Token Vesting Debate Reignites

Why Compounding Feels Broken | Tether’s Growing Gold and BTC Bet

📢Sponsor | 💡Telegram | 📰Past Editions

Good Morning,

The vesting debate is heating up again. One side wants faster unlocks for cleaner price action. The other says that playbook already blew up once during the ICO era.

Check out our latest episode with Lista DAO!

In Today's Email:

What Matters: Token Vesting Debate Reignites 🔥

Product of the Week: Jupiter Lend Refinance 🚀

Charts: Tether’s Growing Gold & BTC Bet, Why Compounding Feels Broken 📊

You read and share. We listen and improve. Send us feedback at [email protected].

Narratives: TradFi Stablecoin

For daily market updates and airdrop alphas, check out our telegram!

WHAT MATTERS

Token Vesting Debate Reignites

State of play: The debate over token vesting has flared up again. Kyle Samani argues that day one unlocks create real price discovery and prevent low-float distortions. Haseeb Qureshi pushes back hard, saying this view ignores history.

He recalls the 2017 to 2018 ICO era when no vesting was the norm.

Teams dumped instantly, incentives broke, and many projects collapsed.

That failure is exactly why vesting became standard.

Solana’s early nine month cliff gets used as an example. Its founders defend it as efficient for markets, though others say the short lockup worked only because of unique conditions that are not easily repeated.

Haseeb’s main argument is simple. Vesting elongates holding periods and slows down the chain of future sell orders.

For him, it is not about VCs versus retail. It is about delaying each wave of selling to give networks time to grow.

He insists that accelerating unlocks is never helpful.

Critics like Brian Tubergen say buyers still care about who holds the supply and at what cost.

Haseeb replies that even long term ETH whales should not dump early, so the same logic should apply to new tokens as well.

Why it matters: The whole debate highlights a core tension in crypto. Faster markets or stronger protections, and where the right balance sits.

Our take: Day one unlocks sound exciting, but most projects are not ready for that kind of chaos. Vesting gives a new token time to breathe and build real demand before the selling starts. In most cases, stability beats speed.

For builders and investors: Think of vesting as alignment, not restriction. Clean cliffs, clear schedules, and real enforcement help your token avoid early shocks. If you want long term holders, you need long term structure.

PRODUCT OF THE WEEK

Jupiter Lend Refinance

Jupiter Lend Refinance is a tool that lets users migrate multiply or leveraged positions from Kamino and MarginFi into Jupiter Lend in a single transaction.

It automates the usual steps of repaying debt, withdrawing collateral, and recreating the position, while keeping the same debt amount and collateral ratio.

The feature is designed to help users move between protocols when rates, yields, or risk parameters change.

It supports migrations up to $1M per operation, adds no extra protocol fees, and remains fully non custodial since all actions are executed directly.

Other cool products:

WalletX, a gasless smart wallet.

Axal, a 6-10% stablecoin savings accounts.

Forta Network, a threat prevention network.

Drift, a crypto payment platform for business.

Take a peek at our referral reward at the bottom of this issue. Share this newsletter and receive our list of 500 crypto VC individuals 👇

CHARTS OF THE WEEK

Tether’s Growing Gold and BTC Bet

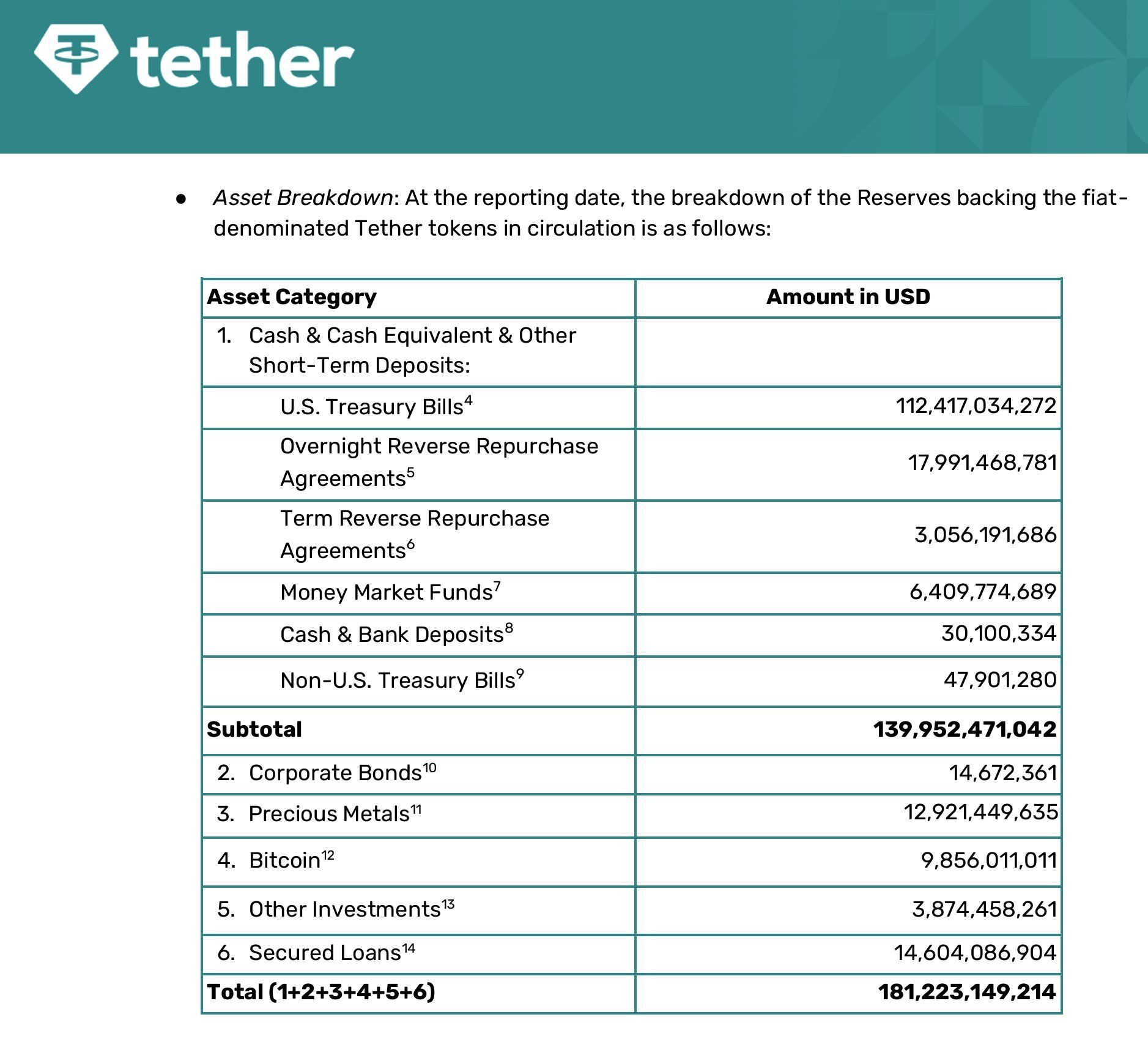

State of play: Tether’s reserve report shows about $181.2B in assets, mostly in short term holdings like $112.4B in US Treasuries, $17.99B in overnight repo, $3.05B in term repo, $6.4B in mm funds, and smaller amounts in bank deposits and non US bills.

Tether also holds $14.6M in corporate bonds, $12.92B in precious metals, $9.85B in BTC, $3.87B in other investments, and $14.6B in secured loans.

Arthur Hayes argues that the large gold and Bitcoin allocations show Tether is positioning for Fed rate cuts. If rates fall, interest income from its massive Treasury bill portfolio drops.

Tether appears to be offsetting that risk by increasing exposure to assets that could rally when money becomes cheaper.

Hayes warns that this also introduces downside volatility.

A drop of around 30% in the combined gold and Bitcoin holdings could, in his view, wipe out Tether’s equity and create a theoretical solvency issue for USDT.

Our take: The hedge makes sense, but it also adds volatility to something meant to stay stable. The real question is how much risk a major stablecoin should take on.

Why Compounding Feels Broken

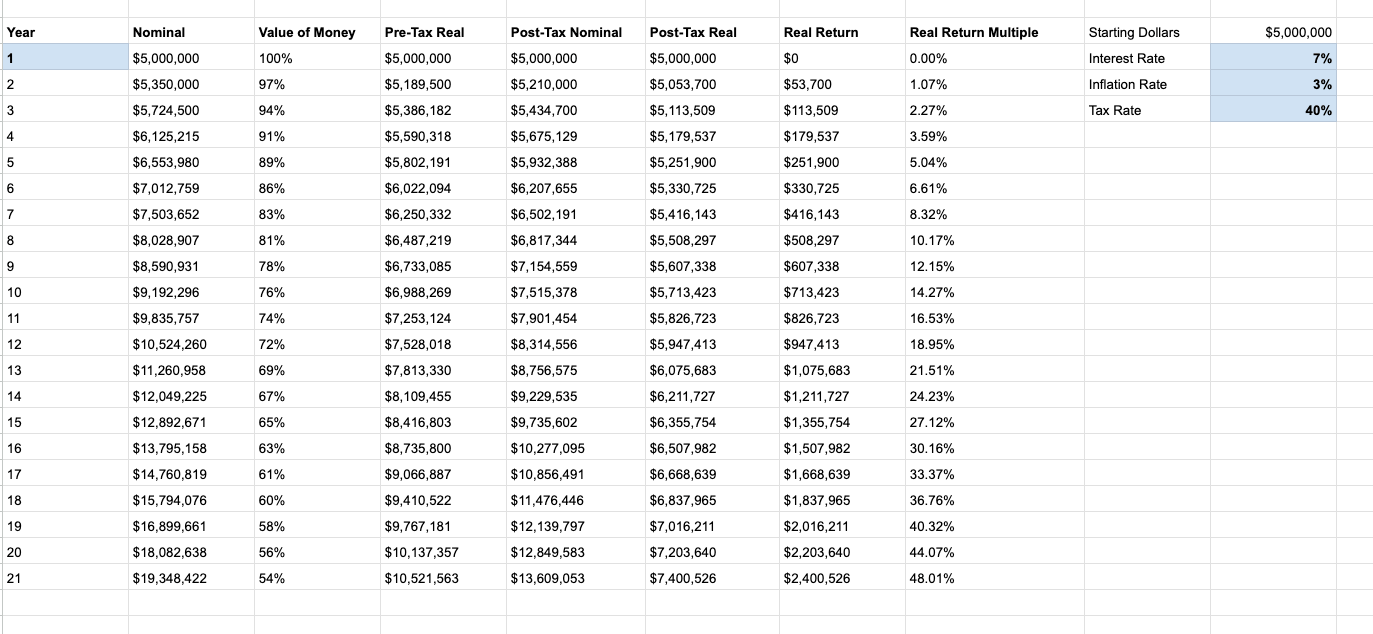

State of play: Sam Lessin is pointing out a simple, uncomfortable truth about modern investing. With today’s numbers, slow compounding barely gets you anywhere.

Even if you earn 7% a year, once you subtract 3% inflation and 40% taxes, the real growth almost vanishes.

In his example, $5M turns into about $7.4M after 20 years, which is only a 1.5x increase.

That kind of return used to look solid. Now it feels like running in place.

The system makes steady, conservative investing look unrewarding, so younger investors naturally reach for higher upside options instead.

When the safe path barely grows your money, the YOLO mindset starts to look rational.

Our take: If “safe” investing barely grows your money, people will naturally chase bigger swings. It’s less about culture and more about the numbers pushing them there.

QUICK BITES

Spot BTC ETF outflows hit $3.5B in November.

HashKey clears key hearing for Hong Kong IPO.

Sony Bank to launch US stablecoin for games and anime.

Rising Japanese bond yields could shake global carry trade, crypto.

$3M in ETH sent to Tornado Cash following apparent attack on Yearn.

Crypto exchange volume drops to $1.6T in November, lowest since June.

Strategy will sell BTC as ‘last resort’ if mNAV drops, capital is unavailable.

Terminal Finance abandons launch after Converge chain fails to materialize.

NOTEWORTHY READS & MEME

If you enjoy reading this issue, please consider subscribing. It takes 1 minute of your time, but it would mean the world to us 🙇

Disclaimer: All the information presented in this publication and its affiliates is strictly for educational purposes only. It should not be construed or taken as financial, legal, investment, or any other form of advice.