Tether’s Two-Track Play: Gold Power & US-Regulated Stablecoin

Hyperliquid’s HIP-3 Perps Hit $790M OI | Theo Launched thGOLD

📢Sponsor | 💡Telegram | 📰Past Editions

Good Morning.

Tether is running a very deliberate two-lane strategy. Offshore, it is converting stablecoin float into hard assets like gold. Onshore, it is wrapping itself in US regulation with USAT.

Check out our latest podcast episode!

In Today's Email:

What Matters: Tether Is Quietly Building a Gold Empire 🥇

Case Study: Hyperliquid’s HIP-3 Perps Hit $790M OI 📈

Governance & Features: Theo Launched thGOLD 🔎

You read and share. We listen and improve. Send us feedback at [email protected].

Narratives: Gold

For daily market updates and airdrop alphas, check out our telegram!

WHAT MATTERS

Tether’s Two-Track Play: Gold Power and US-Regulated Stablecoin

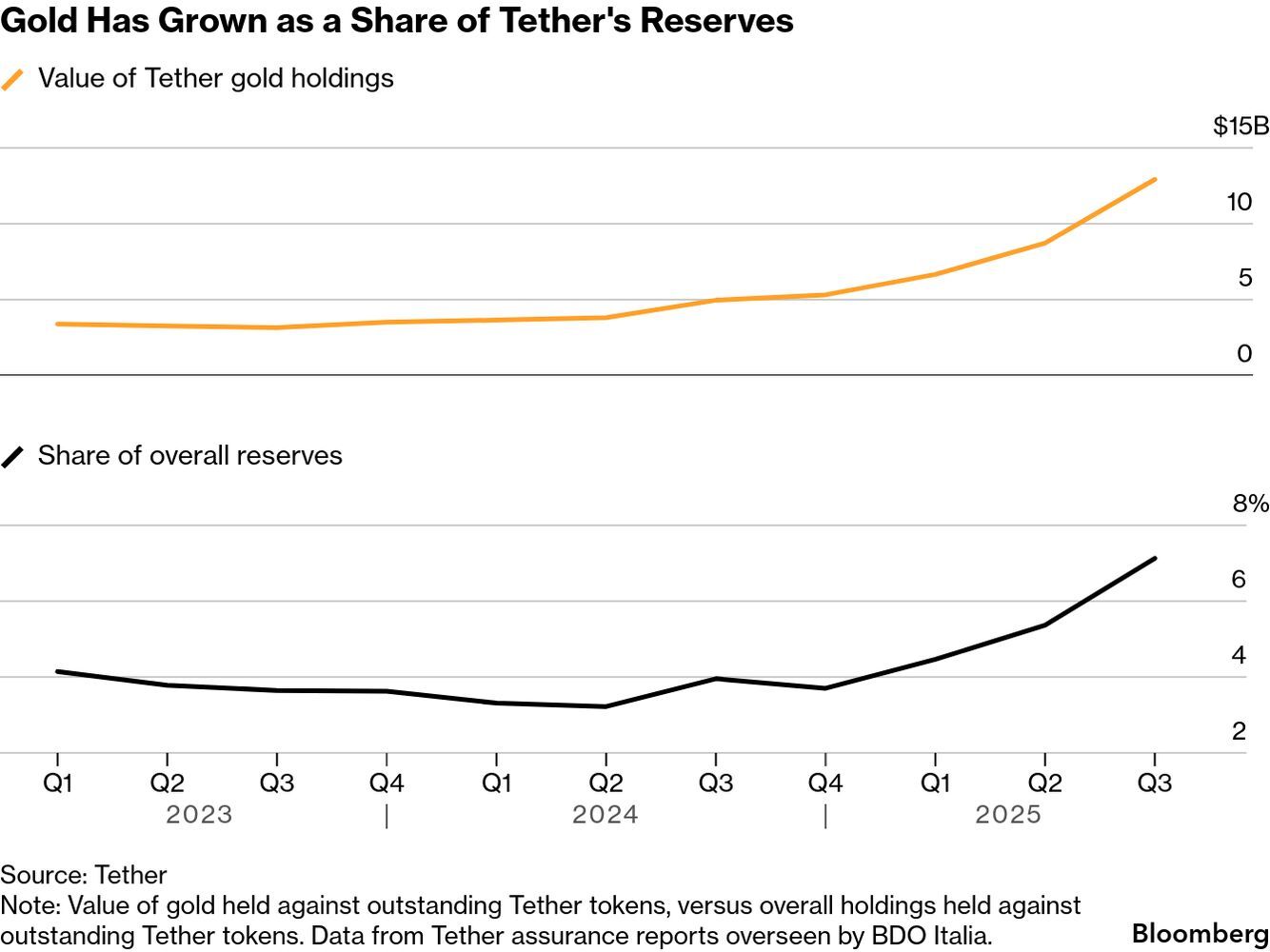

Source: Bloomberg

State of play: Tether CEO Paolo Ardoino says the company is positioning itself as a gold central bank in a post dollar world. Tether holds around 140 tons of gold worth over $23B and is still buying one to two tons per week.

The gold is stored in a Cold War era bunker in Switzerland.

The company plans to actively trade its gold reserves, hiring senior traders from HSBC and competing with major bullion banks.

Ardoino says gold is safer than national currencies as geopolitical tensions rise.

Beyond just holding gold, Tether plans to actively trade its reserves to generate profit and arbitrage opportunities.

To support this move, Tether has already hired senior gold traders from HSBC.

Tether has also officially launched USAT, its federally regulated, US only dollar stablecoin, marking its first direct entry into the American market.

USAT is issued through Anchorage Digital Bank with Cantor Fitzgerald as reserve custodian, following the passage of the GENIUS Act.

Unlike USDT, USAT is fully compliant with the US federal stablecoin regime and available to American users.

The launch is led by former White House crypto advisor Bo Hines and positions Tether for mass TradFi adoption as banks begin treating stablecoins as core financial infrastructure.

Why it matters: With over $186B USDT in circulation and dominance in gold stablecoins through XAUT, Tether is evolving from a stablecoin issuer into a major global capital allocator.

Our take: Gold is the neutral asset in a fragmented world, and Tether is using stablecoin scale to front run that shift.

For builders and investors: Watch how capital concentration plays out. If Tether can turn stablecoin float into a profitable gold trading engine, it sets a new playbook for crypto natives becoming real financial institutions.

CASE STUDY

Hyperliquid’s HIP-3 Perps Hit $790M OI

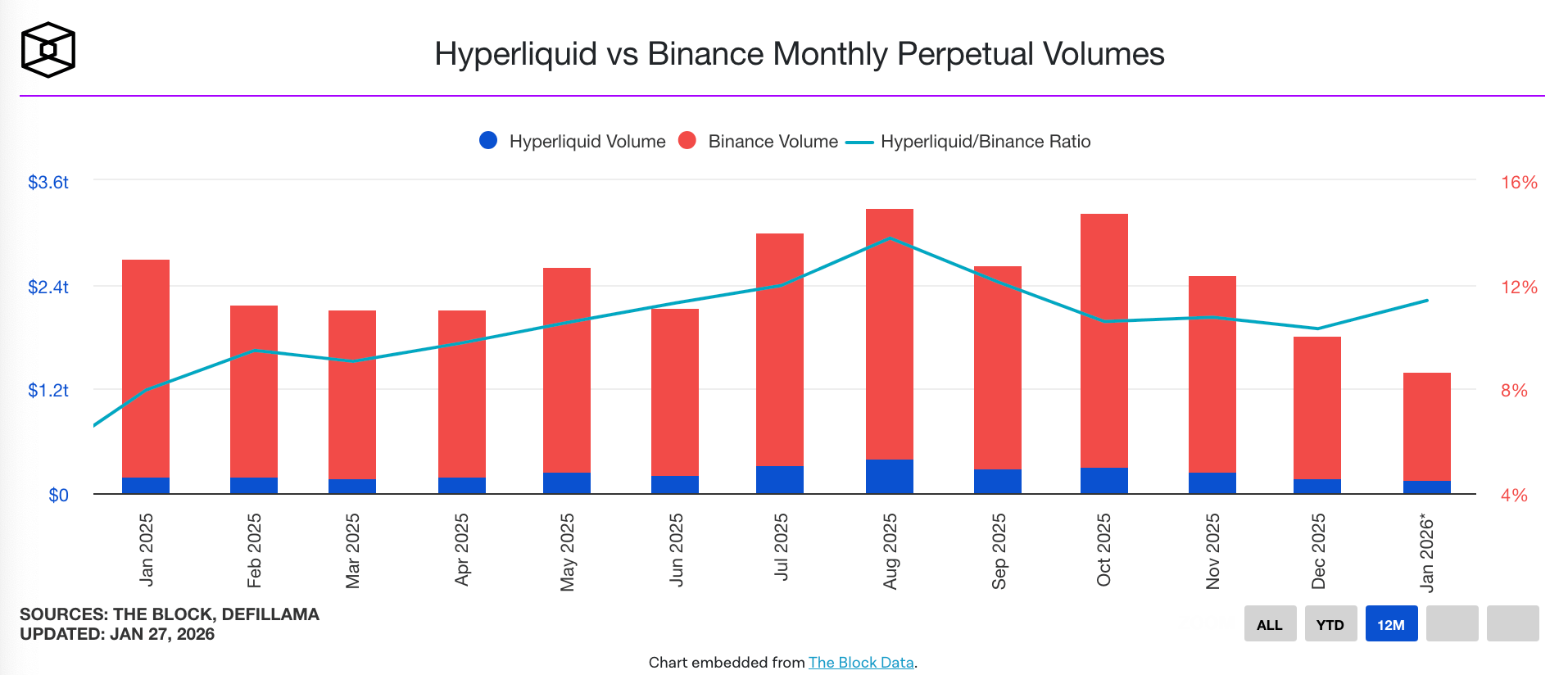

Hyperliquid’s HIP-3 builder deployed perpetual DEXs have hit a new all-time high of over $790M in open interest, driven by a surge in commodities trading, especially metals like gold and silver.

CEO Jeff Yan says Hyperliquid has become the most liquid venue for perpetuals tied to traditional financial assets, with BTC perps spreads tighter than Binance.

Recent data shows Hyperliquid quoting roughly $1 spreads versus around $5.50 on Binance, alongside deeper order book liquidity.

HIP-3 allows qualified builders staking HYPE to deploy their own perpetual DEXs directly on Hyperliquid’s infrastructure.

Open interest has grown rapidly from $260M a month ago, highlighting accelerating adoption.

The majority of volume is concentrated in TradeXYZ, which accounts for roughly 90% of HIP-3 market share.

Take a peek at our referral reward at the bottom of this issue. Share this newsletter and receive our list of 500 crypto VC individuals 👇

INSIGHTS

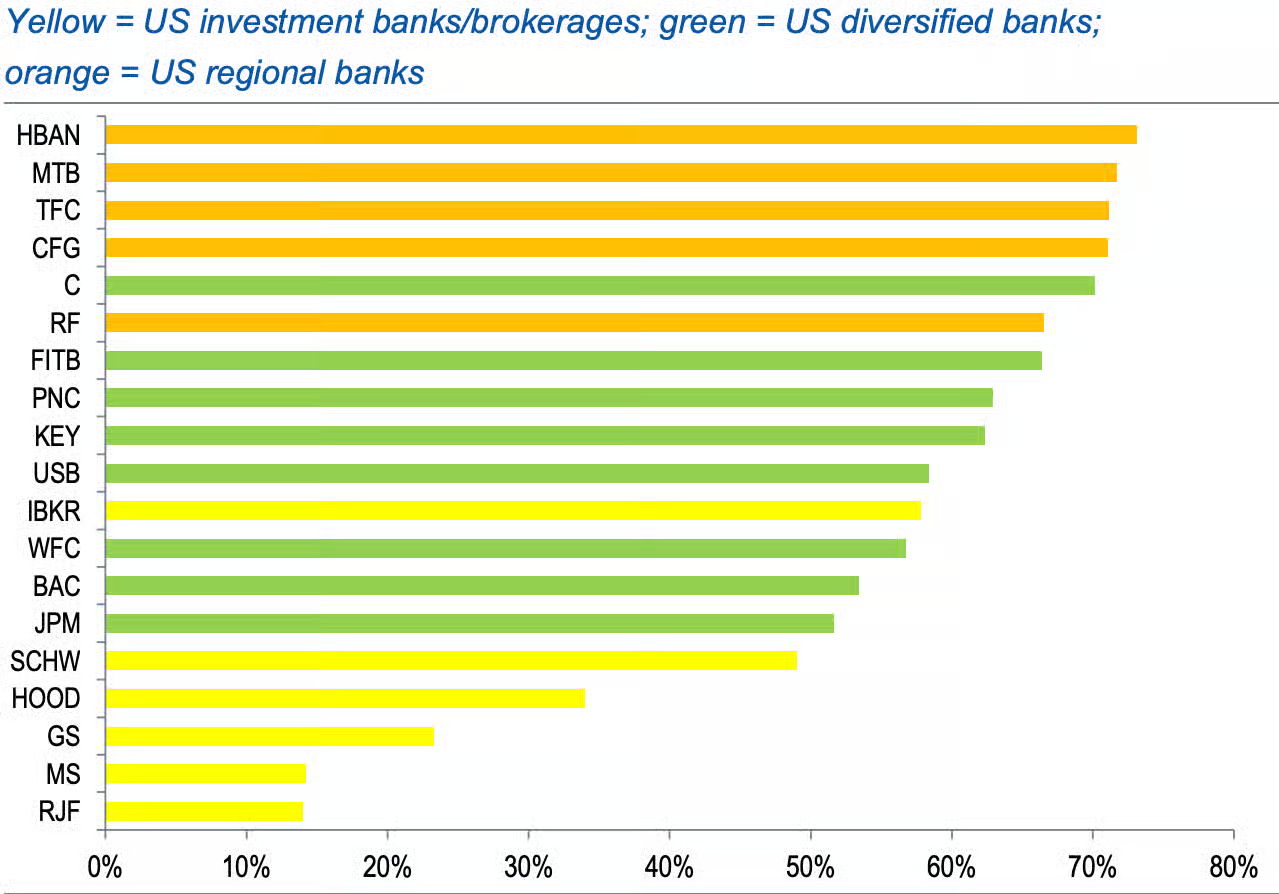

US banks; NIM income as % of total revenue | Image: Standard Chartered

State of play: Standard Chartered says accelerating stablecoin adoption could drain up to $500B from US bank deposits by 2028, framing it as a structural threat rather than a cyclical one.

The bank expects the stablecoin market to reach around $2T by the end of the decade, with roughly 1/3 of that coming from developed markets like the US.

Deposit outflows would hit US regional banks hardest due to their reliance on deposit funded net interest margins, while diversified banks face moderate risk.

Analyst Geoffrey Kendrick points to regulatory uncertainty in Washington and growing use of blockchain based payments as accelerants.

He also notes that major issuers like Tether and Circle hold limited reserves in bank deposits, reducing any natural recycling back into the banking system.

Stablecoins are no longer a niche crypto product. They are starting to compete directly with bank deposits at scale, especially if regulation eventually greenlights broader adoption.

FEATURES & GOVERNANCE UPDATE

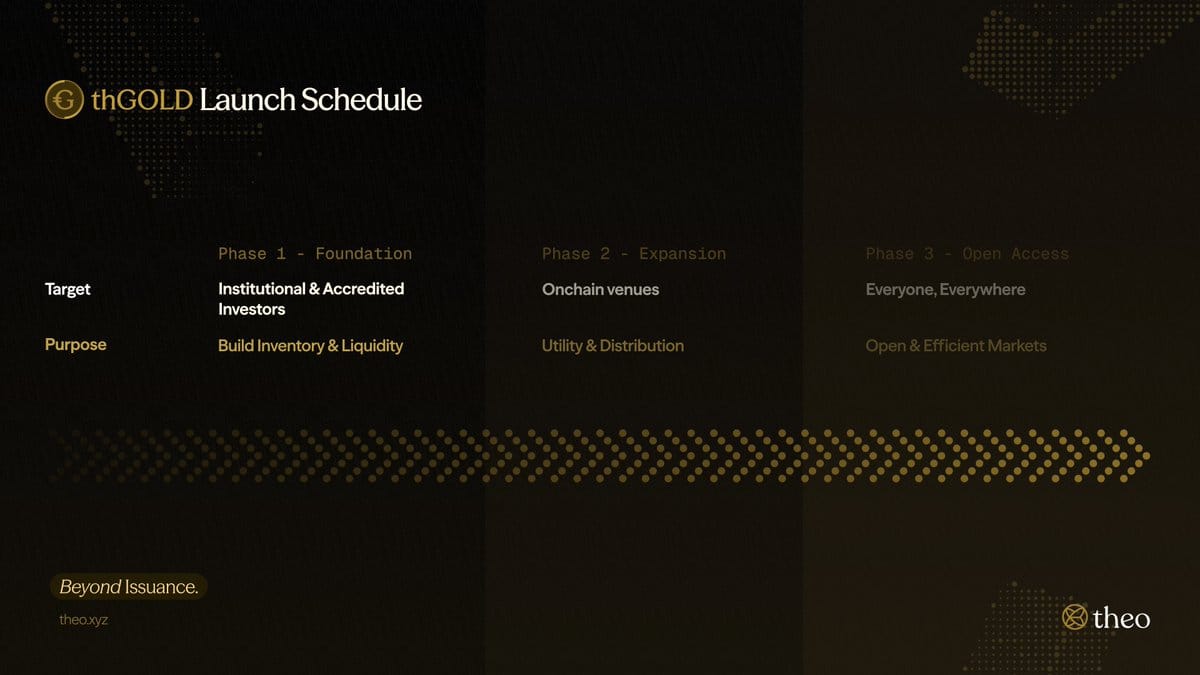

Theo Launched thGOLD

Theo has launched thGOLD, a yield bearing tokenized gold product designed to actually work inside DeFi rather than just track gold prices.

The token is built on FundBridge Capital’s MG999 On Chain Gold Fund and generates yield by lending against physical gold inventories pledged by established retailers, starting with Singapore based Mustafa Gold.

Borrowers use gold as collateral, allowing the fund to earn interest while maintaining spot gold exposure.

Theo partnered with Libeara, which is backed by Standard Chartered, to bring the product onchain.

thGOLD will be available across major DeFi venues including Hyperliquid, Uniswap, Morpho, and Pendle.

Unlike incumbents like XAUT and PAXG, thGOLD adds native yield, unlocking use cases like collateralization and yield strategies.

Other notable feature updates:

Maple launched on Base.

HyperLend announced HPL.

Twyne was rolled out to all Aave users.

MegaETH launched a live global stress test.

Pendle is replacing vePENDLE with sPENDLE.

Glider launched gas-free, one-click trading for any token.

Ondo Finance launched tokenized stocks and ETFs on Solana.

QUICK BITES

Tether launches 'Made in America' USAT stablecoin.

AIP launches fellowship to bring crypto expertise to Capitol Hill.

Crypto payments adoption spearheaded by large businesses.

Coinbase moves closer toward rolling out ‘custom stablecoins’.

Theo launches yield-bearing tokenized gold built to 'work in DeFi'.

Mesh reaches unicorn status after $75M Series C led by Dragonfly.

Standard Chartered warns stablecoins could drain $500B from US bank.

Tether will become 'gold central bank' in post-dollar world, CEO Ardoino says.

Japan's regulator seeks public input on bonds eligible for stablecoin reserves.

NOTEWORTHY READS & MEME

If you enjoy reading this issue, please consider subscribing. It takes 1 minute of your time, but it would mean the world to us 🙇

Disclaimer: All the information presented in this publication and its affiliates is strictly for educational purposes only. It should not be construed or taken as financial, legal, investment, or any other form of advice.