Etherealize: Building Ethereum’s Rails for Wall Street

Bridging institutions and Ethereum to move finance on-chain

📢 Sponsor | 💡 Telegram | 📰 Past Editions

The DTCC clears about $2.5 quadrillion in securities annually, making it the largest financial utility in the world. Despite this scale, most trades still move on a T+2 basis, an inefficiency that forces institutions to post and hold billions in daily margin requirements

Blockchain has long promised to fix this. But institutions don’t adopt because of promises. They adopt when there’s a credible team that can meet them halfway.

That’s the gap Etherealize wants to fill. Built by a mix of Ethereum core developers and Wall Street operators, it positions itself as the missing connective tissue that lets banks, asset managers, and even sovereigns move real money onto Ethereum.

The thesis: if tokenization is truly a multi-trillion-dollar market, Etherealize wants to be the rail that carries it.

Key Takeaways:

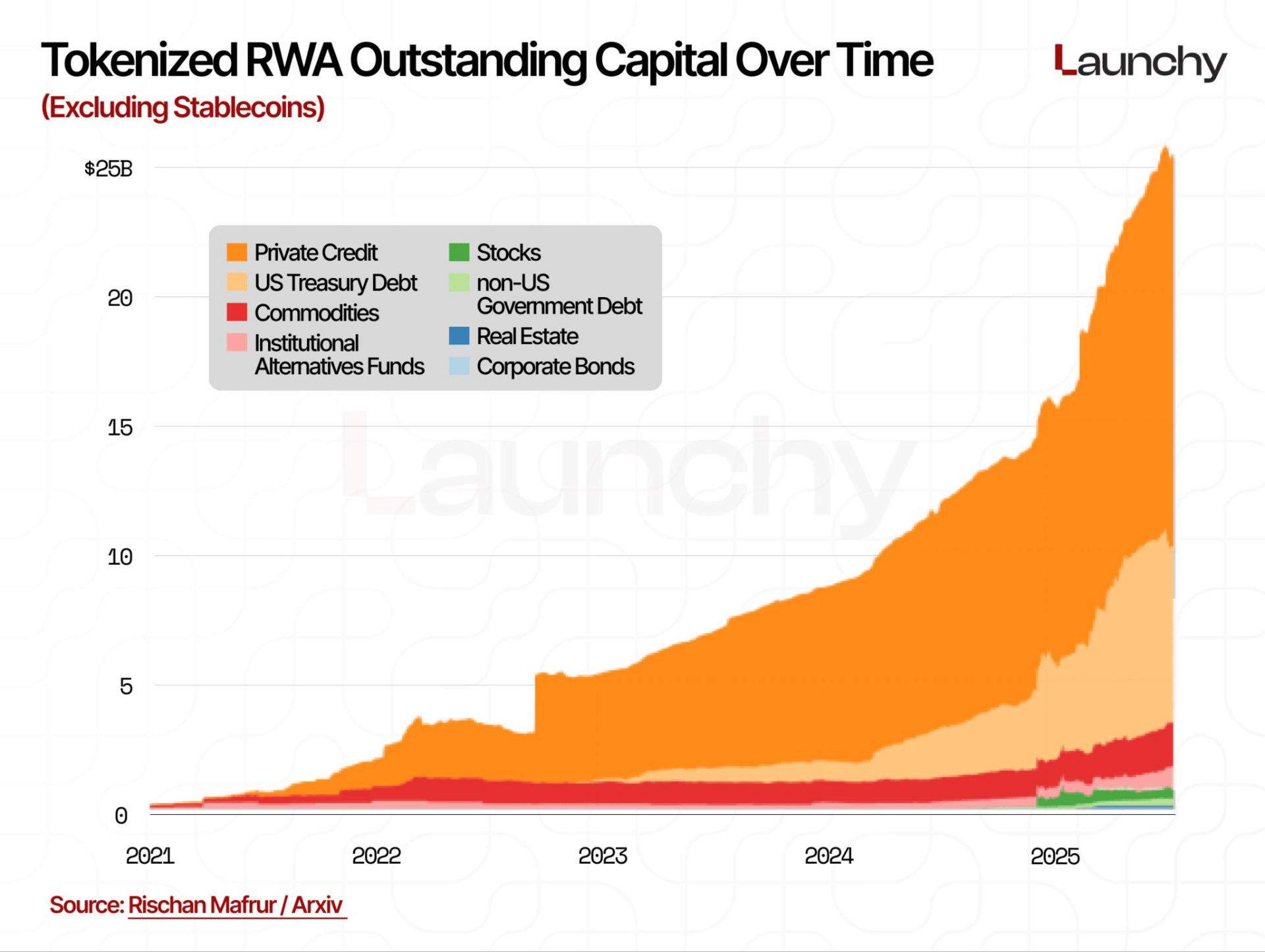

Tokenization is scaling fast: The RWA market has grown to $24B by mid-2025, with treasuries leading at $7.4B, showing the shift from pilots to live adoption.

Institutions drive the market: A few banks, funds, and sovereigns will move most of the volume. Winning these clients is where Etherealize’s leverage lies.

Ethereum is the trusted rail: With $78B TVL, 1M validators, and $165B in stablecoins, Ethereum is the only public chain institutions already use, validated by BlackRock’s BUIDL launch.

Privacy is the hurdle: Zero-knowledge proofs can balance confidentiality with compliance, but regulators will not accept opaque dark pools. Selective disclosure is key.

Economics matter: Even at $2B in annual flow, a 20% margin equals $400M revenue. Fee design and buyback policies will decide whether Etherealize stays niche or scales into multi-B infrastructure.

The Market Problem: Outdated Rails

Every market has the same choke points. Trades settle too slowly, capital sits idle, and compliance eats margins.

Settlement volume: DTCC clears about $2.5 quadrillion in securities per year. DTCC

Margin and liquidity cost: With settlement still lagging, firms post and maintain over $13.4B in margin daily to cover counterparty risk.

Operational bloat: Financial-crime compliance alone costs institutions ~$206B globally, with $61B in the US and Canada and $85B in EMEA. A 2024 view puts $155.3B to operations and $34.7B to tech.

Today’s market plumbing still functions, but mainly through costly workarounds. The analogy is dial-up internet: serviceable for its time, but not fit for what followed.

Tokenization is compelling because it aims directly at the largest inefficiencies, settlement measured in quadrillions and operating costs in the hundreds of billions.

Tokenization Megatrend: From Theory to Scale

Forecasts

McKinsey estimates total tokenized financial assets (excluding crypto like Bitcoin or stablecoins such as Tether) could reach $2T by 2030, with a bullish scenario of $4T.

Boston Consulting Group had a higher estimate: $16T by 2030, placing tokenization at about 10 % of global GDP.

Standard Chartered (2025) sees the tokenization pie ballooning to $30T by 2034.

Even the conservative McKinsey base case dwarfs the entire current DeFi market. These aren’t back-of-the-envelope numbers, they’re institutional bets on structural transformation.

Real-World Asset (RWA) Growth Today

The RWA tokenization market has surged from a few billion to roughly $24B by mid-2025, up 380% in three years alone.

Tokenized US Treasuries and money-market fund products now total $7.4B, marking an 80% year-to-date increase.

One report tracked a rise from under $1B in early 2024 to over $7.4B by mid-2025 for tokenized US Treasuries.

This isn’t hype. It’s measurable traction, tightly concentrated in safe, liquid asset classes so far.

Issuance Examples: Bonds & Credit

Over $10B in tokenized bonds have been issued globally over the last decade. Key actors include Siemens, the City of Lugano, and the World Bank.

Siemens issued a €300M digital bond on a blockchain platform, and the first secondary market trade was recently executed on German trading venue 360X.

Securitize is one of the largest platforms for tokenizing real-world assets, reporting over $3.9B in tokenized securities under management as of mid-May 2025. This includes tokenized fund launches with institutional partners like BlackRock (e.g., the BUIDL fund), KKR, Apollo, Hamilton Lane, and others.

What started as experiments measured in millions is now billions. The projections, from $2T on the low end to $30T on the high end, underline the uncertainty but also the scale of what’s coming.

Etherealize Product Suite

Etherealize frames its offering around three core product pillars. Each is designed to address a structural inefficiency in today’s market plumbing.

Upgrading Markets

The biggest inefficiencies in capital markets are in the slowest-moving asset classes — bonds, loans, private funds. These markets still rely on legacy rails that make issuance, lifecycle management, and settlement costly and fragmented.

Etherealize’s stack is designed to pull those markets on-chain, enabling institutions to issue and settle tokenized assets with the liquidity and reliability they expect.

Automating Infrastructure

Wall Street’s infrastructure was never built for a 24/7 global economy. Trade execution and post-trade processing remain tied to batch systems and business-day schedules.

Etherealize is building automated execution and near-instant settlement while still aligning with compliance requirements. In practice, this means cutting out layers of operational drag that currently cost banks billions each year.

Embedding Privacy

Institutions will not move serious volume on-chain without privacy. But regulators will not allow flows to vanish into opaque dark pools.

Etherealize is embedding customizable privacy environments using zero-knowledge technology, so institutions can transact with counterparties privately while still proving compliance to supervisors.

Why It Matters

The pitch is credibility. Etherealize combines deep Ethereum expertise (its team has roots in Ethereum’s core research), Wall Street experience (senior roles at Goldman Sachs, JPMorgan, UBS), and regulatory access (direct engagement with SEC, Treasury, Congress).

The product thesis is simple: Ethereum is ready, institutions are ready, but the missing piece is infrastructure that satisfies both sides. Etherealize is trying to deliver it.

The Institutional Bridge Role

Etherealize’s value proposition is straightforward. Banks, asset managers, sovereign funds, and hedge funds are curious about blockchain efficiency, but they won’t jump into the chaos of retail DeFi. They need rails built for them, explained in their language, and trusted enough to move real money.

What Etherealize Focuses On

Policy presence: The team engages directly with the Treasury, SEC, Congress, and the White House. That gives Ethereum a credible seat in policy conversations.

Boardroom outreach: They sit down with global banks, sovereign wealth funds, and asset managers to frame Ethereum as an institutional settlement layer.

Market structure work: The focus is on trading, settlement, and privacy systems, not retail speculation.

Case Study: JPMorgan Onyx (Kinexys)

JPMorgan’s Onyx (rebranded to Kinexys) reveals that publicly reported notional throughput has crossed $1T, with some platforms exceeding $1.5T in total volume, and $2B daily average flow. This proves large-scale settlement can happen on blockchain rails, but on a permissioned system, meaning liquidity stays inside JPMorgan’s ecosystem.

Etherealize is betting that public Ethereum will eventually beat closed systems. The argument is simple: Permissioned chains might scale faster in the short term, but they cannot match Ethereum’s open liquidity, developer base, and composability.

Why It Matters

Scale is already proven: Onyx and Broadridge show that trillions in repo flows can run on chain.

Open vs closed: Closed systems save costs but keep liquidity siloed. Ethereum offers the network effects that institutions will eventually want.

Trust gap: Someone has to make Ethereum safe, compliant, and credible for global finance. Etherealize wants to fill that role.

Privacy Meets Regulation

Institutions need two things from blockchain rails: trusted settlement for counterparties, and enough transparency for regulators without revealing every position.

On Ethereum, everything is visible. That’s a dealbreaker for banks. But regulators won’t approve flows they can’t see.

Zero-knowledge proofs (ZK) offer a way through. They let firms prove compliance without exposing all details. Pilots on Polygon zkEVM and StarkWare show promise, and studies suggest ZK could cut 30–50% of reconciliation and reporting costs (EY).

The risk is going too far. Aztec Network, a privacy rollup, shut down Aztec Connect (the network’s privacy infrastructure serving as the encryption layer for Ethereum) in 2023 under regulatory pressure over private transactions.

Regulators won’t accept dark pools, so privacy has to mean selective disclosure.

Etherealize is betting it can balance the two. Too opaque and regulators walk. Too transparent and institutions won’t show up. Striking that balance is what unlocks adoption.

Ethereum Maximalism for Institutions

Etherealize is not aiming for a multichain future. The bet is that Ethereum alone will become the institutional settlement layer. Banks need chains they can trust, and Ethereum checks those boxes.

Ethereum’s Market Position

TVL: Ethereum (mainnet and L2s) holds around $78B in DeFi TVL as of mid-2025, about 63% of all DeFi value.

Validators: Roughly 1M active validators secure the network.

Stablecoins: Stablecoin supply on Ethereum reached $165B, a record high, following $5B in inflows in one week.

Competitors

Solana: Holds $9–12B TVL, strong in retail but less trusted by institutions.

Avalanche: Around $6B TVL, with ambitions in tokenized RWAs but smaller adoption .

Permissioned rails (JPMorgan Onyx, now Kinexys): Reported $1.5T+ in notional volume processed, with daily averages above 2B, but liquidity is siloed.

Case Study: BlackRock BUIDL

BlackRock launched its BUIDL tokenized money-market fund in March 2024 on Ethereum, not on Solana or Avalanche. For the largest asset manager in the world, credibility outweighed raw throughput (coindesk.com).

What This Means for Etherealize

Etherealize’s Ethereum-only strategy aligns with the chain institutions already trust. The risk is that multichain liquidity gains traction in the future. But at present, Ethereum is the only public chain with the scale and reputation to support settlement flows measured in trillions.

Platform Economics

Etherealize is not selling to millions of retail users. Its customer base will be small but heavy. In tokenized finance, a handful of banks, sovereign funds, and asset managers will account for nearly all the flow. That mirrors other markets where whales dominate activity.

Whale Dynamics

In gaming gacha platforms, 5–20% of users often drive 90% of spend.

In tokenized finance, the equivalent is global institutions. A few big actors moving into treasuries, credit, or repos can instantly shift billions.

Net Margins

How much margin can a platform like Etherealize actually keep? It depends on the design.

Conservative models with high buyback rates and lower fees net around 12%.

Balanced approaches can net around 20–21%.

Leaner models with on-demand procurement can clear 30% or more, though fulfillment risk rises.

These ranges are observable in other tokenized markets and gacha-style platforms, and they map well onto how Etherealize may operate once scaled.

Scenario Modeling

If Etherealize processes $200M of flow in a year and nets 21%, that equals $42M in revenue.

If flow grows to $2B annually, net revenue jumps to $420M at the same margin.

At $10B in annual flow, a realistic figure if institutions begin tokenizing funds and credit at scale, revenue would exceed $2.1B.

Why It Matters

Unit economics are often ignored in the hype around tokenization. The reality is that platform take rates, buyback cadence, and fee structures will determine whether Etherealize is a modest infrastructure provider or a multi-billion revenue rail.

Key Risks

Scalability

Ethereum mainnet is limited in throughput. Institutions will need L2 solutions to handle volume. Fragmentation across multiple L2s could dilute liquidity and create new frictions.

Liquidity Depth

As of mid-2025, tokenized RWAs are about $24B in size. That is real growth, but still tiny compared to the trillions that flow through traditional markets. Secondary trading is shallow, and many assets remain locked in buy-and-hold mode.

Competition

Permissioned rails are already proving scale. JPMorgan’s Onyx (Kinexys) has processed $1.5T+ in notional repo volume, averaging $2B per day. Public Ethereum has not yet matched that kind of institutional throughput.

Our Take

Tokenization has moved from theory to practice. The market has reached about $24B in RWAs by mid-2025, small compared to forecasts of $2T–30T but already meaningful progress, concentrated in safe assets like treasuries.

Institutions, not retail, will drive the next wave. A handful of banks, funds, and sovereigns can shift billions overnight, and winning these clients is where Etherealize’s leverage lies.

Ethereum is the only public chain with enough credibility. With $78B TVL, 1M validators, and $165B in stablecoins, it is already the default for institutions, confirmed by BlackRock’s BUIDL launch.

Privacy is still the key barrier. Zero-knowledge tech can enable selective disclosure, but regulators will not accept dark pools. Etherealize must strike the balance that satisfies both sides.

Margins will define the business. At $2B in flow, a 20% margin equals $400M in revenue. Policy choices around fees and buybacks will decide whether Etherealize stays niche or scales into a multi-B infrastructure player.

If you enjoy reading this issue, please consider subscribing. It takes 1 minute of your time but it would mean the world to us 🙇

Disclaimer: All the information presented in this publication and its affiliates is strictly for educational purposes only. It should not be construed or taken as financial, legal, investment, or any other form of advice.