Stream Finance Halts Deposits & Withdrawals After $93M Loss

Perp DEX Volumes Hit Record $1.2T in October | FTSE Russell Joins Chainlink

📢Sponsor | 💡Telegram | 📰Past Editions

Good Morning.

DeFi hit both highs and lows in October. Perp DEXs smashed records with $1.2T in trades, driven by incentives and liquidations, while Stream Finance froze activity after a $93M loss exposed deeper risks across the ecosystem.

Check out our latest episode with Buzzing!

In Today's Email:

What Matters: Stream Finance Halts Deposits & Withdrawals After $93M Loss

Case Study: Perp DEX Volumes Hit Record $1.2T in October 📈

Governance & Features: FTSE Russell Joins Chainlink 🤝

You read and share. We listen and improve. Send us feedback at [email protected].

Narratives: Perp DEX Mania

For daily market updates and airdrop alphas, check out our telegram!

TOGETHER WITH

Humanity Protocol Integrates Mastercard’s Open Finance into Human ID

Humanity Protocol is redefining digital identity for the open finance era.

By integrating Mastercard’s open finance technology, Humanity Protocol now enables Human ID users to securely prove who they are and what they own without giving up control of their data.

The company views identity as a foundation for the future of finance. Through its collaboration with Mastercard, Humanity Protocol is transforming Human ID from a simple verification tool into a gateway to global finance.

The integration allows users to validate key financial elements such as bank account ownership, income range, or asset holdings in a secure, privacy-preserving way without exposing sensitive data.

These verified data points are converted into cryptographic credentials that can be reused across ecosystems.

Whether applying for a DeFi loan, participating in RWA markets, or opening an account with a traditional bank, Human ID provides trusted proof across both on-chain and off-chain environments.

By removing manual checks and redundant onboarding steps, Humanity Protocol enables faster, more reliable access to financial services.

The result is a privacy-first financial identity that moves seamlessly between Web3 and traditional finance, simplifying participation in the broader digital economy.

No paperwork. No friction. Just trusted, verified identity powered by Humanity Protocol.

WHAT MATTERS

Stream Finance Halts Deposits & Withdrawals After $93M Loss

Yesterday, an external fund manager overseeing Stream funds disclosed the loss of approximately $93 million in Stream fund assets.

In response, Stream is in the process of engaging Keith Miller and Joseph Cutler of the law firm Perkins Coie LLP, to lead a comprehensive

— Stream Finance (@StreamDefi)

3:55 AM • Nov 4, 2025

State of play: Stream Finance has suspended all deposits and withdrawals after an external fund manager reported a $93M loss in its managed assets.

The DeFi protocol, known for its synthetic tokens xUSD, xBTC, and xETH, has engaged Perkins Coie LLP to investigate.

Analysts from YieldsAndMore estimate $285M+ in potential exposure across seven networks involving protocols such as Elixir, MEV Capital, and TelosC.

Elixir’s deUSD holds the largest exposure at $68M, around 65% of its reserves.

Preliminary findings point to liquidity mismatches and collateral rehypothecation as key causes.

Stream’s xUSD has depegged to $0.53, with no confirmation yet on fund recovery.

Why it matters: The incident caps a volatile week for DeFi, following the $128M Balancer exploit and Moonwell’s $1M oracle attack, bringing total sector losses to more than $220M.

Our take: Stream’s loss shows how fragile DeFi’s leveraged systems still are. Rehypothecation and opaque fund management turn efficiency into risk fast, especially when trust and transparency are missing.

For builders and investors: Build for stability, not just yield. Keep collateral flows clear and verifiable. Also, be wary of synthetic yield products you can’t fully trace.

CASE STUDY

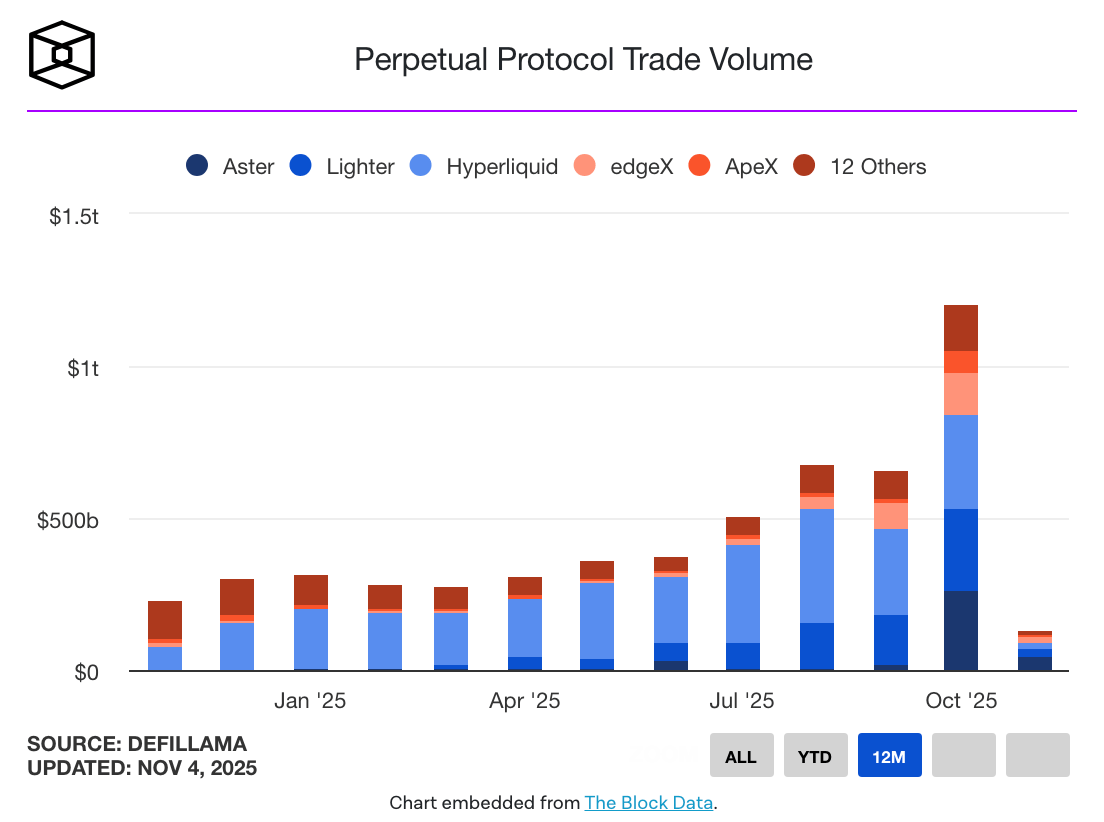

Perp DEX Volumes Hit Record $1.2T in October

Perpetual DEX trading volume hit an all-time high of $1.2T in October, nearly doubling September’s total.

The surge was driven by aggressive incentive programs and a major Oct. 10 liquidation wave that triggered heavy trading activity.

Lighter led the market with a 27% share, overtaking Hyperliquid, whose volume fell 16% below its peak and market share dropped to 10% from 33% last month.

Other major gainers included Aster, EdgeX, Pacifica, and ApeX, all recording record volumes.

Analysts attribute the boom to ongoing points and airdrop programs, zero-fee trading designs, and post-liquidation “revenge trading” behavior.

While volumes are expected to cool in coming months, analysts expect a higher baseline supported by continued trading incentives.

Take a peek at our referral reward at the bottom of this issue. Share this newsletter and receive our list of 500 crypto VC individuals 👇

INSIGHTS

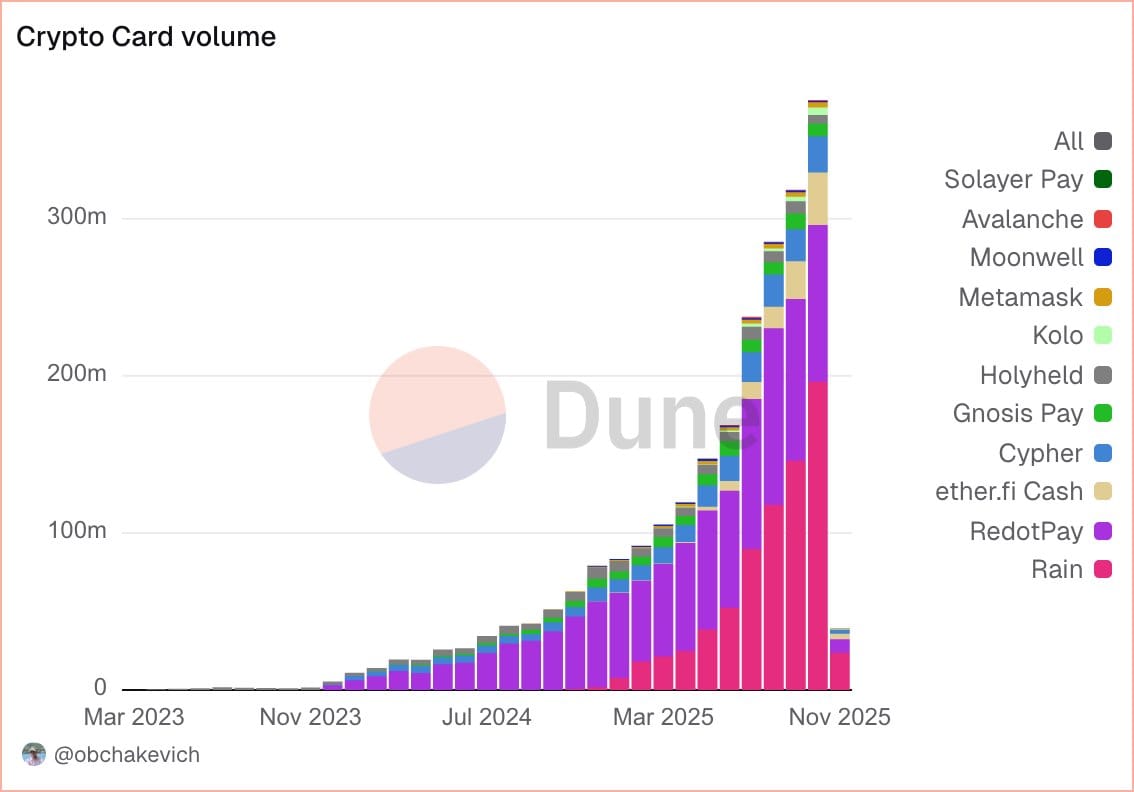

Crypto Card Volumes Jump to $376M in October

Credits to @obchakevich_ for the original tweet

Crypto card transaction volumes climbed from $318M to $376M in October.

Rain Cards ($196M) and RedotPay ($100M) leading the market.

Ether.fi Cash followed with $33M in volume.

Top growth performers included Rain Cards (+$50M), Ether.fi Cash (+$9M), Cypher (+$3M), KoloHub (+$2M), and MetaMask (+$0.4M).

FEATURES & GOVERNANCE UPDATE

Gemini to Launch Prediction Markets as FTSE Russell Joins Chainlink

Gemini is preparing to launch prediction market contracts, according to Bloomberg. The exchange has already filed with the CFTC to operate a designated contract market, which could host trading for prediction-based derivatives.

The move comes amid rising interest in prediction markets, with Kalshi and Polymarket posting record October volumes of $4.4B and $3B, respectively.

Meanwhile, FTSE Russell has partnered with Chainlink to bring its major stock indices, including the Russell 1000, 2000, and 3000, onchain using Chainlink’s DataLink service.

The integration makes FTSE Russell’s benchmark data continuously accessible to smart contracts across multiple blockchains.

Other notable feature updates:

Frax has launched FraxNet.

Wormhole launched Portal Earn.

Spark released its Q3 financial report.

Circle has launched the Arc Public Testnet.

Ondo Global Markets has expanded to BNB Chain.

Ethereum’s Fusaka is now live on the Hoodi test network.

Polynomial launched onchain perpetuals for traditional markets.

QUICK BITES

Perp DEX volumes hit record $1.2T in October.

Canada’s budget promises laws to regulate stablecoins.

Gemini preparing to launch prediction market contracts.

Strategy files IPO for euro stock to fund more Bitcoin buys.

Stream Finance halts withdrawals and deposits after $93M loss.

SBF returns to court seeking new trial after FTX fraud conviction.

$1.3B+ in crypto positions liquidated as BTC drop below $104,000.

Hut 8 joins rank of top 10 largest public BTC holders with 13,000+ BTC.

EU plan to centralize crypto oversight under ESMA dividing the industry.

US prosecutors seek 5-year prison terms for Samourai Wallet founders.

FTSE Russell taps Chainlink to bring Russell 1000 & other index data onchain.

NOTEWORTHY READS & MEME

Told him to buy bitcoin at $124,000

— Not Jerome Powell (@alifarhat79)

7:03 PM • Nov 4, 2025

If you enjoy reading this issue, please consider subscribing. It takes 1 minute of your time, but it would mean the world to us 🙇

Disclaimer: All the information presented in this publication and its affiliates is strictly for educational purposes only. It should not be construed or taken as financial, legal, investment, or any other form of advice.