PumpFun Raises $500M in 12 Minutes

Bitcoin ETFs Hit $158B | Tokenized Time Marketplace

📢Sponsor | 💡Telegram | 📰Past Editions

Good Morning.

Happy Bitcoin All-Time High! (again). As I’m writing this, we’re breaking above $122,000, and maybe it’s time to reframe the narrative again and say a Bitcoin is merely $0.12M — means there are room to grow… right?

Check out our latest episode with David Choi from USDai.

In Today's Email:

What Matters: Pumpfun Raises $500M in Minutes 💊

Product of the Week: Timefun’s Tokenized Time Marketplace ⌛️

Charts: SharpLink Adds 10,000 ETH, Bitcoin ETFs Hit $158B 🚀

You read and share. We listen and improve. Send us feedback at [email protected].

Narratives: Stay cautious on the macro side.

For daily market updates and airdrop alphas, check out our telegram!

TOGETHER WITH

Launch Your Brand with Pro-Grade Video, Without Breaking the Bank

We just launched something new in Launchy - a full-service video production agency designed specifically for your brand growth!

We specialize in:

🚀 Brand launch videos that highlight your products.

📱 Vertical & horizontal videos optimized for YouTube Shorts, TikTok, IG Reels, and more.

🎙️ Complete podcast production (video + audio), plus expert content repurposing.

✂️ Premium video editing for events and in-person moments.

We've already worked with over 20 clients and offer something rare in this space: pricing that's friendlier than any comparable offer you'll find.

If you have an upcoming video need or just want to learn more, we’d love to talk.

WHAT MATTERS

Pumpfun Raises $500M in 12 Minutes

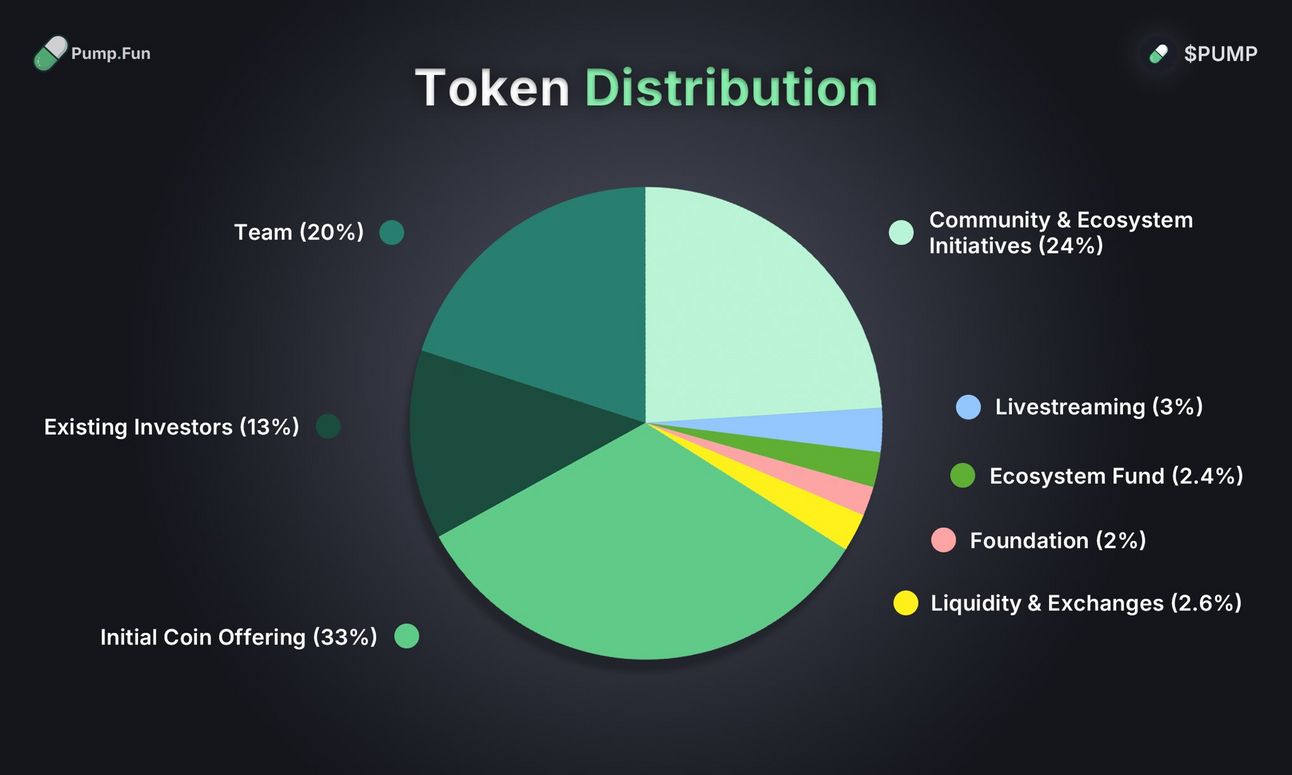

State of play: Pumpfun raised $500M in a public sale of its PUMP tokens, which sold out in just 12 minutes despite a planned 72-hour sale window. The platform offered 15% of its total 1T token supply at $0.004 per token, giving the project an FDV of $4B.

The website initially stated only 12.5% of the tokens were available to the public, but co-founder Alon Cohen clarified that the entire 15% allocation was sold.

The sale was conducted across multiple exchanges, including Bybit, which reported its offering was oversubscribed due to an API delay and promised refunds to users who did not receive tokens.

Pumpfun plans to explore utility options for PUMP, such as fee rebates and token buybacks, and is considering sharing protocol revenue with holders.

Our take: PumpFun has a P/E ratio of ~5.7 ($4B FDV divided by $700M in fees), but unlike traditional equities you don’t really “own” the PumpFun team/company and acquiring 51% of PUMP doesn’t mean that you’re now the UBO that’s in charge of deciding where the $700M in fees goes too. Thus, the buyback mechanism is the next best thing we have. Extrapolating on the 25% number, that gets us to ~$175M in annual buyback pressure.

I don’t believe this number is enough to offset the sell pressure from the ICOs, existing investors, and team members. Unlike HYPE, only 25% instead of 97% of the protocol fee is going to be used in token buybacks. While there might be upside because of the lack of tokens to bid, the gap between $4B FDV and $40B FDV is simply caused by the higher selling pressure and lower buying pressure. Sometimes, it’s better to keep it simple, stupid.

For builders and investors: Be careful when comparing PUMP with HYPE. There are significant differences.

PRODUCT OF THE WEEK

Timefun’s Tokenized Time Marketplace

Timefun has gone live on Solana, allowing creators to tokenize their time into tradable minutes. Fans can buy, sell, and redeem these minutes for direct messages, group chats, and soon voice or video calls.

All interactions happen within the platform using escrow contracts that hold the minutes until the creator responds, ensuring transparency and refunds if needed.

Each trade includes a 2% fee split among the creator, Timefun, referrers, and an award pool that distributes USDC rewards monthly to active holders.

Auctions for activities like calls can also be priced in minutes.

Founder Kawz said the bigger vision is to create a new asset class where people can invest in someone early and benefit as their popularity grows.

While Timefun started on Ethereum’s Base network, it moved to Solana for faster, cheaper transactions.

At launch, buying and redeeming time is open to everyone, while selling time is permissioned to control early demand.

A native token may be introduced later to connect the ecosystem once the platform reaches broader adoption.

Other cool products:

TONCO, a concentrated liquidity DEX on TON.

ORA, a protocol for decentralized AI and data in Web3.

Aurelius Finance, a CDP-integrated lending-borrowing protocol.

MemHustle, a full-scale game seamlessly integrated into Telegram.

Atomiq, a trustless cross-chain swap between Bitcoin and smart chains.

Take a peek at our referral reward at the bottom of this issue. Share this newsletter and receive our list of 500 crypto VC individuals 👇

CHARTS OF THE WEEK

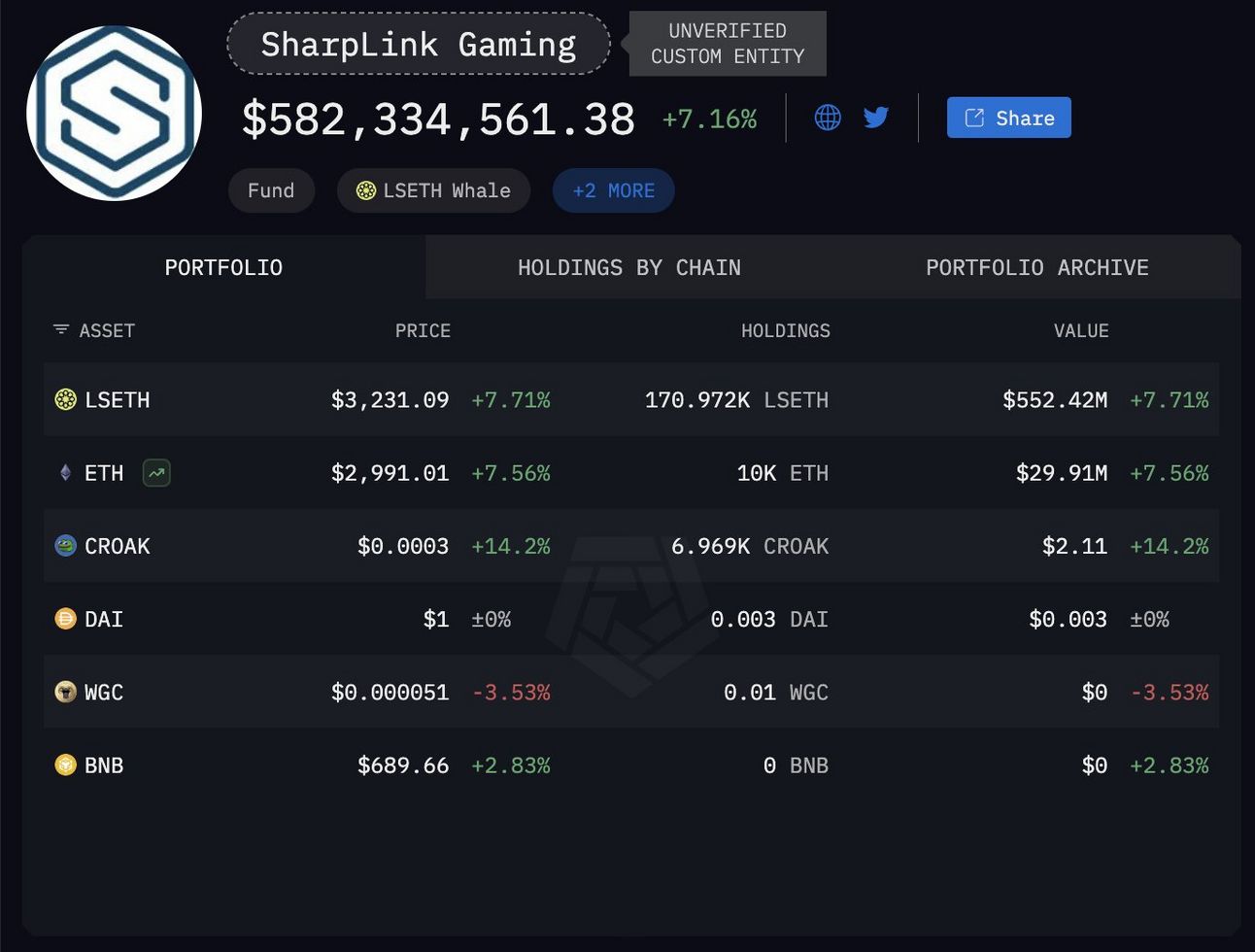

Source: Arkham

State of play: SharpLink Gaming purchased 10,000 ETH from the Ethereum Foundation for $25.7M at $2,572.37 per coin, lifting its total holdings to 215,634 ETH valued at around $558M.

The Nasdaq-listed firm began building its ether treasury in June and financed the acquisitions through up to $425M in share sales led by Consensys.

SharpLink plans to become the largest publicly traded ETH holder while staking and restaking ETH to strengthen the Ethereum ecosystem.

Shares (SBET) rose 10% in pre-market trading after the announcement.

Our take: SharpLink has a shot to become the MSTR for Ethereum, especially given Joe Lubin’s involvement. Now we just need a very strong showman to market it.

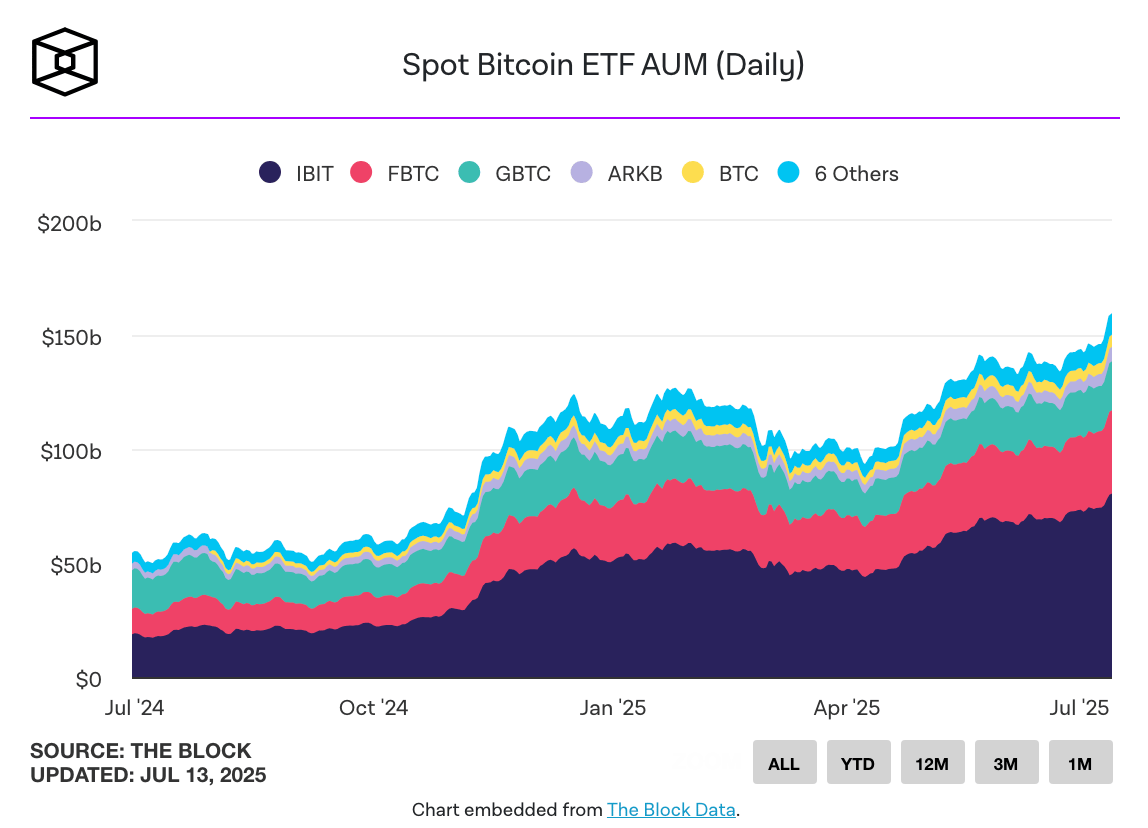

Bitcoin ETFs Hit $158B After $2.21B Inflows

Source: The Block

State of play: US spot Bitcoin ETFs reached a record $158.03B in total net assets after massive inflows last week. Funds took in $1.18B on Thursday and $1.03B on Friday, totaling $2.21B, the biggest two-day inflow since launch.

BlackRock’s IBIT led with $953.5M Friday and now manages $80B, more than double Fidelity’s FBTC at $36.4B.

Bitcoin’s price hit a record $118,500 Friday before dipping to $117,400 Saturday.

Meanwhile, spot Ethereum ETFs saw $1.057B in six-day inflows, pushing cumulative net inflows to $5.31B.

Our take: TradFi capital is really crucial to sustain the current bull run — which is why altcoins have been struggling significantly.

QUICK BITES

Bhutan moves $62M+ in BTC to Binance.

Bitcoin hits $120,000 as all-time high rally continues.

Metaplanet buys an additional 797 BTC for nearly $94M.

Czech Central Bank buys $18M in Coinbase stock in Q2.

Bitcoin ETFs hit $158B after two billion-dollar inflow days.

Kraken to airdrop PUMP tokens to users whose orders failed.

Bank of England boss warns banks against issuing stablecoins.

MoonPay Execs may have sent $250,000 to a Nigerian scammer.

Pumpfun raises $600M in 12 minutes as PUMP tokens fully sell out.

SharpLink adds nearly $49M worth of ETH to the corporate treasury.

NOTEWORTHY READS & MEME

If you enjoy reading this issue, please consider subscribing. It takes 1 minute of your time, but it would mean the world to us 🙇

Disclaimer: All the information presented in this publication and its affiliates is strictly for educational purposes only. It should not be construed or taken as financial, legal, investment, or any other form of advice.