IBIT Volume Spikes as Bitcoin Dumps

Tether's $250M Gold & Crypto Infrastructure Push | Esteban Castaño of TRM Labs

📢Sponsor | 💡Telegram | 📰Past Editions

Good Morning

Bitcoin had a proper air pocket moment, and this time the action wasn’t onchain, it was in ETFs. As BTC dumped nearly 15% in a day, IBIT turned into the main exit door, printing record volume while TradFi flows drove price discovery.

Check out our latest podcast episode!

In Today's Email:

What Matters: IBIT Volume Spikes as Bitcoin Dumps 👀

Founders Highlight: Esteban Castaño of TRM Labs 👨

Deal Flows: Tether's $250M Gold & Crypto Infrastructure Push 💰️

You read and share. We listen and improve. Send us feedback at [email protected].

Narratives: ETF-Led Capitulation

For daily market updates and airdrop alphas, check out our telegram!

WHAT MATTERS

IBIT Volume Spikes as Bitcoin Dumps

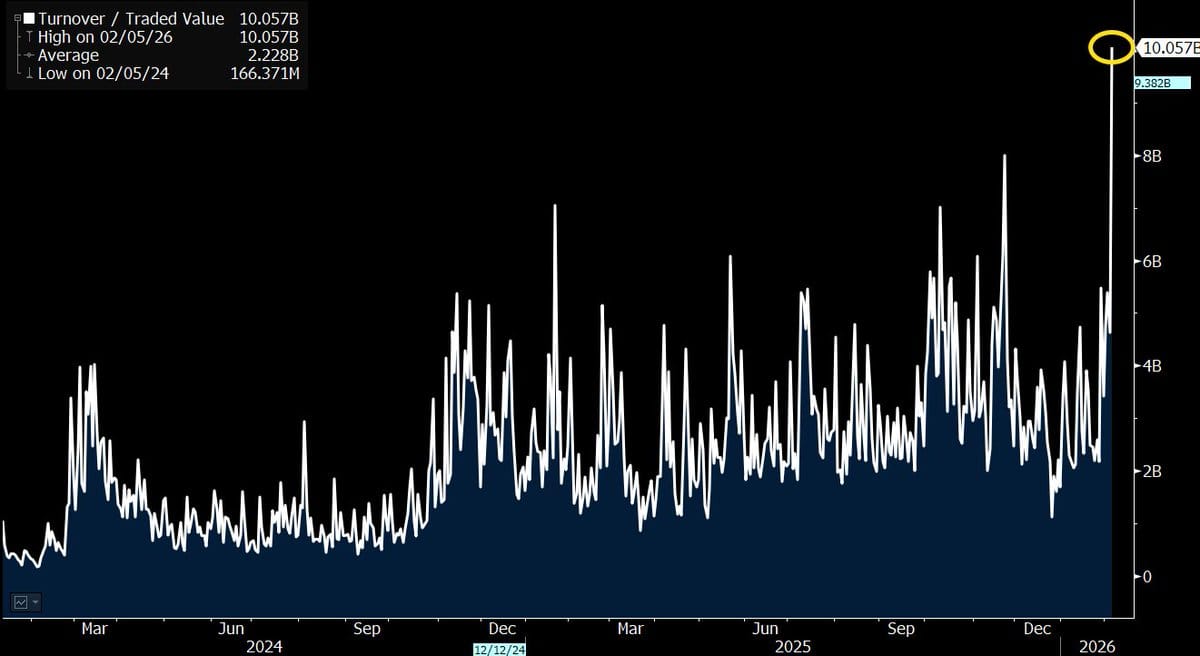

IBIT Volume / Source: Eric Balchunas

State of play: BlackRock’s spot Bitcoin ETF IBIT just saw a record $10B in daily trading volume. BTC fell nearly 15% in a single day, sliding from around $73,100 to about $60,000 and breaking below $70,000 for the first time in 15 months.

The heavy selling pushed IBIT’s price down 13%, its second worst daily move since launch, while trading activity surged well above normal levels.

The previous volume record was about $8B, and a typical busy day is closer to $3B.

The broader crypto market also took a hit, with total market cap falling from over $3T in late January to roughly $2.16T.

Despite the volatility, IBIT remains the largest spot Bitcoin ETF with roughly $56B in assets.

Why it matters: Spot Bitcoin ETFs are now the main price discovery engine. During stress, ETF flows push volatility faster and harder than native crypto markets.

Our take: High volume into a sharp drop usually signals positioning reset, not trend death.

For builders and investors: Watch ETF flows closely, stay liquid, and avoid thin, narrative driven bets.

BUILDER-INVESTOR HIGHLIGHT

Esteban Castaño of TRM Labs

Intro: Esteban Castaño is the founder and the CEO of TRM Labs, a blockchain intelligence company helping public agencies and financial institutions detect, monitor, and investigate crypto-facilitated crime.

Previous background: Before founding TRM, Esteban worked at McKinsey & Company on digital technology initiatives and at Generation on global youth employment.

He holds a BA in Government from Dartmouth College and withdrew from Stanford Graduate School of Business to co-found TRM.

The big idea: Esteban through TRM Labs aims to build a safer financial system for billions of people by creating a "foundational defense layer" for the blockchain economy.

Take a peek at our referral reward at the bottom of this issue. Share this newsletter and receive our list of 500 crypto VC individuals 👇

INSIGHTS

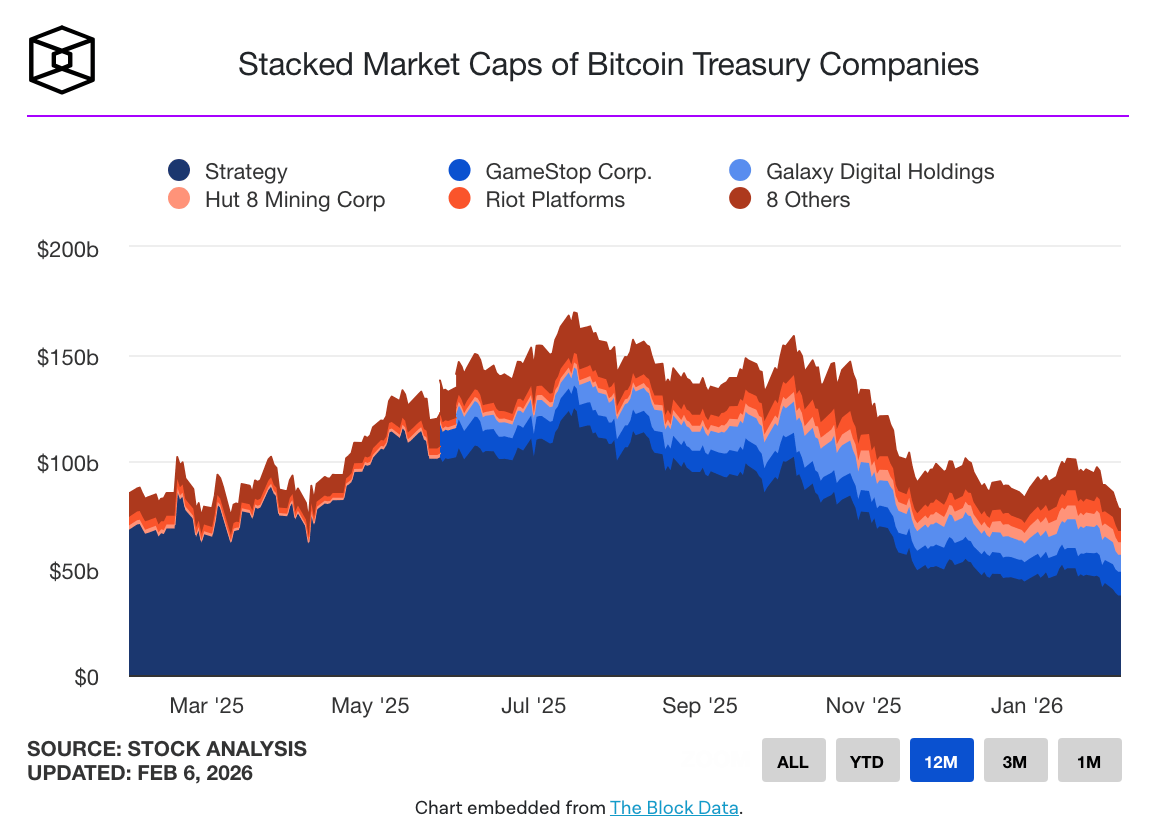

Strategy Says BTC Must Hit $8K to Threaten Balance Sheet

Strategy CEO said the balance sheet would only face real stress if BTC fell to $8,000 and stayed there for 5-6 years.

At that point, Strategy’s BTC reserves would roughly equal its net debt, limiting its ability to service convertibles without restructuring, issuing equity, or raising more debt.

Despite reporting a $12.6B quarterly loss driven by mark to market declines on its Bitcoin holdings, management emphasized that the loss is unrealized and tied to accounting rules, not operational weakness.

CFO Andrew Kang and executive chairman Michael Saylor reiterated that the firm is built to withstand extreme volatility and multi year downturns.

Saylor also dismissed quantum computing risks to Bitcoin, calling them long term and overblown FUD.

He argued that Bitcoin can be upgraded through global consensus and announced a new Bitcoin Security program to coordinate work on future quantum resistant solutions.

DEAL FLOWS

Tether Makes $250M Gold and Crypto Infrastructure Push

Deal flows soared this week - we saw $430M+ in deals 💼

Tether ramped up its balance sheet strategy with two major deals totaling $250M, targeting both hard assets and regulated financial infrastructure.

First, Tether committed $150M into Gold.com, buying $125M in common shares upfront with another $25M pending regulatory approval.

The deal gives Tether board representation and tightens its push into vertically integrated gold, linking physical bullion, retail distribution, and digital products like XAU₮.

The move builds on Tether’s existing exposure of roughly 140 tons of gold and its dominance in gold-backed stablecoins.

Separately, Tether made a $100M strategic equity investment into Anchorage Digital, valuing the firm at $4.2B.

The investment deepens an existing partnership centered on custody, compliance, and stablecoin issuance infrastructure, especially around USAT.

Deal flows in the past week:

Kairos, $2.5M Seed Round

Ruvo, $4.6M Seed Round

Opinion, $20M Series A Round

TRM Labs, $70M Series C Round

Plutus, $2.3M Public Token Sale

Hurupay, $3M Public Token Sale

Bluff, $21M Strategic Round

Jupiter, $35M Strategic Round

Anchorage Digital, $100M Strategic Round

Gold.com, $150M Strategic Round

Prometheum, $23M Unknown Round

QUICK BITES

Strategy posts $12.6B Q4 loss.

IBIT posts $10B daily volume record.

Gemini exits UK, EU and Australia, cuts 25% of staff.

Bullish reports Q4 loss as BTC options trading grows.

CFTC scraps Biden-era proposal to ban political event contracts.

Pump.fun acquires Vyper to expand cross-chain trading terminal.

Tether deepens metals exposure with $150M investment in Gold.com.

Tether USDT posts record user growth in Q4 despite crypto market shock.

Strategy says BTC would need to plunge to $8K before balance sheet issues.

House launches probe into $500M UAE deal linked to World Liberty Financial.

NOTEWORTHY READS & MEME

If you enjoy reading this issue, please consider subscribing. It takes 1 minute of your time, but it would mean the world to us 🙇

Disclaimer: All the information presented in this publication and its affiliates is strictly for educational purposes only. It should not be construed or taken as financial, legal, investment, or any other form of advice.