The Great Re-Write of Crypto Rules

Inside Congress’s attempt to redraw the boundaries of crypto regulation

📢 Sponsor | 💡 Telegram | 📰 Past Editions

For more than a decade, the United States has treated crypto as a jurisdictional tug of war. The Securities and Exchange Commission (SEC) calls most tokens securities. The Commodity Futures Trading Commission (CFTC) claims they are commodities. Courts have struggled to interpret laws written in the 1930s. The result has been uncertainty, enforcement actions, and billions in compliance risk.

Congress is now attempting to end that chaos through the Digital Asset Market Clarity Act of 2025, known as the CLARITY Act. Passed by the House in July, the bill now sits before the Senate Banking Committee alongside a parallel draft, the Responsible Financial Innovation Act (RFIA). Together they aim to define what digital assets are, who regulates them, and how token markets should function.

The stated goal is to move from “regulation by enforcement” to a transparent market structure. But the deeper effect could be more complicated. The bill weakens the SEC’s reach, expands the CFTC’s power, and introduces a new concept of “mature blockchains” that could determine whether a token is treated as a security or a commodity. It is not an incremental reform. It is a full rewrite of how the United States defines crypto.

Key Takeaways

A Structural Overhaul of U.S. Crypto Law: The CLARITY Act marks the most comprehensive legislative rewrite of crypto regulation in US history. It divides oversight among the SEC, CFTC, and Treasury, setting distinct lanes for securities, commodities, and stablecoins.

The Rise of the CFTC: The bill significantly expands the CFTC’s authority, granting it full jurisdiction over digital-asset commodities like Bitcoin and Ether. This shift reduces the SEC’s control and introduces optional federal charters for digital-asset exchanges.

The “Mature Blockchain” Concept: A new idea gaining traction is the certification of “mature blockchains,” which would allow tokens to move from SEC to CFTC regulation once they meet decentralization criteria. Critics argue this could lead to superficial decentralization for regulatory relief.

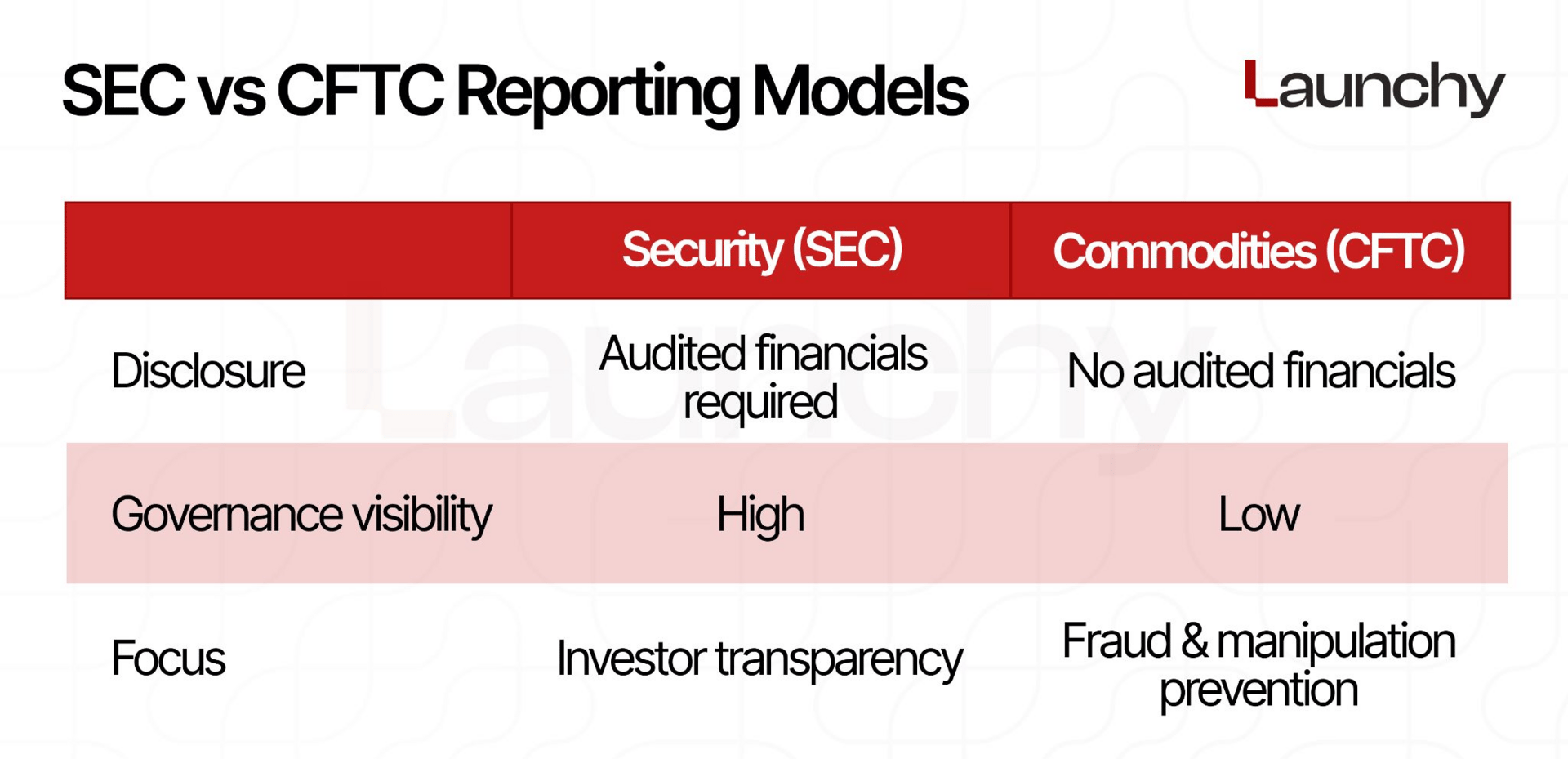

Lighter Disclosure and Investor Risks: While the Act brings clearer market rules, it weakens continuous disclosure standards. The CFTC’s fraud-focused model provides less transparency into corporate governance and financial reporting compared to the SEC regime.

Innovation vs. Oversight Tradeoff: The framework aims to end “regulation by enforcement,” but it risks creating new loopholes. By favoring flexibility and competition over strict investor protection, the US could see faster innovation and greater systemic risk.

Why It Matters

The CLARITY Act is the second piece in a three part legislative sequence that began with the Guiding and Establishing National Innovation for US Stablecoins (GENIUS) Act and will end with a forthcoming taxation bill. Together these laws would create a complete digital asset framework covering stablecoins, token issuance, trading, and investor protection.

Title I defines digital asset securities, Title II extends CFTC jurisdiction over digital assets that function as commodities, and Title III puts fiat-backed stablecoins under Treasury oversight. Together, they create a three-lane framework: the SEC for fundraising and disclosure, the CFTC for trading and market integrity, and the Treasury for stablecoin approval and supervision.

This shift redistributes regulatory power and redefines how tokens, exchanges, and DeFi platforms will function in the United States. Whether it brings clarity or creates new loopholes will depend on how those boundaries hold up once money starts to move.

The Core of the Re-Write

At the core of the Digital Asset Market Structure and Investor Protection Act is an attempt to rewrite how the U.S. classifies and regulates crypto. The bill draws a sharp line between dal asset securities and digital assets, dividing responsibility between the SEC, the CFTC, and the Treasury.

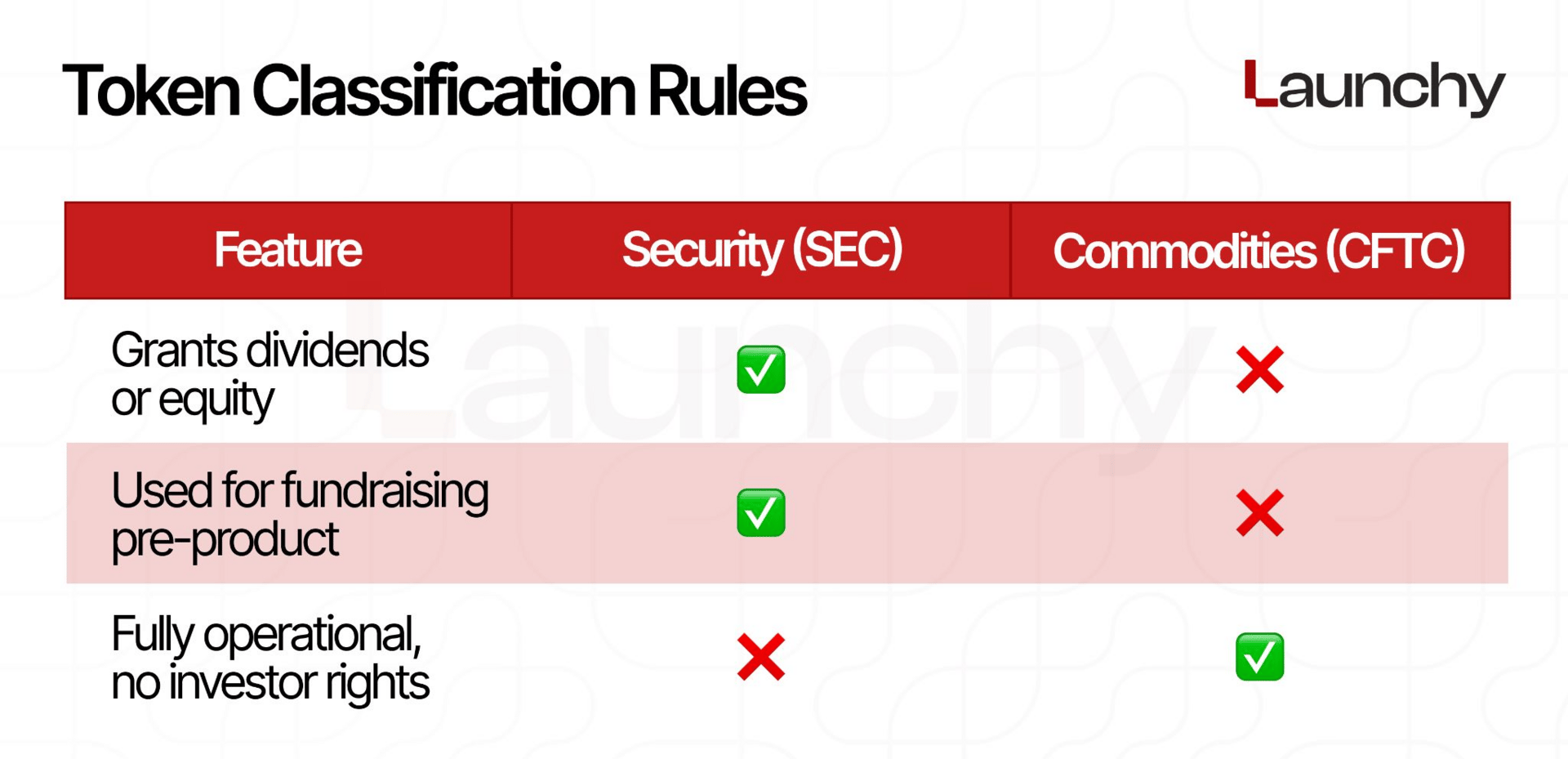

Section 101 defines what makes a token a security. If a token gives holders equity or debt rights, dividends, voting power in major corporate actions, or liquidation rights, it qualifies as a digital asset security.

Tokens sold to raise money for platforms that are not yet operational also fall under this category.

Anything that does not fit these definitions is treated as a digital asset, a commodity under the Commodity Exchange Act.

Title II formally expands the CFTC’s reach. It amends the Commodity Exchange Act to classify digital assets as commodities and names Bitcoin and Ether explicitly. It gives the CFTC authority to issue optional federal charters for digital asset trading and clearing, sets a 24-hour delivery rule for on-chain transactions, and requires exchanges to report activity to digital asset repositories of transactions.

Section 102 changes how registration works for digital asseturities. It allows issuers more time before they must register with the SEC, adjusting the threshold to $10Min assets and 2,000 holders.

Section 103 creates a process called desecuritization, which lets projects move tokens from SEC to CFTC jurisdiction. Once a company can prove that its product is fully operational and no longer grants investor-style rights, it can file a certification with the SEC.

Unless the agency challenges it, the token stops being a security and becomes a commodity.

Title III turns to stablecoins and central bank digital money. It gives the Treasury full authority over fiat-based stablecoins, requiring any issuer to obtain approval. The section also bars grandfathering existing stablecoins and makes clear that digital assets and stablecoins are not deposits covered by FDIC or NCUA insurance.

The SEC and CFTC keep anti-fraud enforcement powers, but prudential oversight moves to banking regulators.

In simple terms, the Act sets up a regulatory handoff: a token can begin life as a security, shift to a commodity once it’s functional, and face Treasury oversight if it’s a stablecoin. The structure could finally give exchanges and issuers a predictable legal map, but it also risks weakening disclosure and investor protections at the moment crypto is becoming systemic.

The “Mature Blockchain” Debate

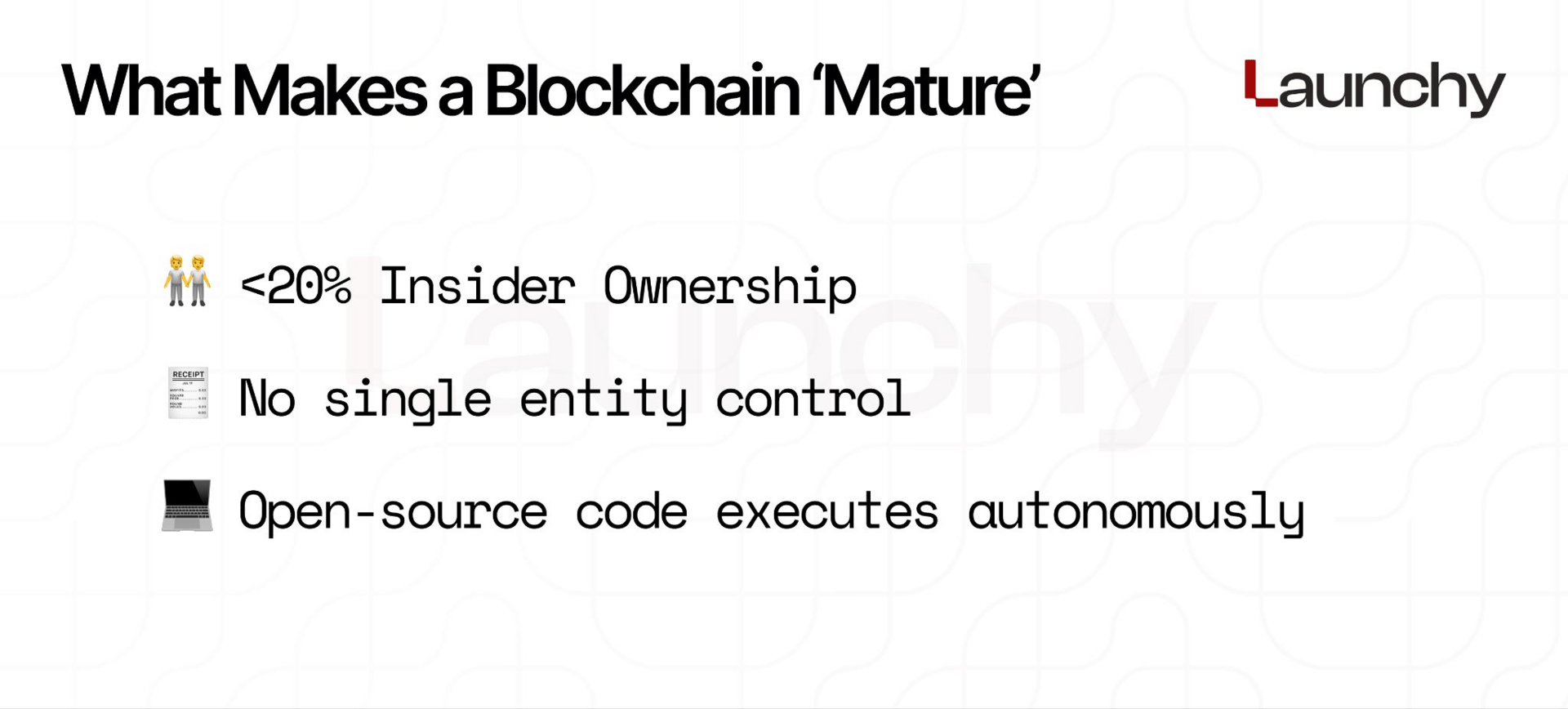

The most controversial idea surrounding the CLARITY framework is the notion of a “mature blockchain.” While not yet written into statute, drafts circulating in Congress describe a network as mature when no single entity controls it, insider ownership falls below twenty percent, and its open-source code executes transactions autonomously.

Once certified as mature, the related token would shift from SEC to CFTC oversight.

The goal is to translate decentralization into law, but the risk is that projects could engineer pseudo-decentralization, splitting holdings or using scripted governance, to qualify early. Critics warn this could make decentralization a paperwork exercise instead of a structural safeguard.

From Enforcement to Architecture

For years, crypto oversight in the United States has beeiven by enforcement rather than statute. The SEC has leaned on the 1946 Howey Test to classify most tokens as securities, while the CFTC has only limited spot-market authority under the Commodity Exchange Act. The CLARITY proposal aims to replace this fragmented system with structural rules.

Under Title II, Section 201, the CFTC would gain full authority over digital-asset commodities, defined as tokthat do not provide equity or profit rights.

Registered platforms would operate as Digital Asset Trading Facilities or Digital Commodity Exchanges, following Core Principles on trade surveillance, capital standards, and fund segregation.

At the same time, the SEC would continue to regulate initial offerings, particularly those that raise capital for development before a network becomes functional. Some committee drafts also explore a simplified fundraising exemption, modeled on Regulation A+, that would let smaller projects raise limited amounts with fewer disclosure requirements.

Retail Protection and Information Gaps

Traditional securities law requires extensive financial and managerial disclosure. The CFTC’s commodity model does not. Under Section 204 of H.R. 5745, exchanges must report trade data to a Digital Asset Repository of Transactions but are not required to publish audited financials or governance information.

This means investors would gain transparency on blockchain activity but not necessarily on the businesses or teams behind the assets. The CFTC’s focus on fraud and manipulation contrasts with the SEC’s continuous disclosure regime, which historically prioritizes investor information.

The bill also modifies how customer assets are treated in bankruptcy. Although segregation of client funds is required, Section 201(d) allows limited waivers, potentially creating counterparty risk if an exchange fails. The result is a faster but thinner form of investor protection.

DeFi and Developer Carve Outs

Although not part of H.R. 5745’s text, ongoing policy discussions include exemptions for decentralized finance participants. Under this framework, validators, node operators, and open-source developers who do not hold customer funds would not be treated as intermediaries.

The intention is to protect open-source activity from registration requirements, but it raises concerns about accountability. If protocols fail or are exploited, users would have little legal recourse.

This mirrors the tension in Section 503 of the Act, which directs agencies to study decentralized finance and report on how DeFi should be defined and regulated.

Global and Political Context

The CLARITY framework positions the United States differently from other major jurisdictions. The European Union’s Markets in Crypto Assets (MiCA) regulation emphasizes licensing, reserve standards, and centralized oversight. The American approach focuses on market structure and competition.

Politically, the framework has bipartisan momentum:

Republicans view it as a foundation for domestic innovation and financial competitiveness.

Some Democrats, such as Senator Kirsten Gillibrand, support it for its clarity and consumer focus.

Others worry that transferring authority from the SEC to the CFTC weakens investor safeguards built after the Great Depression.

If both chambers reconcile their versions, the combined legislation could reach the President’s desk by late 2025. Implementation would depend on new rulemaking from both agencies, as directed in Section 401, with timelines extending into 2026.

Regulatory Arbitrage and Outlook

By allowing digital assets to transition from securities to commodities after certification, the framework opens the door to regulatory arbitrage.

Projects might design “synthetic decentralization” to move into the lighter CFTC regime as quickly as possible.

Section 103 of H.R. 5745 sets the precedent by permitting an issuer to file a desecuritization certification once its network is operational. If the SEC does not reject the filing after review, the token becomes a CFTC-supervised commodity.

While the process is meant to provide clarity, it could also incentivize premature declarations of maturity.

The certification mechanism may end up resembling the pre-2008 self-classification model for derivatives, where market participants defined their own risk categories until systemic failures forced reform.

Our Take

The CLARITY framework represent the most serious attempt yet to codify crypto’s legal structure. They finally define what counts as a security, what qualifies as a commodity, and how tokenized markets should be supervised. But the balance tilts toward deregulation.

By curbing the SEC’s reach and relying on the CFTC’s lighter enforcement model, the law assumes that decentralization can replace disclosure and that competition can substitute for oversight. That assumption may fuel innovation in the short term but risks leaving the system exposed when the next market cycle turns.

The promise of clarity is real. The danger is that it may only arrive in hindsight, once the same rules need to be rewritten again.

If you enjoy reading this issue, please consider subscribing. It takes 1 minute of your time but it would mean the world to us 🙇

Disclaimer: All the information presented in this publication and its affiliates is strictly for educational purposes only. It should not be construed or taken as financial, legal, investment, or any other form of advice.