CZ Pushes Back on Iran Probe Firings Report

Benchmark Cuts COIN Target | USDT0 RWA Perps on Hyperliquid

📢Sponsor | 💡Telegram | 📰Past Editions

Good Morning,

Binance is back in focus after reports claimed internal investigators were dismissed over $1B in Iran linked USDT flows. With the exchange still under post settlement oversight, the story revives questions about whether its compliance framework is truly institutional grade or still fragile under pressure.

Check out our latest podcast episode!

In Today's Email:

What Matters: CZ Pushes Back on Iran Probe Firings Report 👀

Product of the Week: USDT0 RWA Perps on Hyperliquid 🚀

Charts: Benchmark Cuts COIN Target, Solana Company Shares Jumps 📊

You read and share. We listen and improve. Send us feedback at [email protected].

Narratives: Treasury Leverage Play

For daily market updates and airdrop alphas, check out our telegram!

WHAT MATTERS

CZ Pushes Back on Iran Probe Firings Report

State of play: Former Binance CEO Changpeng Zhao has rejected claims that Binance dismissed internal investigators after they flagged more than $1B in Iran-linked transactions, calling the report self-contradicting.

The allegations suggest that several Binance’s internal investigators were let go in late 2025 after raising concerns about transfers involving USDT on Tron.

CZ responded on X, saying he was not aware of the specific details but argued the narrative did not add up.

He emphasized that Binance uses multiple third-party AML screening tools, the same ones relied upon by law enforcement agencies.

He also criticized the reliance on anonymous sources, suggesting such reporting can be used to frame negative narratives.

Binance remains under heightened compliance oversight following its 2023 $4.3B settlement with US authorities over AML and sanctions violations.

Binance is also reportedly undergoing leadership changes within its compliance division.

Separately, Elliptic reported increased use of stablecoins, particularly USDT, by Iranian-linked entities to move funds outside traditional banking systems.

Why it matters: Binance’s credibility is still fragile post settlement, so any narrative about sidelining sanctions investigators risks triggering renewed regulatory heat, especially around stablecoin flows tied to sanctioned jurisdictions.

Our take: This is less about one report and more about whether Binance’s compliance architecture is genuinely institutional grade or still reactive under pressure.

For builders and investors: Exchanges exposed to stablecoin and cross border flows carry embedded geopolitical risk that markets will increasingly price in.

PRODUCT OF THE WEEK

Dreamcash: USDT0 RWA Perps on Hyperliquid

Dreamcash, a self custodial mobile trading app built on Hyperliquid, has launched USDT0 collateralized perpetual markets for real world assets including the S&P 500, gold, silver, and major US stocks like Tesla and Nvidia.

The markets are deployed using Hyperliquid’s HIP 3 standard, which allows third party builders to create permissionless perps with custom collateral types.

Unlike Hyperliquid’s core USDC based markets, Dreamcash enables traders holding USDT to access these perps directly using USDT0.

Backed by a strategic investment from Tether, Dreamcash is also rolling out a $200K weekly incentive program to drive trading activity.

Other cool products:

Cybro, a smart hub for LP.

AlchemixFi, a lending protocol.

OWN, a DeFi mortgages protocol.

Rubicon, an order book protocol for Ethereum.

Idle Finance, a DeFi yield automation protocol.

Avon, a MegaETH‘s lending and borrowing protocol.

Take a peek at our referral reward at the bottom of this issue. Share this newsletter and receive our list of 500 crypto VC individuals 👇

CHARTS OF THE WEEK

Benchmark Cuts COIN Target, Stays Bullish

State of play: Benchmark slashed its Coinbase price target by 37% to $267 from $421, citing weaker crypto market conditions and trimming its 2026 EPS forecast to $5.34, well below prior expectations.

The cut follows Coinbase’s Q4 miss, which included a $667M GAAP loss mainly from unrealized crypto and investment losses.

Despite the downgrade, Benchmark maintained a buy rating, arguing that Coinbase’s underlying business is more diversified and resilient now.

Institutional trading revenue surged 37% sequentially, boosted by Deribit, while stablecoin balances hit record levels.

Subscription and services revenue now accounts for 43% of total net revenue, highlighting a shift away from purely transaction driven income.

The broader thesis is that Coinbase is shifting from pure crypto beta to a multi product platform, despite near term earnings pressure.

Our take: If derivatives, stablecoins, and subscriptions keep scaling, Coinbase’s earnings volatility should compress over time, even if the stock still trades like leveraged crypto beta in the near term.

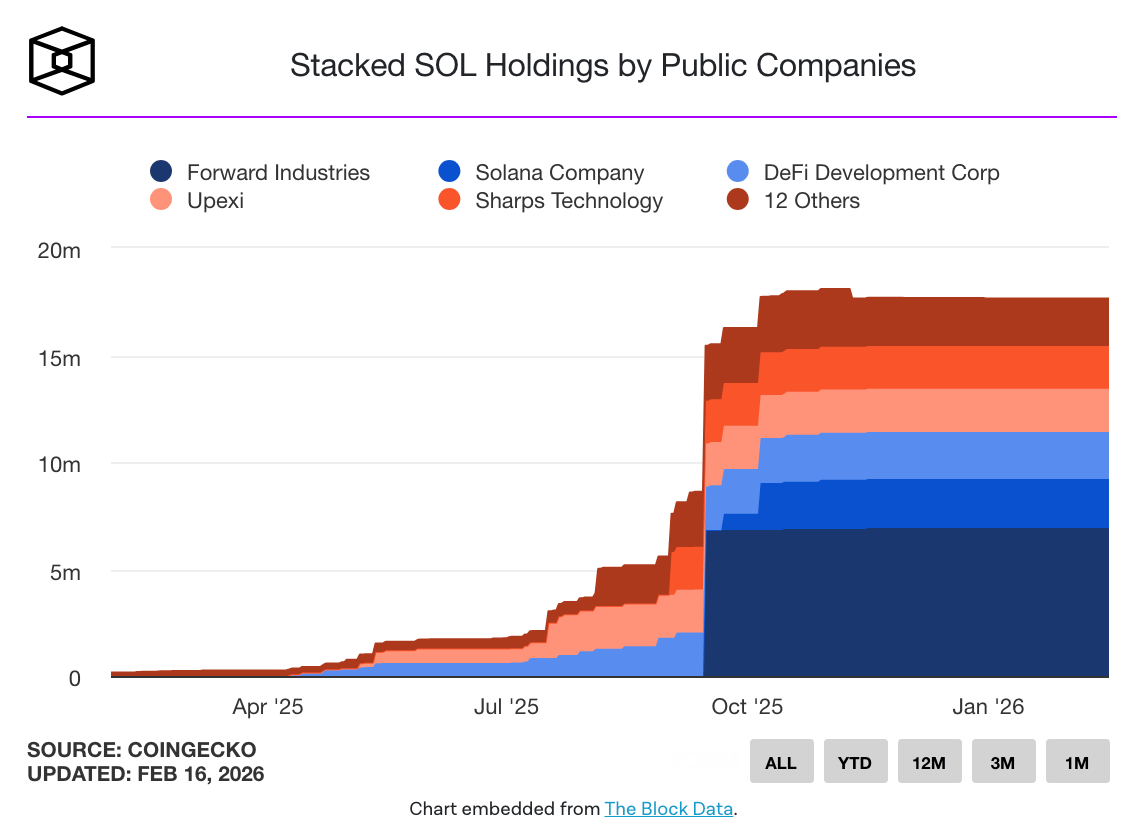

State of play: Solana Company shares surged 17% after the firm launched a structure that lets institutions borrow against natively staked SOL without unstaking or selling tokens.

Through Anchorage and Kamino, staked SOL can be used as collateral without unstaking, preserving rewards while unlocking liquidity.

The move comes as falling SOL prices push treasury firms to rely more on staking and onchain yield for revenue.

Solana Company holds about 2.3M SOL, making it the second largest publicly traded SOL holder despite the sector wide downturn.

Our take: If SOL price upside is uncertain, the only lever left is capital efficiency. Borrowing against staked SOL turns idle treasury into productive liquidity, but it also adds leverage risk in an already volatile asset.

QUICK BITES

Solana Company shares jump 17%.

CZ pushes back on Iran probe firings report.

Benchmark cuts Coinbase price target by 37%.

Tether invests in Hyperliquid frontend Dreamcash.

Mirae Asset agrees to buy 92% stake in Korbit for $93M.

Kevin O'Leary wins $2.8M defamation judgment against BitBoy.

Harvard trims BTC ETF holdings by 21%, builds $87M ETH position.

Sens. Warren, Kim demand CFIUS review of UAE's $500M stake in WLFI.

NOTEWORTHY READS & MEME

If you enjoy reading this issue, please consider subscribing. It takes 1 minute of your time, but it would mean the world to us 🙇

Disclaimer: All the information presented in this publication and its affiliates is strictly for educational purposes only. It should not be construed or taken as financial, legal, investment, or any other form of advice.