Polymarket vs. Kalshi

Is Centralization Winning the Prediction Market War?

📢 Sponsor | 💡 Telegram | 📰 Past Editions

From Ancient Wagers to Digital Prediction Markets

Throughout history, gambling has remained a constant and evolving aspect of human culture, reflecting fundamental elements of commerce and human nature. From ancient times to the modern digital era, the human inclination to wager is as old as civilization itself. The pursuit of a dopamine release drives people to return to games of chance repeatedly, even in the face of significant losses.

While traditional forms of gambling such as casinos and sports betting are now commonplace, the human desire to speculate on future events has found a new outlet: prediction markets. This concept takes the familiar impulse to make a casual bet and scales it to a global level, allowing anyone in the world to place a wager on real world outcomes.

Prediction markets offer a unique blend of speculation, strategy, and human nature. Unlike simply holding a personal belief about a future event, such as a political election, a prediction market provides a mechanism to turn that conviction into a tangible wager and a potential profit. This aligns with the psychological drivers seen in popular culture and entertainment, where the pursuit of gain and the inherent drama of uncertainty are central themes.

Prediction Market Timeline

After a long period of competition, the two leading prediction markets, Polymarket and Kalshi, have emerged victorious, marking the beginning of a bullish season for prediction markets.

Polymarket

Launched in June 2020 by Shayne Coplan in New York City, Polymarket pioneered on-chain USDC-settled contracts for forecasting political, economic, and entertainment events. In October 2020, the platform secured $4M in seed funding from Polychain Capital to support its development. In May 2022, former CFTC Chairman J. Christopher Giancarlo joined its advisory board, bringing regulatory expertise.

Following a $1.4M CFTC settlement in January 2022 that restricted access for U.S. users, Polymarket raised $70M across Series A and B rounds in May 2024, with investors including Vitalik Buterin and Founders Fund. In November 2024, the platform saw a record $2.6B in trading volume during the U.S. election cycle, coinciding with an FBI search of its CEO’s home. By June 2025, a nearly $200M round led by Founders Fund valued Polymarket at over $1B. In September 2025, a CFTC no-action letter, combined with the acquisition of QCX, enabled its U.S. relaunch after resolving prior enforcement issues.

Polymarket operates on Polygon, offering yes/no share trading priced between $0.01 and $0.99. Its markets span politics, economics, entertainment, and novelty events, with settlements executed through publicly verifiable oracles and payouts made in USDC.

With its U.S. relaunch imminent through the QCX acquisition, Polymarket plans to expand into regulated swaps and futures. However, it faces several risks: evolving CFTC rulemaking on event contracts, competitive pressure from regulated platforms such as Kalshi, rising compliance costs, and reputational challenges tied to market sensitivity and integrity.

Kalshi

Founded in 2018 by Tarek Mansour and Luana Lopes Lara, Kalshi became the first federally regulated prediction market in the U.S. after achieving CFTC Designated Contract Market (DCM) status on June 14, 2021, and launching a month later with yes/no event contracts. In late 2023, the CFTC disapproved of Kalshi's proposed “Congressional Control” markets, prompting the company to sue. Kalshi won approval from the D.C. District Court on September 12, 2024, and the D.C. Circuit denied the CFTC’s stay request on October 2, 2024. Kalshi Klear LLC registered as a Derivatives Clearing Organization (DCO) in August 2024, and on May 5, 2025, the CFTC dropped its appeal. A month later, Kalshi raised $185M at a $2B valuation and expanded into sports contracts, though under continued legal scrutiny over gaming classifications.

Kalshi operates as a centralized exchange offering yes/no contracts on macroeconomic, political, sports, and entertainment events, settling at $1 for correct outcomes. Position limits vary by market, reaching up to $100M for elections.

Looking ahead, Kalshi is integrating with retail brokers such as Robinhood and expanding its product lineup to include sports spreads and IPO event markets. However, risks remain, including potential CFTC rule changes targeting event contracts, legal challenges over gambling definitions, state-level cease-and-desist actions, and reputational concerns related to underage participation and cross-jurisdictional access.

The Crown and the Contender: Who Will Rule the Prediction Market?

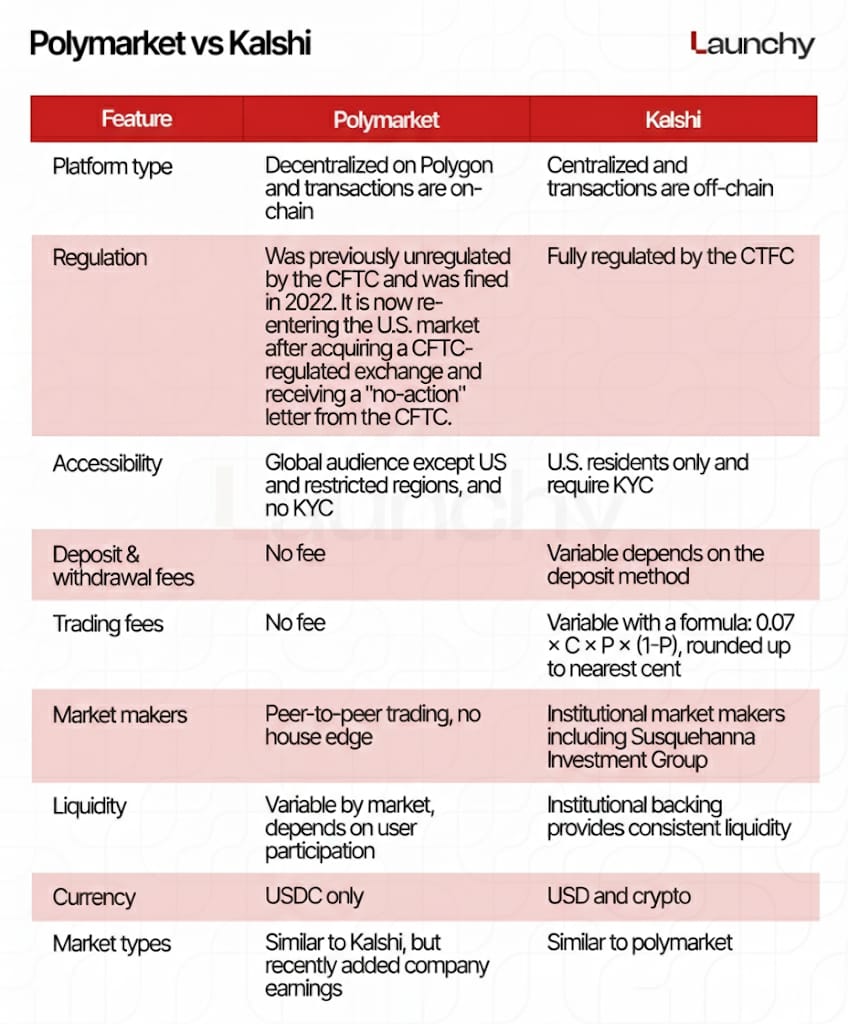

Polymarket and Kalshi stand as the two giants of the prediction market space. Polymarket represents the decentralized frontier, while Kalshi embodies the centralized model. It’s a classic duel familiar to the crypto industry. But the real question remains: who will emerge as the true market leader? Will centralized platforms prevail once again, or can decentralization take the crown? Let’s take a closer look.

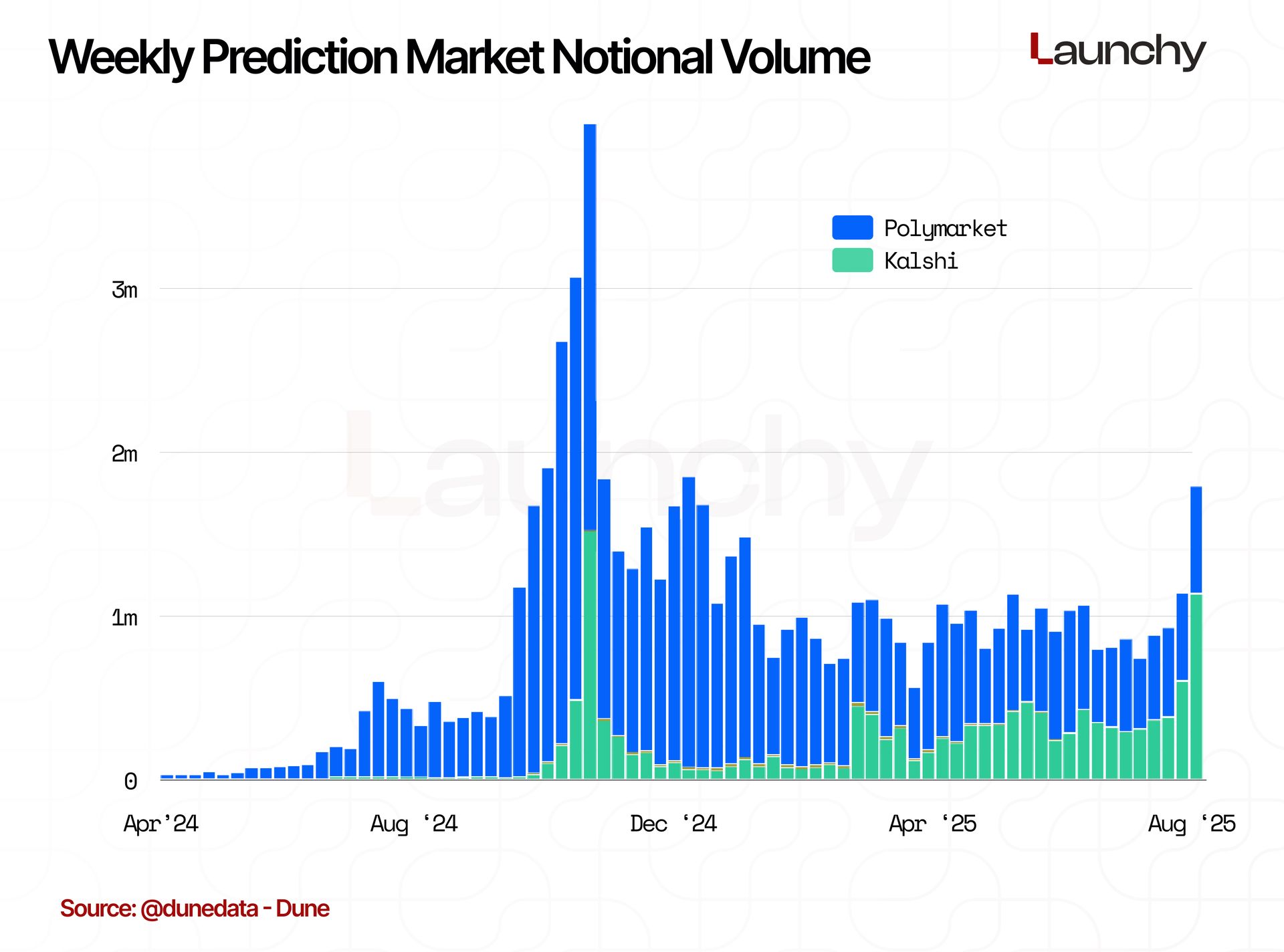

Weekly Notional Volume

Weekly notional volumes show a clear spike between October and November 2024, driven by the U.S. presidential election between Donald Trump and Kamala Harris, which ultimately resulted in Trump’s victory. During this period, Polymarket recorded ~$5.13B in volume, about 2.3x higher than Kalshi’s ~$1.56B.

However, a closer look reveals a turning point. Beginning in late August and early September 2025, Kalshi surpassed Polymarket in weekly volume for the first time. Since then, the gap has continued to widen, growing from just ~12% to ~73% more volume generated by Kalshi.

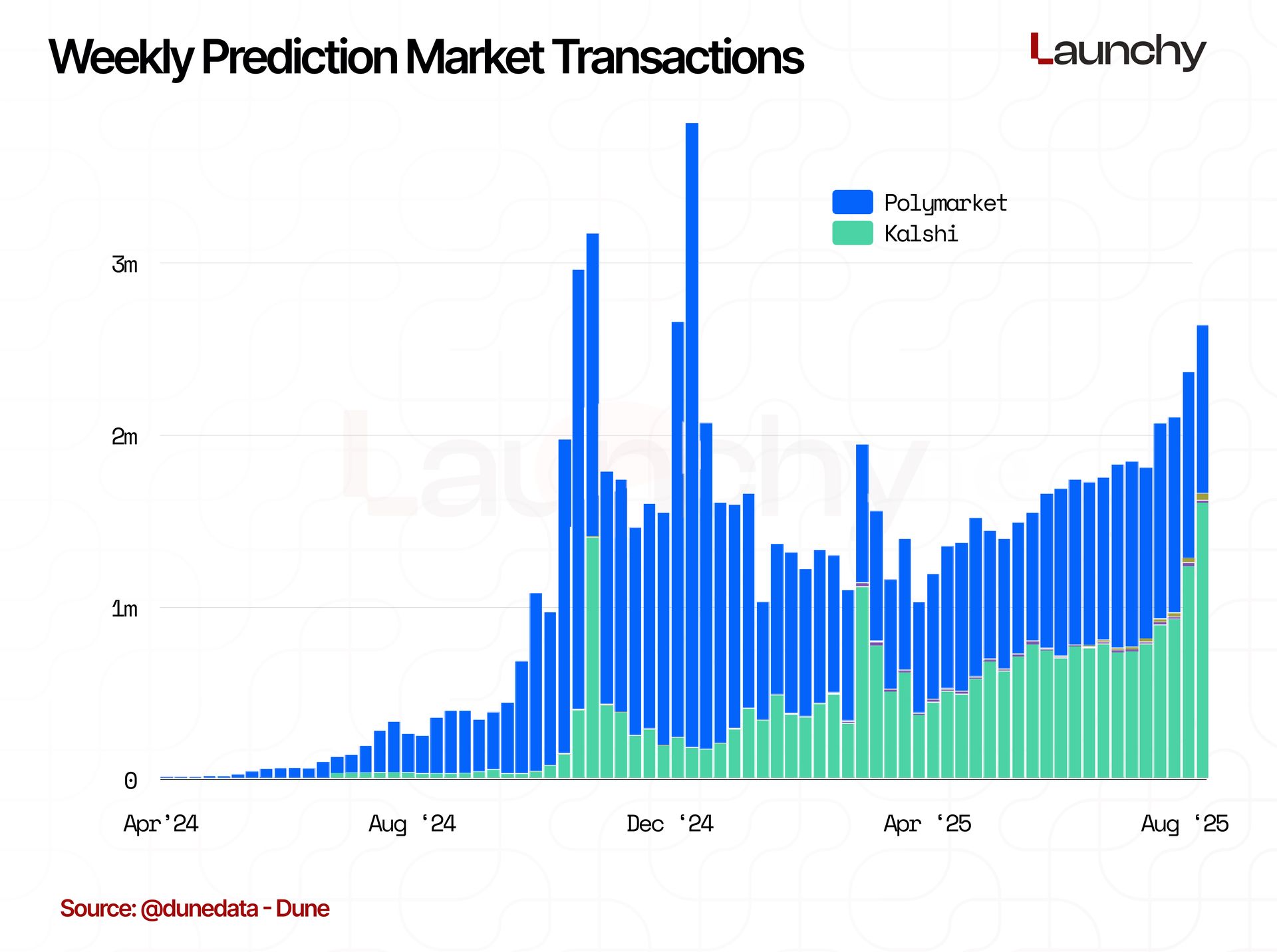

Weekly Transactions

Interestingly, the highest transaction activity didn’t occur in November 2024 during the heat of the U.S. presidential election, but rather during Christmas week, with roughly 3.8M transactions or ~95% of transactions came from Polymarket. Despite the surge in activity, combined trading volume across Polymarket and Kalshi remained under $1B.

This spike was likely driven largely by retail participants rather than insiders, and may have come from one of the more unusual markets that closed at the end of 2024: “Will the U.S. confirm that aliens exist in 2024?” This market alone generated ~$3.4M before closing, and by 2025 had already accumulated another ~$3M in volume.

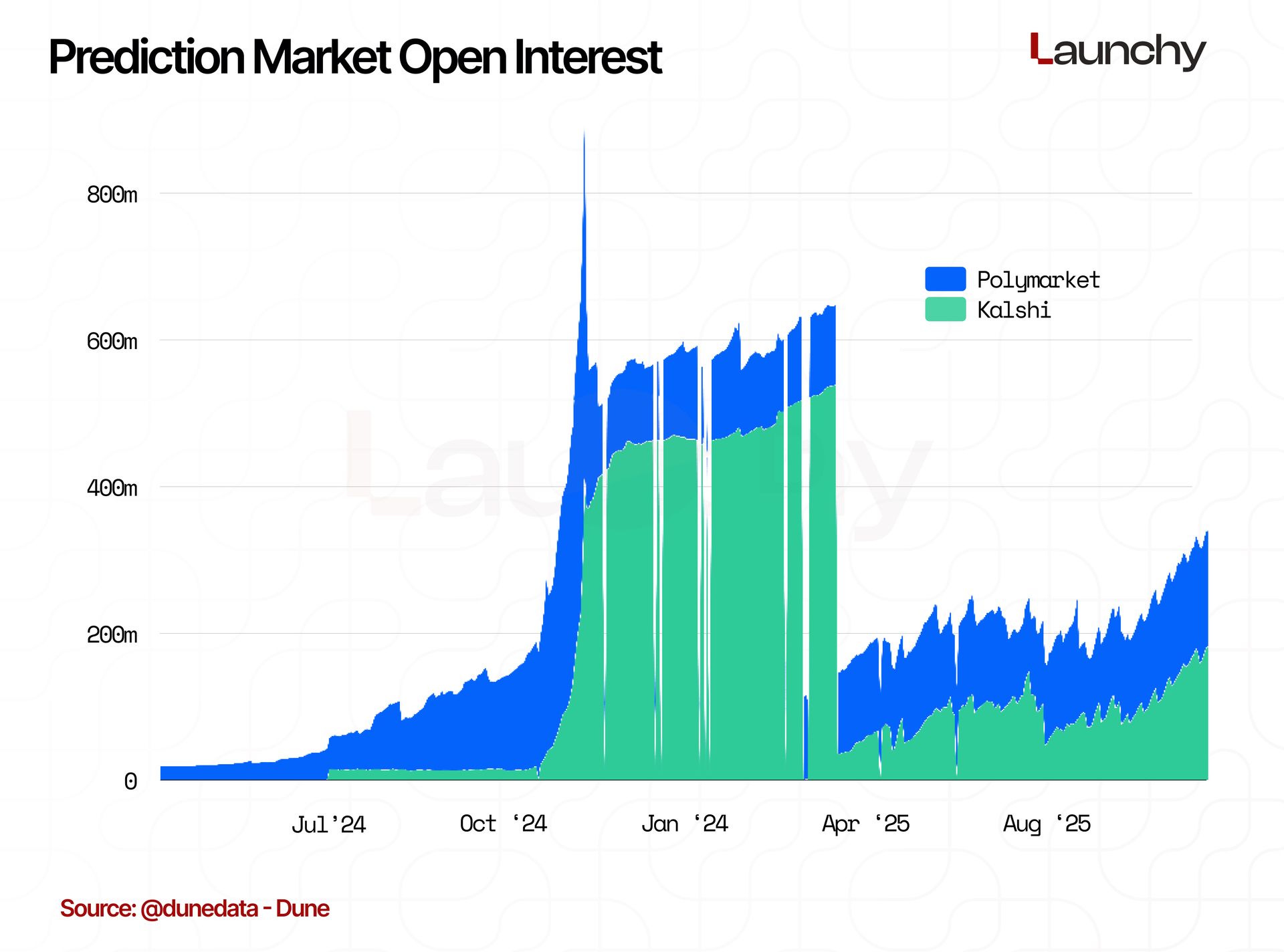

Open Interest

While Polymarket may lead in notional volume and transaction count, open interest in unresolved or active markets has been dominated by Kalshi since the U.S. presidential election, a trend that continued through March 2025. During this period, Kalshi’s open interest outpaced Polymarket’s by a factor of 4x to 5x. In Kalshi’s recent surge past Polymarket in both volume and transaction counts, its lead in open interest has remained relatively narrow, with the difference not exceeding 10%.

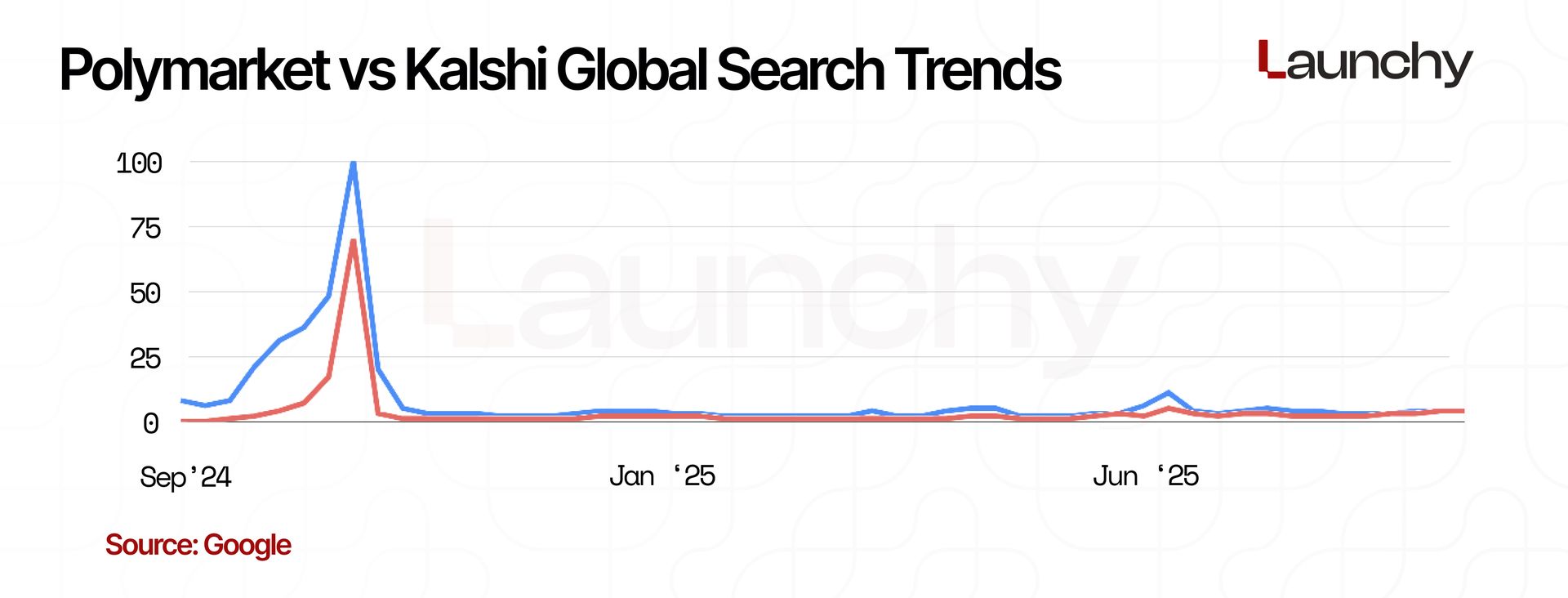

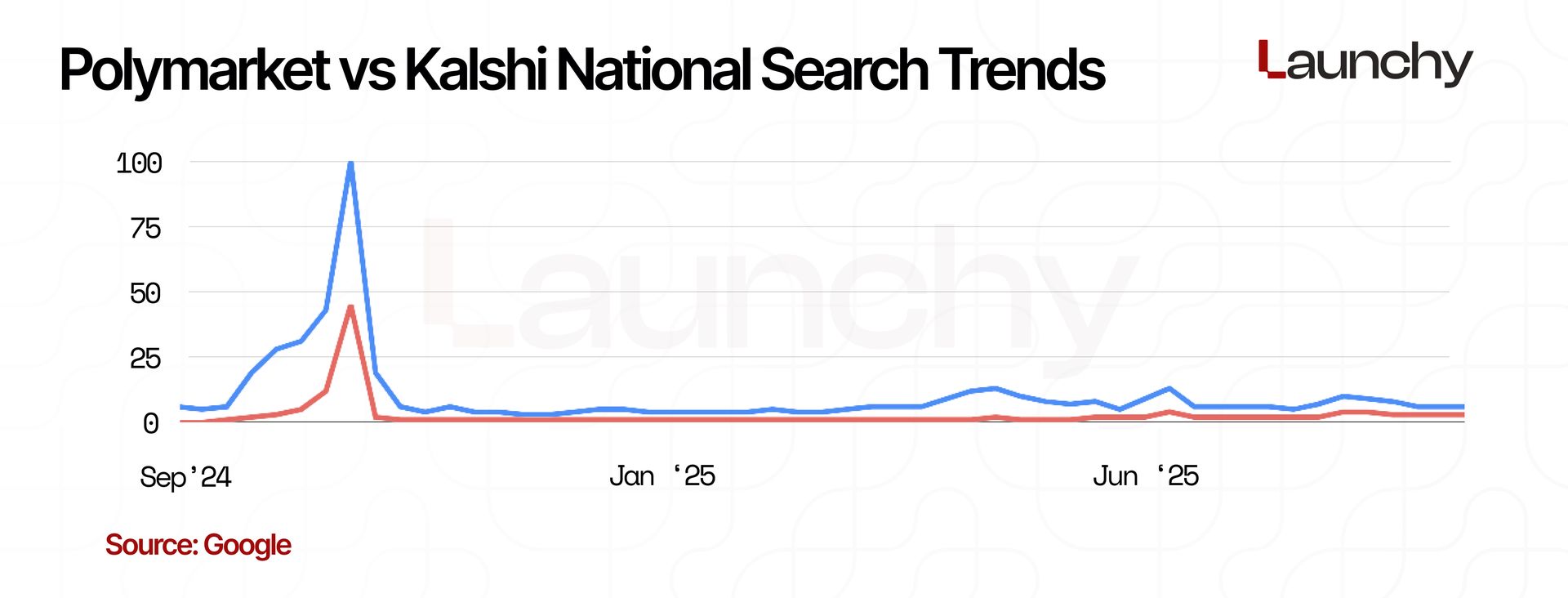

Search Trends

On global Google search trends, Polymarket is more widely recognized than Kalshi, which is understandable given that Kalshi is limited to U.S. residents. But how does Kalshi’s popularity look within the U.S. itself?

Interestingly, even without a U.S. launch, Polymarket still ranks slightly higher in popularity among American users. However, the gap is narrower compared to the global trend. Both platforms saw a noticeable spike in interest around November, coinciding with the U.S. elections.

Final Thoughts

At first glance, Polymarket seems to lead across most metrics. But Kalshi can’t be underestimated as it has recently climbed and even flipped Polymarket in volume and transactions. Why has this shift happened?

A key factor may be Kalshi’s integration with Robinhood. While sports betting is not new in prediction markets, Polymarket already offered it. Robinhood’s massive user base has given Kalshi unique exposure. Robinhood traders are now discovering prediction markets, and with Kalshi being the only fully legal platform in the U.S., it has captured a valuable audience.

Another influence is the hiring of John Wang, a prominent crypto figure who became Kalshi’s Head of Crypto. Known for his viral posts on X, including one about Justin Sun that reached 658.9K views, surpassing Polymarket’s ATH of 462.6K active traders. Wang has boosted Kalshi’s visibility in crypto circles. His presence has already begun to draw attention from the broader CT.

But how sustainable is Kalshi’s momentum? In my view, it won’t last long once Polymarket officially launches in the U.S. For now, Kalshi enjoys a monopoly as the only legal U.S. prediction market, but that advantage will be tested once the decentralized giant enters the same playing field. That’s when the real competition begins. Let’s look at some key markets where the two platforms currently compete:

Economics: The most active market is “Fed Decision in September?” where Polymarket leads with ~$113M in volume versus Kalshi’s ~$50M, a 2x gap. This single market on Polymarket exceeds the combined volume of all active economic markets on Kalshi.

Politics: In “New York Mayoral Election,” Polymarket again dominates with ~$67M in volume against Kalshi’s ~$24M. In fact, Polymarket’s top two political markets already surpass the entire category volume on Kalshi.

So far, Polymarket appears to remain the stronger player despite Kalshi’s recent surge. But the picture shifts in other areas:

Crypto: On trending topics like “Who will win the USDH ticker?” Polymarket is far ahead (~$4M vs. Kalshi’s <$10K). Yet, when it comes to price-specific markets (e.g., “Will Bitcoin reach [X] price?”), Kalshi often leads with up to ~$10M per market compared to Polymarket’s <$1M.

Sports: Kalshi also outperforms Polymarket in sports markets. With U.S. bettors limited in accessing platforms like BetMGM, Bovada, and Stake.US, prediction markets provide an appealing alternative especially where odds may seem more favorable than traditional bookies.

In short, Polymarket still holds the edge overall, but Kalshi has carved out momentum through its U.S. regulatory status, Robinhood integration, and strategic hires. The rivalry is only just beginning, and the real test will come once Polymarket’s U.S. relaunch levels the playing field.

If you enjoy reading this issue, please consider subscribing. It takes 1 minute of your time but it would mean the world to us 🙇

Disclaimer: All the information presented in this publication and its affiliates is strictly for educational purposes only. It should not be construed or taken as financial, legal, investment, or any other form of advice.