Terraform Liquidator Sues Jump Trading for $4B

DTCC Tokenization: Explained | 2025 Token Launches Struggle

📢Sponsor | 💡Telegram | 📰Past Editions

Good Morning,

New token launches in 2025 are also struggling to hold value after TGE, suggesting a market that is increasingly skeptical of opaque structures and early access narratives.

Check out our latest podcast episode!

In Today's Email:

What Matters: Terraform Liquidator Sues Jump Trading for $4B 👀

Product of the Week: DTCC Tokenization Explained 🪙

Charts: Hyperliquid’s $430M Outflows, 2025 Token Launches Struggle 📊

You read and share. We listen and improve. Send us feedback at [email protected].

Narratives: TGE Repricing

For daily market updates and airdrop alphas, check out our telegram!

TOGETHER WITH

Artura Platform is Officially LIVE on Base

Trade your favorite Base memecoins with $ARA and enjoy improved liquidity after Artura’s V3 pool migration.

🟦 Base-ready – fully optimized for the Base ecosystem, fast and low-cost

💧 V3 liquidity – deeper liquidity, tighter ranges, better execution

🔥 $ARA utility live – $ARA is now actively used for trading Base memecoins and powering the platform

WHAT MATTERS

Terraform Liquidator Sues Jump Trading for $4B

State of play: Terraform Labs’ court appointed liquidation administrator has filed a $4B lawsuit against Jump Trading and senior executives, alleging the firm secretly profited from a backdoor deal tied to the Terra ecosystem before its 2022 collapse.

The suit claims Jump helped prop up TerraUSD after a brief depeg in 2021 through its crypto arm Tai Mo Shan, receiving early access to unlocked Luna tokens that were later sold into the market.

The administrator argues this created a false sense of stability around TerraUSD while allowing Jump to extract billions in profit.

Terraform Labs collapsed in 2022 after TerraUSD lost its dollar peg, wiping out more than $40B in market value and triggering widespread crypto bankruptcies.

Terraform filed for bankruptcy in 2024 and later agreed to pay $4.47B in SEC penalties.

Jump has rejected the claims as an attempt to shift blame and says it will defend itself. Around $300M has been recovered so far for creditor compensation.

Why it matters: This case puts a spotlight on whether Terra’s collapse was purely a design failure or partly driven by behind the scenes deals. If proven, it raises serious questions about market making practices and investor trust across crypto.

Our take: Terraform is trying to shift the narrative from bad design to bad behavior. Even if Jump defends successfully, the lawsuit shows how fragile ecosystems become when stability depends on quiet interventions.

For builders and investors: If a protocol needs hidden support to survive, that is a red flag.

PRODUCT OF THE WEEK

DTCC Tokenization: Explained

Recent news around on-chain securities infrastructure have created mixed expectations about what is changing in US markets. The Depository Trust & Clearing Corporation has received regulatory clearance to tokenize part of its infrastructure, but the scope is limited.

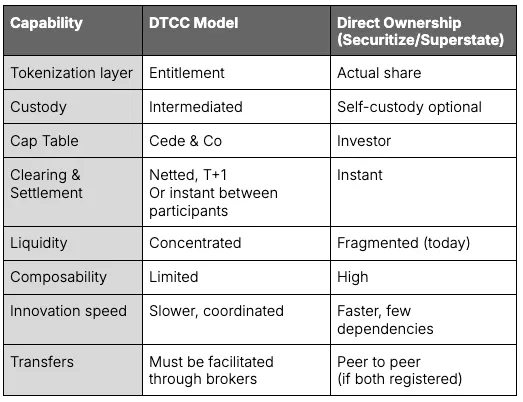

In the current market structure, investors do not hold shares directly.

Shares are immobilized at DTCC under Cede & Co., while investors hold legal entitlements through brokers and clearing firms.

DTCC’s initiative tokenizes these security entitlements, not the underlying shares.

The product creates tokenized representations of entitlement records that can move on approved blockchains between participants.

This can enable extended settlement windows, improved reconciliation, and more efficient collateral management, while preserving centralized netting and settlement guarantees.

The ownership model itself does not change. Issuer records continue to list Cede & Co. as the registered holder, and tokenized entitlements remain permissioned within the existing legal framework.

In parallel, other implementations are emerging that tokenize shares directly on issuer registers, placing ownership onchain at the transfer agent level.

These models introduce different characteristics, such as direct ownership and programmable transfers, with tradeoffs around liquidity aggregation and netting.

DTCC’s model modernizes existing infrastructure, while direct ownership models explore alternative ownership and settlement structures.

Other cool products:

COCA, an MPC wallet with non-custodial card.

Tymio, a decentralized structured products protocol.

Flair, a real-time custom data indexing for EVM chains.

Accumulated Finance, an omnichain modular liquid staking protocol.

Bloom, a decentralized credit scoring powered by Ethereum and IPFS.

Take a peek at our referral reward at the bottom of this issue. Share this newsletter and receive our list of 500 crypto VC individuals 👇

CHARTS OF THE WEEK

Hyperliquid Records $430M Weekly Outflows

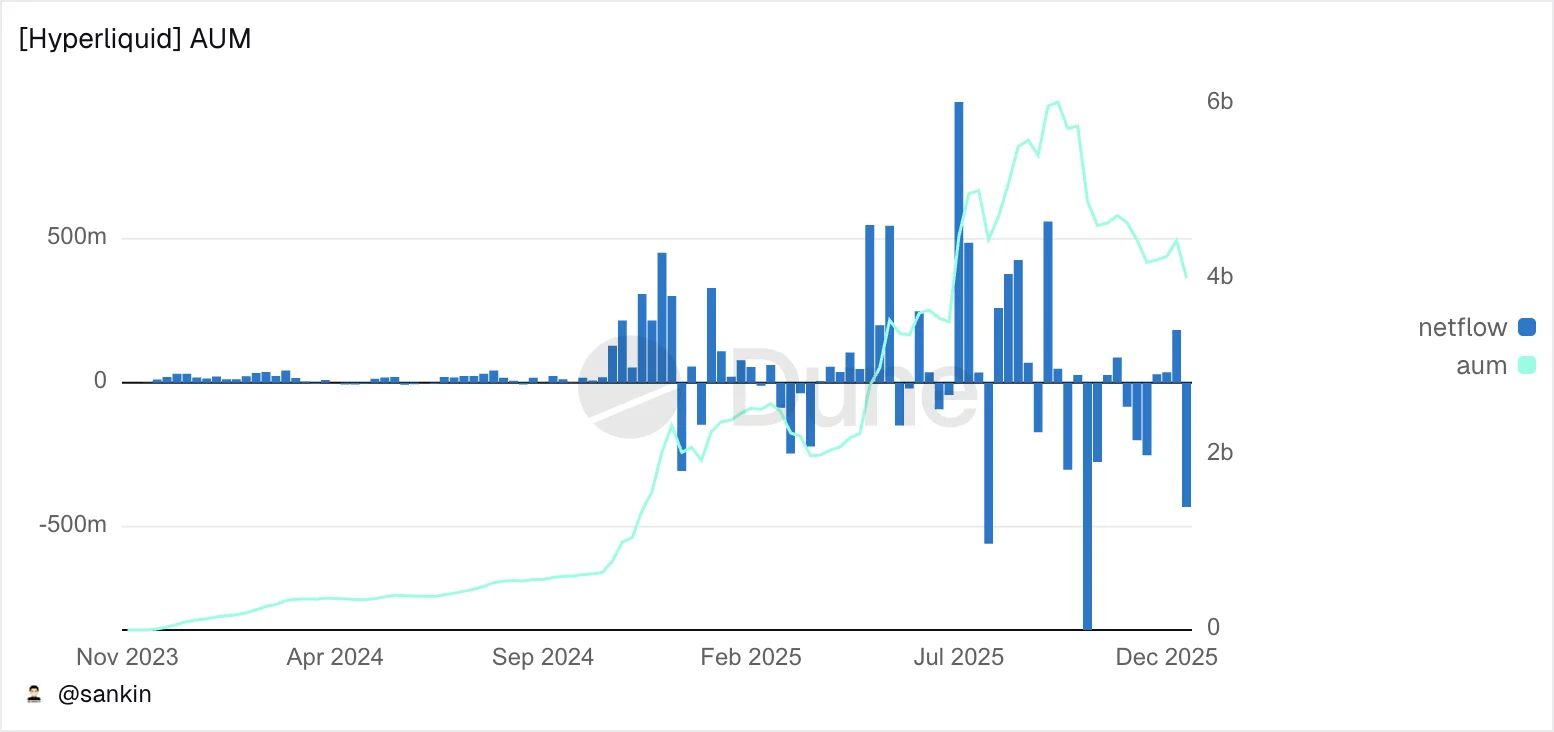

IMG: Dune Analytics / @sankin_eth.

State of play: Hyperliquid recorded more than $430M in net outflows over the past week, marking its third-largest outflow event, according to Dune data.

The withdrawals coincided with a drop in AUM from $6B+ in September to ~$4B, alongside a nearly 20% weekly decline in the HYPE token.

The outflows come as competition in decentralized perpetual trading tightens.

Rivals Lighter and Aster have gained market share in recent months, narrowing Hyperliquid’s earlier lead in trading volume and activity.

Lighter has attracted attention through a points-based rewards system, with market speculation around a potential token launch later this year.

Aster has also remained active despite recent controversy around data integrity and a delayed airdrop.

Our take: This feels like traders rotating, not panicking. Incentives and new launches are pulling liquidity elsewhere, but Hyperliquid is still a core venue.

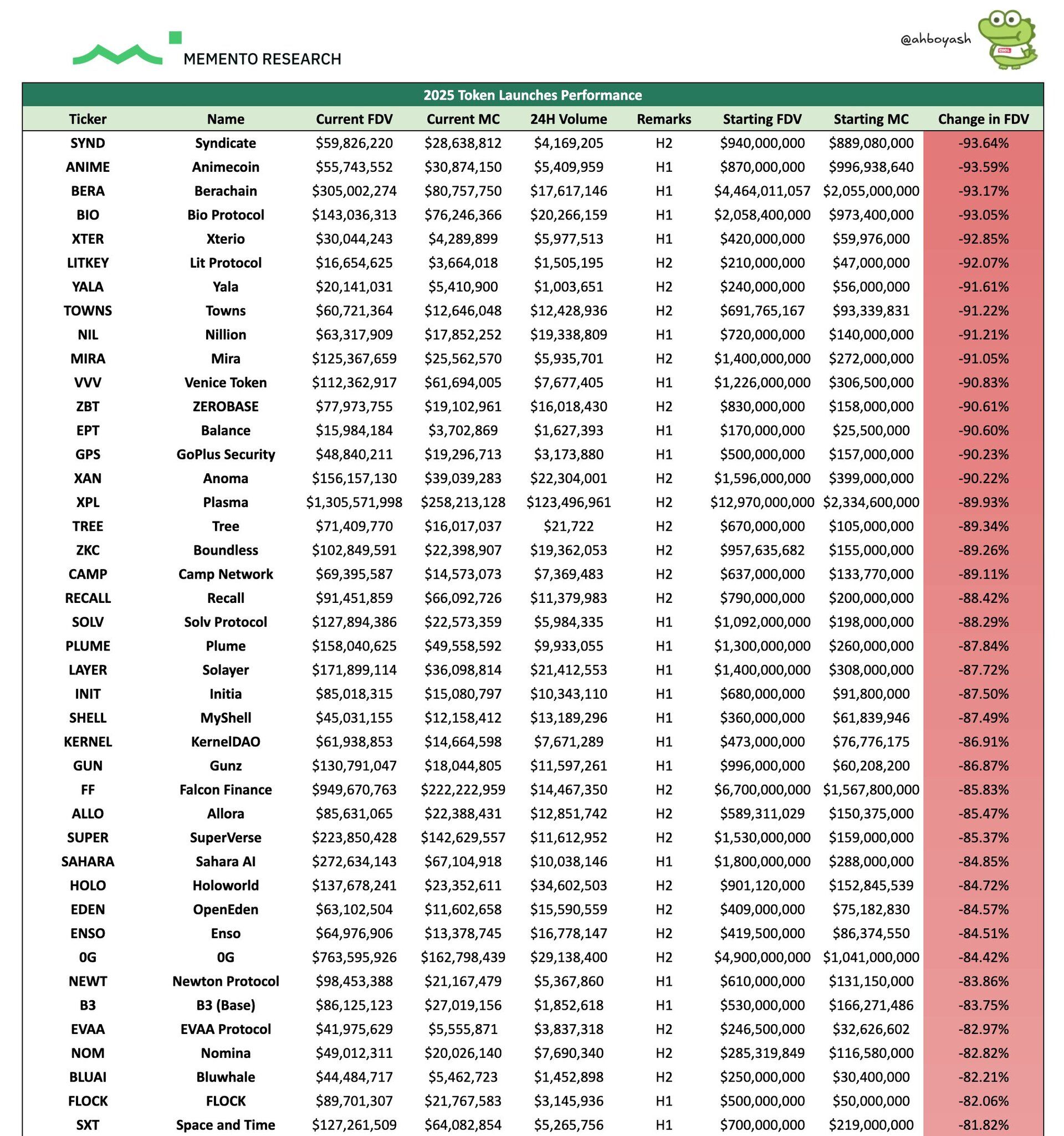

2025 Token Launches Struggle After TGE

IMG: Ash / Memento Research

Credits to Ash for the original research

State of play: Data tracking 118 token launches in 2025 shows broad underperformance after launch. ~85% of tokens are trading below their initial TGE valuation, meaning roughly 4 out of 5 launches are now underwater.

The median token is down about 71% in FDV and 67% in market cap from launch levels.

Only around 15% of tokens remain above their opening valuation, highlighting how rare sustained post TGE strength has been this year.

The takeaway is that TGE no longer represents an early entry point for most tokens.

Many launches have faced sharp valuation compression shortly after going live, reflecting weaker demand, heavy unlock dynamics, and a more selective market environment.

Our take: TGE has shifted from an entry point to a liquidity event. With heavy unlocks and crowded launches, most tokens are priced for perfection on day one. Patience now matters more than access.

QUICK BITES

Uniswap fee switch to go live as community vote set to pass.

Hilbert Group bolsters institutional crypto push with $25M deal.

Hyperliquid says ex-employee responsible for HYPE token shorting.

HK insurance regulator weighs new capital rules, risk charge on crypto.

Bipartisan House unveil crypto tax framework with stablecoin safe harbor.

Crypto activity in Brazil rises 43% with avg investment surpassing $1,000.

Aave Labs' unilateral push to vote on brand-rights proposal sparks outcry.

Coinbase says Big Beautiful Bill could push gamblers into prediction markets.

NOTEWORTHY READS & MEME

If you enjoy reading this issue, please consider subscribing. It takes 1 minute of your time, but it would mean the world to us 🙇

Disclaimer: All the information presented in this publication and its affiliates is strictly for educational purposes only. It should not be construed or taken as financial, legal, investment, or any other form of advice.