Hyper Foundation Proposes $1B HYPE Supply Reduction

David Choi of USD.A I Fuse Energy Reaches $5B Valuation After $70M Raise

📢Sponsor | 💡Telegram | 📰Past Editions

Good Morning.

Hyperliquid governance is moving to formally recognize a large portion of HYPE as burned, aligning supply metrics with how the protocol already operates. At the same time, JPMorgan is pushing back on trillion dollar stablecoin forecasts, arguing growth will remain tied to crypto activity rather than explode through payments alone.

Check out our latest podcast episode!

In Today's Email:

What Matters: Hyper Foundation Proposes $1B HYPE Supply Reduction 👀

Founders Highlight: David Choi of USD.AI 👨

Deal Flows: Fuse Energy Reaches $5B Valuation After $70M Raise 💰️

You read and share. We listen and improve. Send us feedback at [email protected].

Narratives: Mechanics Over Hype

For daily market updates and airdrop alphas, check out our telegram!

TOGETHER WITH

LI.FI Secures $29M Series A Extension as Volume Tops $60B

LI.FI has closed a $29M Series A extension led by Multicoin and CoinFund, bringing total funding to approximately $52M. The raise comes as the protocol continues to scale its role as a core liquidity layer for digital assets.

The platform has processed more than $60B in lifetime volume and now routes roughly $8B per month, marking a 595% increase in monthly volume over the past year.

LI.FI is integrated with close to 1,000 B2B partners and powers widely used products including Robinhood, Binance, MetaMask, Phantom, Ledger, Hyperliquid, Circle, and Alipay.

The new capital is expected to accelerate expansion across assets, chains, and markets, as well as support the development of intent based infrastructure and solver driven liquidity products planned for 2026.

As onchain activity becomes more fragmented across ecosystems, LI.FI is positioning itself as a unifying layer built for real usage at global scale.

WHAT MATTERS

Hyper Foundation Proposes $1B HYPE Supply Reduction

State of play: The Hyper Foundation has submitted a governance proposal to formally recognize the HYPE tokens held in Hyperliquid’s Assistance Fund as burned and remove them from both circulating and total supply.

The fund contains around 37M HYPE tokens, representing more than 13% of the current 270M circulating supply, with a market value close to $1B.

The Assistance Fund is a protocol level mechanism that automatically converts a portion of Hyperliquid’s trading fees into HYPE through the L1 execution layer.

It was intentionally designed without a private key or access controls, making the tokens mathematically inaccessible without a hard fork.

In practice, the system already functions like a continuous buyback and burn, but the tokens remain counted in supply metrics.

Most validators have already indicated support, with the vote scheduled to conclude on December 21.

Why it matters: The Assistance Fund already acts like a permanent sink, so this clarifies supply and strengthens the deflation story tied to real trading activity.

Our take: The tokens are already inaccessible, and the vote simply formalizes that reality. It shows a preference for clean governance and minimal disruption on a live, high volume network.

For builders and investors: How tokens are structured, accessed, and governed often matters more than nominal circulation when assessing protocol sustainability and long term value.

BUILDER-INVESTOR HIGHLIGHT

David Choi of USD.AI

Intro: David Choi is the Co-Founder and the CEO of USD.AI, a yield-bearing synthetic dollar backed by AI infrastructure.

USD.AI is built by Permian Labs (which also co-founded by David) a fintech company building blockchain-based financial tools to fund AI infrastructure.

Previous background: Before USD.AI, David was an investment banking analyst at Deutsche Bank, contributing to large M&A deals including the $24B Unibail Rodamco Westfield merger and the $632M NYX Gaming acquisition.

David has been active in crypto since 2016 through Taureon, focusing on MEV, onchain experimentation, and early stage investments, and is an ETHGlobal Hackmoney 2021 winner.

The big idea: Thorugh USD.AI, David’s core idea is to bridge AI infrastructure and DeFi by enabling AI companies to borrow against GPUs through a stablecoin protocol.

Take a peek at our referral reward at the bottom of this issue. Share this newsletter and receive our list of 500 crypto VC individuals 👇

INSIGHTS

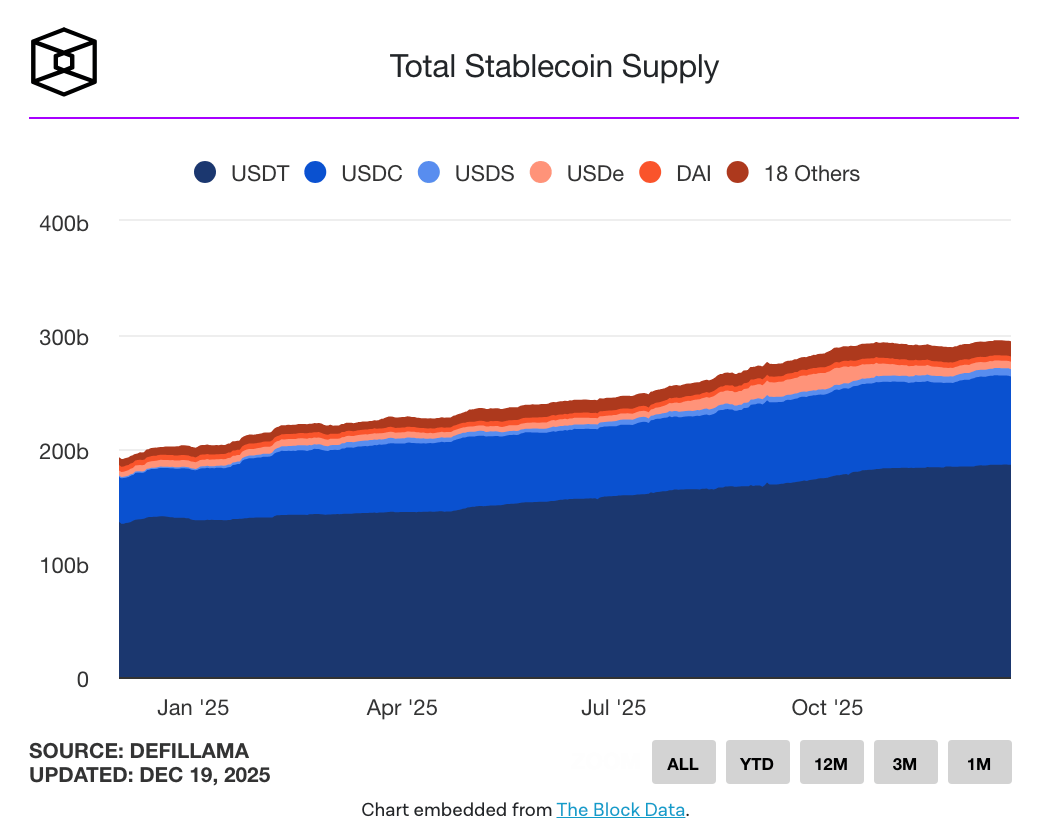

JPMorgan analysts reiterated that the stablecoin market is unlikely to reach trillion-dollar levels by 2028, projecting total market capitalization at around $500B to $600B instead.

They argue that stablecoin growth continues to track activity within the crypto ecosystem rather than expanding independently through mainstream payments.

The bank noted that stablecoin supply has grown by roughly $100B this year to over $300B, with most of the increase coming from USDT and USDC.

Demand remains largely driven by crypto trading, derivatives, DeFi lending, and the use of stablecoins as idle cash by crypto-native firms.

Derivatives exchanges alone added around $20B in stablecoin holdings this year due to increased perpetual futures activity.

While payment use cases are expanding, JPMorgan said higher transaction velocity reduces the need for a large outstanding stablecoin supply.

The analysts also highlighted growing competition from tokenized bank deposits, such as JPMorgan’s JPM Coin, and from central bank digital currencies, which could limit stablecoins’ long-term role in institutional and cross-border payments.

DEAL FLOWS

Fuse Energy Reaches $5B Valuation After $70M Raise

Deal flows soared this week - we saw $313M+ in deals 💼

London-based Fuse Energy raised $70M in a funding round led by Balderton Capital and Lowercarbon Capital, valuing the company at $5B just three years after launch.

The company plans to use the capital to expand internationally, with near-term moves into Ireland, Spain, and the US, and to accelerate new product launches.

Fuse was founded in 2022 by former Revolut executives Alan Chang and Charles Orr.

This structure allows Fuse to cut costs by around 10% compared to traditional suppliers, saving UK households up to £200 per year on energy bills.

The company currently serves more than 200,000 households in the UK, reports around $400M in annual recurring revenue, and has achieved cash-flow positivity with 8x year-over-year growth.

The new funding will support grid-balancing initiatives, including its upcoming Energy Network product, as well as consumer hardware such as micro solar-battery systems.

Deal flows in the past week:

DeepBook AI, $2M Seed Round

Strata, $3M Seed Round

Harbor, $4.2M Seed Round

ETHGAS, $12M Seed Round

YO Protocol, $10M Series A Round

Olea, $30M Series A Round

Fuse Energy, $70M Series B Round

RedotPay, $107M Series B Round

HolmesAI, $5M Strategic Round

METYA, $50M Strategic Round

Rainbow Wallet, $3M Public Token Sale

Football.fun, $4.5M Public Token Sale

worm.wtf, $4.5M Unknown Round

Speed, $8M Unknown Round

QUICK BITES

Crypto market cap falls to 8-month low.

Senate confirms CFTC Chair pick Michael Selig.

Coinbase sues three states over prediction markets.

Crypto hacks hit $3.4B in 2025, attacks on individual wallets rise.

JPMorgan doesn’t see a trillion-dollar stablecoin market by 2028.

Terraform Labs liquidator sues Jump Trading for $4B in damages.

Federal Reserve withdraws 2023 policy limiting 'novel' crypto activities.

Brazilian stock exchange to launch tokenization platform and stablecoin.

US crypto czar David Sacks says Clarity Act markup confirmed for January.

NOTEWORTHY READS & MEME

If you enjoy reading this issue, please consider subscribing. It takes 1 minute of your time, but it would mean the world to us 🙇

Disclaimer: All the information presented in this publication and its affiliates is strictly for educational purposes only. It should not be construed or taken as financial, legal, investment, or any other form of advice.