SEC Allows State Trusts to Hold Crypto Assets

Stripe Launches Platform for Custom Stablecoins | Cronje’s Flying Tulip Raises $200M

📢Sponsor | 💡Telegram | 📰Past Editions

Good Morning.

The SEC just made a notable pivot: investment advisers can now use state trusts to custody crypto. It’s a win for clarity, but the real impact may be uneven, with big firms better positioned to take advantage than smaller ones.

In Today's Email:

What Matters: SEC Allows State Trusts to Hold Crypto Assets 👀

Case Study: Stripe Launches Platform for Custom Stablecoins 💵

Governance & Features: Visa Tests Stablecoin Payments 💳️

You read and share. We listen and improve. Send us feedback at [email protected].

Narratives: Stablecoin Infrastructure Race

For daily market updates and airdrop alphas, check out our telegram!

TOGETHER WITH

0G Mainnet Goes Live With Key Integrations

The Aristotle Mainnet is now live. 0G is built as a modular AI Layer 1, designed for speed, scale, and openness from day one. What sets this launch apart is the strength of the integrations that went live alongside it.

Chainlink is live on 0G, bringing CCIP as the core cross-chain infrastructure and Data Streams as the low-latency oracle of choice.

Pyth Network is live, delivering more than 2,000 institutional-grade price feeds to power real-time data for the next wave of AI-driven finance.

BitGo is live, offering custody and staking for $0G so institutions can participate with confidence.

Interport Finance is live, giving users seamless cross-chain liquidity and a smooth entry point into the 0G ecosystem.

This is not just a chain launch. It is the start of decentralized AI at scale.

WHAT MATTERS

SEC Allows State Trusts to Hold Crypto Assets

State of play: The SEC has taken a surprising step by confirming that investment advisers can rely on state-chartered trust companies to act as custodians for crypto.

The no-action letter gives clarity for registered advisers and funds under the Investment Advisers Act, letting them handle crypto assets much like cash.

The move comes after a request from Simpson Thacher & Bartlett LLP.

This signals a shift away from the tougher stance seen during “Operation Choke Point 2.0.”

Lawmakers and industry voices, including Sen. Cynthia Lummis, welcomed the decision as overdue recognition of the frameworks built by states.

Why it matters: The SEC is finally giving clearer rules on who can hold crypto safely, which could ease concerns for advisers and funds that have been hesitant to enter the space.

Our take: While this is progress, it mainly benefits well-connected financial firms. Smaller players may still struggle with the costs and legal complexity of custody.

For builders and investors: Expect more traditional firms to dip into crypto, but don’t assume this fixes all the regulatory uncertainty. Custody may be clearer, but other rules remain murky.

CASE STUDY

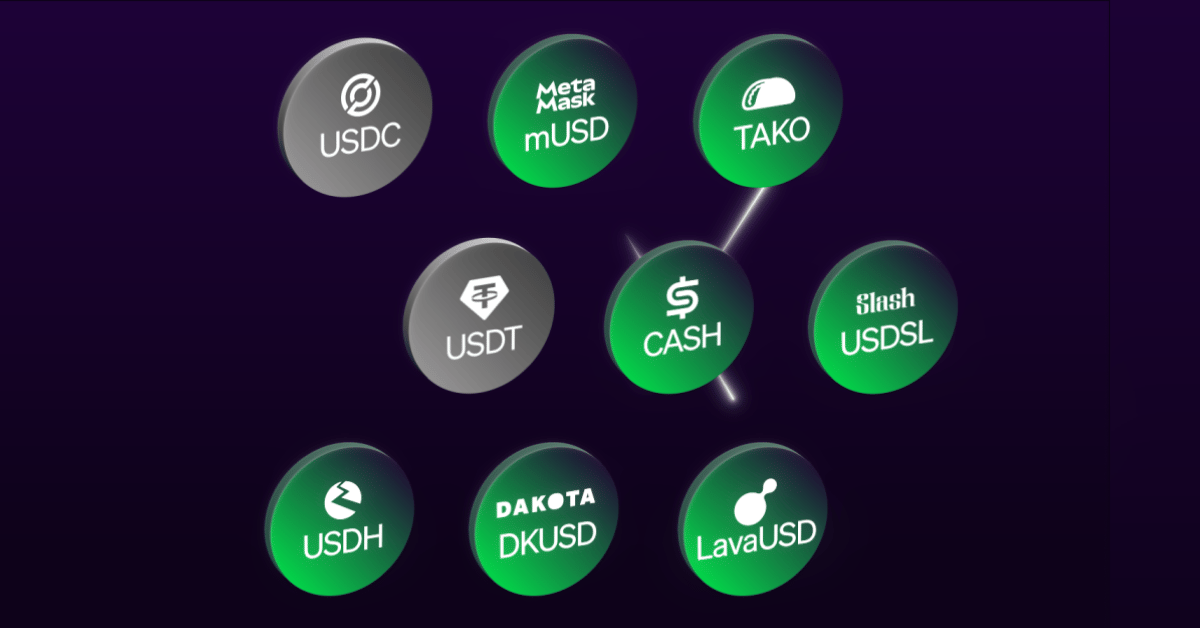

Stripe Launches Platform for Custom Stablecoins

Stripe announced Open Issuance, a platform that allows companies to create and manage their own stablecoins with minimal coding. The service is powered by last year’s $1.1B Bridge acquisition.

Open Issuance lets businesses mint, burn, and customize reserves between cash and treasuries, managed by firms like BlackRock and Fidelity.

Stripe plans to apply for a federal banking charter and a New York trust license to meet US regulations.

Stripe is positioning itself as a major player by offering infrastructure that gives businesses full control over their own tokens while ensuring interoperability.

Take a peek at our referral reward at the bottom of this issue. Share this newsletter and receive our list of 500 crypto VC individuals 👇

INSIGHTS

Cronje’s Flying Tulip Raises $200M at $1B Valuation

Andre Cronje’s Flying Tulip has raised $200M at a $1B valuation to build a full-stack onchain exchange spanning trading, lending, stablecoins, and insurance.

The raise features an “onchain redemption right,” allowing investors to redeem their original principal anytime, protecting downside while keeping upside intact.

Funds are deployed into yield strategies on Aave, Ethena, and Spark, with returns used for growth, buybacks, and incentives.

Flying Tulip now plans a public sale of up to $800M at the same valuation.

FEATURES & GOVERNANCE UPDATE

Visa Tests Stablecoin Payments

Visa has launched a pilot program allowing businesses to fund cross-border payments on Visa Direct with stablecoins instead of fiat. The initiative aims to cut settlement times from days to minutes, improve liquidity, and lower costs.

Circle’s USDC and EURC are the first stablecoins being tested, with more to follow.

While Visa hasn’t ruled out issuing its own stablecoin, the focus is on scaling existing assets through cards, settlement, and banking integrations.

The pilot, set for limited rollout by April 2026, reflects Visa’s growing push into stablecoin use cases as global adoption accelerates under new US regulations.

Other notable feature updates:

Circle launched USDC and CCTP V2 on Ink.

Spark announced a partnership with PayPal.

Drake Exchange launched its testnet on Monad.

Gate launched Gate Layer, a new Layer 2 network.

Plasma launched its mainnet and native token XPL.

Jupiter Lend introduced permissionless liquidation bots.

LayerZero Foundation repurchased 50M ZRO from early investors.

QUICK BITES

ETH and BTC spot ETFs' daily inflows top $1B.

Flying Tulip raises $200M at $1B token valuation.

Robinhood eyes overseas prediction market launch.

SEC lets advisers use state trusts for crypto custody.

Stripe to help companies to launch their own stablecoins.

Tether moves 8,888 BTC worth $1B into bitcoin reserve wallet.

White House drops Brian Quintenz from CFTC chair consideration.

Tether to tap Rumble through upcoming wallet to drive USAT adoption.

Visa pilots stablecoin payments for businesses sending money abroad.

Gary Gensler's deleted texts under scrutiny from House Republicans.

Sen. Lummis says progress is underway on crypto tax rules in the Senate.

Chainlink integrates Swift messaging to streamline tokenized fund workflows.

NOTEWORTHY READS & MEME

throwback to this banger

— Iced (@IcedKnife)

6:45 PM • Sep 29, 2025

If you enjoy reading this issue, please consider subscribing. It takes 1 minute of your time, but it would mean the world to us 🙇

Disclaimer: All the information presented in this publication and its affiliates is strictly for educational purposes only. It should not be construed or taken as financial, legal, investment, or any other form of advice.