Lighter Launches LIT Token With Major Ecosystem Allocation

An Incomplete Guide to Reputation and Trust | Flow Rollback After $3.9M Exploit

📢Sponsor | 💡Telegram | 📰Past Editions

Good Morning.

Lighter has introduced its LIT token as part of a broader effort to define how value, incentives, and participation are structured across its ecosystem. The launch frames LIT as a foundational layer tied to usage and protocol growth, rather than a standalone trading event.

Check out our latest podcast episode!

In Today's Email:

What Matters: Lighter Launches LIT Token With Major Ecosystem Allocation 👀

Case Study: An Incomplete Guide to Reputation and Trust 🔎

Governance & Features: Flow Rollback After $3.9M Exploit 🔙

You read and share. We listen and improve. Send us feedback at [email protected].

Narratives: Tokenized Incentives

For daily market updates and airdrop alphas, check out our telegram!

WHAT MATTERS

Lighter Launches LIT Token With Major Ecosystem Allocation

State of play: Lighter has introduced its native Lighter Infrastructure Token (LIT) ahead of its token generation event, positioning the token as a core incentive and governance asset for the platform.

50% of the total supply is allocated to ecosystem growth, including a 25% airdrop to users from Lighter’s first two points seasons in 2025.

The remaining ecosystem share will fund future incentives and partnerships.

The team and investors will receive 26% and 24% respectively, both under a one year lock followed by three years of linear vesting.

Lighter said exchange revenues and future product income will be transparently tracked onchain and used for growth initiatives and token buybacks.

LIT will also be used for staking to access protocol infrastructure, with these functions decentralizing over time.

The token began trading near $2.34, below its pre market price.

Why it matters: LIT turns Lighter from just a high volume perps exchange into a broader onchain infrastructure play, with token economics tied directly to real usage and revenue.

Our take: This looks more like an alignment move than a hype driven TGE. The focus on ecosystem funding and transparent revenue suggests a longer term mindset.

For builders and investors: This sets a clearer framework around how value flows through the ecosystem, giving participants a more predictable way to engage with the protocol and assess its long term sustainability.

CASE STUDY

An Incomplete Guide to Reputation and Trust

Credits to Dino for the original article

Reputation comes from how humans learned to make fast trust decisions in small groups, using simple binaries like friend or foe or safe or dangerous. This was efficient but lost nuance.

As societies grew, reputation evolved into a form of collective memory, allowing people to be trusted in specific roles or contexts rather than judged as entirely good or bad.

In the modern world, trust still operates on two levels. Universal trust compresses signals into broad judgments, while contextual trust recognizes that people are multidimensional and reliable only in certain domains.

Reputation helps bridge these two by adding history and texture to trust over time.

Reputation can be understood both as a general social judgment and as the outcome of individual actions shaped by values and decision making. It also exists in two forms.

Social reputation comes from real, repeated interactions, while parasocial reputation is built through one way exposure, such as media and online presence.

Today, these boundaries are increasingly blurred. Digital relationships mix social and parasocial signals, making trust harder to assess.

As misinformation and synthetic content grow, the challenge is less about finding a perfect reputation system and more about helping people combine many imperfect signals to decide who to trust, and in what context.

Take a peek at our referral reward at the bottom of this issue. Share this newsletter and receive our list of 500 crypto VC individuals 👇

INSIGHTS

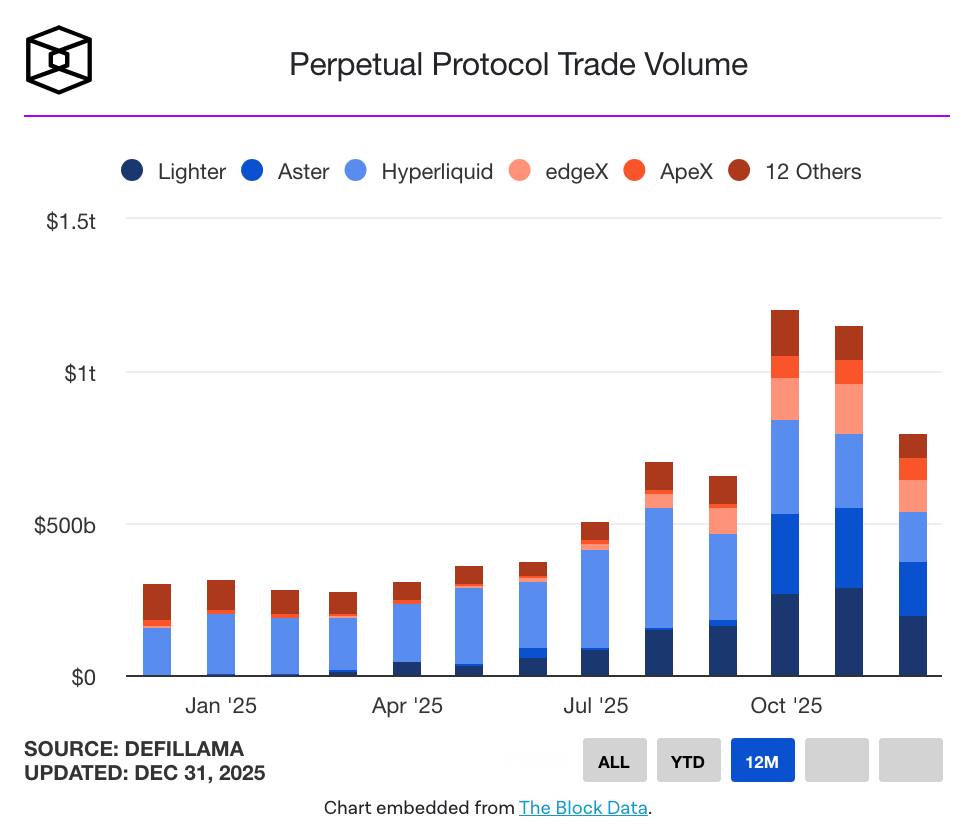

State of play: Hyperliquid Labs is set to distribute around 1.2M HYPE tokens to team members on January 6, following an unstaking event disclosed on Discord.

At current prices, the payout is worth roughly $31.2M and marks the team’s second major allocation after a November distribution.

HYPE was launched in November 2024 through a large community airdrop, with about 23.8% of the 1B total supply reserved for core contributors under a multi year vesting plan.

Around 238M tokens are currently in circulation, with more than 61% of supply still locked.

While monthly distributions may occur on the 6th, the full vesting schedule has not been publicly detailed, and the team has clarified that the unlocks are not linear.

Despite growing competition from rivals like Lighter and Aster, Hyperliquid remains the largest decentralized perps platform by cumulative trading volume.

FEATURES & GOVERNANCE UPDATE

Flow Faces Backlash Over Planned Rollback After $3.9M Exploit

Flow plans to roll back around six hours of transactions to reverse a $3.9M exploit, but the move has drawn strong criticism from ecosystem partners who say they were not informed in advance.

The attacker had already bridged the stolen funds off Flow, meaning the rollback would not recover the assets.

deBridge said the decision blindsided partners and could harm users, liquidity providers, and exchanges that processed transactions during the window.

A major centralized exchange trading FLOW was also reportedly unaware of the rollback plan.

deBridge and LayerZero are instead pushing for a targeted hard fork that fixes the vulnerability and blacklists illicit funds, citing past precedent on BNB Chain.

The Flow Foundation said it is reassessing the plan after partner feedback and taking more time to align on next steps.

Other notable feature updates:

Movement launched M1.

Solana Foundation announced Kora.

GMX is now live on the Ethereum mainnet.

Shift4 has launched stablecoin settlement on Polygon.

Uniswap governance approved the UNIfication proposal.

QUICK BITES

South Korea's stablecoin bill stalls over issuer eligibility dispute.

Ethereum L1 transactions hit 2.2M a day; each costs about 17 cents.

Onchain perpetual futures drive surge in crypto derivatives activity.

Lighter launches native token LIT, allocates half to ecosystem growth.

Hyperliquid Labs set for next HYPE token payout as 1.2M tokens unstake.

Spot bitcoin ETFs record $355M net inflows, ending 7-day negative streak.

NOTEWORTHY READS & MEME

If you enjoy reading this issue, please consider subscribing. It takes 1 minute of your time, but it would mean the world to us 🙇

Disclaimer: All the information presented in this publication and its affiliates is strictly for educational purposes only. It should not be construed or taken as financial, legal, investment, or any other form of advice.