Launchy Regulatory Roundup #55 - CFTC Pushes Stablecoin Collateral in Derivatives

SEC, FINRA Probe DAT Trading Ahead of Crypto Buys

📢 Sponsor | 💡 Telegram | 📰 Past Editions

Good Morning.

Welcome to our 55th edition of the regulatory roundup. If you know anybody who would benefit from this content, please help us spread the word!

In Today's Edition:

Headline: CFTC Pushes Stablecoin Collateral in Derivatives 👀

Global Legal Roundup

Case Study: SEC, FINRA Probe DAT Trading Ahead of Crypto Buys 🔎

You read and share. We listen and improve. Send us feedback at [email protected].

For daily market updates and airdrop alphas, check out our telegram!

HEADLINE

CFTC Pushes Stablecoin Collateral in Derivatives

State of play: The CFTC has launched an initiative to allow tokenized collateral, including stablecoins, in US derivatives markets.

Acting Chairman Pham said the move builds on last year’s GMAC recommendation to expand non-cash collateral through distributed ledger technology.

Industry leaders like Circle, Coinbase, Crypto.com, Ripple, and Moonpay are participating in the pilot program.

The effort aims to boost efficiency and transparency while aligning with new rules under the GENIUS Act, which regulates stablecoins.

Public comments are open until October 20.

What’s Next: The CFTC will gather industry feedback until October 20 and may expand its tokenized collateral pilot into formal rulemaking.

A digital asset sandbox could follow, creating a clearer framework for stablecoin use in derivatives.

Why it Matters: Allowing stablecoins as collateral directly integrates crypto into the heart of capital markets. It signals regulators are not just tolerating but actively shaping tokenized finance.

Our Take: This is more than a technical upgrade. It positions stablecoins as core financial infrastructure, not just a payments tool. If executed well, the CFTC’s initiative could legitimize tokenized markets globally and push other regulators to follow.

GLOBAL LEGAL ROUNDUP

America:

🇺🇲 FTX Trust sues bitcoin miner Genesis Digital.

🇺🇲 US Senate schedules hearing on crypto taxation.

🇺🇲 SEC Chair responds to crypto conflicts of interest.

🇺🇲 US & UK team up to create crypto focused task force.

🇺🇲 Sens. Warren call for ethics probe into Trump-linked crypto dealings.

🇺🇲 White House eyes year-end finish line for crypto market structure bill.

🇺🇲 SEC Chair pushes 'innovation exemption' to fast-track crypto products.

🇨🇦 KuCoin appeals $14M penalty from Canadian regulator over AML violations.

Europe:

Middle East & Africa:

🇦🇪 UAE signs agreement for automatic exchange of crypto tax data.

APAC:

CASE STUDY

SEC, FINRA Probe DAT Trading Ahead of Crypto Buys

State of play: The SEC and FINRA are investigating suspicious stock trading patterns that occurred before public digital asset treasury companies (DATs) announced crypto purchases, the Wall Street Journal reported.

Regulators are focusing on unusual volumes and price spikes that suggest possible leaks of non-public information.

The SEC has cautioned some firms about potential violations of Regulation Fair Disclosure, which requires broad, simultaneous disclosure.

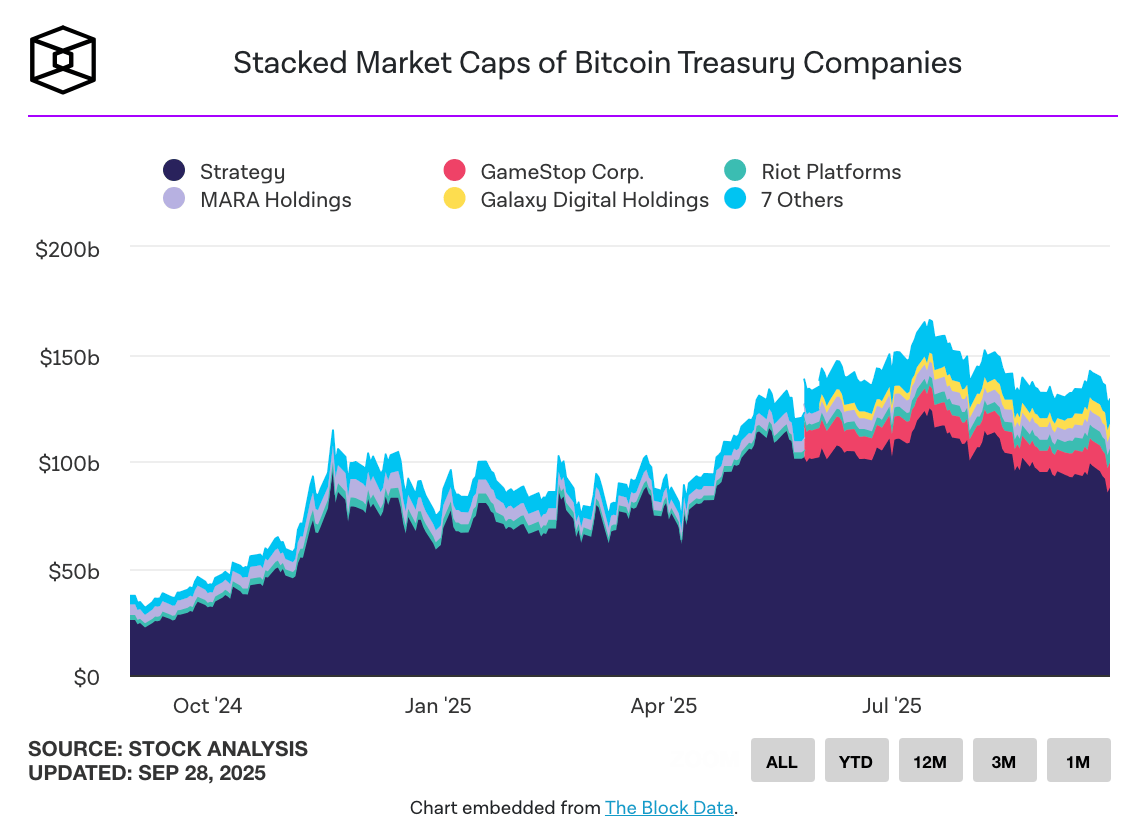

The probe comes as DATs attract over $20B in funding this year, with Strategy still leading corporate bitcoin holdings at nearly 640,000 BTC.

Our Take: If regulators prove front-running, DATs may need to treat crypto buys like traditional market moves. It could dampen hype-driven momentum but strengthen long-term credibility.

Take a peek at our referral reward at the bottom of this issue. Share this newsletter and receive our comprehensive database of crypto regulations around the world👇

NOTEWORTHY READS & MEME

I missed all the perp dex trades the past week

— Tom (@SolportTom)

11:57 AM • Sep 27, 2025

If you enjoy reading this issue, please consider subscribing. It takes 1 minute of your time but it would mean the world to us 🙇

Disclaimer: All the information presented in this publication and its affiliates is strictly for educational purposes only. It should not be construed or taken as financial, legal, investment, or any other form of advice.