The DAO Returns to Fund Ethereum Security

Flying Tulip Tops $225M Raised at $1B Valuation | Austin Adams of Doppler

📢Sponsor | 💡Telegram | 📰Past Editions

Good Morning

Almost ten years after The DAO hack, unclaimed funds from that era are being reused to fund real security work on Ethereum. Instead of letting that ETH sit idle, it is now being turned into a long term budget for audits, tooling, and user protection as the network keeps scaling.

Check out our latest podcast episode!

In Today's Email:

What Matters: The DAO Returns to Fund Ethereum Security 👀

Founders Highlight: Austin Adams of Doppler 👨

Deal Flows: Flying Tulip Tops $225M Raised at $1B Valuation 💰️

You read and share. We listen and improve. Send us feedback at [email protected].

Narratives: Commodities-focused derivatives

For daily market updates and airdrop alphas, check out our telegram!

WHAT MATTERS

The DAO Returns to Fund Ethereum Security

State of play: Ethereum developer Griff Green says unclaimed funds from the 2016 The DAO hack will be used to launch a new Ethereum security initiative called TheDAO Security Fund.

Around 20% of the original refund pool was never claimed, roughly $6M back then and now worth about $200M.

The fund will use over 75,000 ETH sourced from old DAO related contracts with no clear claimants.

These assets will be staked, and the yield will be used to support Ethereum security efforts.

The initiative is being developed alongside the Ethereum Foundation and ties into its broader Trillion Dollar Security push.

Funding decisions will rely on community driven methods like quadratic funding, retroactive funding, and ranked choice voting, with Giveth involved in budget allocation.

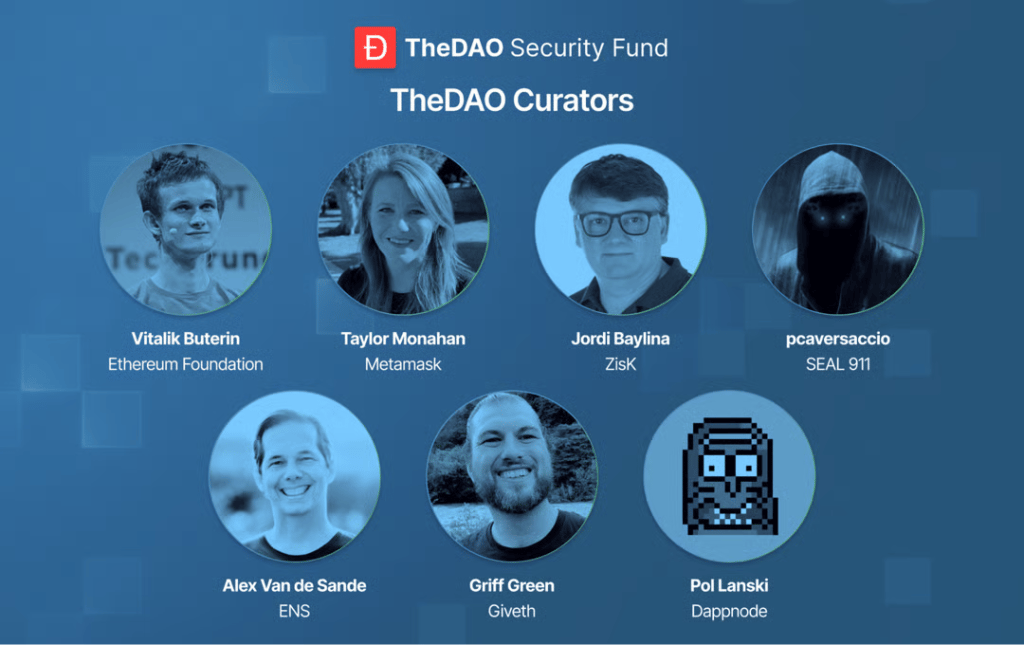

A group of well known Ethereum security figures, including Vitalik Buterin and MetaMask’s Taylor Monahan, will act as curators.

Why it matters: Old, unclaimed DAO hack funds are being turned into a long term security war chest. Instead of sitting idle, that ETH now actively funds audits, tooling, and people working on Ethereum’s weakest layer, user safety.

Our take: Using staking yield plus community driven allocation is smart, especially when security spending usually struggles to find sustainable funding.

For builders and investors: Better security infrastructure lowers ecosystem risk over time. For builders, this means more grants and support for real security work.

BUILDER-INVESTOR HIGHLIGHT

Austin Adams of Doppler

Intro: Austin Adams is the Founder of Doppler, an on-chain token creation and launch protocol.

Austin is the founder of Whetstone Research, which raised the seed round for Doppler and also built Pure Markets.

Austin is also an advisor at Variant, specializing in mechanism design for protocols and other technical guidance for early-stage builders.

Previous background: Austin spent over two years at Uniswap Labs as a full time researcher, where he focused on market structure, liquidity dynamics, and onchain data analysis inside one of the most important DeFi protocols.

Before that, he worked at the Federal Reserve Board as a Research Assistant in the Global Capital Markets section.

The big idea: Austin said Doppler differentiates itself from platforms like Pump.fun by focusing on market structure and outcomes, rather than simply making it easy to create a token.

Take a peek at our referral reward at the bottom of this issue. Share this newsletter and receive our list of 500 crypto VC individuals 👇

INSIGHTS

Benchmark Pushes Back on Bitcoin Quantum Panic

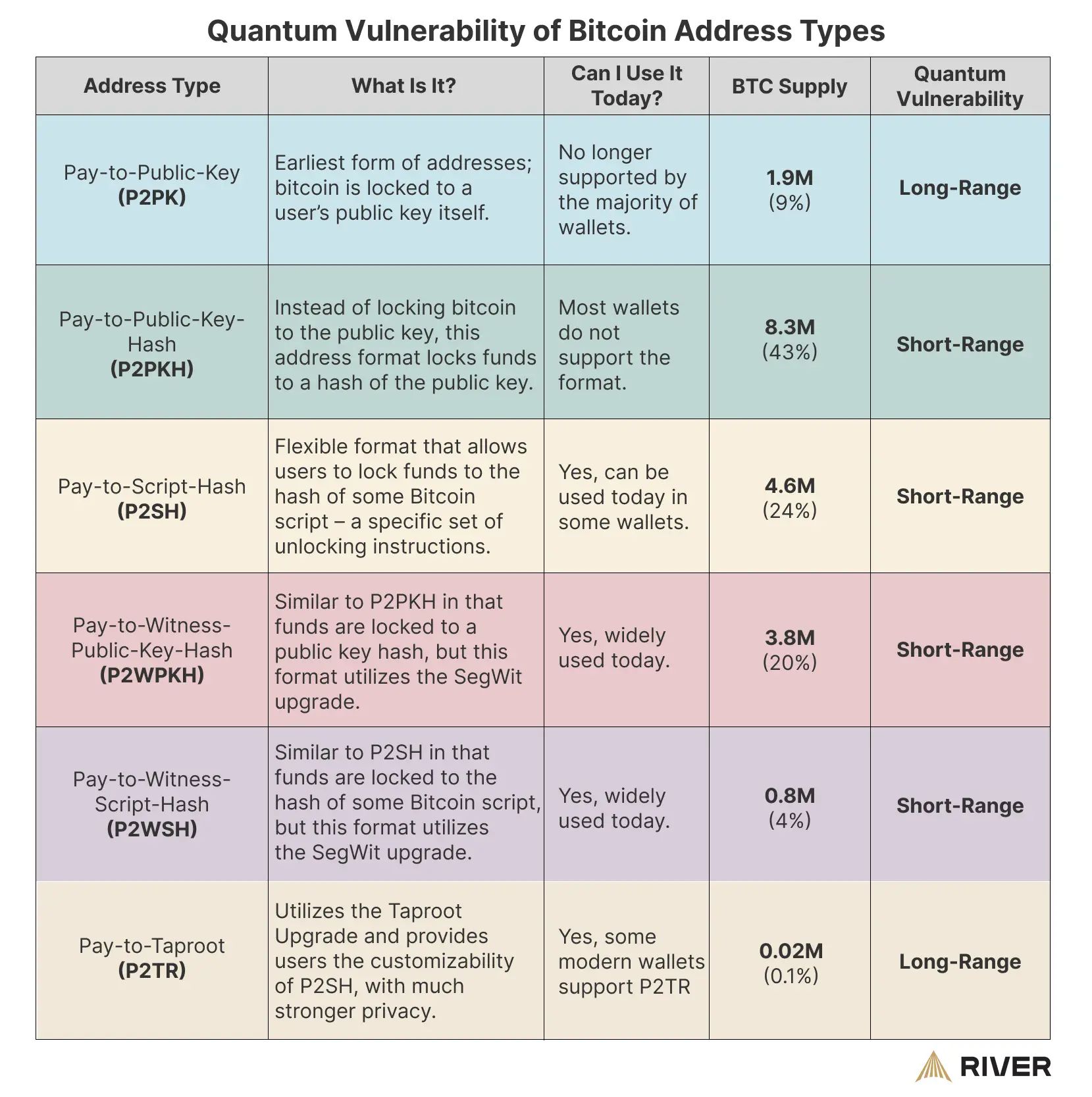

Source: River Financial

Benchmark says fears around quantum computing breaking Bitcoin are getting ahead of reality. The firm agrees there is a theoretical risk, but argues it is long dated and manageable, with practical attacks likely decades away.

Only a subset of BTC would ever be vulnerable. Coins at risk are those in addresses with already exposed public keys.

Benchmark estimates this at roughly 1 to 2M BTC, lower than higher estimates near 7M.

Chamath Palihapitiya has suggested quantum threats could emerge within two to five years, while Adam Back believes the risk is more likely 20-40 years away.

Benchmark also argues Bitcoin can adapt, pointing to past upgrades like Taproot.

Any shift toward quantum resistant cryptography would likely be gradual and coordinated, not a sudden emergency response.

DEAL FLOWS

Flying Tulip Tops $225M Raised at $1B Valuation

Deal flows slowed down this week - we saw $280M+ in deals 💼

Andre Cronje’s new DeFi project Flying Tulip has raised an additional $75.5M, pushing total institutional capital to $225.5M at a consistent $1B token valuation.

The latest $25.5M came from a private Series A round backed by Amber Group, Fasanara Digital, and Paper Ventures, priced the same as last year’s $200M seed round.

On the public side, Flying Tulip has already raised $50M through Impossible Finance’s Curated platform, with another $200M allocation lined up for CoinList starting next week.

Total soft commitments now sit around $1.36B, with roughly $400M of capacity left if current allocations fill.

All rounds are priced at $0.10 per FT token and include onchain redemption rights, letting investors burn tokens to reclaim their original principal.

Flying Tulip plans to deploy up to $1B of potential capital into onchain strategies across protocols like Aave, Ethena, and Spark, targeting around 4% annual yield to fund growth and buybacks.

Deal flows in the past week:

Zona, $0.5M Pre-Seed Round

Bleap, $6M Seed Round

Everything, $6.9M Seed Round

Tenbin Labs, $7.1M Seed Round

Doppler, $9M Seed Round

Startale Labs, $13M Series A Round

Talos, $45M Series A Round

Flying Tulip, $75.5M Series A Round

Mesh, $75M Series C Round

AetheriumX, $8M Strategic Round

River, $12M Strategic Round

StreamX, $35M IPO

Zama, $44M Public Token Sale

QUICK BITES

OP token holders approve buyback plan.

Stablecoin growth stalls after October shock.

Binance seeks top spot in South Korean market.

Russia to roll out crypto regulatory framework this July.

Trump names crypto-friendly Kevin Warsh as pick for Fed chair.

CFTC and SEC join forces on 'Project Crypto' to modernize rules.

Hang Seng debuts gold ETF with Ethereum-based tokenized units.

Binance pledges $1B fund to bitcoin as market tanks to months-low.

Bitcoin’s quantum risk is ‘long-dated and manageable,’ Benchmark says.

Vitalik commits ~$45M in ETH to open-source security and privacy projects.

Ethereum dev Griff Green to use unclaimed hack funds for new security fund.

NOTEWORTHY READS & MEME

If you enjoy reading this issue, please consider subscribing. It takes 1 minute of your time, but it would mean the world to us 🙇

Disclaimer: All the information presented in this publication and its affiliates is strictly for educational purposes only. It should not be construed or taken as financial, legal, investment, or any other form of advice.