PMX: The AMM-Powered Future of Decentralized Prediction Markets

How the Dual-Token AMM Solves Liquidity Fragmentation and Drives Deflationary Value Accrual

📢 Sponsor | 💡 Telegram | 📰 Past Editions

PMX Strategic Profile

PMX represents a technically sophisticated, second-generation decentralized prediction market platform that attempts to resolve the critical liquidity inefficiencies endemic to earlier models. Launched by Polycule founder Krish in collaboration with Meteora, PMX distinguishes itself through the adoption of a dual-token Automated Market Maker (AMM) structure. This core architectural choice provides guaranteed liquidity and low slippage, contrasting sharply with the often-fragmented order books utilized by its primary competitors.

The platform’s strategic focus is on highly specialized, crypto-native speculation, specifically targeting "Presales" and "Near Funding" events. This deliberate niche acquisition strategy grants PMX access to high-value capital and trading frequency often unavailable to platforms focused on general global events. The robust technical pedigree, evidenced by the founder’s history and $560K seed funding from Alliance DAO, generated immediate market validation, resulting in a 44% token surge and an initial market capitalization of $22.8M.

PMX’s financial model employs aggressive fee minimization (0.01%–0.05% per trade) combined with a direct value accrual mechanism where 30% of transaction fees are allocated to token buybacks and burns. This creates a high volume-dependent deflationary dynamic. While capital-efficient for the user, the long-term viability of the tokenomics relies heavily on achieving substantial, institutional-level trading volume to make the thin margin and subsequent burns impactful.

Architectural Deep Dive: Mechanism and Liquidity Model

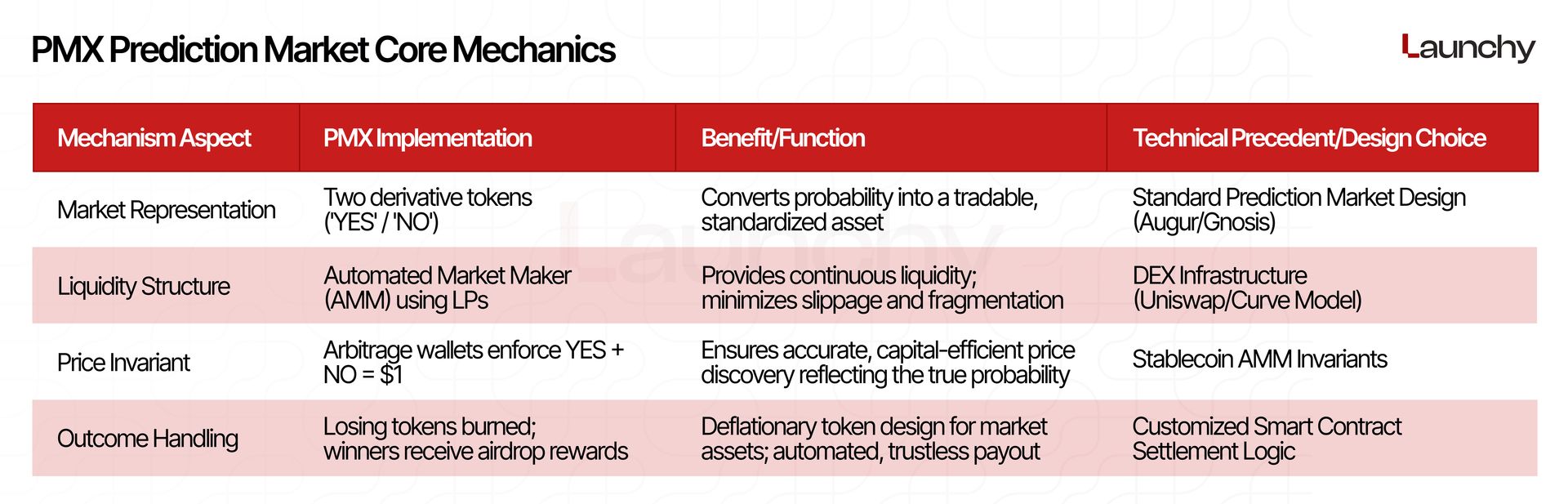

The Dual-Token AMM System

The most significant competitive differentiator for PMX is its departure from traditional order book models in favor of an Automated Market Maker (AMM) structure. Prediction markets have historically struggled with liquidity depth, where low trading volume can quickly cause order books to dry up, resulting in high slippage and making the markets inefficient for larger traders.

PMX addresses this by utilizing a core mechanism inspired by DEX liquidity pools. For every verifiable event proposed on the platform, PMX transforms the potential outcomes into two distinct, tradable assets: a 'YES' token and a 'NO' token. These two derivative tokens are immediately minted and placed into a dedicated liquidity pool (LP) for that specific market.

This AMM approach guarantees continuous, instantaneous liquidity, eliminating the need for a counterpart order to be matched immediately. Trading occurs directly against the pooled assets, which dramatically improves execution efficiency and significantly minimizes slippage, particularly for high-frequency or institutional-sized bets. This guarantees constant liquidity and allows the platform to offer a predictable trading experience, a critical factor for professional market participants.

Arbitrage and Price Discovery Mechanism

The integrity of the AMM model in prediction markets is maintained through a precisely calibrated price invariant. PMX’s architecture ensures that the price of the 'YES' token plus the price of the 'NO' token must always sum up to $1. For example, if the YES token trades at $0.70, the NO token must trade at $0.30, indicating a 70% probability of the event occurring.

This invariant is enforced by dedicated arbitrage wallets. If the combined price deviates from $1 due to trading activity, external arbitrageurs are incentivized to restore the balance. By buying the cheaper side and selling the more expensive side until the prices normalize, these actors not only profit but also ensure that the token prices accurately reflect the true, consensus probability of the event. The successful functioning of this system relies on the assumption that external actors will find the arbitrage opportunities sufficiently profitable to continuously monitor and correct price deviations. This reliance on external, profitable market participants is key to maintaining market integrity.

Settlement and Resolution Process

The settlement mechanism of PMX is designed to be automated and trustless, tied to the confirmed outcome of the predicted event. Once the event result is confirmed (presumably via a dedicated oracle network, though the specific solution is not detailed in available information), the platform initiates the payout process.

Losing Token Deflation: The tokens representing the losing outcome are systematically "burned to zero". This action removes the supply of the incorrect market instrument, applying a deflationary mechanic specifically to the concluded contract assets.

Winning Payout: Holders of the winning tokens receive "airdrop rewards". This terminology referencing rewards instead of direct collateral payouts may serve as a specific classification tool to manage the legal or regulatory perception of the transaction, potentially classifying returns as non-security incentives rather than pure financial payouts, thereby lowering the platform’s regulatory exposure. The underlying collateral (likely USDC or another stable asset equivalent to $1 per winning share) is distributed efficiently via smart contract logic. However, the speed and fairness of the settlement are entirely dependent on the robustness and decentralization of the chosen oracle mechanism used to confirm the event’s outcome.

PMX Product Features and Market Ecosystem

Core User Experience and Functionality

The platform is explicitly designed as a venue for users to "Explore trending prediction markets and make your bets". A key feature signaling the platform’s philosophy is the ability for users to "Launch a Market". This permissionless market creation functionality is essential for any decentralized platform seeking organic growth and high market diversity, ensuring the community can dictate the range of supported events rather than relying solely on central administrators.

The markets are categorized and tracked by their status, including "Open," "Closed," "Rejected," "Active," "Pending," and "Resolved". This structured tracking system aids user navigation and operational transparency.

Strategic Market Categorization: The Alpha Niche

PMX has adopted a focused strategy by targeting specialized categories, which distinguishes it from general prediction markets. The key market categories advertised include "Presales," "Near Funding," and general "Markets".

The inclusion of "Presales" and "Near Funding" is highly significant. This positioning indicates a direct focus on high-stakes, capital-intensive speculation related to the crypto venture capital (VC) and primary token markets. By targeting these events, PMX is positioning itself as an essential tool for sophisticated crypto investors seeking alpha (excess returns generated by skill) on primary market milestones, such as whether a specific protocol will raise its next funding round or what the valuation of an upcoming token generation event (TGE) will be.

This niche acquisition strategy is vital for competitive differentiation. Markets focused on VC and fundraising milestones inherently possess high value per trade and attract experienced, high-frequency traders. This specific vertical is largely untouched by regulated competitors, providing PMX with a vast regulatory arbitrage opportunity and ensuring higher liquidity density in a smaller, high-value segment. The expectation is that this focus will lead to a higher average trading volume per market, maximizing the effectiveness of the low-fee revenue model.

PMX Token Utility and Governance Integration

The PMX token functions as the native digital asset of the platform, designed with both Governance and extensive Utility. This dual purpose is structured to tightly integrate the token holder into the platform's operational and financial success.

Governance: PMX holders possess voting power on all matters related to the protocol’s future direction.

Utility Functions: The token’s design incentivizes long-term holding and staking:

Staking: Users can deposit PMX to earn yield and simultaneously increase the weight of their governance votes. This mechanic reduces the actively circulating supply while securing the governance process.

Fee Discounts: Holding PMX in the protocol balance can result in a decrease in trading fees and may grant access to exclusive strategies and markets. The ability to reduce trading friction further enhances the attractiveness of the ultra-low fee structure for high-volume traders.

Keeper Rewards: PMX is partially utilized to reward Keepers, the decentralized agents responsible for executing crucial operational tasks such as conditional orders and liquidations.

The totality of the token utility is designed to minimize liquid selling pressure by maximizing the incentives for users to stake or hold the asset for operational benefits. This creates strong early network effects and provides a structural defense for the initial speculative valuation by integrating the token deeply into the platform's economic engine.

Financial Mechanics and Tokenomics (PMX Token)

Revenue Model and Ultra-Low Fee Structure

PMX generates operational revenue through transaction fees, which are set at an extremely competitive range of 0.01% to 0.05% per trade. This is an aggressively low fee structure, demonstrating a clear strategic intent: PMX is prioritizing high trading volume and capital efficiency over high transaction margins.

This fee range is significantly lower than typical DEX swap fees (which usually hover around 0.3%) and is engineered to compete directly with platforms that have historically utilized a zero-fee model, such as Polymarket. By offering such a low fee in an AMM environment, PMX aims to provide a superior net execution price for large traders, as the marginal fee cost is offset by the guaranteed low slippage provided by the liquidity pools. This strategy is an essential component of attracting high-frequency and institutional flow.

Deflationary Mechanics and Value Accrual Strategy

The PMX tokenomics incorporate a direct value capture mechanism intended to reward long-term holders and reduce circulating supply. Specifically, 30% of all generated transaction fees are allocated to token buybacks and subsequent burns. This deflationary pressure is intended to drive long-term intrinsic value by continuously reducing the supply of PMX relative to its platform usage.

However, the efficacy of this mechanism is directly proportional to the platform’s trading velocity. Given the extremely thin margins (0.01%–0.05%), PMX requires astronomical, sustained trading volume to generate sufficient fee revenue to make the 30% buyback/burn percentage meaningful. The long-term sustainability of the PMX token’s value hinges entirely on the platform's ability to onboard massive liquidity and capture a significant share of the global speculative market, validating the strategic choice of prioritizing volume over margin. If trading volume stagnates, the deflationary mechanism, while conceptually sound, will yield negligible results, severely hindering the token’s ability to defend its initial $22.8M market valuation.

Initial Market Traction and Valuation

Following the public launch announcement and the endorsement from Alliance DAO, the token (formerly PCULE) experienced a rapid appreciation of nearly 44% in 24 hours. This rapid movement propelled the token to an initial market capitalization of $22.8M.

This initial valuation is based predominantly on the perceived credibility and technical prowess of the founding team. The valuation is speculative, as the platform lacks publicly verifiable fundamental metrics for the prediction market PMX (such as TVL or user adoption statistics). Therefore, the $22.8M market cap represents a significant validation of the founder’s pedigree, granting the team substantial momentum and initial capitalization to execute on their technical roadmap and acquire initial liquidity.

Competitive Landscape and Strategic Positioning

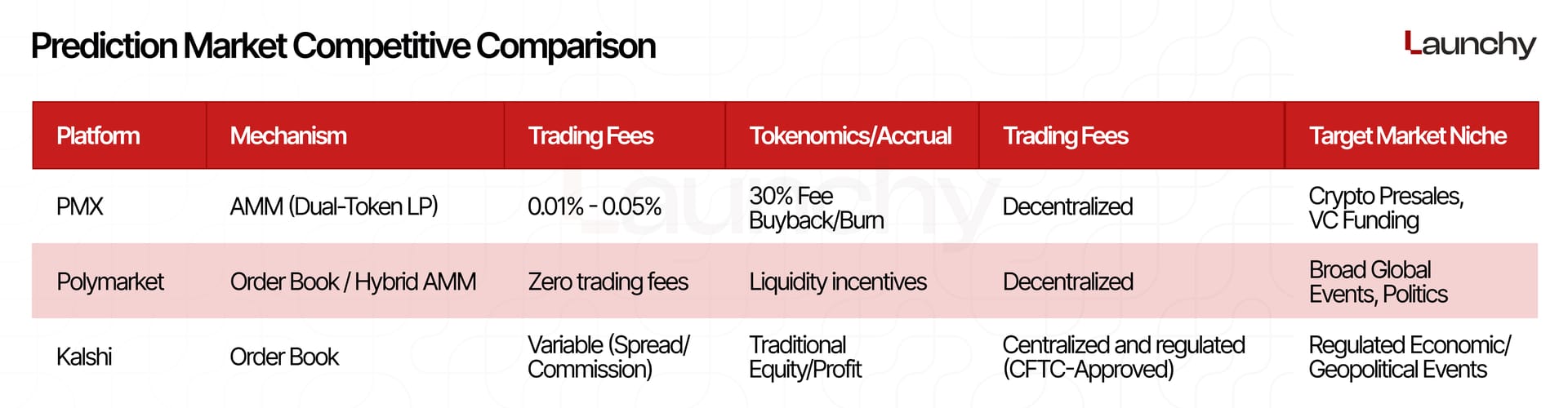

The prediction market industry is highly fragmented, segmented by regulatory compliance, technical architecture, and market focus. PMX competes across three distinct categories of platforms: regulated exchanges, decentralized order books, and nascent decentralized AMM protocols.

Comparison with Regulated Centralized Entities (Kalshi)

Platforms like Kalshi operate under the stringent oversight of regulatory bodies, such as the CFTC (Commodity Futures Trading Commission). This compliance drastically restricts the types of markets they can legally offer, typically focusing on economic or verifiable geopolitical events. They generally employ traditional order book systems.

PMX gains a significant advantage by maximizing the regulatory arbitrage opportunity available to decentralized protocols. By operating outside of these jurisdictions, PMX can offer highly speculative, crypto-native markets like "Presales" and "Near Funding" events that are impossible for regulated entities to touch due to compliance concerns regarding unregistered securities or financial instruments. This allows PMX to capture a segment of sophisticated capital that is inherently excluded from the regulated domain.

Direct Comparison with Decentralized Competitors

The most direct competition comes from established decentralized platforms, particularly Polymarket, which has gained significant recognition and volume.

PMX vs. Polymarket

The technical and financial divergences between PMX and Polymarket are crucial for determining strategic market share acquisition:

Mechanism: Polymarket primarily utilizes an order book model for trade execution, which, while common in finance, can suffer from liquidity fragmentation and high slippage on low-volume markets. PMX’s dual-token AMM architecture provides a structurally superior solution by guaranteeing continuous liquidity through LPs, thereby ensuring predictable and efficient execution for all trade sizes.

Fees and Revenue: Polymarket and PMX employ different strategies for their prediction markets. Polymarket, aiming for market dominance and high volume, charges no trading fees and relies on liquidity incentives and venture capital for funding. Conversely, PMX implements a small fee (0.01%–0.05%) to power its deflationary buyback/burn mechanism. PMX's decision to charge a fee, even a minimal one, is based on the conviction that the superior execution efficiency and low slippage offered by its AMM model will be more attractive than Polymarket's zero-fee policy, particularly for professional traders who prioritize execution quality.

Market Focus: Polymarket generally focuses on broad political, social, and global events. PMX has strategically narrowed its focus to the crypto alpha niche ("Presales," "Near Funding"), ensuring its liquidity is dense in high-value, high-frequency speculative events relevant to its core user base.

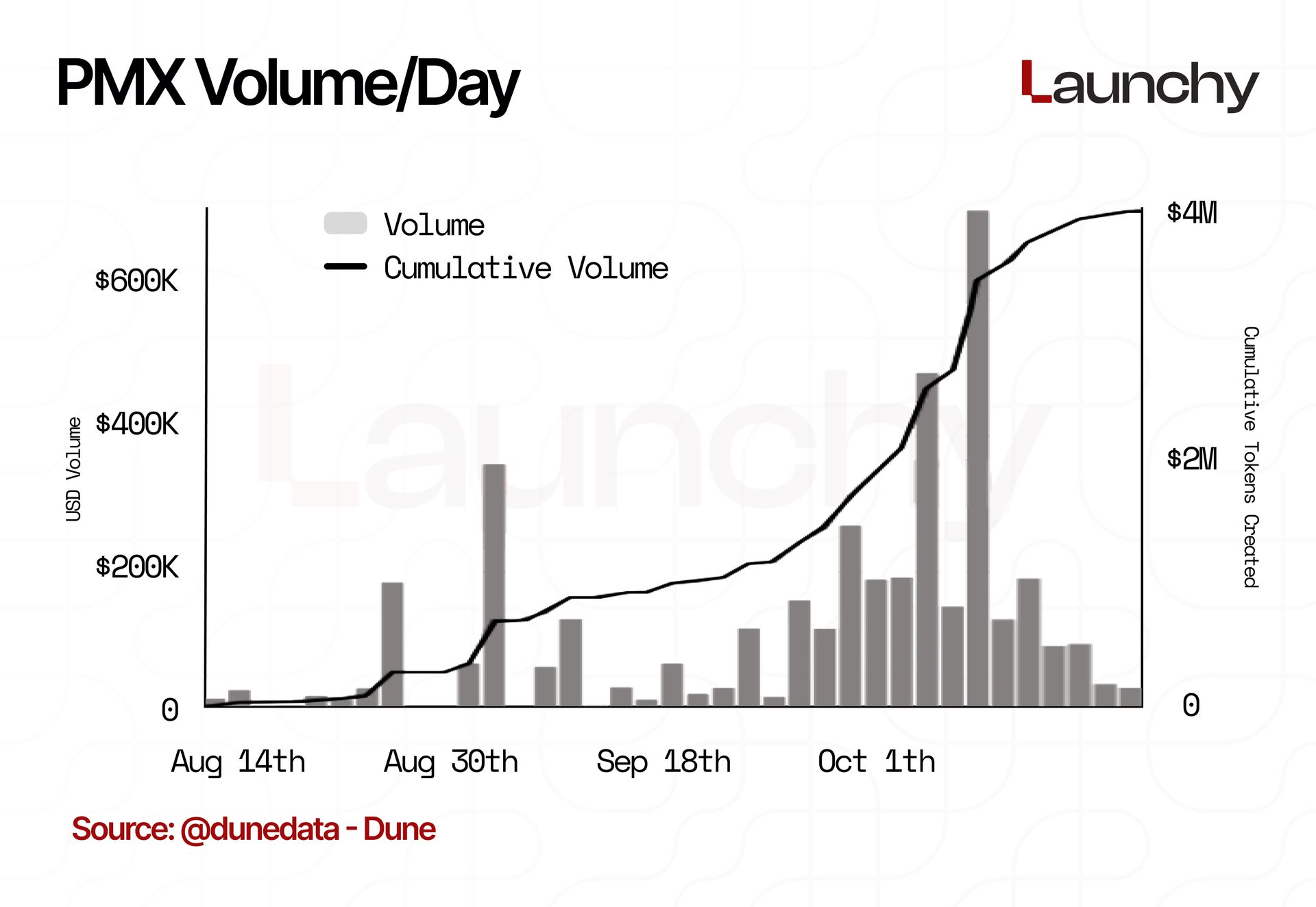

PMX Stat

Volume

Since August 2025, PMX has accumulated ~$4M in total platform volume. While daily volume is highly volatile, peaking at $733K on October 5, 2025, it generally remains below $200K on most days.

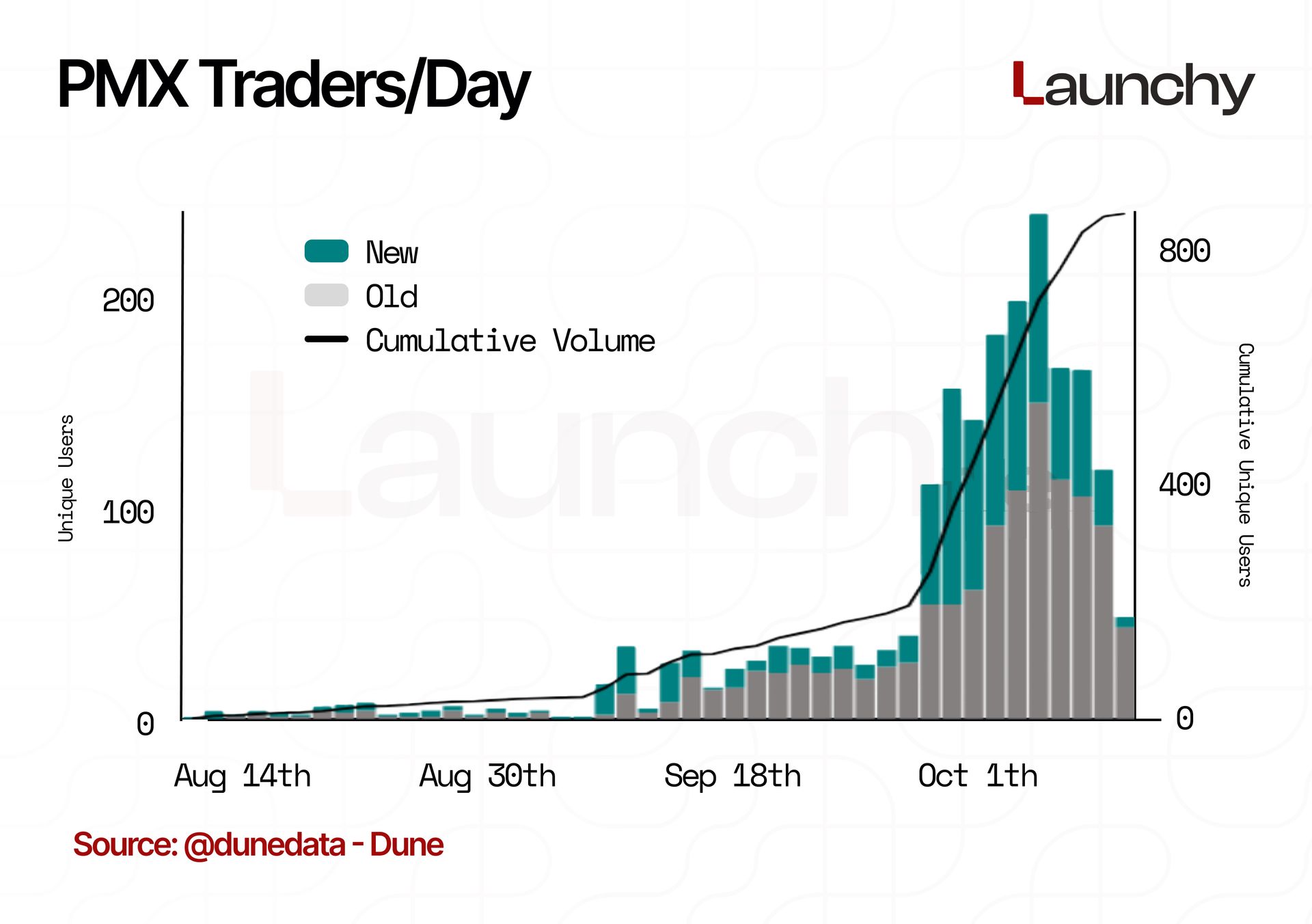

Traders

On the trader side, we saw a significant jump following a PMX announcement, which marked the first day that the platform surpassed 100 daily traders. Consistent with the volume peak, the highest daily count was 243 traders on October 5, 2025. However, this momentum did not last as the daily trader count dropped back below 100 within a week.

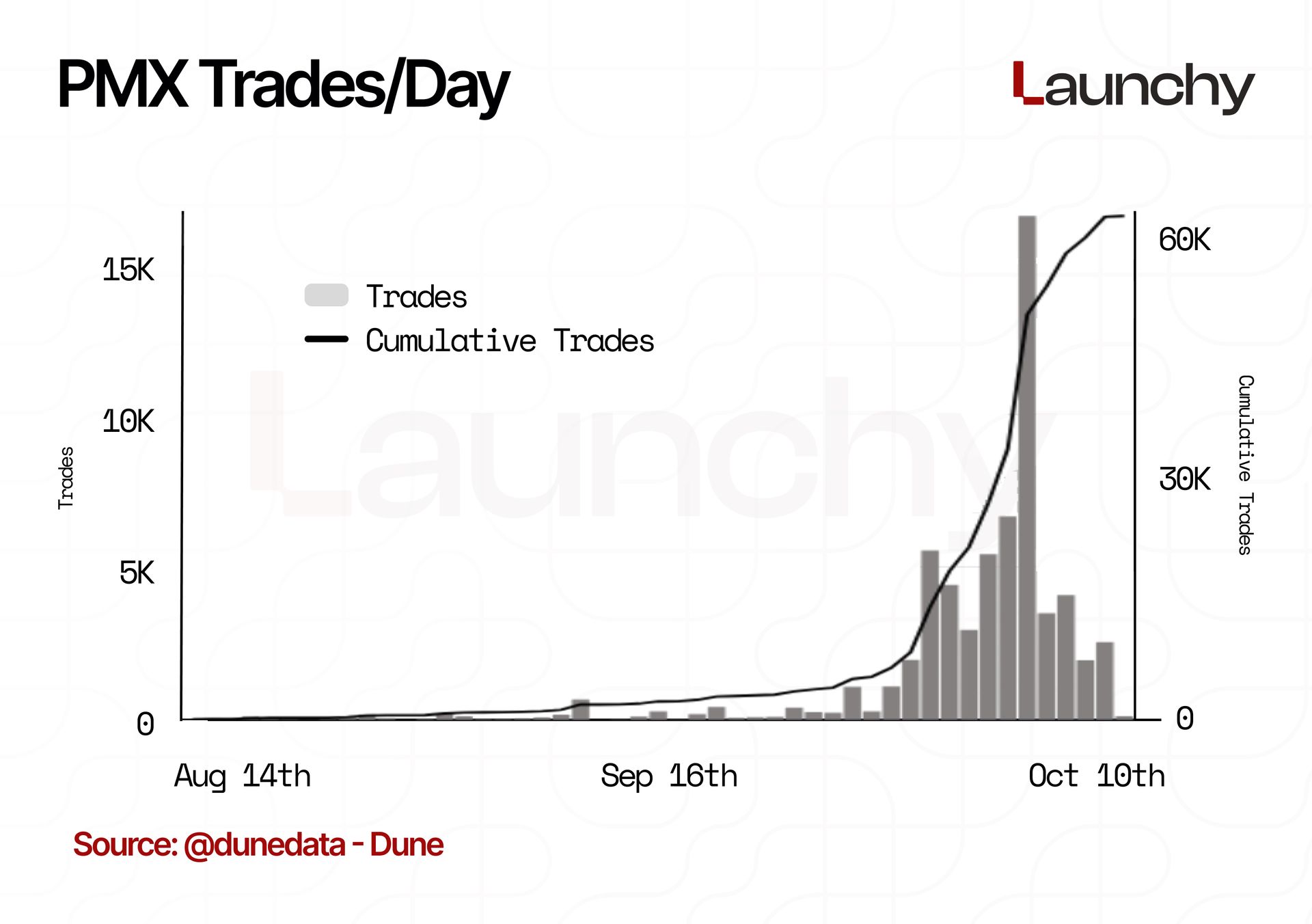

Trades

The daily trade count follows a trend consistent with the other metrics. A high of 16,490 trades was recorded on October 5, 2025, while the count rarely surpasses 5,000 on most other days.

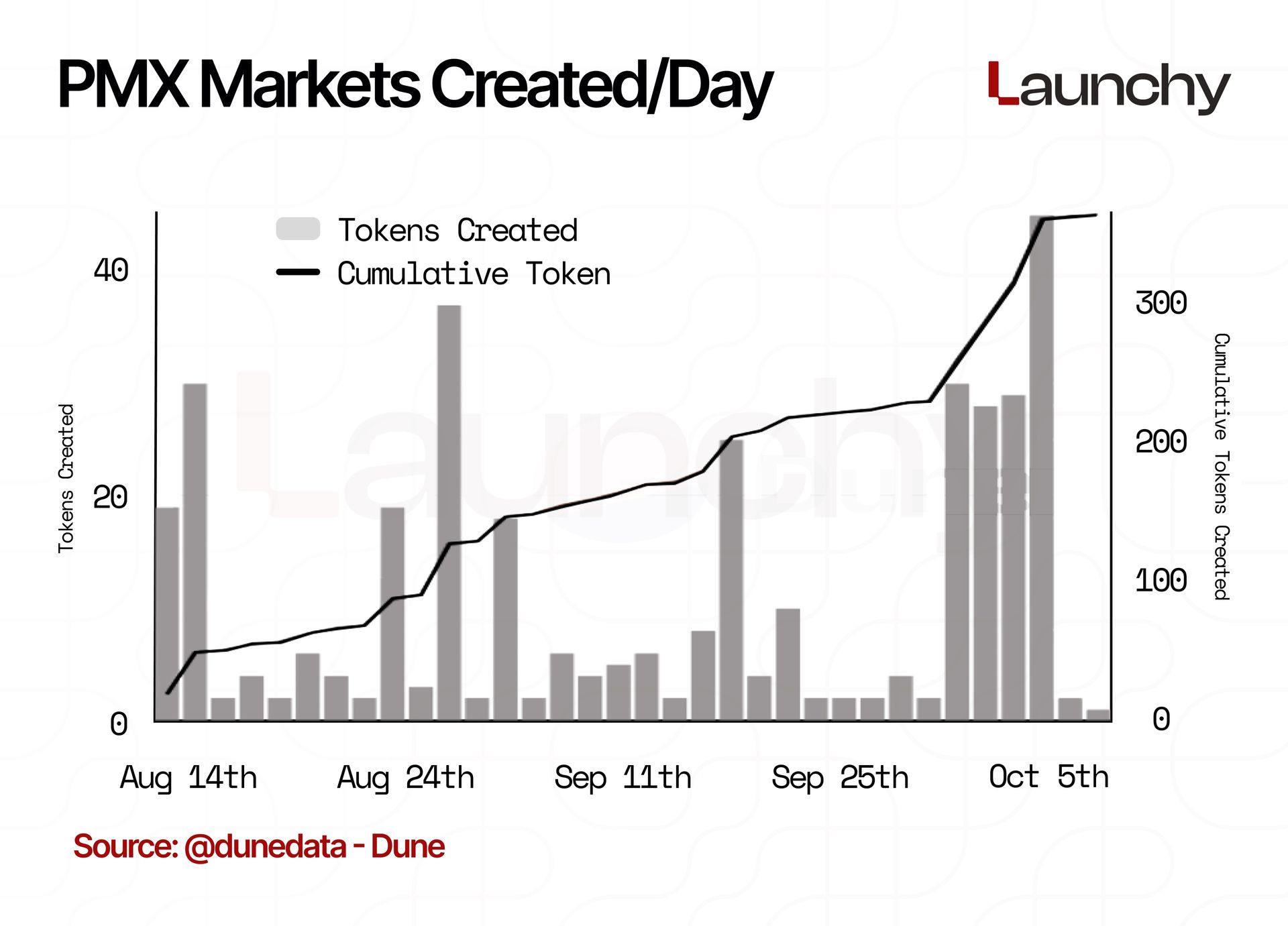

Markets Created

The daily market creation rate has been relatively consistent across August, September, and October. The highest single-day creation was 45 markets on October 4, 2025, and the cumulative total currently remains below 500.

Risk Assessment and Future Outlook

Technical and Operational Risk

The platform’s reliance on its novel AMM architecture introduces several dependencies. The integrity of the market is paramount, meaning the smart contract logic underpinning the dual-token creation, the arbitrage mechanism, and the settlement/burning process must be flawless. Any flaw in the invariant enforcement could lead to capital loss for liquidity providers or incorrect payouts, undermining user trust.

A full, rigorous smart contract audit by a reputable blockchain security firm is a non-negotiable requirement for validating the platform's reliability. Such firms specialize in detecting vulnerabilities, blending manual code examination with specialized security tools. Without public confirmation of such an audit, the protocol carries an elevated risk of catastrophic failure typical of novel DeFi architecture.

Furthermore, the operational reliance on "arbitrage wallets" to constantly rebalance the price invariant suggests that the initial execution of the arbitrage function may be centralized or reliant on a specific set of privileged bots. The long-term decentralization and robustness of the system require that this arbitrage function be permissionless and highly profitable, ensuring that a diverse pool of external actors maintains market integrity without reliance on the core team.

Regulatory Risk Profile

Prediction markets exist in a highly sensitive regulatory domain. PMX’s strategic decision to target the crypto-native alpha niche, specifically "Presales" and "Near Funding", significantly amplifies its regulatory exposure compared to platforms that focus solely on verifiable general events (e.g., weather or sports).

Markets related to venture capital milestones, private valuations, and the success or failure of specific token offerings carry inherent risk of being classified as providing markets on unregistered securities or facilitating insider trading. This aggressive market focus maximizes the profit potential but simultaneously places the platform in a legal gray area, requiring constant monitoring of international regulatory enforcement actions. The risk of future legal challenges, similar to those faced by other prominent decentralized prediction markets, remains elevated.

Future Growth Vectors

To minimize risks and establish long-term market leadership, PMX could focus on these critical growth areas:

Blockchain Expansion: Expansion to additional Layer 2 (L2) networks or low-cost sidechains is crucial for reducing gas fees. Low fees are essential for attracting the high-frequency traders necessary to sustain the volume required by the tokenomics model.

Product Layering: Introducing structured financial products built atop the core prediction markets, such as options, insurance contracts, or hedging strategies could significantly deepen liquidity and attract sophisticated institutional capital seeking complex risk management tools.

Liquidity Partnerships: Leveraging the established network of Alliance DAO and the Polycule founder to secure major liquidity providers (LPs) will be essential for seeding high-demand markets quickly and ensuring the AMM can handle multi-million dollar trades without excessive price impact.

Scaling Permissionless Markets: The permissionless market creation feature must be aggressively promoted to foster organic growth and rapid diversification of available contracts, ensuring the platform remains a relevant hub for real-time speculation across the rapidly evolving crypto ecosystem.

Final Thought

PMX presents a compelling technical proposition within the decentralized prediction market sector. Its use of the dual-token AMM structure provides a verifiable technical advantage over competitors relying primarily on order books, fundamentally addressing the liquidity challenges that have plagued previous generations of platforms. The strategic choice to target the lucrative, high-frequency crypto-native niche ("Presales" and "Near Funding") is a high-risk, high-reward strategy designed to maximize volume and capital efficiency, justifying the low-fee structure (0.01%–0.05%).

The platform's success hinges on achieving substantial scale. Its deflationary tokenomics model relies entirely on a massive trading volume to effectively implement the 30% buyback/burn mechanism. Additionally, the elevated regulatory risk associated with its specialized market focus necessitates proactive strategic management.

If you enjoy reading this issue, please consider subscribing. It takes 1 minute of your time but it would mean the world to us 🙇

Disclaimer: All the information presented in this publication and its affiliates is strictly for educational purposes only. It should not be construed or taken as financial, legal, investment, or any other form of advice.

1