Securitize Goes Public in $1.25B SPAC Deal

CME XRP & SOL Futures Hit $3B Record | Circle Launches Arc Public Testnet

📢Sponsor | 💡Telegram | 📰Past Editions

Good Morning.

The walls between Wall Street and onchain finance are getting thinner. Securitize is taking its $1.25B shot at the public markets while putting its own stock onchain, and CME just saw XRP and Solana futures crack a $3B open interest record.

Check out our latest episode with Buzzing!

In Today's Email:

What Matters: Securitize Goes Public in $1.25B SPAC Deal 👀

Case Study: CME XRP & SOL Futures Hit $3B Record 📈

Governance & Features: Circle Launches Arc Public Testnet 🚀

You read and share. We listen and improve. Send us feedback at [email protected].

Narratives: Regulated Onchain Boom

For daily market updates and airdrop alphas, check out our telegram!

TOGETHER WITH

Nuvolari Canvas Series #2: Making Crypto AI Usable

Nuvolari has just published the second edition of its Canvas Series, a deep exploration of how AI and crypto can finally become usable together. The piece continues Nuvolari’s effort to uncover what truly drives adoption in the next generation of AI-powered financial tools.

The article examines why AI agents in crypto remain far from mainstream despite rapid progress in LLMs and automation. It looks at real user behavior, findings from the CAIA benchmark, and months of interviews with traders and builders.

The takeaway is clear: the future of crypto AI isn’t about smarter agents but about trust, transparency, and adapting to how users actually operate in DeFi.

WHAT MATTERS

Securitize Goes Public in $1.25B SPAC Deal

State of play: Tokenization leader Securitize will go public through a $1.25B SPAC merger sponsored by Cantor Fitzgerald, with the combined firm set to trade on Nasdaq under the ticker SECZ.

The company will also tokenize its own equity as part of the listing.

Securitize has become a key player in RWA tokenization, powering BlackRock’s $1B BUIDL fund and helping tradfi giants like Apollo and VanEck move onchain.

The firm has tokenized over $4B in assets and sees a $19T opportunity across equities, fixed income, and alternatives.

As part of the transaction, Securitize will raise $469M, including a $225M PIPE from investors such as Arche, Borderless Capital, Hanwha, and ParaFi.

Existing backers including ARK Invest, BlackRock, and Morgan Stanley will roll over their stakes.

Why it matters: If SECZ trades well, it sets a reference price for the whole RWA stack. If it stumbles, it tells you demand is still thin and compliance alone is not a moat.

Our take: Tokenizing its own equity is clever signaling, yet liquidity and recurring fee growth will decide whether the $1.25B tag is justified.

For builders and investors: Track hard metrics after listing: assets tokenized, take rates, secondary trading volume on its ATS, and issuer concentration.

CASE STUDY

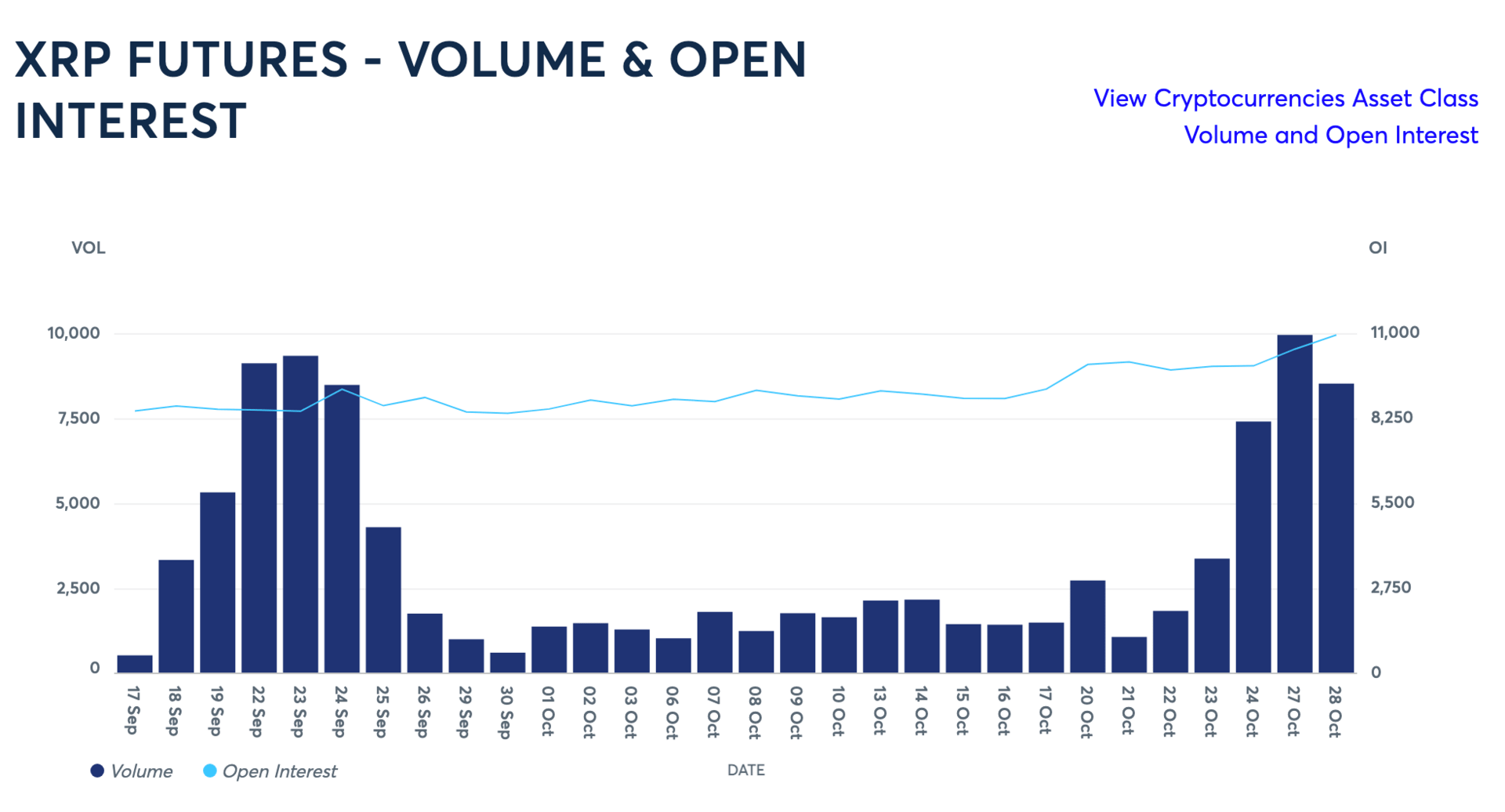

CME XRP & SOL Futures Hit $3B Record

Source: CME

Open interest in CME’s XRP and Solana futures reached a record $3B, showing surging institutional and retail demand for regulated altcoin exposure.

The exchange recorded 9,900 active XRP and micro XRP contracts and 15,600 open Solana positions.

Solana futures, launched in March, crossed $1B in open interest by August, while XRP futures hit the same milestone within three months of debut.

CME’s head of equity and FX products said the growth highlights rising adoption of regulated futures for crypto risk management and exposure.

Take a peek at our referral reward at the bottom of this issue. Share this newsletter and receive our list of 500 crypto VC individuals 👇

INSIGHTS

WLFI to Airdrop 8.4M WLFI to Early USD1 Users

From Day One, the USD1 Points Program aimed to redefine how users are recognized for driving the adoption and use of a top 10 stablecoin.

Now, only two months in, the vision is becoming reality. CEX partners are distributing 8.4 Million $WLFI to adopters of the USD1 points

— WLFI (@worldlibertyfi)

12:53 AM • Oct 29, 2025

World Liberty Financial will distribute 8.4M WLFI tokens to early adopters of its USD1 stablecoin through the USD1 Points Program.

The rewards target users who traded USD1 pairs or held balances on partner exchanges, including Gate.io, KuCoin, HTX, LBank, Flipster, and MEXC.

The Trump-backed firm said the program will expand with new DeFi integrations, trading pairs, and earning options.

WLFI currently trades at $0.14 with a $3.8B market cap, while USD1 holds the sixth-largest stablecoin position at $2.98B.

FEATURES & GOVERNANCE UPDATE

Circle Launches Arc Public Testnet

Circle has launched the public testnet for Arc, a new Layer 1 blockchain built to bring large-scale financial activity onchain.

More than 100 institutions including BlackRock, Visa, AWS, Goldman Sachs, and Deutsche Bank are taking part in early development.

Arc is designed as an “economic operating system” with predictable dollar-based fees, sub-second transaction finality, and configurable privacy.

It uses USDC as the native gas token and aims to support payments, capital markets, and lending applications.

The testnet also involves major partners such as Mastercard and Cloudflare, along with exchange integrations from Coinbase, Kraken, and Robinhood.

Circle plans to expand validator participation and governance as Arc moves toward community-driven operation.

Other notable feature updates:

Jupiter launched Ultra v3.

Nillion introduced Nillion 2.0.

Spark launched Spark Savings V2.

Ethereal launched its Mainnet Alpha.

Aerodrome introduced Aero Ignition.

Maple and Aave formed a strategic partnership.

MegaETH announced its public sale on Sonar by Echo.

Jupiter launched its first-ever prediction market in beta.

Polymarket launched 15-minute up/down crypto prediction markets.

QUICK BITES

Securitize to go public via $1.25B SPAC deal.

Polymarket to go live in the US by late November.

WLFI to distribute 8.4M WLFI for early USD1 adopters.

Ethereum's Fusaka hard fork activates on final testnet.

Truth Social jumps into prediction markets with Crypto.com.

Stable to launch Phase 2 of pre-deposit campaign next week.

Western Union plans stablecoin launch on Solana for early 2026.

Visa adding support for four stablecoins on four unique blockchains.

Ethereum ICO participant moves $6M in ETH after 8-year dormancy.

Australia classifies stablecoins, wrapped tokens as financial products.

Circle launches Arc public testnet with over 100 institutional participants.

NOTEWORTHY READS & MEME

$XRP holders rn:

— lucas (@lucasdimos)

5:20 PM • Oct 28, 2025

If you enjoy reading this issue, please consider subscribing. It takes 1 minute of your time, but it would mean the world to us 🙇

Disclaimer: All the information presented in this publication and its affiliates is strictly for educational purposes only. It should not be construed or taken as financial, legal, investment, or any other form of advice.