FTX to Distribute $1.6B in Third Creditor Payout

Kalshi Tops $500M in Prediction Market Volume | DATs Hit $20B in Funding

📢Sponsor | 💡Telegram | 📰Past Editions

Good Morning,

ChatGPT said:

FTX is set to pay out another $1.6B to creditors on Sept. 30, its third major distribution since the 2022 collapse. With over $15B recovered, retail users are already made whole and larger lenders are nearing full recovery.

Check out our latest episode with PumpPals!

In Today's Email:

What Matters: FTX to Distribute $1.6B in Third Creditor Payout 💰️

Product of the Week: Vitalik: Low-Risk DeFi is Ethereum’s Backbone 🔎

Charts: DATs Hit $20B in Funding, Kalshi $500M Volume 📈

You read and share. We listen and improve. Send us feedback at [email protected].

Narratives: Low-Risk DeFi

For daily market updates and airdrop alphas, check out our telegram!

OGETHER WITH

0G: The First Decentralized AI Operating System

0G is the world’s first decentralized AI operating system, created to make artificial intelligence a true public good. It combines Ethereum-level security with a design built for infinite scalability, allowing AI applications to finally run fully on-chain.

This is not just vision. On the Galileo Testnet, 0G reached 50 gigabytes per second in throughput, up to 50,000 times faster than conventional blockchains.

Storage costs have dropped to five dollars per terabyte per month, cheaper than Amazon’s cloud. And with its decentralized training framework, the team has already trained a 107-billion parameter model at a fraction of the usual cost.

0G is proving what it looks like when AI becomes affordable, scalable, and verifiable.

WHAT MATTERS

FTX to Distribute $1.6B in Third Creditor Payout

FTX Distribution: 30th Sept 25

Kraken sends emails to confirm they received distributions from FTX

Accts to be credited on 30th Sept 25

Previously disputed are allowed this distribution have received emails: $1.9bn

— Sunil (FTX Creditor Champion) (@sunil_trades)

6:36 AM • Sep 20, 2025

State of play: FTX will begin a third round of creditor payouts on Sept. 30, distributing $1.6B as part of its bankruptcy reorganization. Funds will be distributed via Bitgo, Kraken, or Payoneer within one to three business days.

The plan is backed by more than $15B in recovered assets from cash reserves, clawbacks, and asset sales such as stakes in Anthropic and Robinhood.

Retail creditors have already received refunds worth about 120% of their November 2022 balances.

Meanwhile, while unsecured lenders have recovered 85% to date, with full recovery projected.

Why it matters: Creditors are getting real recovery after one of the biggest wipeouts in crypto history.

Our take: Creditors may get close to full repayment on paper, but missing the upside of the bull run still stings.

For builders and investors: This is a reminder to factor in counterparty risk, even with big names. Clearer recovery plans and faster distributions will be the standard going forward.

PRODUCT OF THE WEEK

Vitalik: Low-Risk DeFi is Ethereum’s Backbone

Ethereum L1 defi losses. Source: AI research

Vitalik Buterin urged the Ethereum community to prioritize low-risk DeFi protocols such as payments, savings, and fully collateralized lending, calling them the foundation that can economically sustain Ethereum’s broader ecosystem.

In a blog post, he compared their role to Google’s ad business, which funds the company’s other ventures.

Buterin argued that while speculative trading and memecoins generate fees, they cannot be the backbone of Ethereum’s future.

Instead, sustainable, culturally aligned financial products can provide lasting value, support experimentation, and eventually evolve into new applications like flatcoins, reputation-based lending, and integrated prediction markets.

Other cool products:

Yei Finance, a non-custodial money market protocol on Sei.

Interport, a cross-chain hub for swaps, bridging, and gas transfers.

Accumulated Finance, an omnichain modular liquid staking protocol.

CiaoTool, a no-code automation tools for crypto creators, traders, and project.

Take a peek at our referral reward at the bottom of this issue. Share this newsletter and receive our list of 500 crypto VC individuals 👇

CHARTS OF THE WEEK

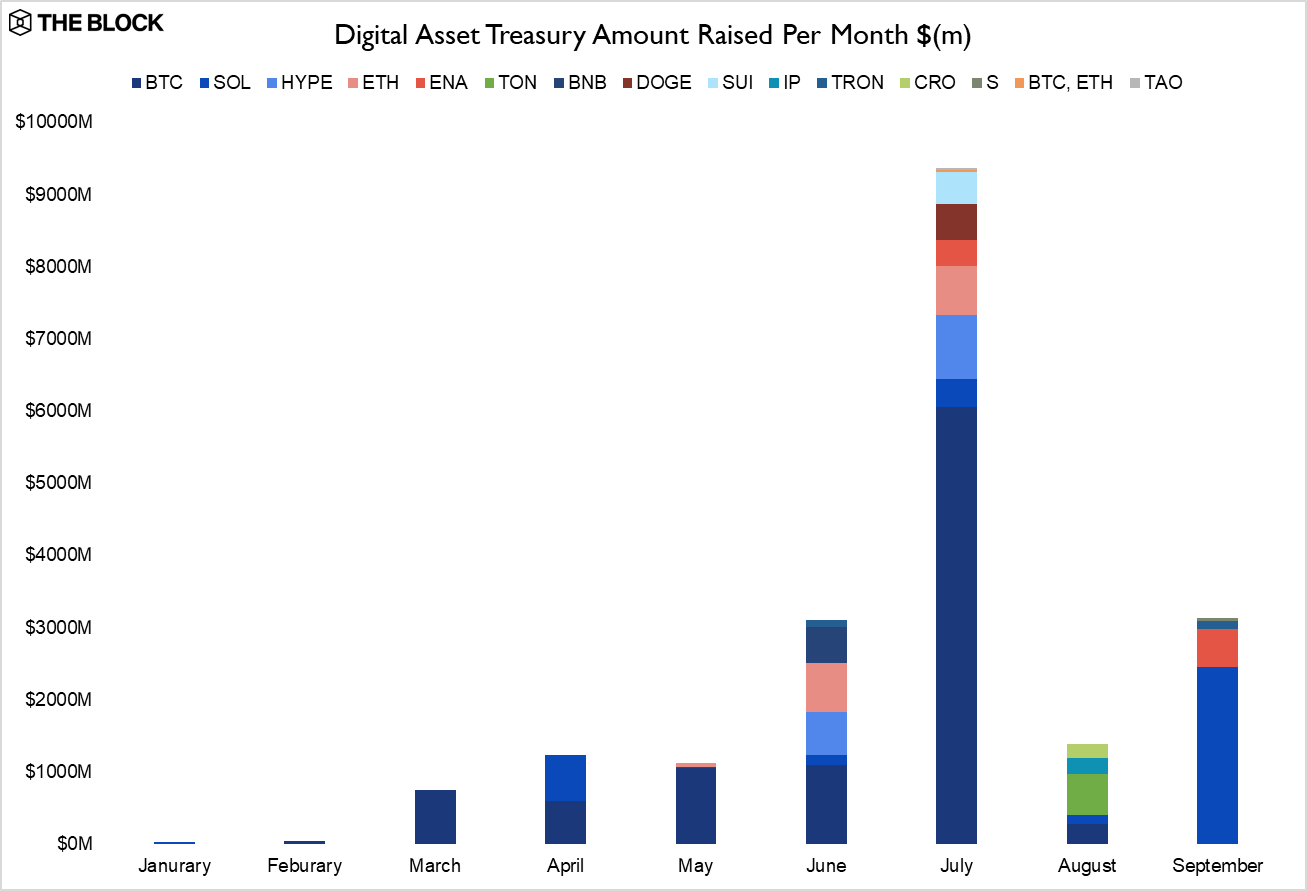

DATs Hit $20B in Funding

Source: The Block

State of play: Digital asset treasury firms have raised more than $20B in 2025, but investors say the fundraising wave has likely peaked.

Mega $500M–$1B rounds are expected to slow, with focus shifting to execution, scaling, and consolidation.

Many DATs now trade at or below net asset value, raising the likelihood of mergers and acquisitions as stronger firms absorb weaker ones.

Liquidity remains a challenge, though strategies like staking and discounted token purchases help sustain yields.

Our take: Looking ahead, venture capital may rotate toward DeFi, stablecoins, and consumer applications as the market matures.

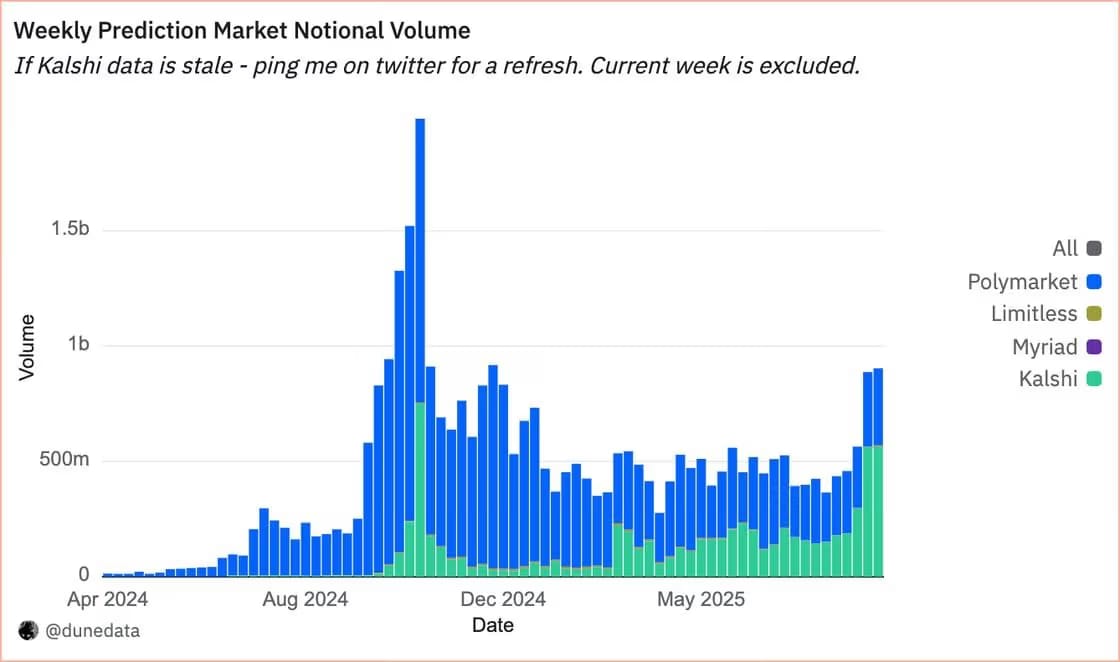

Kalshi Tops $500M in Prediction Market Volume

Source: Dune / Coindesk

State of play: Kalshi captured 62% of on-chain prediction market volume from Sept. 11–17, reaching over $500M in weekly trades and $189M in open interest, according to Dune data.

Polymarket trailed with $430M in volume and $164M in open interest, reflecting its longer-term market structure versus Kalshi’s faster turnover.

While Kalshi dominates activity, Polymarket is expanding its US presence through the acquisition of regulated exchange QCX.

Polymarket also launched a new earnings-based markets with Stocktwits.

Our take: The real battle may be less about weekly volume and more about who secures long-term market relevance.

QUICK BITES

DATs hit $20B in funding.

BitGo reveals 2025 revenue surge in US IPO filing.

CZ's Family Office deepens stake in Ethena Labs.

FTX set to repay $1.6B to creditors starting on Sept. 30.

EU finance ministers set roadmap to launch digital euro.

Kalshi outpaces Polymarket in prediction market volume.

$1.7B in liquidations sweep crypto markets over past day.

MetaMask’s mUSD tops $65M supply a week after launch.

Unreported attack on Crypto.com leaked users' personal data.

Metaplanet buys $632M in Bitcoin, largest BTC acquisition to date.

LINE and Kaia to launch stablecoin superapp for cross-border payments.

NOTEWORTHY READS & MEME

binance running search ads on 'hyperliquid' is the funniest thing i have seen in a while hahahahhaa

— goombler 🟢 (@BlerGoom)

3:46 PM • Sep 21, 2025

If you enjoy reading this issue, please consider subscribing. It takes 1 minute of your time, but it would mean the world to us 🙇

Disclaimer: All the information presented in this publication and its affiliates is strictly for educational purposes only. It should not be construed or taken as financial, legal, investment, or any other form of advice.