Open Campus (EDU): Can Blockchain Really Fix Education?

A Critical Look at the First Layer-3 EduFi Chain

📢 Sponsor | 💡 Telegram | 📰 Past Editions

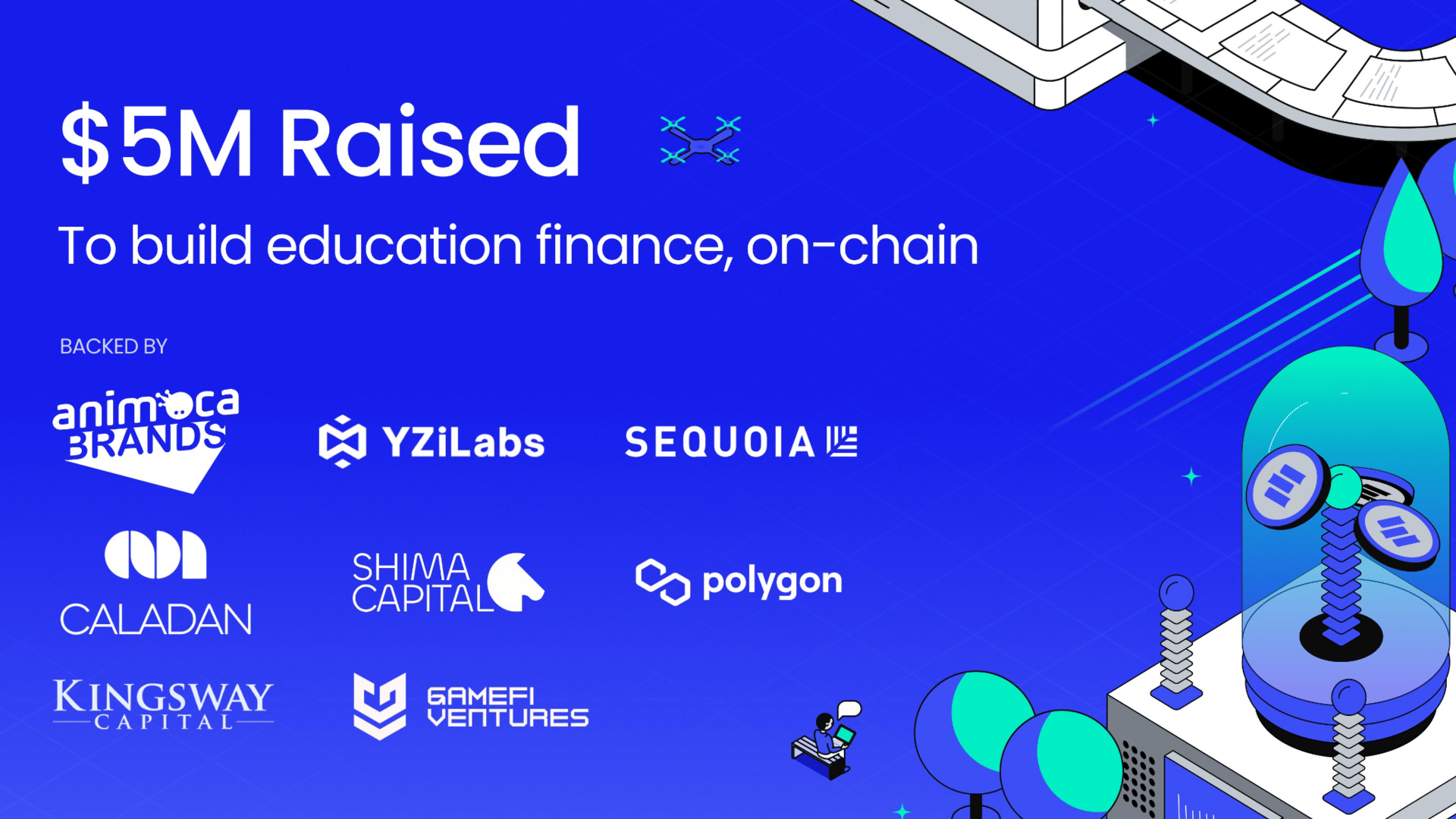

Education is one of the largest yet least disrupted industries in the world. Despite its five trillion dollar global value, inefficiency, poor credential systems, and underpaid teachers remain common problems. Open Campus aims to change that through its blockchain-based education ecosystem. Built on EDU Chain, a Layer 3 blockchain supported by Animoca Brands, Open Campus positions itself as the “on-chain future of learning,” where people can learn, own, and earn through verifiable credentials, tokenized courses, and decentralized financing.

The vision sounds bold, but the critical question remains: can blockchain realistically solve education’s structural problems, or is this another speculative ecosystem waiting for product-market fit?

Key Takeaways

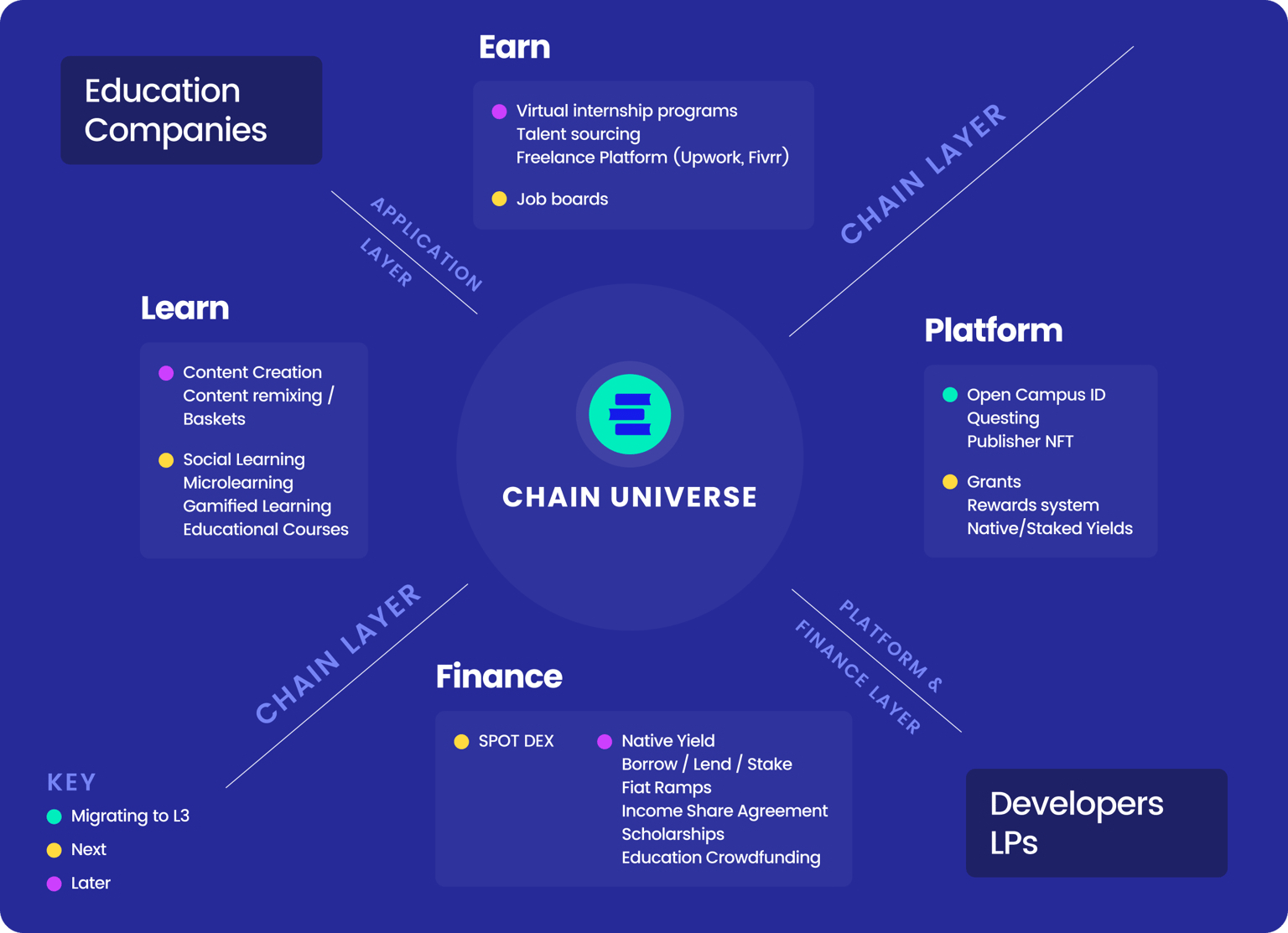

Open Campus combines education technology, decentralized identity, and DeFi under one network called EDU Chain.

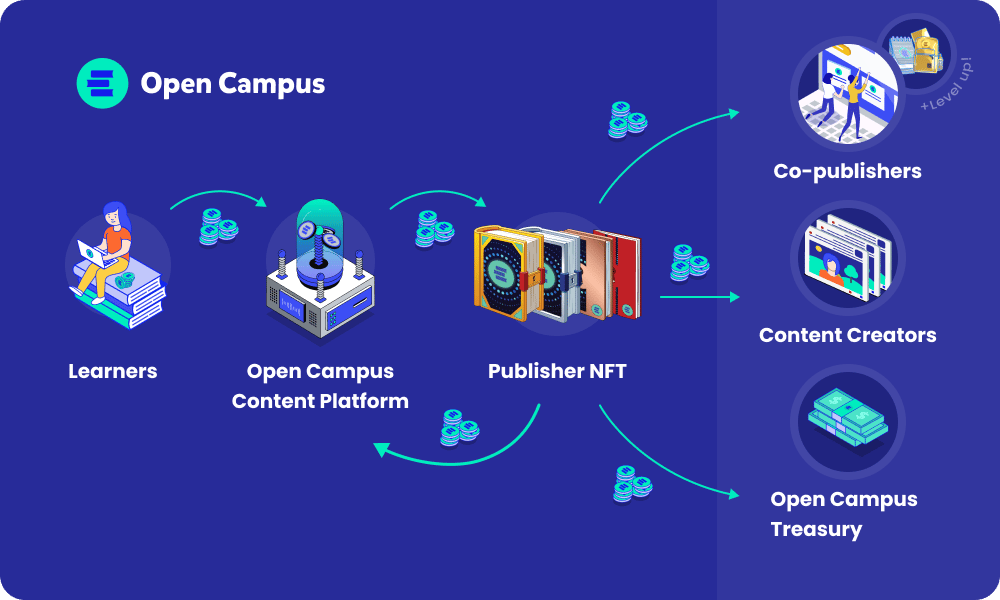

The model attempts to tokenize both learning outcomes and educational content using tools like Publisher NFTs and Open Campus ID.

It introduces the idea of EduFi, a form of decentralized student loan and education finance built on blockchain.

The biggest challenge is not technology but adoption. Education is a slow-moving industry with complex regulation, limited crypto familiarity, and high trust requirements.

What Is Open Campus and EDU Chain

Open Campus describes itself as a community-driven education protocol. Its core blockchain, EDU Chain, is a Layer 3 built to host consumer-facing educational apps and decentralized financing products. It is powered by the $EDU token, which serves as both gas and governance.

The ecosystem is backed by Animoca Brands, RISE In, HackQuest, and NewCampus, and already features dozens of decentralized apps. The chain’s stated mission is to “prepare learners for the future of work” by connecting educators, students, and institutions into a single on-chain economy.

While this design looks comprehensive, the challenge is execution. Running a dedicated blockchain for education makes sense in theory, but its utility depends on whether learning institutions, employers, and governments choose to adopt it.

The Vision and the Problem It Tries to Solve

Open Campus targets four chronic problems: lack of access, inefficient credentialing, limited teacher compensation, and poor financing options.

It argues that blockchain can fix these through transparency, tokenization, and ownership. Students gain control over their learning records, teachers can monetize lessons directly, and investors can finance education through on-chain lending.

Yet, the system’s core assumption—that education problems are primarily technical or data-based—is questionable. Education inequality stems more from social, economic, and policy gaps than from record-keeping. Verifiable credentials may help, but without institutional backing, they risk becoming another isolated data layer.

Core Pillars and Product Stack

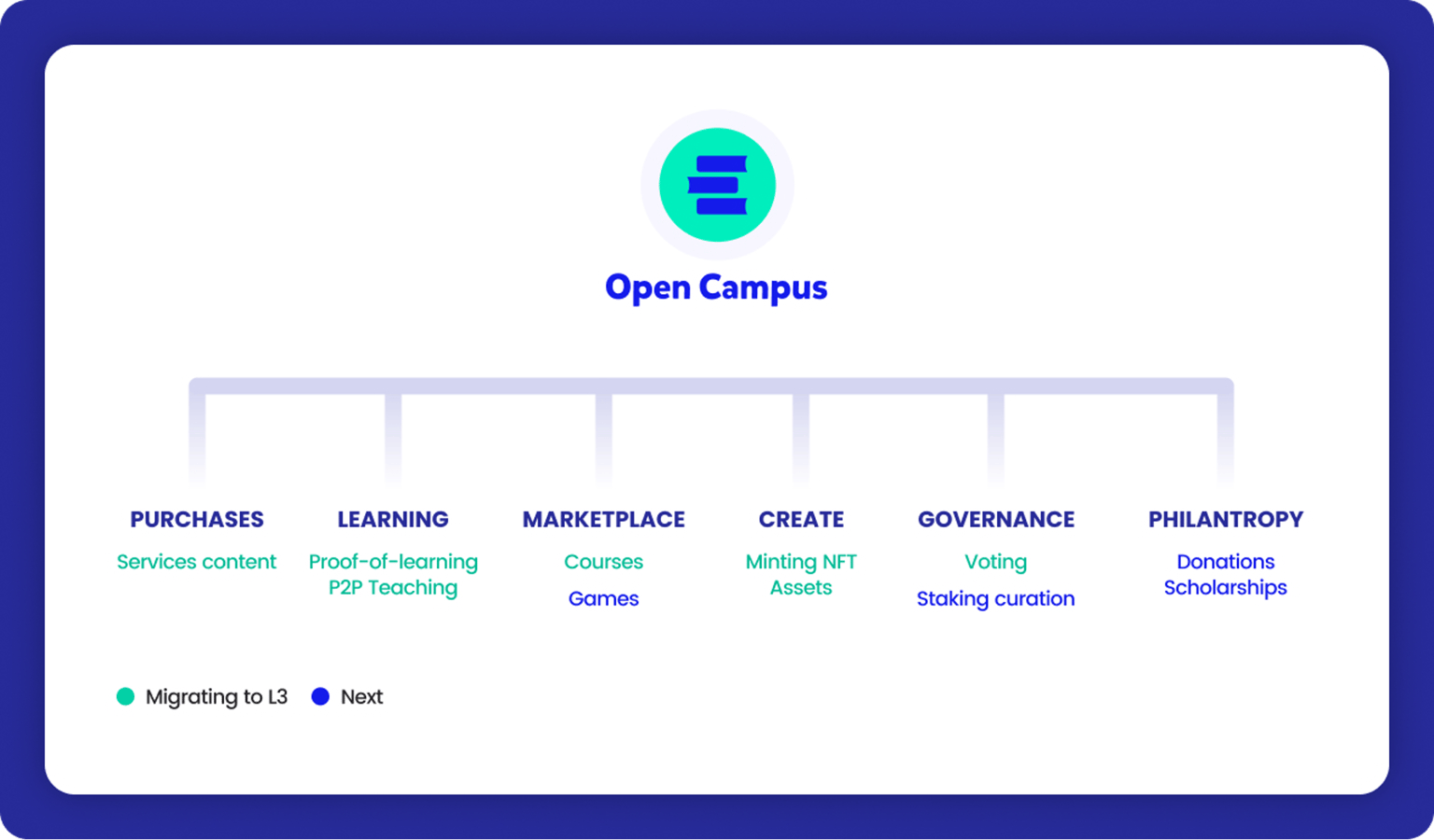

Open Campus operates through several key products:

$EDU Token: Serves as gas for transactions and a governance asset.

Open Campus ID (OCID): A soulbound on-chain identity storing academic achievements.

Publisher NFTs: Tokenized course rights that let teachers and co-publishers earn from content.

OC-X Accelerator: A funding program for EdTech startups building within the ecosystem.

This stack is impressive but fragmented. Each component has potential, yet the system’s success relies on integration. Without clear interoperability between these tools, users might face friction rather than empowerment.

The dApp Layer: Does the Ecosystem Have Real Users?

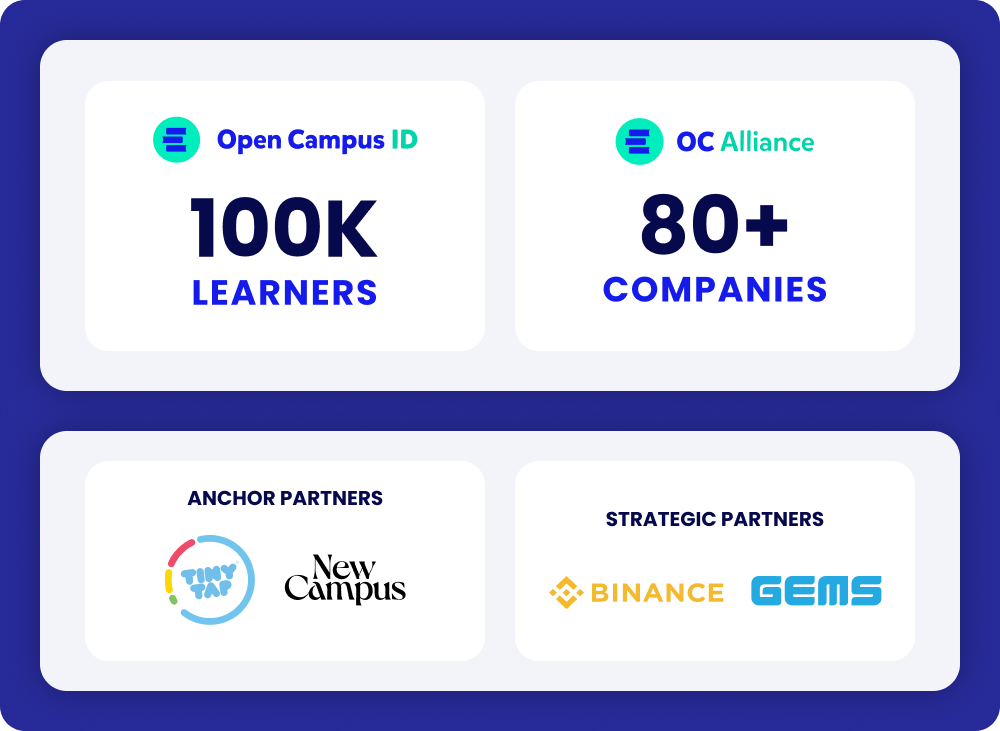

The Open Campus ecosystem is visibly growing, though its adoption still leans early-stage. According to official data, Open Campus ID has surpassed 100K learners, while the OC Alliance now includes 80+ companies building or integrating within the EDU Chain network. Anchor partners such as TinyTap and NewCampus, alongside strategic partners like Binance and GEMS, bring both credibility and access to broader audiences.

At the dApp level, Open Campus showcases a mix of learning, DeFi, and infrastructure applications:

SailFish, the first decentralized exchange on EDU Chain, distributes 100% of protocol fees to users.

EduHub develops tooling to help creators and developers build seamlessly on EDU Chain.

Pencil Finance tokenizes real-world student loans with risk-adjusted yields.

Pody Network offers a classroom-style communication platform with earning rewards.

Grasp Academy allows educators to publish, share, and monetize their educational content.

These dApps collectively form the practical layer of the ecosystem, but a critical view reveals that most user activity remains incentive-driven. Reward programs like Yuzu still account for much of the engagement rather than sustained learning or financial demand.

Reaching 100K learners is a solid early milestone, yet it represents a fraction of the global education market. The challenge now is converting these early users into long-term participants who rely on EDU Chain tools without needing token rewards. Adoption by 80+ companies shows momentum, but translating that into consistent on-chain transactions and active credential issuance will determine whether the network matures beyond early experimentation.

Tokenomics and Governance

The $EDU token powers both the DAO and the chain’s transaction system. Tokenholders can propose and vote on governance initiatives through Open Campus DAO.

This dual-purpose design has benefits and risks. It creates consistent demand for the token, but also blurs its identity. A token that serves as both a utility and governance instrument can struggle to maintain clear valuation logic. Moreover, EDU’s value capture depends heavily on whether EDU Chain achieves meaningful throughput and whether its DAO governance avoids stagnation.

EduFi Model: Tokenizing Student Loans and Credentials

Pencil Finance and edBank represent the EduFi side of Open Campus. The concept is to tokenize student loans and yield opportunities based on off-chain repayments.

While promising, this model is complex. Education loans rely on reputation, income expectations, and regulatory oversight. Without proper credit scoring and legal enforcement, the on-chain system risks default cycles or mispricing risk. Furthermore, tokenizing off-chain repayments introduces legal gray areas, especially across jurisdictions.

EduFi can democratize financing but must build strong compliance and verification mechanisms to survive.

Open Campus ID: Proof of Education or Proof of Concept

The Open Campus ID is a soulbound NFT acting as a decentralized identifier. It allows learners to own and selectively share their educational credentials.

In theory, this is powerful. It could replace fragmented transcripts with a unified, verifiable profile. Yet, adoption challenges are steep. Institutions must accept these IDs as valid credentials, and learners must trust the system with sensitive data.

Without regulatory clarity on data ownership and privacy, OCID could face friction similar to early DID experiments. It is a strong concept, but still closer to proof of concept than widespread adoption.

Publisher NFTs: Can Teachers Really Earn?

The Publisher NFT model, launched through TinyTap, is among the most innovative parts of Open Campus. It lets teachers mint NFTs representing ownership in educational courses. Holders can co-publish and share revenue generated by the course.

Some teachers have reportedly earned over 350,000 dollars selling education NFTs, but these cases remain exceptional. The model depends heavily on demand for specific course IPs, liquidity of NFTs, and user engagement on TinyTap. Without sustained learner activity, earnings may not scale beyond initial hype.

Still, this model highlights a meaningful attempt to build an education creator economy, though its long-term sustainability will depend on whether NFTs retain real pedagogical value beyond speculation.

OC-X Accelerator: Building or Subsidizing the Future

The OC-X Accelerator supports EdTech startups with mentorship and alternative financing structures such as venture debt and revenue-based financing. It reflects Open Campus’s ambition to become a capital hub for education.

The question is whether OC-X builds sustainable businesses or just distributes token incentives. Many Web3 accelerators struggle to bridge short-term token grants with long-term market viability. For OC-X to work, it needs to produce independent companies that can survive without the EDU ecosystem.

Critical Outlook: What Needs to Happen for EDU to Work

For Open Campus to succeed, several shifts are needed:

Real institutional partnerships: Schools, universities, and employers must adopt EDU IDs and credentials.

Compliance infrastructure: EduFi and DID systems must align with data and lending laws.

Sustainable token economy: EDU must capture actual transactional value, not just governance speculation.

Simplified user experience: Web3 learning tools must be as seamless as existing education apps.

Proof of learning value: Students and teachers must find real outcomes, not just rewards.

Without these, EDU risks becoming an education-themed blockchain rather than a genuine reform movement.

Final Thoughts

Open Campus stands out for its ambition. It is one of the few Web3 projects that approaches education with a holistic framework, connecting finance, identity, and content ownership. Yet, ambition alone does not guarantee impact.

The model faces the same paradox as many blockchain ventures: powerful technology meeting human systems resistant to change. Unless Open Campus secures institutional validation, simplifies user onboarding, and proves tangible benefits for teachers and learners, its ecosystem may stay confined within crypto circles.

Still, it offers a meaningful experiment. If it can bridge the gap between tokenized learning and real-world recognition, Open Campus could become a blueprint for future education economies.

If you enjoy reading this issue, please consider subscribing. It takes 1 minute of your time but it would mean the world to us 🙇

Disclaimer: All the information presented in this publication and its affiliates is strictly for educational purposes only. It should not be construed or taken as financial, legal, investment, or any other form of advice.