Tether Joins Top 20 US Treasury Holders

Exchange Volume Hits $1.7T | US Crypto ETFs See $1B Outflows

📢Sponsor | 💡Telegram | 📰Past Editions

Good Morning.

Crypto just reminded everyone it's not a one-way street. July ended with record highs and surging volumes, but August opened with ETF outflows and layoffs. Momentum remains strong, yet so does volatility. As TradFi and DeFi increasingly collide, the stakes are rising and the players are getting bigger.

Check out our latest episode with Oasys!

In Today's Email:

What Matters: Tether Joins Top 20 US Treasury Holders 👀

Product of the Week: Concrete’s AUSD Yield Vault on Katana 💵

Charts: Exchange Volume Hits $1.7T, US Crypto ETFs See $1B Outflows 📊

You read and share. We listen and improve. Send us feedback at [email protected].

Narratives: Stablecoin Power Play

For daily market updates and airdrop alphas, check out our telegram!

WHAT MATTERS

Tether Joins Top 20 US Treasury Holders

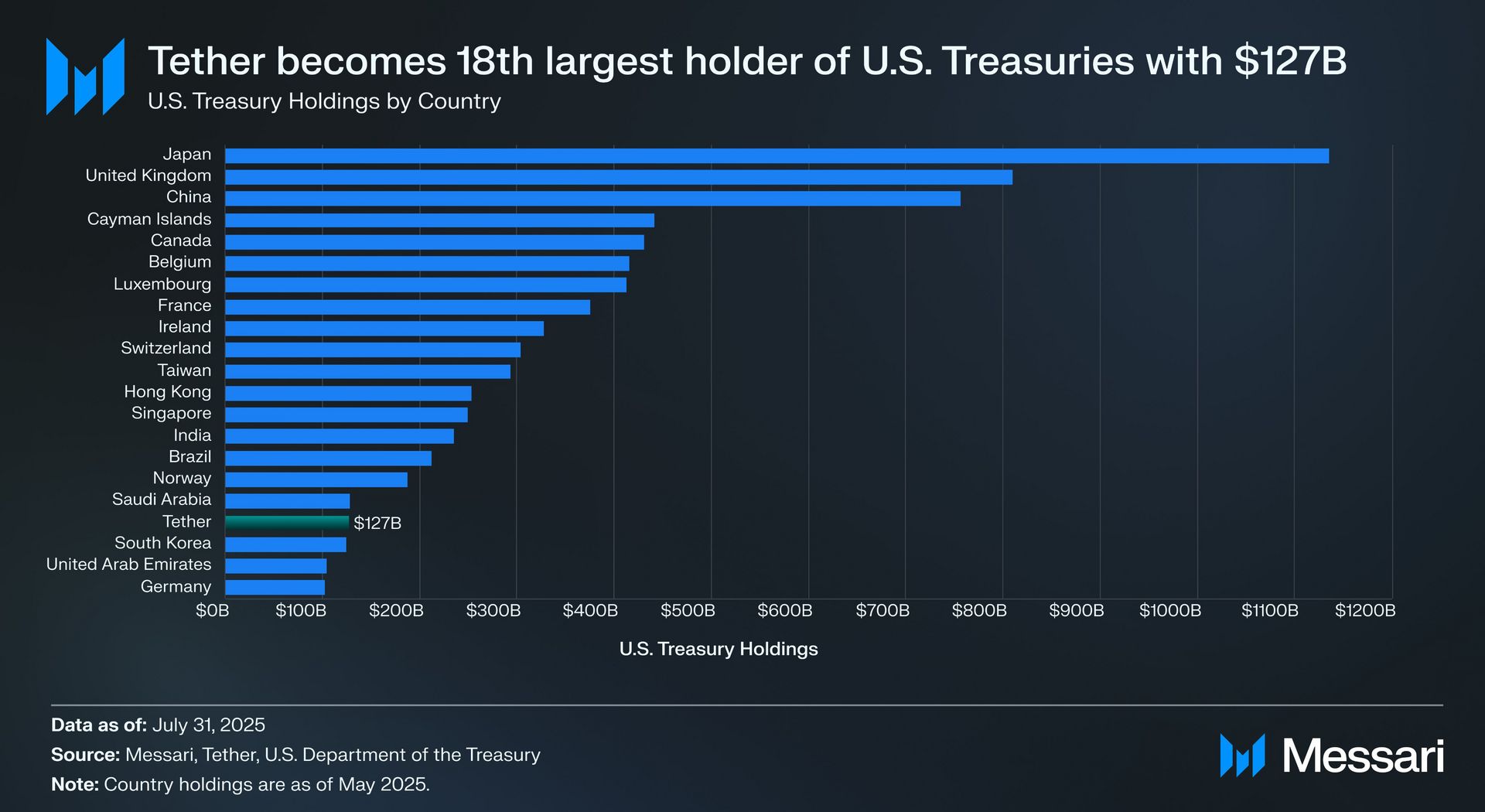

State of play: Tether, the issuer of USDT, has become the 18th largest holder of US Treasuries with $127B in government debt, surpassing countries like Germany, South Korea, and the UAE.

This positions the stablecoin issuer as a significant financial player, now trailing only slightly behind sovereign holders like Saudi Arabia.

The majority of Tether’s reserves are in short-term Treasuries, reinforcing its stance on liquidity and stability as it faces heightened regulatory scrutiny.

This growing exposure may also be a strategic response to upcoming US legislation demanding stricter oversight of stablecoin reserves.

Why it matters: Tether holding more US Treasuries than major countries shows crypto's growing role in global finance and raises the stakes for stablecoin regulation.

Our take: Tether isn’t just defending its turf, it’s embedding itself into the heart of traditional finance to stay ahead of regulatory shifts.

For builders and investors: Stablecoins are becoming key infrastructure. Prioritize assets with strong backing, and watch how crypto ties into sovereign debt markets.

PRODUCT OF THE WEEK

Concrete’s AUSD Yield Vault on Katana

1/ Introducing the @katana x @withAUSD Vault.

Powered by @ConcreteXYZ.

— Concrete (@ConcreteXYZ)

1:00 PM • Aug 1, 2025

Concrete has introduced a new institutional-grade yield vault for $AUSD holders on the Katana platform.

The vault allocates AUSD across on-chain strategies to generate real yield, with no lockups and active capital management.

Backed 1:1 by fiat via Agora Reserves, AUSD deposits earn $KAT rewards, ecosystem incentives, LP yield, and Concrete Points.

The vault is secured by audited smart contracts from Zellic and Halborn.

Other cool products:

Interport, a cross-chain hub.

Orbit-chain, a multi-asset blockchain.

ANOME, a fully on-chain PvP card game.

GemPad, a multi-chain decentralized launchpad.

Take a peek at our referral reward at the bottom of this issue. Share this newsletter and receive our list of 500 crypto VC individuals 👇

CHARTS OF THE WEEK

Crypto Exchange Volume Hits $1.7T in July

Source: The Block

State of play: Crypto exchange volume surged to $1.71T in July, the highest since February and a 55% jump from June’s $1.1T.

Binance led centralized exchanges with $683B in volume, while Bitget, Bybit, and Upbit followed.

The spike aligned with a market rally, as Bitcoin hit a record monthly close at $115,644 and Ether soared nearly 50%.

Decentralized exchange volume also rose to $435.3B, with PancakeSwap dominating at $188.6B.

Our take: The $1.7T volume spike shows real momentum is back. Traders are active, liquidity is flowing, and the rally feels more organic than bot-driven.

US Crypto ETFs See $1B Outflows to Start August

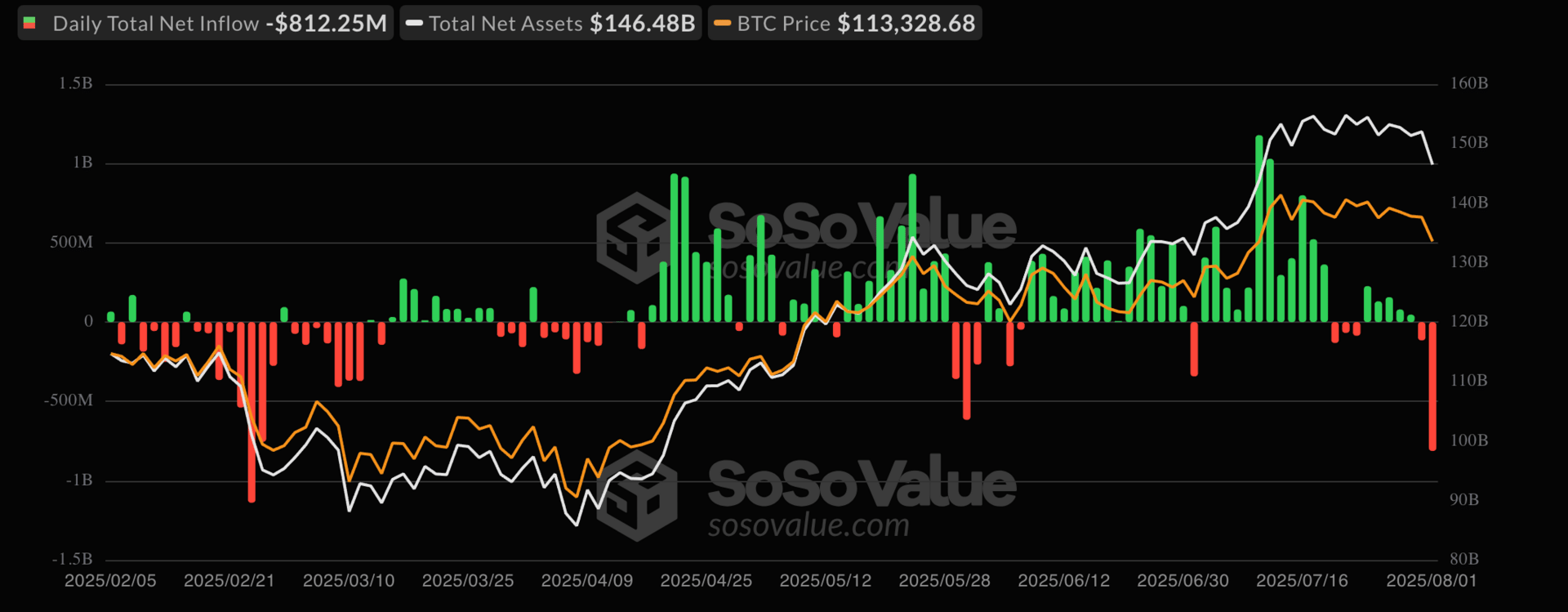

Total Bitcoin Spot ETF Net Inflow / Source: SoSoValue

State of play: After a record-breaking July, US spot Bitcoin and Ethereum ETFs kicked off August with nearly $1B in combined outflows.

Bitcoin ETFs saw $812M withdrawn, marking their second-worst day ever, while Ethereum ETFs lost $152M, breaking a 20-day inflow streak.

Most outflows came from funds like Fidelity’s FBTC, Ark’s ARKB, and Bitwise, while BlackRock’s IBIT and ETHA remained largely unaffected.

The sell-off follows a sharp crypto price dip and comes amid growing interest in new ETF products like staked crypto and potential Solana spot funds.

Our take: After July’s euphoria, August opened with a cold splash of reality. The $1B ETF outflows suggest traders were quick to lock in profits, especially outside of BlackRock’s funds.

QUICK BITES

Crypto exchange volume surged to $1.71T in July.

Lido lays off 15% of workforce for 'long-term sustainability.'

US crypto ETFs open August with largest outflows in months.

Metaplanet buys $54M worth of BTC, maintains 7th place globally.

UK regulator to allow retail investors access to crypto ETNs in October.

Trump Media confirms $2B BTC Treasury and $300M Options Strategy.

Crypto Task Force will tour US to hear from small startups on policy reform.

Coinbase slides nearly 20% in the worst weekly performance since Sept 2024.

NOTEWORTHY READS & MEME

"August's Non-farm Payrolls print was 8 bajillion and the unemployment rate was 0.01%"

— fejau (@fejau_inc)

6:18 PM • Aug 1, 2025

If you enjoy reading this issue, please consider subscribing. It takes 1 minute of your time, but it would mean the world to us 🙇

Disclaimer: All the information presented in this publication and its affiliates is strictly for educational purposes only. It should not be construed or taken as financial, legal, investment, or any other form of advice.