JPMorgan Eyes Crypto-Backed Loans

LetsBonk Overtakes Pumpfun | ETH Treasuries vs. MSTR

📢Sponsor | 💡Telegram | 📰Past Editions

Good Morning.

Crypto is entering a new phase where TradFi structure and onchain speed are converging. Institutions are leaning in, retail trends are exploding, and the foundations of the next cycle are quietly being built.

In Today's Email:

What Matters: JPMorgan Eyes Crypto-Backed Loans 👀

Case Study: ETH Treasuries vs. MSTR 🔎

Governance & Features: Fogo Testnet Goes Live on SVM 🚀

You read and share. We listen and improve. Send us feedback at [email protected].

Narratives: Institutional crossover

For daily market updates and airdrop alphas, check out our telegram!

WHAT MATTERS

IMG: Global finance Magazine

State of play: JPMorgan Chase is considering offering loans backed by clients’ cryptocurrency holdings, potentially launching the service as early as 2026, according to sources cited by the Financial Times.

While the bank doesn’t plan to provide crypto custody, it has already explored lending against crypto ETFs.

The development comes alongside favorable shifts in US crypto regulation, including the recent signing of the GENIUS Act by President Donald Trump.

This law establishes clear federal oversight for stablecoins, including full dollar backing, annual audits for large issuers, and provisions for foreign entities.

Why it matters: The move signals growing acceptance of crypto assets within traditional finance, even as CEO Jamie Dimon maintains a skeptical stance on Bitcoin.

Our take: JPMorgan’s crypto-secured lending plan marks another step in Wall Street’s gradual adoption of digital assets, despite lingering skepticism at the top.

For builders and investors: Watch for rising demand in crypto collateral infrastructure and regulatory-compliant lending tools as traditional banks enter the space.

CASE STUDY

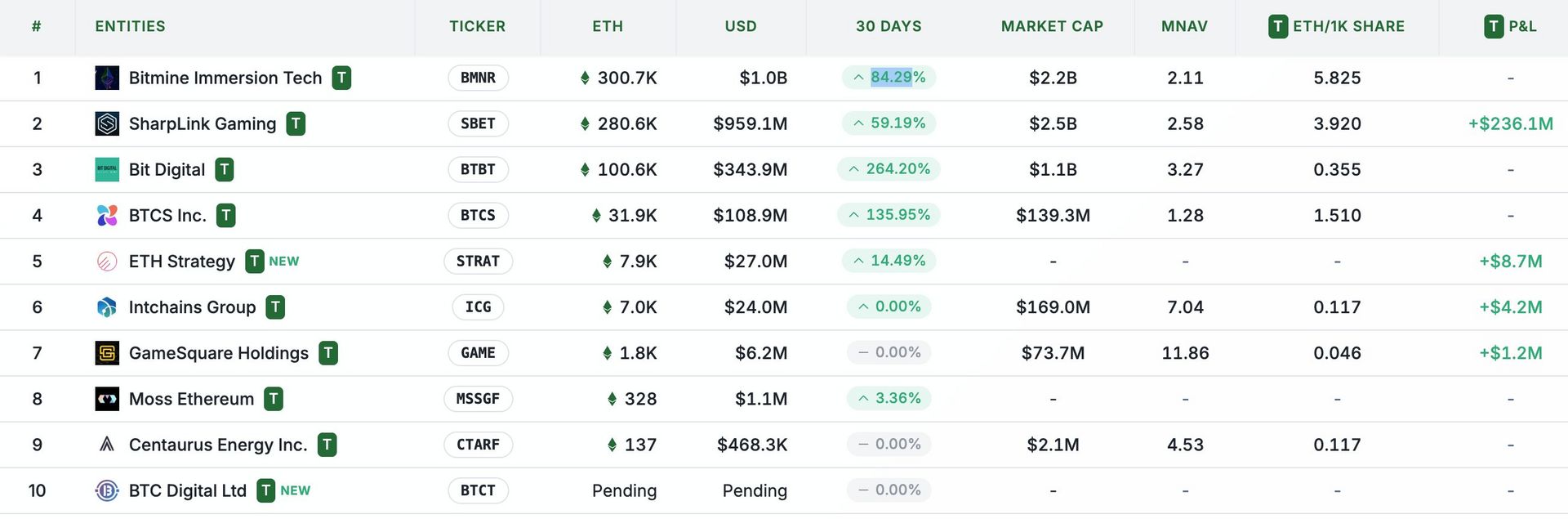

ETH Treasuries vs. MSTR: A New Playbook

Source: strategicethreserve

ETH-based treasury companies like $SBET and $BMNR are emerging as the next evolution of the MicroStrategy playbook. While $MSTR has become a $100B+ firm, these new players are applying the same model to ETH, but with distinct advantages.

As Kevin from Artemis outlines, ETH’s higher volatility makes its convertible bonds more attractive to hedge funds looking for arbitrage opportunities.

Moreover, ETH’s native staking yield provides consistent income, giving ETH treasuries better tools to support preferred equity offerings and repay debt.

This native yield also allows these companies to grow assets per share without additional capital, helping boost their market multiples and fueling the reflexive loop of At-the-Market offerings.

$SBET is gaining traction with a strong retail narrative, while $BMNR is more aligned with institutional channels. They represent a healthy, competitive start to ETH’s treasury landscape, unlike the winner-takes-all dynamic that BTC treasuries face with MSTR.

Beyond capital structure, these ETH treasuries can also help decentralize ETH by spreading validator control away from Lido and CEXs.

Kevin’s analysis suggests this model could eventually rival or surpass the size of Lido, especially as traditional finance flows into ETH-focused vehicles. If adoption continues, Ethereum treasuries may not just mirror MSTR’s success, they could outpace it.

Take a peek at our referral reward at the bottom of this issue. Share this newsletter and receive our list of 500 crypto VC individuals 👇

INSIGHTS

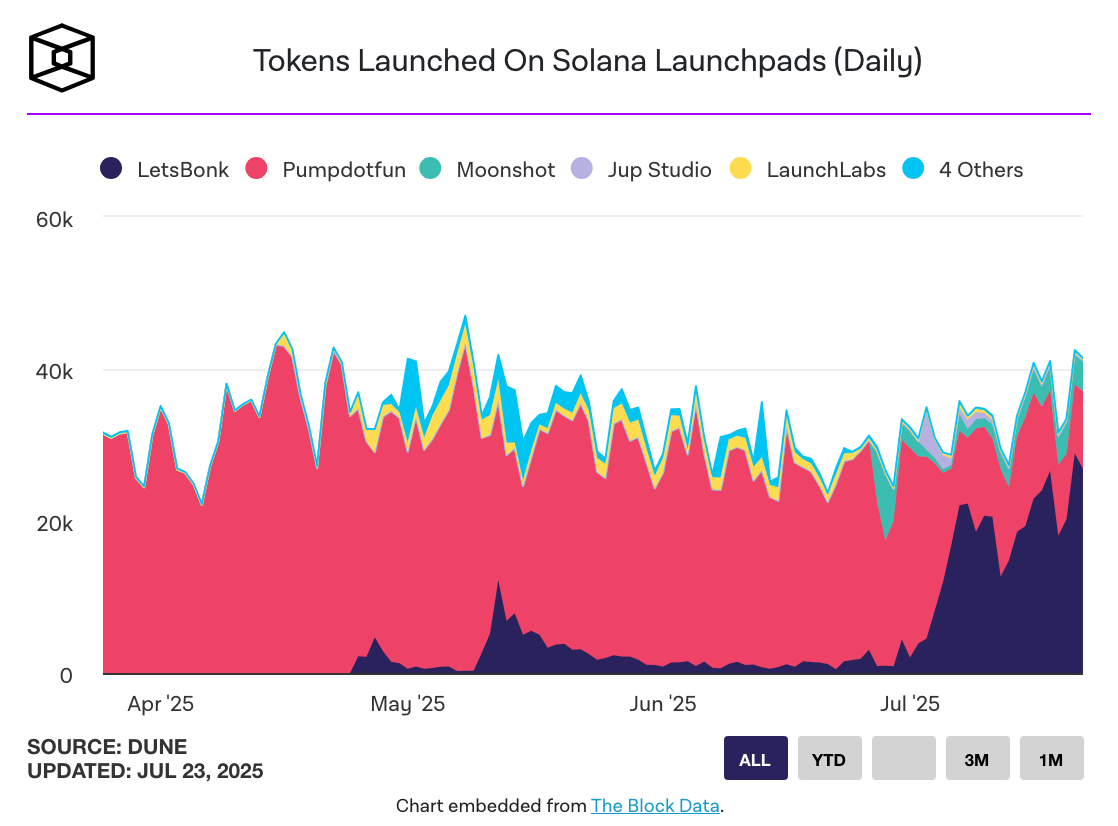

LetsBonk Overtakes Pumpfun

Source: The Block

LetsBonk has surged to dominate Solana meme token launches, capturing 64% of the market, up from just 5% a month ago, while Pump.fun’s share has plunged to 24%.

Token launches, graduations, and trading volume on LetsBonk have all hit record highs.

LetsBonk recorded $179M in daily volume and $8M in weekly fees.

BONK's valuation has also climbed nearly 200% over the past month, outperforming PUMP.

FEATURES & GOVERNANCE UPDATE

Fogo Testnet Goes Live on SVM

Fogo, a new high-speed Layer 1 chain built on the Solana Virtual Machine (SVM), has launched its public testnet.

Ex-Wall Street execs founded Fogo.

Fogo aims to bring TradFi-level speed to DeFi with 40ms block times, MEV protection, and co-located infrastructure for real-time execution.

The network builds on Hyperliquid’s model and plans full Firedancer integration for performance.

Other notable feature updates:

Jupiter launched JLP Loans.

Curve has launched on TON.

Euler is now live on Telegram.

Nerite has launched on Arbitrum.

USDC on Hyperliquid doubles to $4.9B.

YO has launched Smart Lending vaults.

Kinetiq has launched on Hyperliquid mainnet.

Origin Protocol will begin its OGN Buyback Blitz.

Telegram launches non-custodial crypto app in US.

PayPal has expanded its stablecoin PYUSD to Arbitrum.

JPMorgan Chase explores lending secured by clients’ crypto.

SharpLink lifts ETH stash to 360,807 ETH after $97M share sale.

PNC strikes deal with Coinbase to bring crypto services to banking customers.

QUICK BITES

LetsBonk's market share grows to 64%.

Ethereum validator queues swell on both entry and exit sides.

BTC whale moves $1.26B worth of BTC after years of dormancy.

S. Korea tell asset managers to limit exposure to Coinbase, Strategy.

US spot Ethereum ETFs see $534M in inflows, third-largest on record.

Tokenized equities face resistance from Citadel Securities in letter to SEC.

NOTEWORTHY READS & MEME

If you enjoy reading this issue, please consider subscribing. It takes 1 minute of your time, but it would mean the world to us 🙇

Disclaimer: All the information presented in this publication and its affiliates is strictly for educational purposes only. It should not be construed or taken as financial, legal, investment, or any other form of advice.