InshAllah.fi: Shariah-Compliant DeFi on Solana

Unlocking Ethical DeFi for the Global Muslim Community

📢 Sponsor | 💡 Telegram | 📰 Past Editions

As decentralized finance continues to disrupt traditional systems, a critical gap remains for the 2 billion Muslims seeking financial tools that align with Islamic values. InshAllah.fi is building to fill that void. Built on the Solana blockchain, the platform offers a fully Shariah-compliant DeFi ecosystem, featuring halal staking, zero-interest lending, and a yield-bearing stablecoin.

Aligning with Islamic finance principles, InshAllah.fi is designed to bridge the $5T Islamic finance market with DeFi, focusing on ethical, low-risk products that promote financial inclusion for the global Muslim community.

This report is a closer look at the founding team, product offerings, and the early traction that’s positioning InshAllah.fi as a key player in the future of Islamic finance.

Key Takeaways

Mission-Driven Platform: InshAllah.fi aims to bridge the $4T Islamic finance market with decentralized finance by offering halal, interest-free crypto products built on Solana.

Strong Founding Team: Co-founded by Tariq Patanam, a Stanford graduate and former YouTube engineer, and Ammar K., who brings deep knowledge of Islamic sciences.

Halal Infrastructure: Flagship product Goldsand filters out impermissible transactions at the validator level, ensuring Shariah-compliant staking without compromising yields.

Innovative Product Suite: InshAllah offers zero-interest lending (iA Borrow), a yield-bearing stablecoin (iAUSD), and yield amplification through looping (iA Earn), all built with Islamic finance principles in mind.

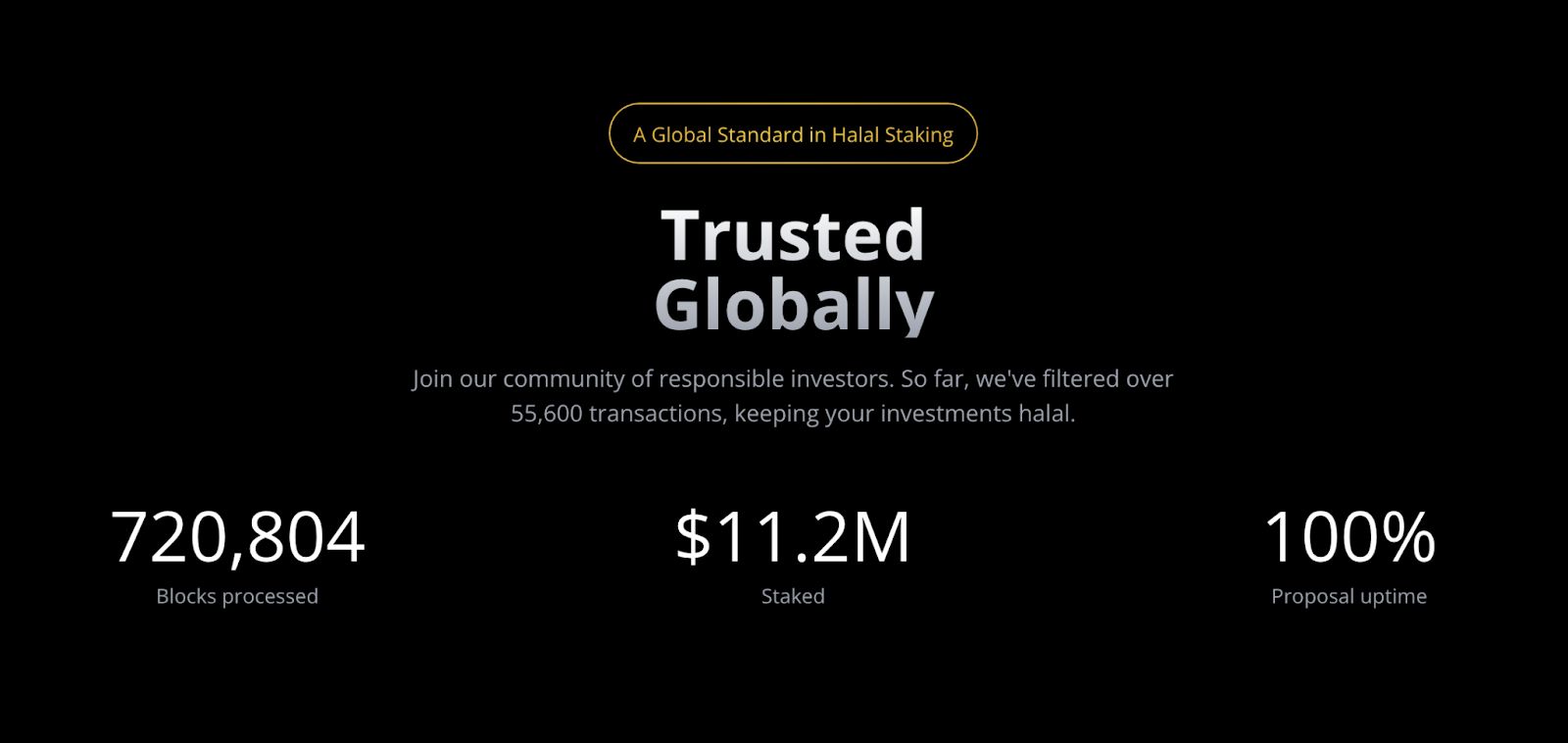

Early Momentum and Growth: With $11.2M staked, 720,800 blocks processed, and over 55,600 impermissible transactions filtered, the platform has gained global trust and now has 100% uptime reliability.

Inshallah.fi Team

Inshallah.fi was founded by Tariq Patanam and Ammar K. Both Tariq and Ammar are described as having strong technical skills and a deep understanding of Islamic sciences, which makes them well-suited to build InshAllah.

Tariq was a software engineer at YouTube from 2018 to 2020 and is a Stanford graduate.

There’s no publicly available information on Ammar’s background.

What is Inshallah.fi

Inshallah.fi is a Shariah-compliant DeFi platform designed to serve Muslim investors seeking halal alternatives in crypto. Its flagship product, Goldsand, offers an interest-free Ethereum staking solution that filters out non-compliant transactions, aligning with Islamic finance principles. Built to bridge the $5T Islamic finance market with decentralized finance, Inshallah.fi focuses on ethical, low-risk products that promote financial inclusion for the global Muslim community.

As of now, InshAllah.fi has processed over 720,800 blocks, with $11.2M staked through its halal staking protocol, Goldsand. The platform has filtered more than 55,600 impermissible transactions, ensuring compliance with Shariah principles. Impressively, it has maintained a 100% proposal uptime, reinforcing its reliability and global trust among responsible investors.

Core Products and Services

InshAllah.fi is building a suite of Shariah-compliant decentralized finance (DeFi) tools aimed at Muslim investors and institutions seeking ethical, riba-free alternatives in crypto. The platform currently offers four key products, each designed to align with Islamic financial principles while leveraging the efficiency and accessibility of blockchain-based finance:

Goldsand Halal Staking

Goldsand is InshAllah.fi’s foundational staking product. It enables users to stake SOL (Solana) and earn staking rewards while ensuring that no impermissible (haram) transactions are validated in the process. Goldsand uses a proprietary validator filtering mechanism that screens and excludes transactions involving protocols classified as impermissible by its Shariah Committee.

These include lending, derivatives, synthetic assets, and stablecoins based on non-halal yields. Importantly, this filtering process occurs within the validator node and has a minimal impact on staking yield. Goldsand ensures that staking rewards are fully halal and transparent.

iA Borrow (Zero-Interest Lending Protocol)

iA Borrow is a novel DeFi primitive: a zero-interest, fee-free lending system that allows users to mint iAUSD—InshAllah’s yield-bearing stablecoin—against their iASOL (staked SOL) collateral. Unlike traditional DeFi borrowing platforms, iA Borrow enforces strict over-collateralization (typically 150–160%) and does not charge interest or fees for minting, holding, or repaying loans.

This makes the borrowing experience fully compliant with Islamic financial ethics, which prohibit riba (interest). Liquidation thresholds and warning LTVs are also built into the system to protect users and maintain stability.

iAUSD (Halal Yield-Bearing Stablecoin)

iAUSD is a USD-pegged stablecoin designed to give users a low-risk, halal return on their digital cash holdings. It is minted through iA Borrow and receives staking yield derived from iASOL, offering users a yield of approximately 4–6% APY (based on current Solana staking rates). iAUSD is ideal for a variety of user profiles:

Risk-averse individuals seeking stable, halal returns

Startups looking to earn low-risk yield on treasury reserves

Crypto investors needing liquidity for real-life expenses without selling their long-term assets

Users seeking halal leverage to increase their crypto exposure without paying interest

iA Earn (Yield Amplifier via Looping)

Built on top of iA Borrow, iA Earn allows users to automatically loop their positions by borrowing iAUSD and using it to stake additional SOL. Users can choose to increase their staking yield by 30% or 50%, depending on how much they wish to borrow.

This functionality abstracts the complexities of traditional yield optimization and offers a streamlined experience for users looking to maximize their staking returns while maintaining full Shariah compliance. Like other InshAllah products, iA Earn charges no fees for opening or closing positions.

How Inshallah.fi Works

InshAllah.fi is a Shariah-compliant DeFi platform built on Solana, offering an ethical crypto ecosystem centered around staking, borrowing, and stablecoin usage. Users stake SOL via Goldsand, which filters out haram transactions at the validator level to ensure halal rewards. In return, users receive iASOL, a liquid staking token.

They can then use iASOL as collateral in iA Borrow to mint iAUSD, a stablecoin that earns staking yield without any interest or fees. iAUSD can be used for spending, saving, or halal leverage. To amplify returns, users can access iA Earn, which automates the process of borrowing iAUSD to stake more SOL.

Every component is governed by a Shariah Committee, and all protocols are screened to exclude impermissible activities like lending, derivatives, or synthetic assets—ensuring full alignment with Islamic financial principles.

Roadmap

As of now, InshAllah.fi has not publicly released a detailed roadmap.

Points, Rewards & Airdrop Program

As of now, InshAllah.fi has not disclosed any official details regarding a points, rewards, or airdrop program.

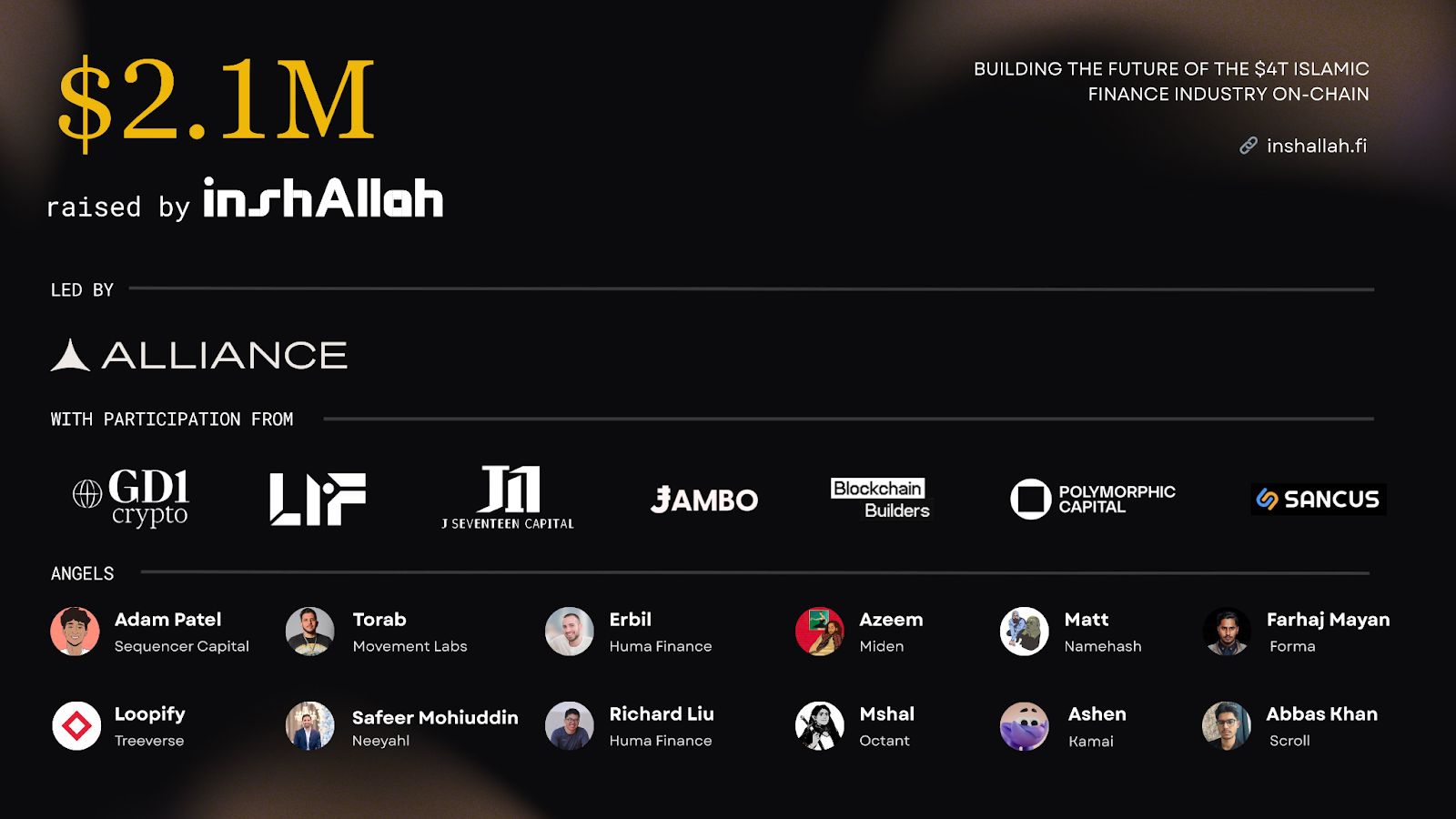

Funding

inshAllah Finance has raised $2.1M in pre-seed funding to build Sharia-compliant financial services on Solana. The round was led by AllianceDAO, aiming to serve the needs of 2B+ people underserved by traditional finance.

Final Thoughts

InshAllah.fi is emerging as a leading force in Islamic DeFi, offering practical, ethical tools for Muslim investors historically underserved by both TradFi and mainstream crypto. With a strong technical foundation, adherence to Islamic law, and fresh funding from AllianceDAO, the project is well-positioned to redefine access and trust in faith-based financial systems, while bringing billions into the decentralized economy.

If you enjoy reading this issue, please consider subscribing. It takes 1 minute of your time but it would mean the world to us 🙇

Disclaimer: All the information presented in this publication and its affiliates is strictly for educational purposes only. It should not be construed or taken as financial, legal, investment, or any other form of advice.