Launchy Regulatory Roundup #56 - SEC Weighs Plan for Tokenized Stock Trading

Is Partisan Politics Good for Crypto?

📢 Sponsor | 💡 Telegram | 📰 Past Editions

Good Morning.

Welcome to our 56th edition of the regulatory roundup. If you know anybody who would benefit from this content, please help us spread the word!

In Today's Edition:

Headline: SEC Weighs Plan for Tokenized Stock Trading 👀

Global Legal Roundup

Case Study: Is Partisan Politics Good for Crypto?

You read and share. We listen and improve. Send us feedback at [email protected].

For daily market updates and airdrop alphas, check out our telegram!

HEADLINE

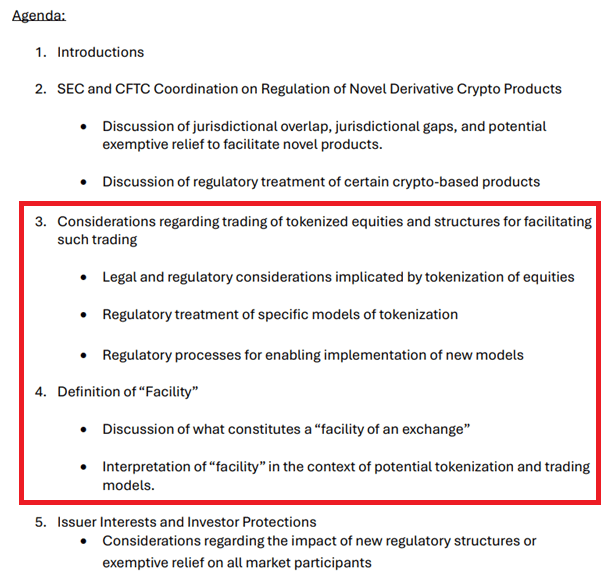

SEC Weighs Plan for Tokenized Stock Trading

Source: Nate Geraci

State of play: The US SEC is working on a plan that would let blockchain-based versions of public company stocks trade on approved crypto exchanges.

Robinhood, Kraken, and Coinbase are already testing similar products, and Nasdaq has asked for permission to list tokenized securities.

SEC Chair has called tokenization an innovation worth supporting, though firms like Citadel have warned a loophole for lighter regulation.

The market for tokenized assets is growing fast, with about $31B now on-chain, and analysts say it could top $1.3T.

What’s Next: If approved, tokenized stocks could start trading on major crypto exchanges, giving investors a new way to buy equities on-chain.

Why it Matters: It would bring stock trading closer to crypto’s 24/7 model and mark real progress in merging traditional markets with blockchain.

Our Take: This is a big step toward hybrid finance.

GLOBAL LEGAL ROUNDUP

America:

🇺🇲 Coinbase pursues OCC federal charter.

🇺🇲 Congressman Begich pushes plan for bitcoin reserv

🇺🇲 FDIC to review rule that may shape banks’ crypto relationships.

🇺🇲 SEC clears DePIN tokens as ‘fundamentally’ outside jurisdiction.

🇺🇲 CME to make crypto futures ‘always on’ with 24/7 trading in 2026.

🇺🇲 White House drops Brian Quintenz from CFTC chair consideration.

🇺🇲 SEC Commissioner urges quick progress as crypto regulation softens.

🇺🇲 SEC opens the door for advisers to use state trusts as crypto custodians.

🇺🇲 Gary Gensler's deleted texts under scrutiny from House Republicans.

🇺🇲 Sen. Lummis says progress is underway on crypto tax rules in the Senate.

🇺🇲 SEC weighs plan to allow blockchain-based stock trading amid crypto push.

Europe:

Middle East & Africa:

🇦🇪 Abu Dhabi agricultural regulator bans use of farmland for crypto mining.

CASE STUDY

Is Partisan Politics Good for Crypto?

Joe Lubin

State of play: Consensys CEO and Ethereum co-founder Joseph Lubin criticized the partisan divide in US crypto policy, saying political agendas are slowing down innovation.

He called for a unified approach to digital asset regulation, arguing that “silly partisan politics” should have no place in a technological revolution.

Lubin said the current administration has made progress with initiatives like the Genius stablecoin bill and upcoming market structure legislation, but warned that entrenched financial interests still resist change.

He emphasized that fostering innovation should be a national priority rather than a political issue.

Our Take: Lubin is right that partisanship has stalled meaningful crypto policy, but his optimism may overlook how deeply politics shapes financial power. Both parties use crypto as a talking point more than a policy goal.

Take a peek at our referral reward at the bottom of this issue. Share this newsletter and receive our comprehensive database of crypto regulations around the world👇

NOTEWORTHY READS & MEME

‘We have 6.9 million users on our testnet’

The users:

— Anon Vee (@AnonVee_)

6:34 AM • Oct 4, 2025

If you enjoy reading this issue, please consider subscribing. It takes 1 minute of your time but it would mean the world to us 🙇

Disclaimer: All the information presented in this publication and its affiliates is strictly for educational purposes only. It should not be construed or taken as financial, legal, investment, or any other form of advice.