Kraken Parent Company Hits $2.2B Revenue

Vitalik Rethinks ETH's Rollup Strategy | MetaMask Adds Tokenized US Stocks and ETFs

📢Sponsor | 💡Telegram | 📰Past Editions

Good Morning.

Vitalik Buterin is openly reassessing Ethereum’s rollup thesis. With L1 scaling faster than expected and most L2s still far from real decentralization, the idea of rollups as Ethereum’s default scaling layer is starting to break.

Check out our latest podcast episode!

In Today's Email:

What Matters: Kraken Parent Company Hits $2.2B Revenue 🐙

Case Study: Vitalik Rethinks Ethereum’s Rollup Strategy 🔎

Governance & Features: MetaMask Adds Tokenized US Stocks and ETFs 🦊

You read and share. We listen and improve. Send us feedback at [email protected].

Narratives: Tokenized Equities Go Mainstream

For daily market updates and airdrop alphas, check out our telegram!

WHAT MATTERS

Kraken Parent Company Hits $2.2B Revenue

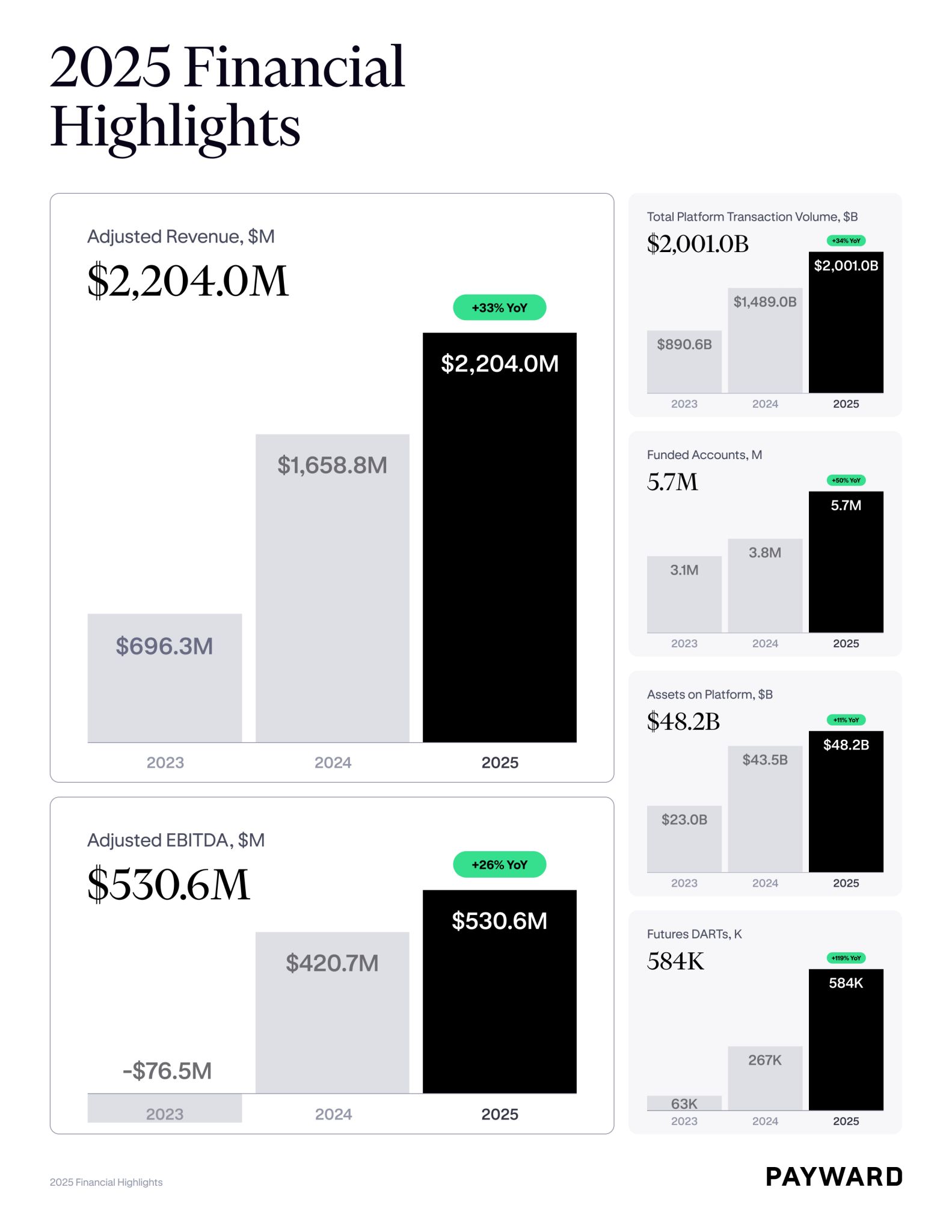

Source: Kraken

State of play: Kraken parent company Payward reported $2.2B in adjusted revenue for 2025, up 33% YoY. Trading made up 47% of revenue, while 53% came from non trading businesses such as custody, payments, yield, and financing.

Total platform transaction volume reached $2T, up 34% YoY, driven by sustained user engagement and growing assets on platform.

In 2025, Kraken ramped up diversification, highlighted by the $1.5B NinjaTrader acquisition, the purchase of prop trading firm Breakout, and the acquisition of Backed to expand into tokenized equities via xStocks.

Kraken also launched the Krak app, positioning itself as a payments focused super app with free transfers, cashback debit cards, salary deposits, and expanded wealth tools.

On the derivatives front, the exchange expanded across Europe and the UK, while its US platform added CME listed contracts spanning equities, FX, metals, and energy.

IPO speculation is growing after a Kraken backed SPAC raised $345M on Nasdaq, following a $200M investment from Citadel Securities that valued the company at $20B.

Why it matters: With over half of revenue coming from non trading businesses, the model looks more resilient and less cycle dependent.

Our take: Trading fees compress over time, but custody, payments, and derivatives scale better once the rails are built.

For builders and investors: The edge is moving to integrated platforms.

CASE STUDY

Vitalik Rethinks Ethereum’s Rollup Strategy

Vitalik Buterin says Ethereum’s rollup centric roadmap no longer fully makes sense, as most L2s have decentralized far slower than expected while the base layer keeps improving.

The original idea was for L2s to act like branded shards of Ethereum, but in reality many remain highly centralized, often due to technical risk, incentives, or regulatory needs.

Only a small number have reached meaningful decentralization milestones.

Buterin is not dropping L2s, but reframing them as a spectrum rather than core Ethereum shards.

He argues L2s should offer value beyond scaling, such as privacy, non EVM designs, or ultra low latency, while Ethereum continues pushing base layer scaling with ideas like enshrined ZK-EVM proofs.

Take a peek at our referral reward at the bottom of this issue. Share this newsletter and receive our list of 500 crypto VC individuals 👇

INSIGHTS

State of play: Y Combinator will allow startups to receive their YC funding in USDC starting with the Spring 2026 batch, marking the first time the accelerator has offered a stablecoin payout option.

The option is available to all YC backed startups, not just crypto companies, and will support USDC across Ethereum, Base, and Solana.

YC says stablecoin transfers typically cost under $0.01 and settle in under one second, making them far cheaper and faster than international bank wires.

YC views the move as timely following clearer US stablecoin regulation after the GENIUS Act.

It also reflects real usage among YC companies operating in regions like India and Latin America, where banking access can be slow or expensive.

The funding terms and amounts remain unchanged. The stablecoin option simply gives founders more flexibility in how they receive capital.

YC has backed nearly 100 crypto startups since Coinbase in 2012 and says it is increasingly interested in stablecoins, tokenization, onchain credit, and capital formation.

FEATURES & GOVERNANCE UPDATE

MetaMask Adds Tokenized US Stocks and ETFs

MetaMask has integrated access to more than 200 tokenized US stocks, ETFs, and commodities through a partnership with Ondo Finance’s Global Markets platform.

Eligible users in select non US regions can now buy, hold, and trade these assets directly inside the MetaMask mobile app using USDC on Ethereum.

The tokens track the prices of major US equities like Tesla, Apple, Nvidia, Microsoft, and Amazon, along with ETFs such as QQQ, SLV, and IAU.

Trading is available 24 hours a day, five days a week, while transfers remain always on.

Access is restricted in the US, UK, EU, Canada, and several other jurisdictions.

The tokens are not registered securities and do not grant ownership rights in the underlying assets.

Other notable feature updates:

Tether launched USAT.

Kraken launched DeFi Earn.

YO Protocol announced its upcoming YO token.

Fidelity plans to launch a US dollar stablecoin(FIDD).

Ethereum ERC-8004 introduces new on-chain registries.

MegaETH public mainnet will go live on February 9, 2026.

Uniswap is launching Continuous Clearing Auctions on its frontend.

QUICK BITES

Crypto.com spins out OG prediction markets app.

Bitwise to acquire crypto staking provider Chorus One.

Kraken parent Payward reports $2.2B adjusted 2025 revenue.

Vitalik Buterin reevaluates Ethereum's rollup-centric roadmap.

Trump says he was unaware of $500M UAE investment in WLFI.

MetaMask integrates tokenized US stocks, ETFs, commodities.

Spot BTC ETFs snap outflow streak with $562M in daily inflows.

Canada's investment watchdog sets new rules for crypto custody.

YC opens stablecoin funding option for startups starting Spring 2026.

Incognito Market founder sentenced to 30 years for crypto-drug market.

S.Korean crypto CEO gets 3-year prison term in market manipulation case.

NOTEWORTHY READS & MEME

If you enjoy reading this issue, please consider subscribing. It takes 1 minute of your time, but it would mean the world to us 🙇

Disclaimer: All the information presented in this publication and its affiliates is strictly for educational purposes only. It should not be construed or taken as financial, legal, investment, or any other form of advice.