JPMorgan Sees $34B Potential in Base Token

JPMorgan to Enable BTC and ETH-Backed Loans | Bitcoin Illiquid Supply Drops

📢Sponsor | 💡Telegram | 📰Past Editions

Good Morning,

Coinbase might be gearing up for its biggest move yet with a Base network token. JPMorgan says it could unlock as much as $34B in value as Coinbase leans deeper into onchain growth.

Check out our latest episode with 0G!

In Today's Email:

What Matters: JPMorgan Sees $34B Potential in Base Token 👀

Product of the Week: JPMorgan to Enable BTC and ETH-Backed Loans 💰️

Charts: Stable Hits $825M Cap, Bitcoin Illiquid Supply Drops 📊

You read and share. We listen and improve. Send us feedback at [email protected].

Narratives: Onchain Value Play

For daily market updates and airdrop alphas, check out our telegram!

WHAT MATTERS

JPMorgan Sees $34B Potential in Base Token

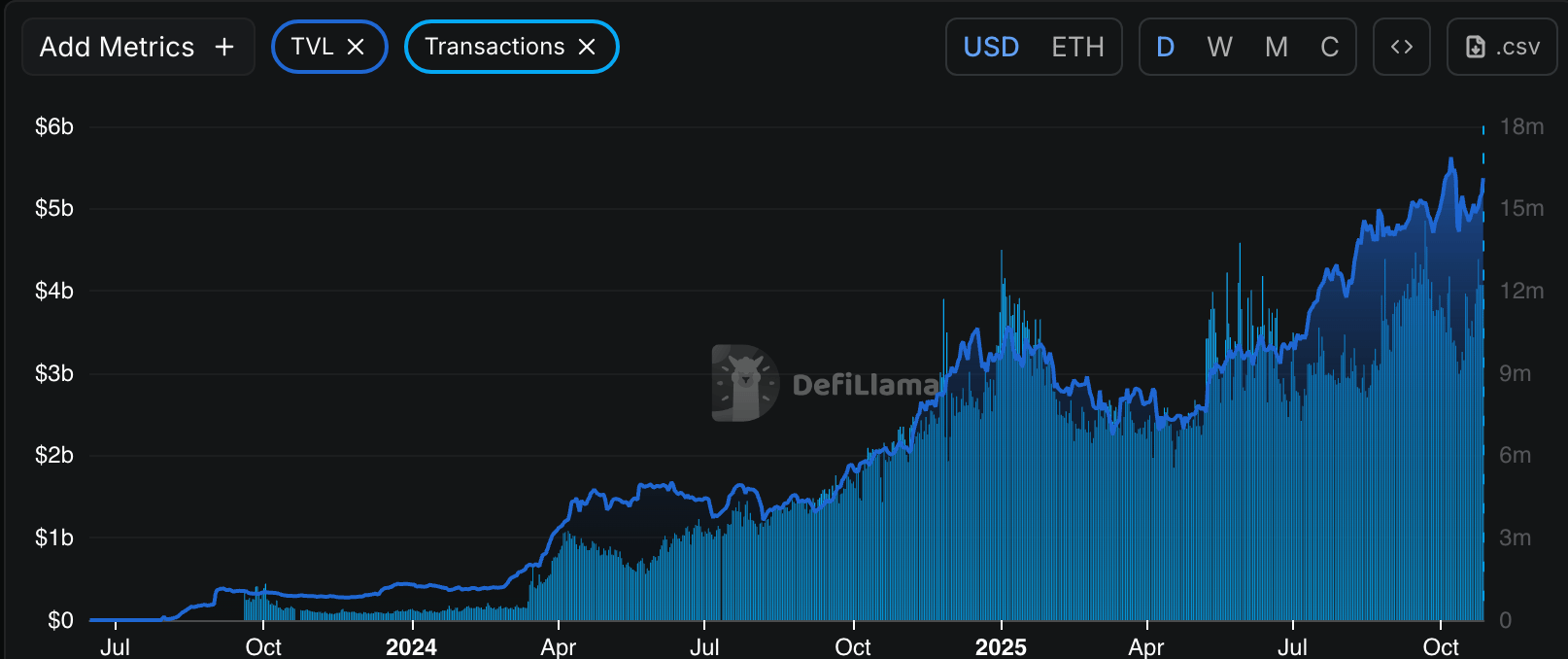

Source: DefiLlama / Base TVL & Txs

State of play: JPMorgan analysts believe Coinbase could unlock between $12B and $34B in value through a potential Base network token, marking a new onchain monetization phase for the exchange.

The report raised Coinbase’s stock target to $404 by December 2026, citing growth from Base’s $5B TVL, expanding onchain activity, and yield programs.

The bank noted that Coinbase may retain 40% of Base’s token supply, translating to $4B to $12B in added equity value.

JPMorgan also highlighted potential earnings upside if Coinbase limits USDC yield rewards to its paid subscribers, saving an estimated $374M annually.

Coinbase’s integration of a DEX aggregator on Base could help offset competition from DEXs, which represent about 25% of global spot volume.

Why it matters: A Base token could be Coinbase’s next big money maker, turning its Layer 2 growth into real shareholder value.

Our take: If Coinbase pulls it off, Base could stand beside the top Layer 2s and boost the company’s edge in DeFi.

For builders and investors: Keep an eye on token plans, yield changes, and Base’s liquidity growth.

PRODUCT OF THE WEEK

JPMorgan to Enable BTC and ETH-Backed Loans

IMG: Coindesk

JPMorgan Chase plans to let institutional clients use Bitcoin and Ether as collateral for loans by the end of 2025, according to Bloomberg. The program will be global and rely on a third-party custodian to hold pledged assets.

This marks a major step in bringing crypto directly into bank lending infrastructure.

Earlier this year, JPMorgan began accepting crypto-linked ETFs as collateral, but the new system allows clients to pledge the actual digital assets.

The move follows similar steps from major firms like Morgan Stanley, BNY Mellon, and Fidelity, as clearer regulations make crypto lending safer for banks.

Other cool products:

Extended, a perp DEX.

Tymio, a decentralized structured products protocol.

Sake Finance, an integrated liquidity protocol on Soneium.

HAPI ID, a digital identification of a user’s on-chain activity.

Untitled Bank, a permissionless, and modular lending platform.

Take a peek at our referral reward at the bottom of this issue. Share this newsletter and receive our list of 500 crypto VC individuals 👇

CHARTS OF THE WEEK

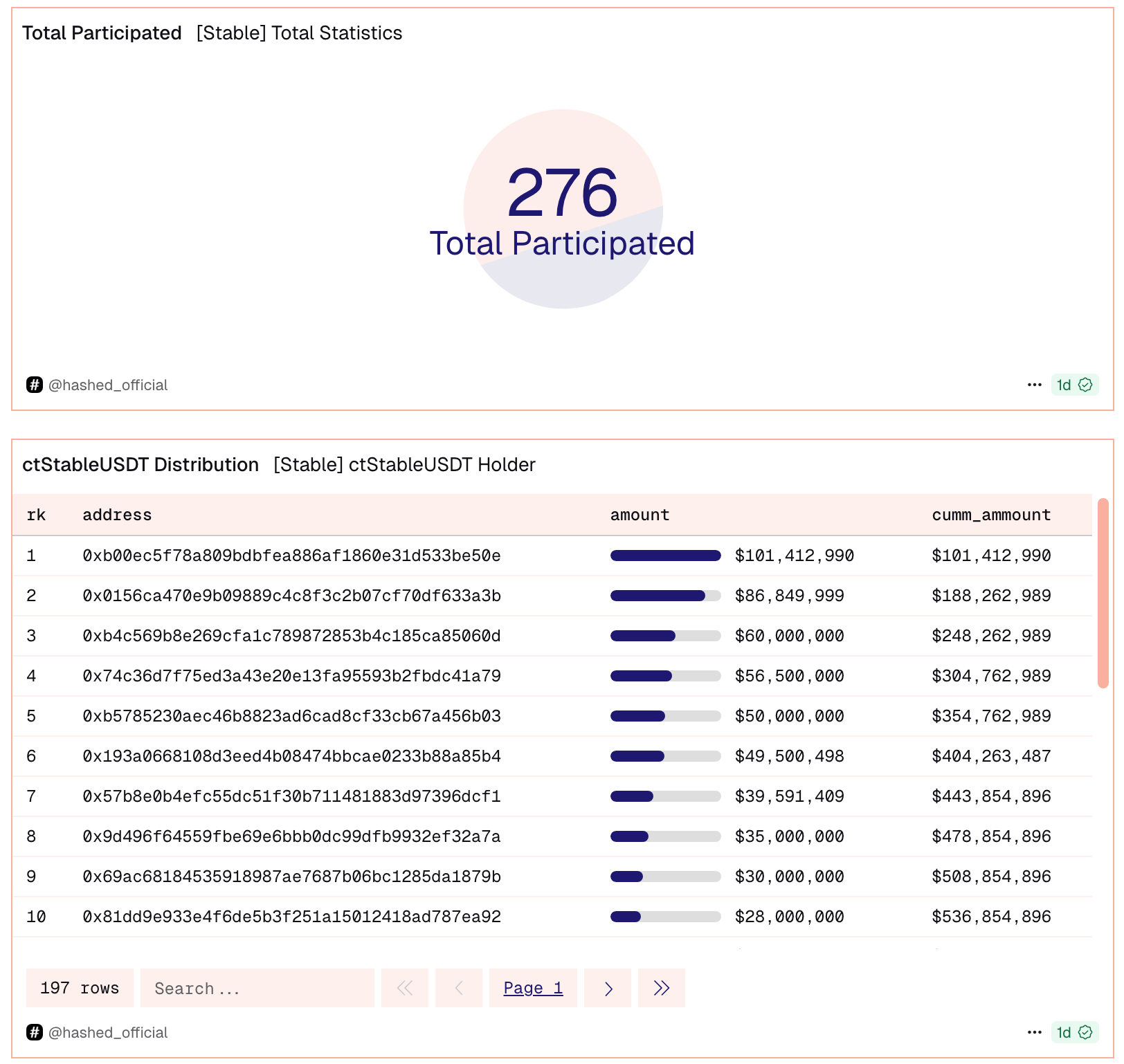

Stable Hits $825M Cap

Source: Dune / @hashed_official

State of play: Stable reached its $825M Phase 1 pre-deposit cap almost instantly after launch. The campaign lets users deposit stablecoins like USDT for future token rewards, with major participants including Frax Finance, Pendle, and LayerZero.

According to onchain data, a significant portion of deposits came from a small number of large wallets.

One address associated with BTSE reportedly contributed around $500M, representing more than half of total deposits.

Stable, backed by Bitfinex and USDT0, has not yet provided further details about the next phase of the campaign.

Our take: Stable’s fast $825M cap highlights strong interest in its network, though early large deposits have raised questions about participation balance. Clearer communication in future rounds could help improve transparency and engagement.

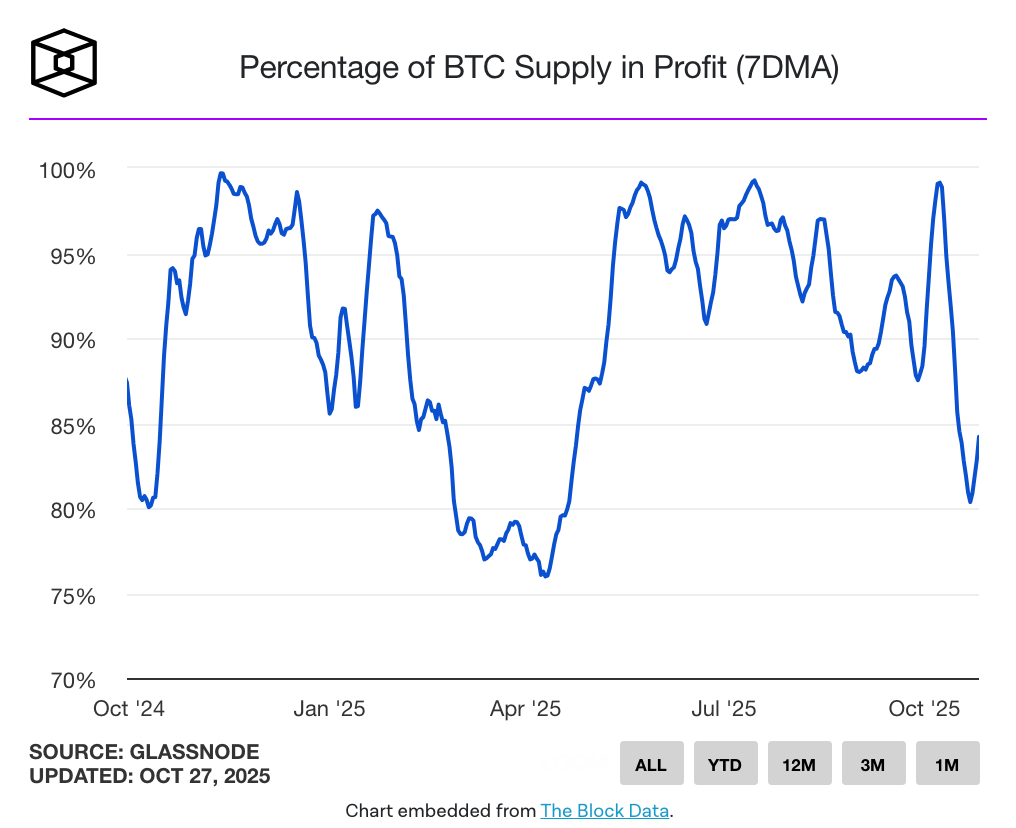

Bitcoin Illiquid Supply Drops as $7B Leaves Long-Term Wallets

Source: The Block

State of play: Around 62,000 BTC (~$7B), has left long-term holder wallets since mid-October, marking the first notable decline in Bitcoin’s illiquid supply during the second half of 2025, according to Glassnode.

Glassnode noted that while whale wallets have been accumulating, mid-sized holders with $10K to $1M in BTC have been selling consistently since late 2024.

The lack of new buyers has added pressure on prices, with Bitcoin currently trading near $113,550 after hitting an ATH above $125,000 earlier this month.

Fidelity Digital Assets projected that 42% of Bitcoin’s total supply could become illiquid by 2032 if long-term holding trends persist.

Our take: Some long-term holders are cashing out after the recent peak, easing Bitcoin’s illiquid supply. Whales are still buying, but without fresh demand, prices may stay muted until new spot interest picks up.

QUICK BITES

Base token could be worth as much as $34B.

President Trump taps Michael Selig to lead CFTC.

Western Union to pilot stablecoin-powered transfers.

Mt. Gox pushes back repayment deadline by another year.

Bitcoin illiquid supply declines as 62,000 BTC moves out.

Japan's JPYC launches country's first yen-denominated stablecoin.

CZ’s pardon came after costly Binance lobbying push in Washington.

US Treasury chief says ‘substantial’ trade framework with China reached.

NOTEWORTHY READS & MEME

If you enjoy reading this issue, please consider subscribing. It takes 1 minute of your time, but it would mean the world to us 🙇

Disclaimer: All the information presented in this publication and its affiliates is strictly for educational purposes only. It should not be construed or taken as financial, legal, investment, or any other form of advice.