State of Ethereum Digital Asset Treasury Companies (ETH DATs) 2025

Inside the Rise of Corporate Validators

📢 Sponsor | 💡 Telegram | 📰 Past Editions

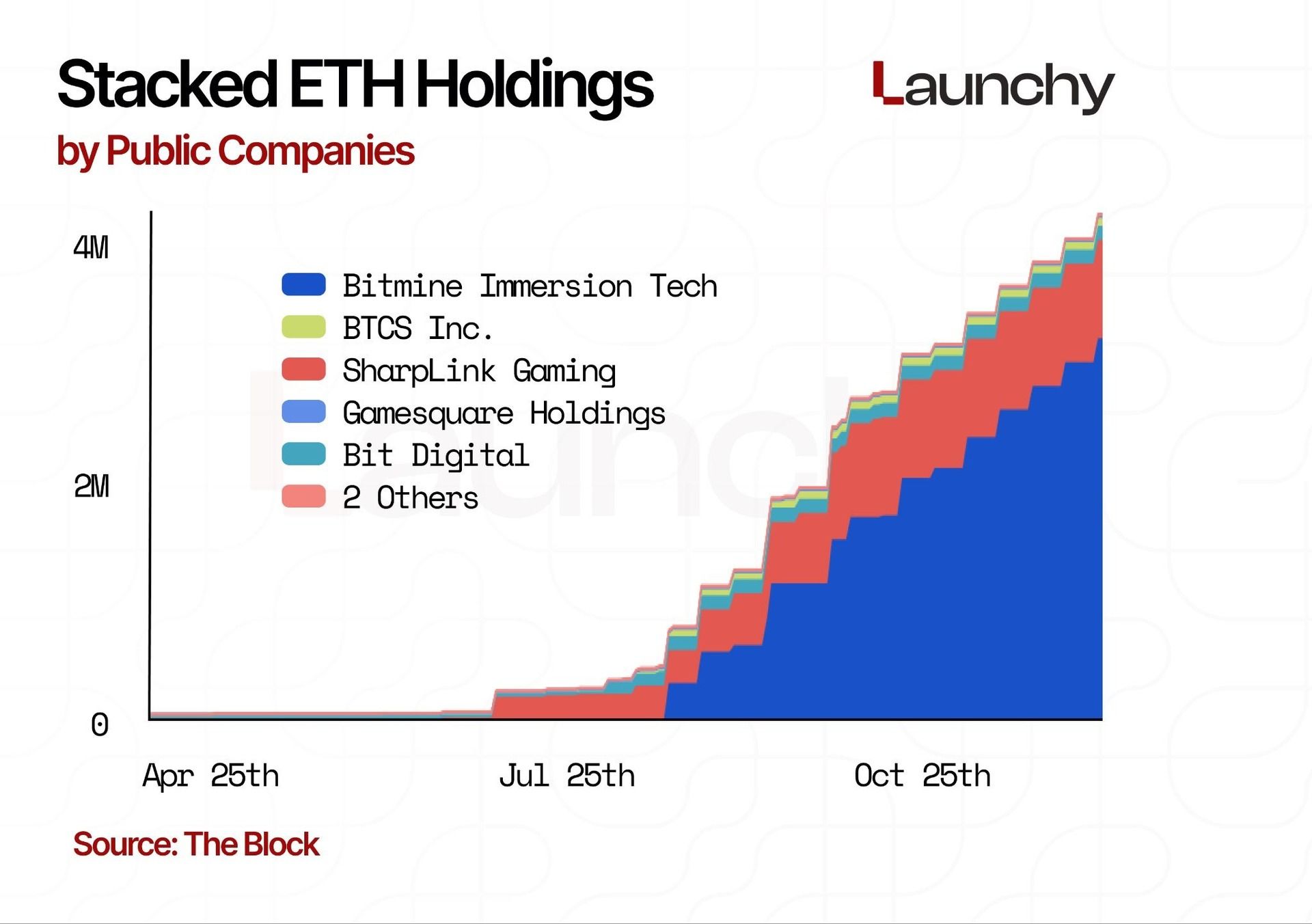

Ethereum-based Digital Asset Treasury Companies (DATs) have evolved from experiments into a maturing asset class. Public companies now collectively hold over 4.8M ETH valued at about $16B, signaling that corporate accumulation is no longer exclusive to Bitcoin.

Unlike Bitcoin DATs, which rely purely on price appreciation, Ethereum treasuries earn on-chain yield through staking, adding a self-sustaining income layer. This structural difference gives Ethereum DATs a unique capital advantage but also new operational and regulatory risks.

In 2025, firms like BitMine Immersion Technologies and SharpLink Gaming dominate this growing field. They are joined by smaller players blending ETH exposure with DeFi infrastructure and validator operations. However, the critical question remains: can the ETH DAT model scale sustainably, or is it repeating the reflexive premium cycle seen in Bitcoin treasuries?

Key Takeaways

Public ETH treasuries now exceed 4.8M ETH, worth nearly $16B, representing 2.8% of Ethereum’s circulating supply.

BitMine Immersion Technologies and SharpLink Gaming control more than 80% of these holdings.

Staking yield provides DATs a built-in return mechanism but introduces regulatory and smart contract risk.

Asia is emerging as a new hub with a planned $1B Ethereum treasury acquisition, signaling Ethereum’s globalization.

Sustainability depends on maintaining equity premiums, regulatory clarity, and long-term staking stability.

Market Composition

The Ethereum DAT ecosystem has grown from niche experiments into a formalized market segment. Publicly listed DATs now hold about 4.8M ETH, valued at roughly $16B, or 2.8% of supply.

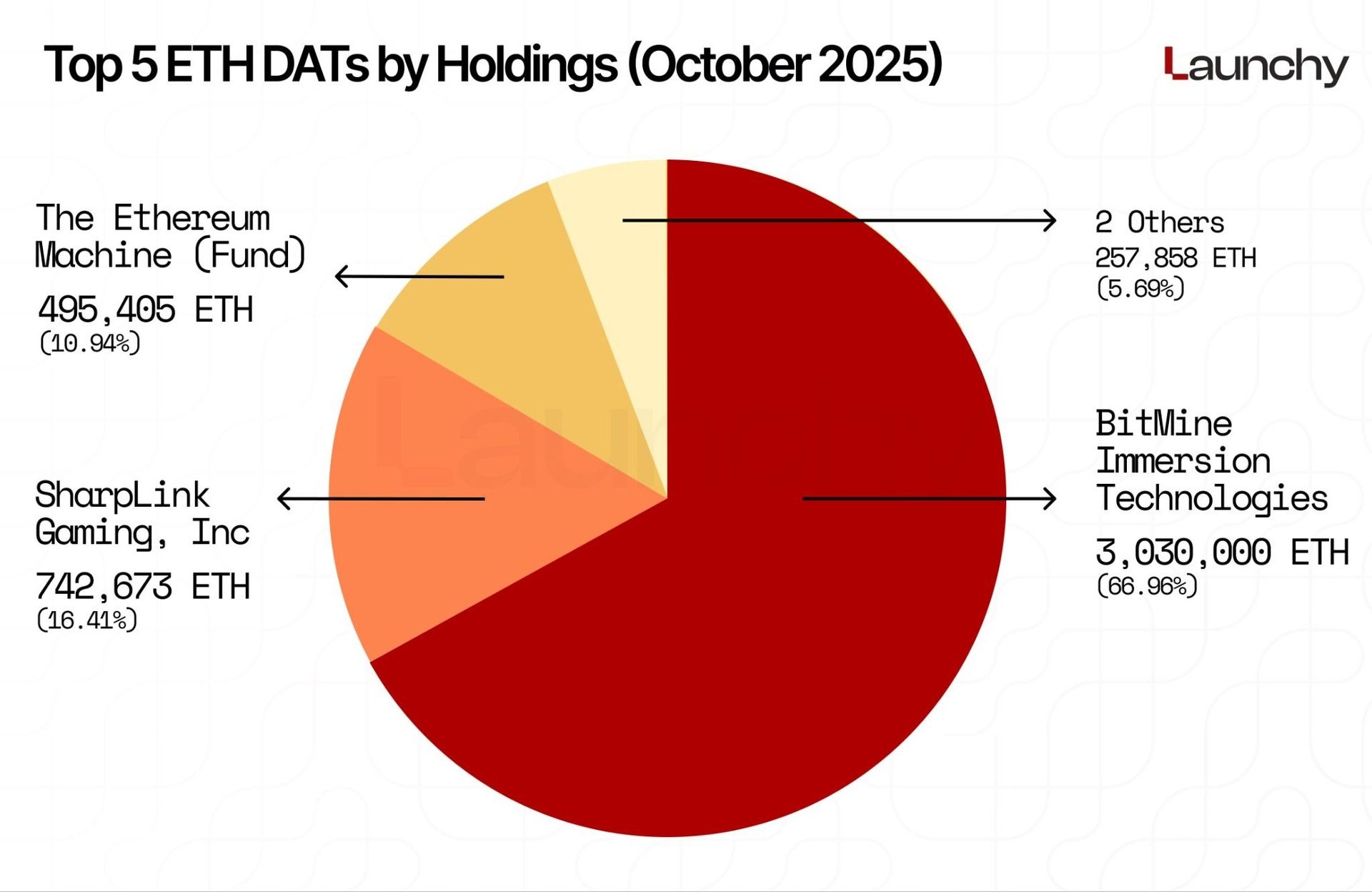

Top 5 ETH DATs by Holdings (October 2025):

BitMine Immersion Technologies – 3.03M ETH ($12.23B)

SharpLink Gaming, Inc. – 742,673 ETH ($2.99B)

The Ethereum Machine (Fund) – 495,405 ETH ($1.99B)

Coinbase Global, Inc. – 136,782 ETH ($551.38M)

Bit Digital, Inc. – 121,076 ETH ($488.07M)

These top five hold more than 90% of all ETH in public treasuries, showing extreme concentration at the top. The long tail of smaller firms holds modest allocations, typically combining treasury accumulation with staking and infrastructure services.

BitMine Immersion Technologies leads by a wide margin with 3.03M ETH, or roughly 2.5% of Ethereum’s supply. Its goal of reaching 5% of supply would give it validator influence rivaling major staking pools.

SharpLink Gaming, guided by Chairman Joseph Lubin, continues to scale aggressively, recently purchasing 19,271 ETH for $75M at an average price of $3,892. Its total ETH holdings now exceed 859,000 ETH and generate over $22M in cumulative staking rewards.

The long tail includes firms like Galaxy Digital and BTCS, which use ETH exposure to complement their infrastructure or DeFi operations. Although smaller, these firms are important liquidity and validation nodes for the wider Ethereum treasury market.

Geographic Distribution

Ethereum DATs follow Bitcoin’s U.S.-centric pattern but are beginning to diversify across Asia and other regions.

United States remains dominant, home to BitMine, SharpLink, and several mid-tier players.

Asia is rising fast, driven by a planned $1B Ethereum treasury backed by Huobi founder Li Lin, Fenbushi Capital’s Shen Bo, HashKey Group’s Xiao Feng, and Meitu founder Cai Wensheng. The group plans to acquire a Nasdaq-listed company as a launch vehicle, signaling Asia’s entry into Ethereum corporate accumulation.

This growing international diversity reflects Ethereum’s dual role as both an asset and a productive layer for decentralized finance.

Capital Strategies

ETH DATs use traditional capital-market mechanisms but add on-chain yield optimization to improve returns.

At-the-Market (ATM) programs remain the main funding route, issuing equity above NAV to buy more ETH.

PIPEs and convertibles provide liquidity during drawdowns, often with discounted terms.

Staking yield adds 4–6% annualized returns, creating a self-funding treasury model. BitMine’s 5,671 ETH in staking income (~$22M) demonstrates the potential.

Some firms are testing validator leasing, renting staking rights to institutions for fixed yields.

This blend of corporate finance and on-chain yield has created a new feedback loop. Higher equity prices enable more ETH purchases, which boost staking income and reinforce valuation. However, this reflexivity is fragile and depends on stable yield and investor optimism.

Valuation remains the most misunderstood yet defining feature of the Ethereum DAT model. While Bitcoin DATs trade largely as leveraged spot proxies, Ethereum DATs trade on both NAV and yield expectations. Investors pay not just for ETH exposure but for the income stream derived from staking and DeFi strategies embedded in the treasury model.

Equity valuations in the ETH DAT sector typically factor in three layers:

Base NAV of ETH holdings measured against circulating supply.

Projected staking yield discounted to present value.

Expansion potential through future accretive equity issuance.

BitMine trades near 0.8x mNAV, balancing yield optimism with scale risk. SharpLink, supported by Consensys and transparent staking disclosures, trades closer to 1x NAV. By contrast, smaller firms like ETHZilla or Galaxy can command 3–5x premiums, driven by narrative momentum rather than fundamentals.

This dynamic introduces a valuation paradox. Staking yield sustains premiums in bull markets, yet those same premiums evaporate quickly in liquidity crunches. If validator yield compresses below 3% or ETH’s deflationary narrative weakens, equity multiples could collapse toward NAV.

Yield acts as both ballast and amplifier. It stabilizes valuations during accumulation phases but accelerates repricing during downturns. Ethereum DATs are therefore trading not only on ETH’s price trajectory but also on network-level yield elasticity.

The New Treasury Archetype

Ethereum DATs have redefined what a corporate treasury can be. Instead of passively holding digital assets, they are active on-chain participants, earning yield, providing liquidity, and in some cases, governing protocols directly.

BitMine’s validator infrastructure, one of the largest corporate-owned node clusters, integrates directly into Ethereum’s consensus mechanism, generating validator income while reinforcing network security. SharpLink leverages smart contracts and DeFi integrations to deploy part of its treasury into staking pools and restaking protocols such as Lido, EtherFi, and EigenLayer.

This model creates a feedback loop between treasury activity and the Ethereum network. When corporate treasuries stake more ETH, they directly enhance network decentralization and security, which in turn supports price stability and equity valuation. However, the same mechanism can destabilize markets if treasuries mass-unstake or exit validator positions during corrections.

This archetype hints at an emerging institutional validator class. DATs are evolving into semi-public validators that monetize blockspace, collect staking rewards, and hold governance influence. Yet this hybridization brings operational challenges. Managing validator uptime, slashing risks, and custody security requires expertise few public firms currently possess. If technical or compliance failures occur, losses could cascade across both treasury and equity valuations.

Risks

The Ethereum DAT model carries multiple layers of risk that intertwine corporate finance with blockchain mechanics.

Premium Collapse: DATs rely on equity premiums to raise capital accretively. If share prices fall below NAV, treasury accumulation halts and balance sheets stagnate. Smaller firms with thin liquidity are already trading near parity, signaling the onset of investor exhaustion.

Smart Contract and Custody Exposure: Validator management and DeFi participation expose treasuries to slashing, contract failure, or counterparty defaults. A single validator exploit could erase millions in ETH and permanently damage corporate credibility.

Regulatory and Tax Classification: The lack of standardized guidance on staking income complicates accounting and compliance. If authorities classify staking as a yield-bearing security, DATs could face new registration requirements and higher effective tax rates.

Liquidity and Macro Sensitivity: DAT equities are high-beta assets. A 20% ETH correction can result in 50% equity drawdowns due to leverage and collapsing premiums. The sector’s dependence on speculative equity inflows mirrors early SPAC cycles.

Validator Centralization: With BitMine holding more than half of corporate ETH reserves, validator power is dangerously concentrated. Should one entity’s governance or infrastructure fail, the Ethereum network could face measurable validator risk exposure.

Dilution Fatigue: Repeated capital raises through ATMs and PIPEs may desensitize investors. Without yield growth or NAV accretion, new issuances risk being seen as opportunistic liquidity events rather than long-term expansion.

Together, these risks form the structural challenge of the Ethereum DAT model. Its success depends on maintaining the illusion of perpetual premium expansion in a market that is inherently cyclical.

Emerging Counterforces

Despite these vulnerabilities, several counterforces are emerging that could fortify the ETH DAT ecosystem.

The Rise of Asian Treasuries

A consortium of Ethereum’s earliest backers, including Li Lin, Shen Bo, Xiao Feng, and Cai Wensheng, is preparing a $1B ETH DAT through the acquisition of a Nasdaq-listed company. This marks the first large-scale corporate ETH treasury initiative out of Asia. If successful, it will diversify validator power and decentralize treasury ownership away from the U.S.

Hybrid Treasury Structures

Some new entrants are building multi-chain treasuries that hold ETH alongside staked derivatives, tokenized treasuries, or even wrapped Bitcoin. This hybrid structure could stabilize yield, reduce volatility, and make DATs less dependent on Ethereum’s economic cycle alone.

Institutional Validator Integration

BitMine and SharpLink are exploring validator leasing markets, where institutions rent validator capacity for fixed yields. This innovation transforms corporate treasuries into yield platforms, blending traditional finance with on-chain infrastructure provisioning.

Regulatory Normalization

While regulation remains a risk, it could also become a catalyst. Clear accounting and disclosure frameworks for staking yield and validator exposure would strengthen investor confidence and attract new capital inflows from institutions.

DAO and DeFi Convergence

Some ETH DATs are beginning to integrate DAO mechanics, allowing shareholders to vote on validator delegation or yield allocation. This hybrid of corporate and decentralized governance may lead to programmable, transparent treasuries that operate autonomously while remaining compliant.

These trends point toward a sector that is maturing through experimentation. Ethereum DATs are shifting from speculative accumulation toward structural integration with the network itself.

Our Take

Ethereum DATs represent the second generation of digital asset treasuries. They extend the Bitcoin treasury model by embedding active yield mechanisms and validator participation. This creates both a more sustainable and more complex system.

In the best-case scenario, Ethereum DATs evolve into institutional validators that secure the network, generate yield, and anchor ETH within global capital markets. In the worst case, they become reflexive instruments, leveraged equity wrappers trading on speculative premiums disconnected from sustainable yield.

The coming year will test the model’s resilience. With BitMine targeting 5% of ETH’s supply, SharpLink’s $22M in staking income, and Asia’s $1B consortium preparing entry, the sector stands at a pivotal point.

If yields compress, regulation tightens, or equity premiums fade, many DATs could face capital exhaustion. But if corporate validators become mainstream and yield remains resilient, Ethereum treasuries could redefine what a corporate balance sheet looks like in the digital era: productive, network-aligned, and transparently on-chain.

If you enjoy reading this issue, please consider subscribing. It takes 1 minute of your time but it would mean the world to us 🙇

Disclaimer: All the information presented in this publication and its affiliates is strictly for educational purposes only. It should not be construed or taken as financial, legal, investment, or any other form of advice.