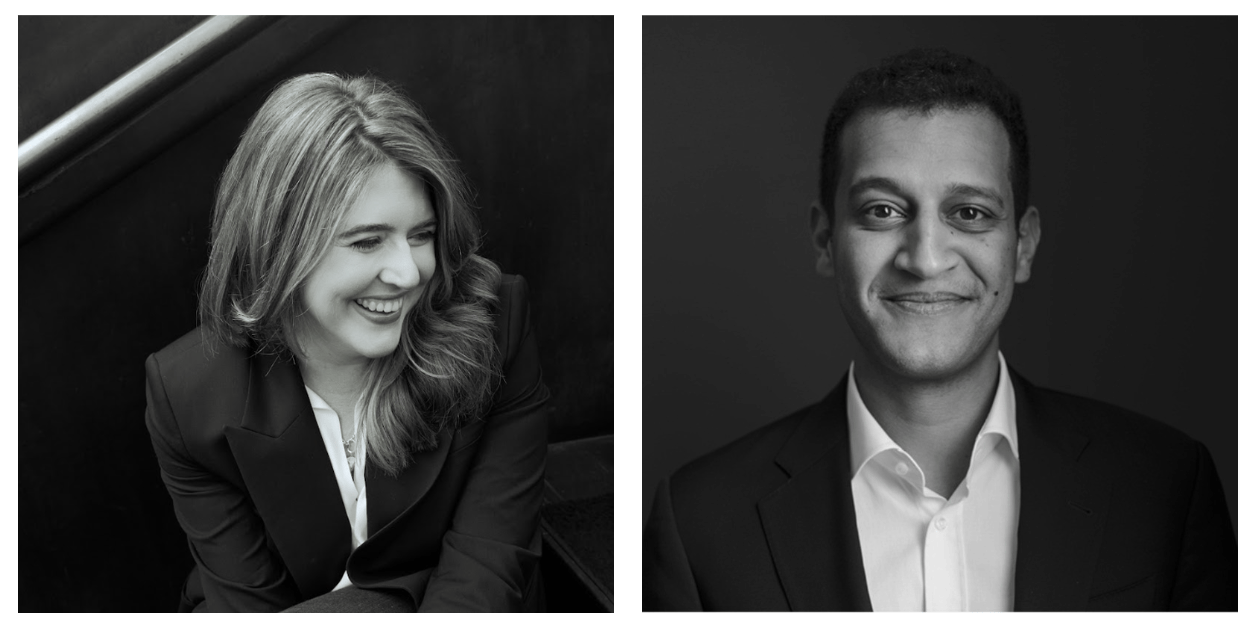

Ophelia Synder & Hany Rashwan of 21Shares

From left to right: Ophelia Synder & Hany Rashwan

Intro: Ophelia Synder & Hany Rashwan are the Co-Founders of 21Shares, one of the world's first and largest issuers of crypto exchange traded products.

Previous background: Before 21Shares, Ophelia Snyder worked in tech investment banking at UBS and Evercore, and as an analyst at The Westly Group. She holds an MBA from NYU Stern and a B.S. from Stanford.

Before 21Shares, Hany Rashwan founded fintech startups Kout, Ribbon, and Payout, focusing on eCommerce and payments. He holds a B.A. in History from Columbia University.

The big idea: Thorugh 21Shares, Ophelia and Hany aim to make digital asset investing more accessible and transparent.

Take a peek at our referral reward at the bottom of this issue. Share this newsletter and receive our list of 500 crypto VC individuals 👇

INSIGHTS

MegaETH Confirms MiCA Whitepaper

Ethereum Layer 2 project MegaETH has verified its leaked MiCA-compliant whitepaper, outlining plans for a regulated MEGA token sale and a new technical framework.

The paper confirms a 10B token supply, with 9.5% for the team, 14.7% for investors, and 53.3% for staking rewards.

EU participants must complete KYC and custody funds with OKCoin Europe, a MiCA-licensed provider.

MegaETH introduces two key features: a rotating sequencer system that follows global economic time zones and proximity markets, where apps bid for low-latency access by locking MEGA tokens.

DEAL FLOWS

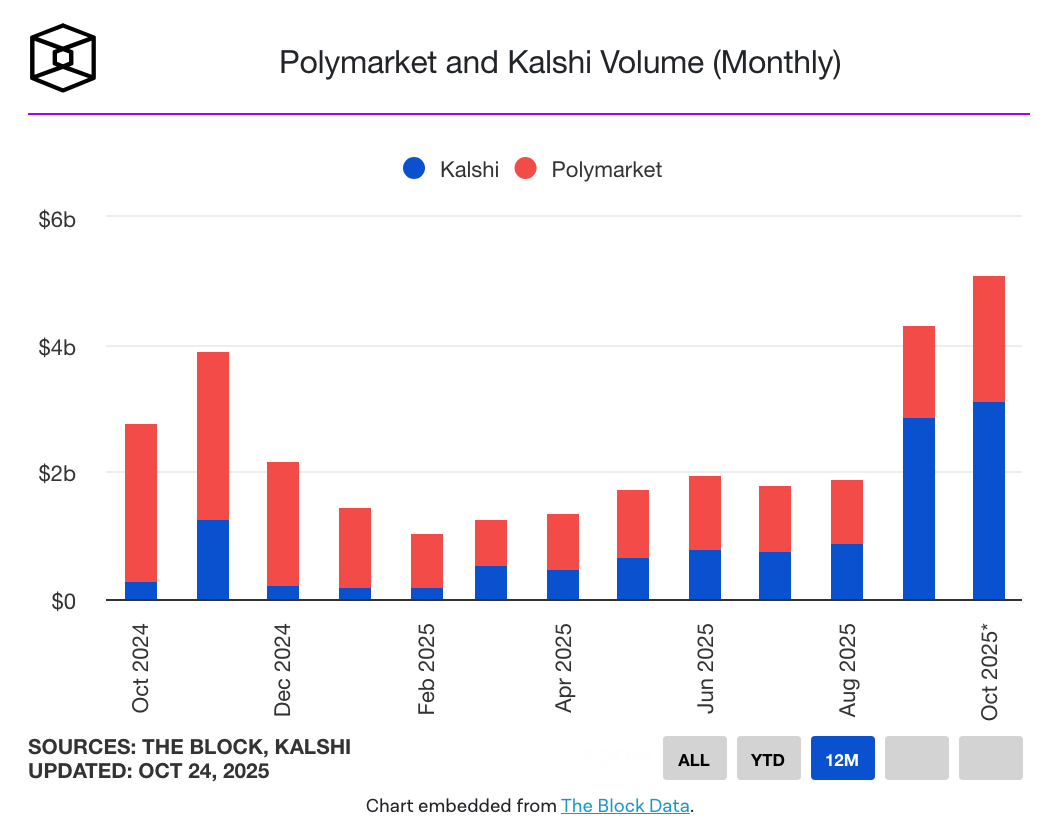

Polymarket & Kalshi Race Toward $15B Valuations

Source: The Block

Deal flows slowed down this week - we saw $510M+ in deals 💼

Crypto-native prediction platform Polymarket is in talks to raise funding at a valuation between $12B and $15B, Bloomberg reported.

The surge follows rapid growth from a $1.2B valuation in June to $9B earlier this month, driven by a potential $2B investment from Intercontinental Exchange (ICE).

The platform’s founder, Shayne Coplan, has also confirmed plans to re-enter the US market and hinted at a future POLY token.

Meanwhile, US-regulated rival Kalshi is fielding offers that could value it at up to $12B, just weeks after raising $300M at a $5B valuation.

Deal flows in the past week:

Printr, $2M Seed Round

Nubila Network, $8M Seed Round

Bluwhale, $10M Series A Round

Pave Bank, $39M Series A Round

Tempo, $500M Series A Round

Rayls, $1.75M Public Token Sale

Loyal, $2.5M Public Token Sale

Avici, $3.5M Public Token Sale

dm.fun, $9M Public Token Sale

Open Campus, $5M Strategic Round

Turtle, $5.5M Strategic Round

Sign, $25.5M Strategic Round

Lit Protocol, $2M Unknown Round

Orochi Network, $8M Unknown Round

QUICK BITES

MegaETH's MiCA whitepaper reveals tokenomics.

Polymarket eyes fresh funding at up to $15B valuation.

Trump pardons former Binance CEO Changpeng Zhao.

Kalshi fielding investment offers at up to $12B valuation.

Trump defends pardon of Binance founder Changpeng Zhao.

EU sanctions Russian A7A5 stablecoin and crypto exchanges.

DeFi perps volume explodes past $1T in record month so far.

Miner wallet containing 4,000 BTC breaks 14-year dormancy.

Stable hits $825M pre-deposit cap amid 'front-running' allegations.

a16z eyes $10B in new funds, leaves crypto behind despite bullish talk.

Crypto spot trading on CEXs recovers by 31% in Q3 after sharp drop.

JPMorgan to let institutional clients pledge BTC and ETH as loan collateral.

UK has ceded crypto hub ground to US amid 'heavy-handed' FCA oversight.

NOTEWORTHY READS & MEME

I'M QUITTING IF HE LETS SBF OUT. 💀

— Coffeezilla (@coffeebreak_YT)

10:14 PM • Oct 23, 2025

If you enjoy reading this issue, please consider subscribing. It takes 1 minute of your time, but it would mean the world to us 🙇

Disclaimer: All the information presented in this publication and its affiliates is strictly for educational purposes only. It should not be construed or taken as financial, legal, investment, or any other form of advice.