Prediction Markets Surge as Kalshi & Polymarket Face Rivals

Vladimir Novakovski of Lighter | Cypherpunk Lifts Zcash Holdings to ~2% of Supply

📢Sponsor | 💡Telegram | 📰Past Editions

Good Morning & Happy New Year! 🎆

Prediction markets stepped into the mainstream in 2025. What started with election bets has turned into a fast growing way to price sports, macro, and cultural outcomes, with billions now flowing through these platforms. Kalshi and Polymarket still lead, but they are no longer the only game in town.

Check out our latest podcast episode!

In Today's Email:

What Matters: Prediction Markets Surge as Kalshi & Polymarket Face Rivals 👀

Founders Highlight: Vladimir Novakovski of Lighter 👨

Deal Flows: Cypherpunk Lifts Zcash Holdings to Nearly 2% of Supply 💰️

You read and share. We listen and improve. Send us feedback at [email protected].

Narratives: Truth by Markets

For daily market updates and airdrop alphas, check out our telegram!

WHAT MATTERS

Prediction Markets Surge as Kalshi and Polymarket Face Rivals

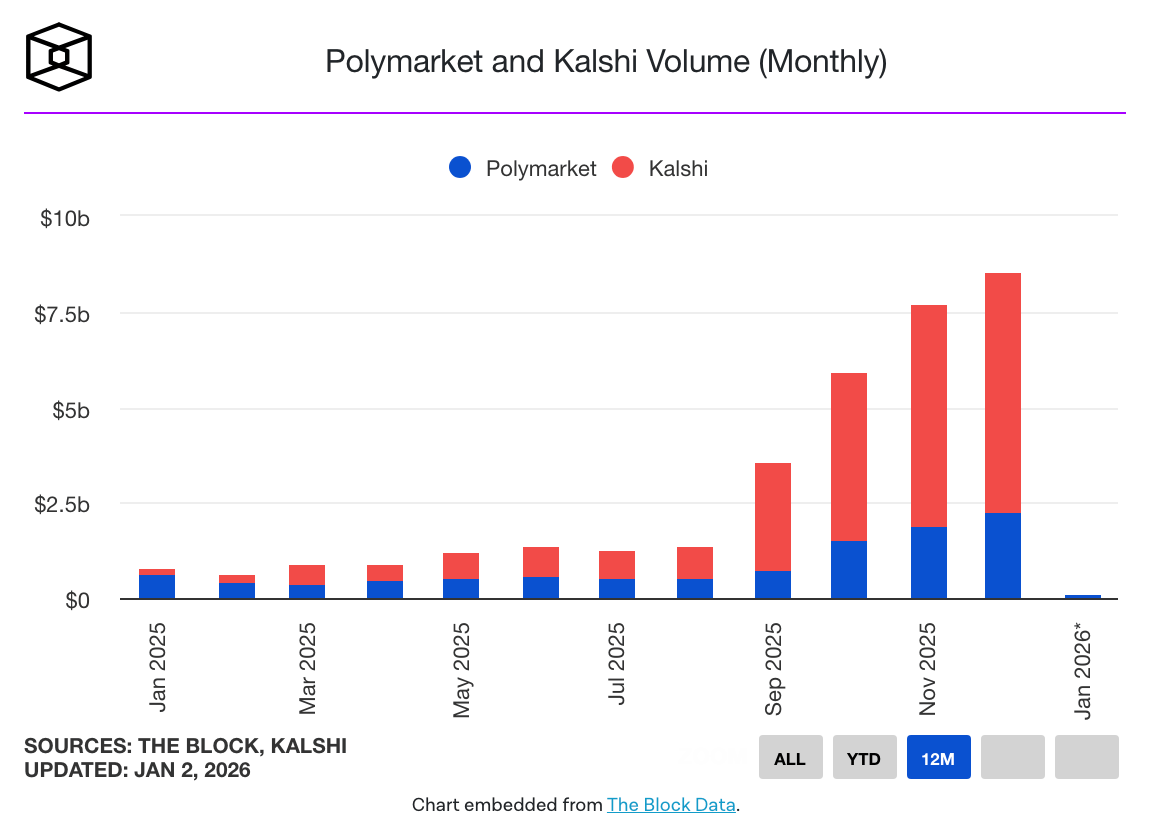

State of play: Prediction markets went mainstream in 2025, led by rapid growth on Kalshi and Polymarket, which together processed tens of billions of dollars in trading volume. What started around elections has expanded into sports, economics, and culture, with sports contracts now driving most activity.

Kalshi gained momentum from regulatory wins in the US, while Polymarket increased visibility through media exposure and claims of superior forecasting accuracy.

Many industry observers now see prediction market data as a credible alternative to traditional polling and sentiment indicators.

The duopoly is facing growing pressure from new entrants such as Crypto.com, Gemini, and DraftKings, which are embedding prediction markets into larger consumer platforms.

Why it matters: While competition is rising, experts say long term success will depend less on features and more on trust, transparent settlement, and regulatory clarity.

Our take: Prediction markets are growing up fast. Kalshi and Polymarket still lead, but the edge is shifting from regulation and volume to trust and daily relevance. The platforms people actually rely on for signals will win.

For builders and investors: Distribution matters, but credibility matters more. Embedding markets into existing products helps, yet transparent outcomes and clean settlement are what build lasting usage.

BUILDER-INVESTOR HIGHLIGHT

Vladimir Novakovski of Lighter

Intro: Vladimir Novakovski is the Founder and CEO of Lighter, a perpetual trading protocol that introduces a scalable, secure, transparent, non-custodial, and verifiable order book trading infrastructure within the Ethereum ecosystem.

Previous background: Novakovski has a deep quantitative and engineering background ahead of Lighter.

He graduated from Harvard with a Bachelor’s degree in Economics at age 18, competed at a top global level in math and computer science.

He went on to work in quantitative finance at Citadel and Graham Capital Management, before moving into senior engineering roles at Quora and Addepar.

He later co founded and led Lunchclub and became an active investor and advisor.

The big idea: Novakovski through Lighter aims to build an institutional grade, high speed perpetual DEX on Ethereum Layer 2, combining centralized exchange performance with the transparency and security of DeFi.

Take a peek at our referral reward at the bottom of this issue. Share this newsletter and receive our list of 500 crypto VC individuals 👇

INSIGHTS

Semantic Layer Turns Polymarket Trading Into Automated Airdrop Farming

Semantic Layer has launched Prophet Arena Season 2, letting users deploy onchain AI agents that automatically copy or inverse major AI models trading on Polymarket.

The system is positioned as both an airdrop farming strategy for 2026 and a way to earn yield directly from prediction markets.

Users choose a model, set rules, and let an AI “intern” execute trades on their behalf.

Funds remain under user control on Base, with all trades and settlements fully onchain via x402.

Season 2 builds on earlier testing with tighter risk controls and improved filters, shifting the product from experimentation to user driven strategies.

DEAL FLOWS

Cypherpunk Lifts Zcash Holdings to Nearly 2% of Supply

Deal flows slowed down this week - we saw $76M+ in deals 💼

Cypherpunk Technologies has added $29M worth of Zcash to its treasury, lifting total holdings to about 290,000 ZEC, or roughly 1.8% of the circulating supply.

The purchase brings the firm more than one third of the way toward its stated goal of accumulating 5% of all ZEC.

The strategy was announced in November following Cypherpunk’s rebrand and a $58.9M investment from Winklevoss Capital.

The company reiterated its view of Zcash as a long term privacy hedge alongside bitcoin and said it plans to continue building its position.

Deal flows in the past week:

QUICK BITES

Mirae in talks to buy Korbit for up to $100M.

China to let banks pay interest on digital yuan to drive adoption.

Eclipse Founder Neel Somani steps down as Executive Chairman.

Strategy buys another 1,229 BTC for about $109M after brief pause.

Hyperliquid Labs set for next HYPE token payout as 1.2M tokens unstake.

North Korean crypto hacks escalate in record year of theft and laundering.

SEC Corpo Finance Deputy Director to retire after shaping crypto guidance.

NOTEWORTHY READS & MEME

If you enjoy reading this issue, please consider subscribing. It takes 1 minute of your time, but it would mean the world to us 🙇

Disclaimer: All the information presented in this publication and its affiliates is strictly for educational purposes only. It should not be construed or taken as financial, legal, investment, or any other form of advice.