JPMorgan Launches Solana USCP for Galaxy Debt

Rushi Manche of Nyx Group | Fogo Announces $FOGO Presale

📢Sponsor | 💡Telegram | 📰Past Editions

Good Morning.

JPMorgan moved Galaxy’s US commercial paper onto Solana, marking a real on chain debt transaction and showing growing comfort with public blockchains for institutional finance.

Check out our latest episode with Yumi Finance!

In Today's Email:

What Matters: JPMorgan Launches Solana USCP for Galaxy Debt 👀

Founders Highlight: Rushi Manche of Nyx Group 👨

Deal Flows: Fogo Announces $FOGO Presale 💰️

You read and share. We listen and improve. Send us feedback at [email protected].

Narratives: Institutional Onchain Finance

For daily market updates and airdrop alphas, check out our telegram!

WHAT MATTERS

State of play: JPMorgan has facilitated Galaxy Digital’s first US commercial paper issuance using a new Solana based token called USCP. The transaction is one of the earliest examples of corporate debt issued directly on a public blockchain.

The USCP token represents short term corporate debt created by JPMorgan, with both issuance and redemption settled in USDC.

Coinbase and Franklin Templeton participated as investors, while Coinbase also provided custody and USDC on and off ramp services.

JPMorgan and Galaxy positioned the issuance as a practical step toward using open blockchain infrastructure for institutional grade financial products.

Why it matters: Public blockchains are starting to handle real financial products, not just experiments. Big banks and asset managers are now comfortable moving short term debt on chain.

Our take: This looks like quiet infrastructure progress. JPMorgan is stress testing public chains for serious use, and Galaxy is helping prove it can work in practice.

For builders and investors: More on chain debt and yield products are coming.

BUILDER-INVESTOR HIGHLIGHT

Rushi Manche of Nyx Group

Intro: Rushi Manche is the co-founder of Nyx Group, a new multi-strategy investment initiative that plans to deploy up to $100M into liquid markets to support vetted projects preparing token launches.

Previous background: Manche previously co founded Movement Labs, a Move based blockchain project, and was removed earlier this year following controversy over a market making deal tied to MOVE token sales after launch.

The big idea: Rushi through the venture is targeting the funding gap facing token founders, aiming to provide better access to capital in a tough market.

Take a peek at our referral reward at the bottom of this issue. Share this newsletter and receive our list of 500 crypto VC individuals 👇

INSIGHTS

Binance Expands USD1, Phases Out BUSD Collateral

IMG: Crypto Briefing

Binance is expanding support for USD1, the stablecoin issued by Trump linked project World Liberty Financial, by adding new trading pairs including BNB/USD1, ETH/USD1, and SOL/USD1.

The exchange will also enable zero fee swaps between USD1 and major stablecoins USDT and USDC.

As part of the shift, Binance will convert all reserves backing its BUSD pegged B Token into USD1 within seven days.

USD1 will then be used as collateral across Binance systems, including margin trading and internal liquidity operations.

USD1 is backed by US Treasuries, cash, and equivalents, with a $2.7B market cap.

The move follows increased attention on the token after a large MGX investment in Binance was settled in USD1, adding political and regulatory scrutiny.

DEAL FLOWS

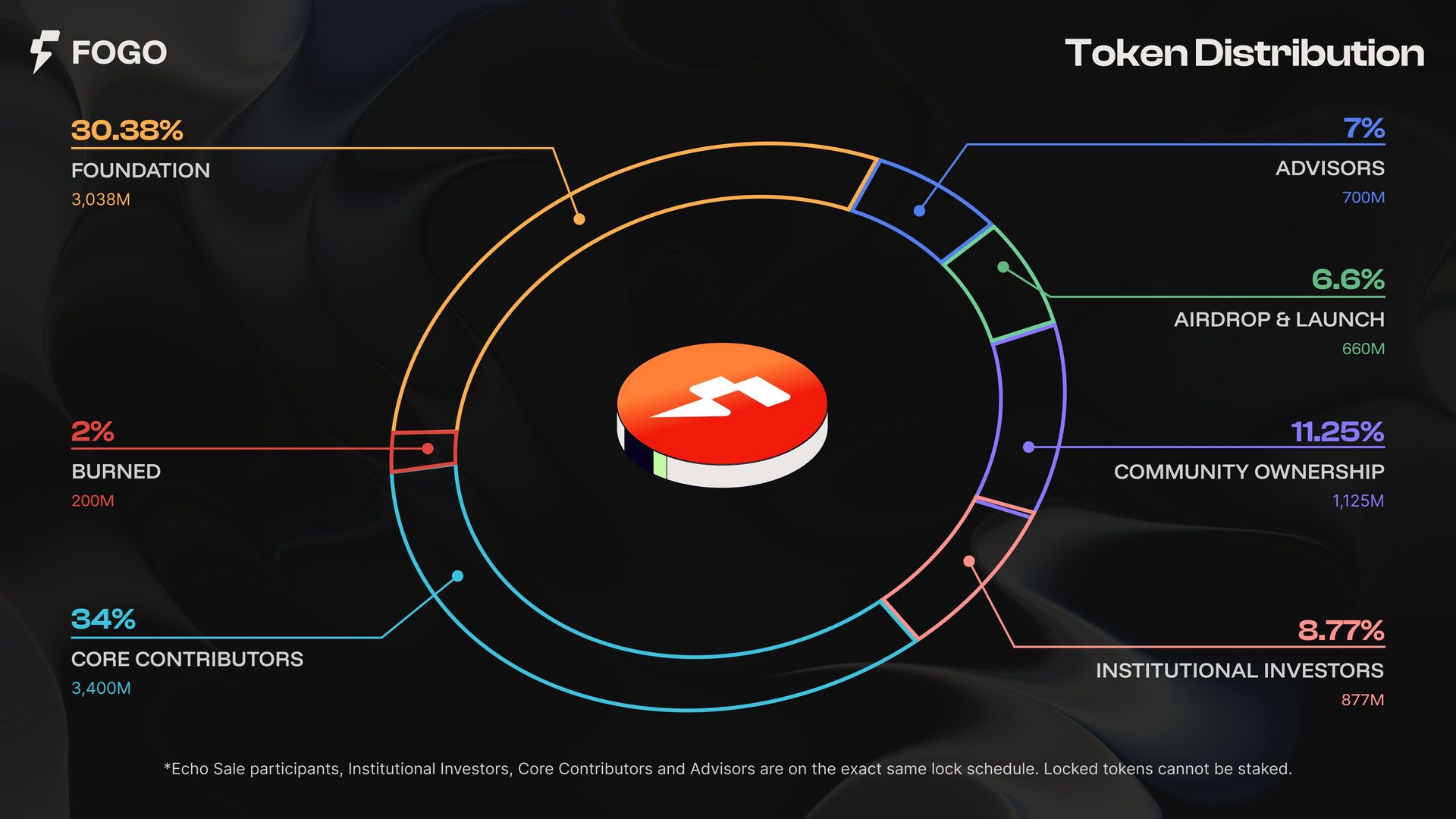

Fogo Announces $FOGO Presale

Deal flows soared this week - we saw $216M+ in deals 💼

Fogo has announced its $FOGO presale, scheduled for December 17 and running for eight hours or until fully allocated. The presale will offer 2% of the total genesis supply on a first come, first served basis.

Participants can pre fund their wallets using USDC, with a minimum ticket size of $100.

Token settlement will occur later, alongside Fogo’s public mainnet launch.

The presale is not available to residents of restricted jurisdictions, including the US, UK, and Canada, and is conducted through the Metaplex Genesis powered presale page.

Deal flows in the past week:

Pheasant Network, $2M Seed Round

Ezeebit, $2.05M Seed Round

AllScale, $5M Seed Round

Pye Finance, $5M Seed Round

Testmachine, $6.5M Seed Round

Crown, $13.5M Series A Round

MetaComp, $22M Series A Round

LI.FI, $29M Series A Round

Goblin Finance, $1M Strategic Round

Magma Finance, $6M Strategic Round

Superform Labs, $3M Public Token Sale

Aztec Network, $40.2M Public Token Sale

Surf, $15M Unknown Round

Cascade, $15M Unknown Round

TenX Protocols, $22M Unknown Round

Real Finance, $29M Unknown Round

QUICK BITES

a16z crypto launches South Korea office.

YouTube enables PYUSD stablecoin payouts for US creators.

Do Kwon sentenced to 15 years over $40B Terra-Luna collapse.

UK financial authority to prioritize stablecoin payments in 2026.

US Senators make 'real progress' on sweeping crypto market bill.

Binance elevates WLFI's stablecoin by adding USD1 trading pairs.

CFTC gives prediction markets leeway on data and record-keeping rules.

CFTC rolls back 2020 guidance focused on 'actual delivery' of digital assets.

JPMorgan creates Solana-based USCP token to facilitate Galaxy debt offering.

NOTEWORTHY READS & MEME

If you enjoy reading this issue, please consider subscribing. It takes 1 minute of your time, but it would mean the world to us 🙇

Disclaimer: All the information presented in this publication and its affiliates is strictly for educational purposes only. It should not be construed or taken as financial, legal, investment, or any other form of advice.