Stripe-Backed Tempo Raises $500M at $5B Valuation

OpenSea’s SEA Token & Crypto Trading Feature | Asia’s $1B ETH Treasury Firm

📢Sponsor | 💡Telegram | 📰Past Editions

Good Morning,

Some of Asia’s biggest Ethereum believers are teaming up to launch a $1B ETH treasury by snapping up a Nasdaq-listed company. Led by Huobi’s Li Lin and Fenbushi’s Shen Bo, the move looks like Asia’s play to give Bitcoin-style treasuries an Ethereum makeover.

Check out our latest episode with 0G!

In Today's Email:

What Matters: Stripe-Backed Tempo Raises $500M at $5B Valuation 💰️

Product of the Week: OpenSea’s SEA Token & Crypto Trading Feature 🔎

Charts: Asia’s $1B ETH Treasury Firm, MegaETH Buy Back 📊

You read and share. We listen and improve. Send us feedback at [email protected].

Narratives: Ethereum Treasuries Rise

For daily market updates and airdrop alphas, check out our telegram!

TOGETHER WITH

Neutrl Vault Fills $50M in 20 Minutes, Expands by $25M on Oct 20

The future of on-chain yield is here. Neutrl’s exclusive Pre-Deposit Vault launched on October 15, and the initial $50M cap was filled in just 20 minutes.

Built in collaboration with K3 Capital and powered by Upshift, the vault enables users to deposit USDT on Ethereum and earn:

Yield from underlying deployment strategies

Neutrl Points, now accruing daily from the initial deposit

450,000 XPL in ecosystem incentives

Upon deposit, participants receive preNUSD, which automatically converts to upNUSD at protocol launch (10–14 days away), representing their proportional vault share. Incentives begin accruing once upNUSD is live.

Due to overwhelming demand, Neutrl will raise the vault cap by an additional $25M, opening for new deposits Monday, October 20 at 2PM UTC.

Lock-in period: 2.5 months.

Deposits available via the Neutrl App on Ethereum Mainnet.

Join early. Earn more. Be part of the next major DeFi yield event.

WHAT MATTERS

Stripe-Backed Tempo Raises $500M at $5B Valuation

State of play: Tempo, a payments-focused blockchain incubated by Stripe and Paradigm, has raised $500M in a Series A led by Thrive Capital and Greenoaks, valuing the project at $5B, according to Fortune.

The round also saw participation from Sequoia Capital, Ribbit Capital, and SV Angel, though Stripe and Paradigm did not reinvest.

Tempo is already collaborating with major firms like OpenAI, Shopify, Visa, and Deutsche Bank.

Stripe CEO Patrick Collison described it as “the payments-oriented L1” designed for real-world financial applications.

Ethereum researcher Dankrad Feist recently joined Tempo as a senior engineer, signaling the project’s technical depth and commitment to permissionless, scalable financial infrastructure.

Why it matters: Stripe’s backing gives it a clear path into real-world finance, where stablecoin rails and traditional payments are starting to merge.

Our take: Its enterprise links could give it a real edge over more speculative chains.

For builders and investors: Tempo could become the go-to chain for payment apps and stablecoin projects. It’s worth watching how quickly it attracts developers and institutional partners.

PRODUCT OF THE WEEK

OpenSea’s SEA Token & Crypto Trading Feature

OpenSea will debut its long-anticipated SEA token in Q1 2026, marking a major step in its transformation from an NFT marketplace to a multi-chain crypto trading platform.

According to CEO Devin Finzer, 50% of the SEA supply will go to OG users and participants in OpenSea’s rewards program.

Meanwhile, half of platform revenue will fund token buybacks at launch.

Users will also be able to stake SEA behind tokens and NFT collections.

The move comes as OpenSea expands beyond NFTs to support perpetual futures trading and prepares to launch a mobile app.

Finzer described the new OpenSea as “the destination for the on-chain economy,” uniting art, culture, and finance in one platform.

Other cool products:

TaskOn, a web3 new task platform.

42, a prediction market platform on Base.

10KSwap, an AMM protocol on StarkNet.

XPIN Network, an AI-driven decentralized communication infrastructure.

Take a peek at our referral reward at the bottom of this issue. Share this newsletter and receive our list of 500 crypto VC individuals 👇

CHARTS OF THE WEEK

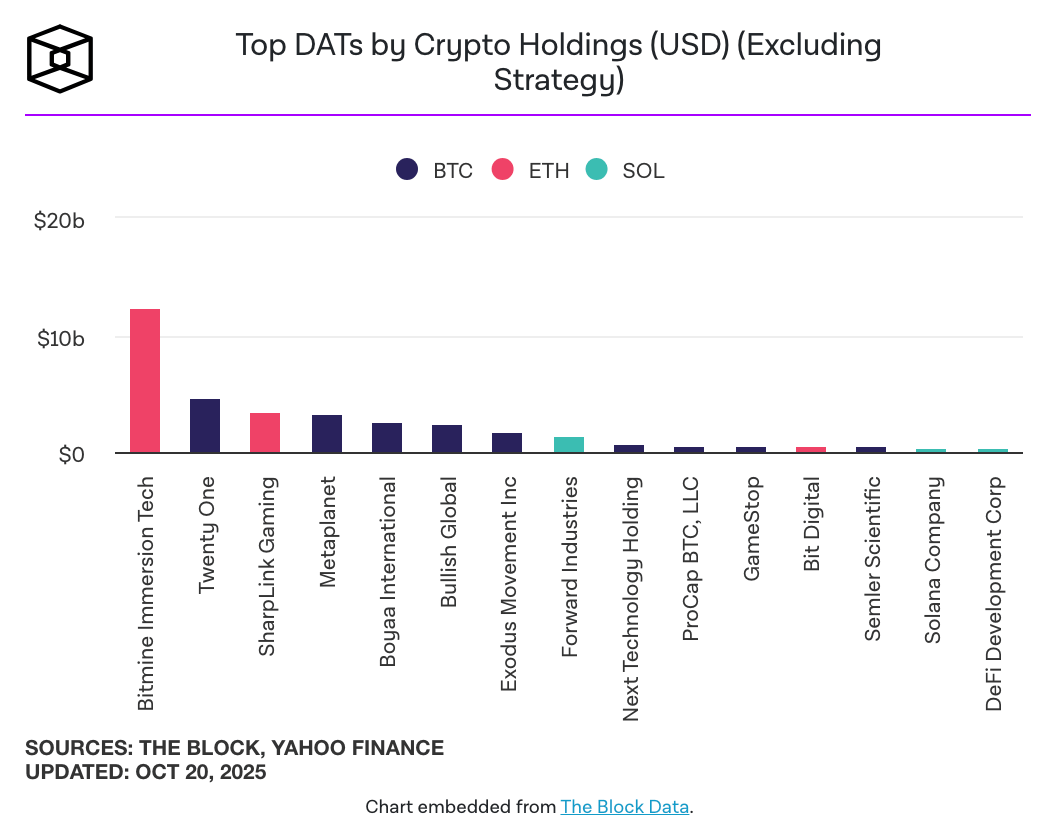

Asia’s Ethereum Backers Plan $1B ETH Treasury Firm

State of play: A group of Asia’s most prominent Ethereum backers are reportedly planning to acquire a Nasdaq-listed company to establish a $1B Ethereum-focused digital asset treasury (DAT), according to Bloomberg.

The effort is led by Huobi founder Li Lin, Fenbushi Capital’s Shen Bo, HashKey Group CEO Xiao Feng, and Meitu founder Cai Wensheng.

Avenir Capital, chaired by Li Lin, has pledged $200M, with additional commitments from major investors including HongShan Capital Group.

Each participant has deep ties to Ethereum’s early ecosystem.

Fenbushi Capital co-launched with Vitalik Buterin in 2015, while HashKey’s Feng recently partnered with Buterin to form the Ethereum Applications Guild.

Meitu’s Wensheng was also one of the first corporate figures in China to hold a crypto treasury, accumulating over 10,000 BTC during the 2018 bear market.

Our take: This marks Asia’s bid to shape the next generation of crypto treasuries after the US-led Bitcoin DAT boom.

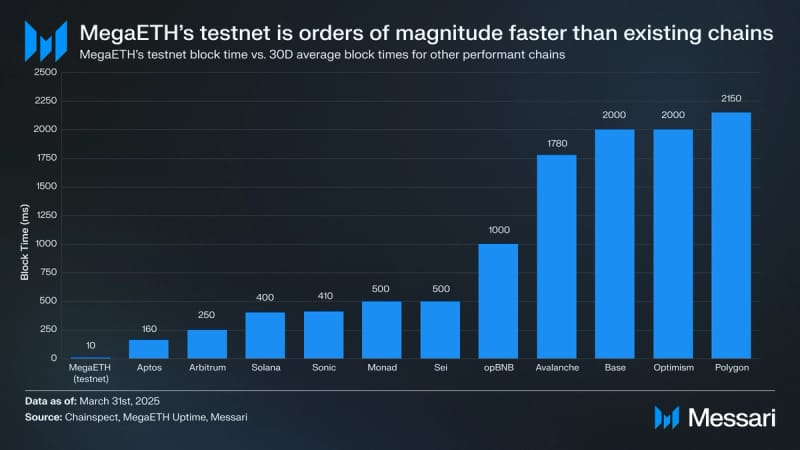

MegaETH Buys Back 4.75% Equity and Token Warrants

State of play: MegaETH has repurchased 4.75% of its equity and token warrants from pre-seed investors, an uncommon move ahead of its mainnet and token launch expected later this year.

Co-founder Shuyao Kong said the buyback followed requests from early investors closing their funds.

Since MegaETH doesn’t allow secondary trades, the team became the sole buyer.

The transaction was completed above the company’s prior $100M+ seed valuation, with approval from major stakeholders Dragonfly and Echo.

MegaETH said the pre-launch buyback aims to tighten ownership and maintain “aligned, long-term builders” rather than passive capital.

The team previously raised $10M via Echo and $13M from The Fluffle NFT sale, both at the same valuation.

A public token sale is planned through Cobie’s Sonar platform, with registration open from October 15 to 27, as the project prepares to go live on mainnet.

Our take: MegaETH’s pre-launch buyback is a bold move to tighten ownership and show confidence ahead of its token debut. It clears out short-term investors and sets the stage for a cleaner, more aligned launch.

QUICK BITES

Stripe-backed Tempo raises $500M at $5B valuation.

Asia’s Ethereum backers plan $1B ETH Treasury Firm.

Japan mulls allowing local banks to buy and sell crypto.

OpenSea will debut its long-anticipated SEA token in Q1’26.

Crypto markets surge as Trump confirms Oct. 31 summit with Xi.

NY mayor candidate Cuomo pledges crypto innovation with new role.

Beijing moves to stop Chinese tech giants from issuing stablecoins in HK.

Spot BTC ETFs shed $1.2B in second-largest weekly outflows since debut.

Crypto execs to meet Senate Democrats over market structure legislation.

Robinhood tokenizes nearly 500 US stocks, ETFs on Arbitrum for EU users.

NOTEWORTHY READS & MEME

POV: You have discovered crypto twitter.

— 0xprincess (@0x9212ce55)

6:32 PM • Oct 19, 2025

If you enjoy reading this issue, please consider subscribing. It takes 1 minute of your time, but it would mean the world to us 🙇

Disclaimer: All the information presented in this publication and its affiliates is strictly for educational purposes only. It should not be construed or taken as financial, legal, investment, or any other form of advice.