Crypto VCs Expect a More Selective 2026

Crypto Trading Volumes Slide in December | Ethereum Activity Hits Record High

📢Sponsor | 💡Telegram | 📰Past Editions

Good Morning,

Crypto venture capital is entering 2026 in a very different mood. Funding has not disappeared, but it has become selective, concentrated, and far less forgiving. After a year where capital flowed to fewer, later stage bets, VCs are doubling down on discipline, real traction, and clearer paths to outcomes.

Check out our latest podcast episode!

In Today's Email:

What Matters: Crypto VCs Expect a More Selective 2026 🧐

Product of the Week: Elfa Turns Crypto Social Noise Into Actionable Signals 😺

Charts: Crypto Volumes Slide in December, ETH Activity Hits Record High 📊

You read and share. We listen and improve. Send us feedback at [email protected].

Narratives: Selective capital era

For daily market updates and airdrop alphas, check out our telegram!

WHAT MATTERS

Crypto VCs Expect a More Selective 2026

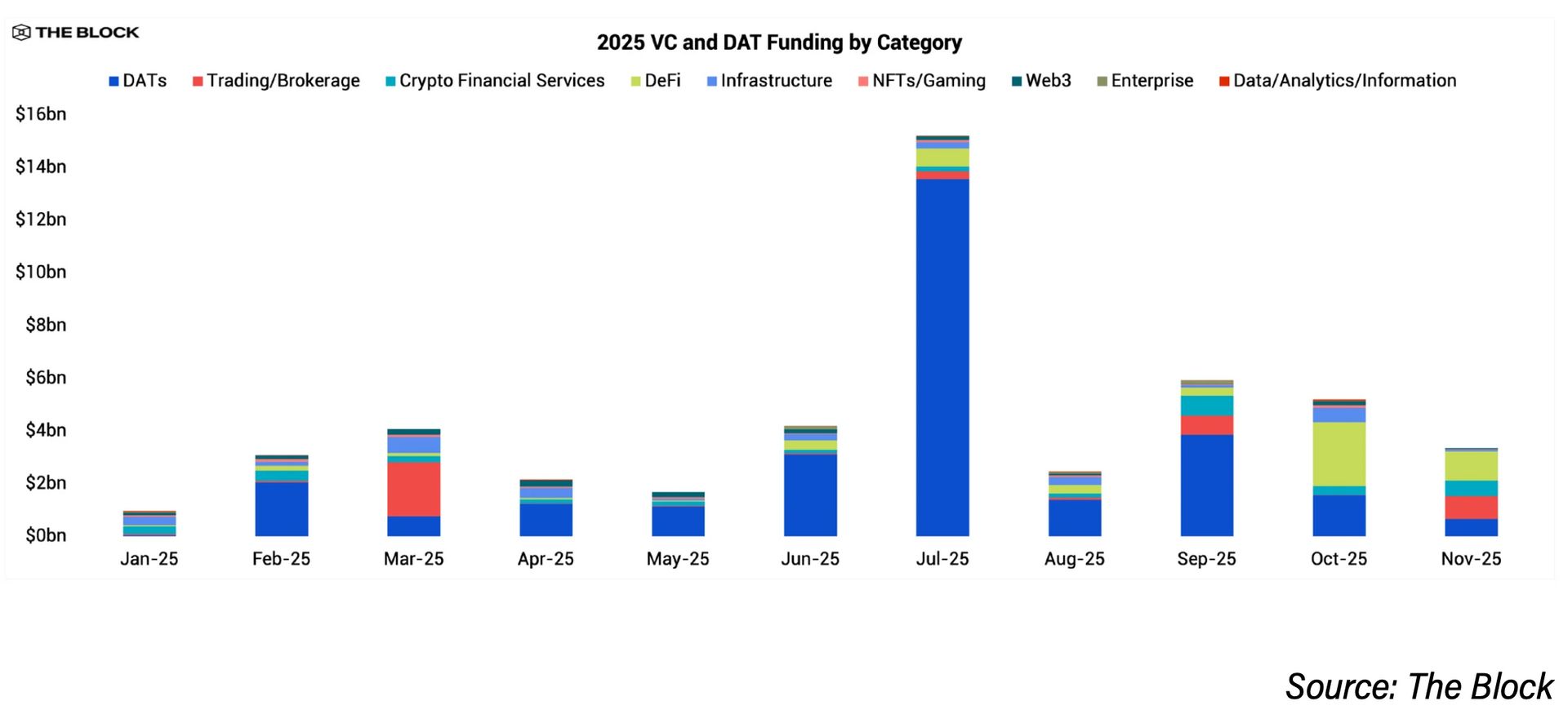

Source: The Block

State of play: Crypto VC funding in 2025 stayed resilient in dollar terms but became highly concentrated in later stage deals, while early stage funding fell sharply. Deal count dropped ~60%, leaving seed and pre seed founders in a difficult environment.

Investors expect 2026 to look similar, with discipline remaining high and only a modest recovery in early stage activity.

The focus is on traction, fundamentals, and clearer exit paths rather than narrative driven bets. Regulatory clarity in the US is seen as a key catalyst.

VCs are most bullish on stablecoins and payments, institutional grade market infrastructure, and selective real world asset tokenization.

Interest in crypto and AI is mixed, with some calling out a gap between hype and execution.

Token sales are expected to play a supporting role, often alongside venture backing, rather than replacing VC funding.

Why it matters: Funding is still there, but it is harder to access. Capital is concentrating around fewer, more proven ideas, making it tougher for early stage teams to get started.

Our take: This is a more realistic market. VCs are backing businesses with clear use cases and revenue, not hype. Stablecoins and infrastructure stand out, while token sales remain secondary.

For builders and investors: Builders need real traction and clear execution early. Investors should expect fewer bets, slower timelines, and more focus on fundamentals.

PRODUCT OF THE WEEK

Elfa Turns Crypto Social Noise Into Actionable Signals

Elfa is a Web3 social listening and market intelligence platform that helps traders and builders spot alpha faster. It turns scattered onchain and offchain signals into clear, real time summaries, so users can see what is moving the market in seconds.

The product focuses on tracking credible crypto accounts, narratives, and tokens, while filtering out noise and bias.

Users can discover trusted CT and smart accounts, monitor their hit rates, and follow insights tied directly to price action.

Elfa also provides instant token analysis, combining social data with market context to support faster decision making.

Built for efficiency, Elfa emphasizes minimal effort, real time intelligence, and broad token coverage.

It also offers an API for developers and integrates TradingView charts for price visualization.

Other cool products:

Flair, a real-time custom data indexing for EVM chains.

Sharpe Labs, an AI-powered crypto intelligence terminal.

Opporty, a service marketplace for small business on the blockchain.

Bloom, a decentralized credit scoring powered by Ethereum and IPFS.

Take a peek at our referral reward at the bottom of this issue. Share this newsletter and receive our list of 500 crypto VC individuals 👇

CHARTS OF THE WEEK

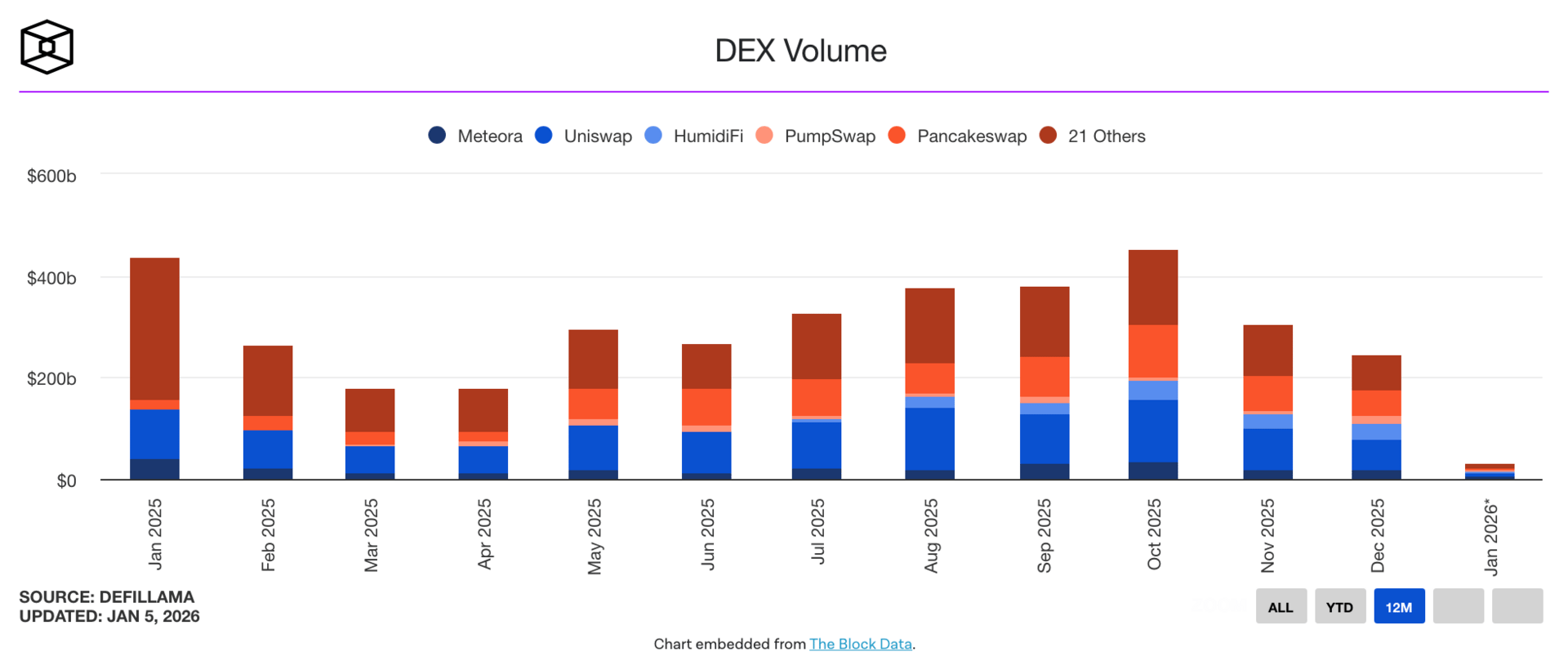

Crypto Trading Volumes Slide in December

State of play: Crypto exchange activity slowed sharply in December, with spot trading volume on centralized exchanges falling to $1.13T, the lowest level in 15 months.

That marked a 32% drop from November and nearly a 50% decline from October, driven by low volatility, seasonal sentiment, and year end repositioning.

Decentralized exchanges also saw weaker activity, with volume down 20% month over month to $245B.

Despite the slowdown, DEXs continued to gain relative share, with the DEX to CEX volume ratio rising to nearly 18%.

The volume decline coincided with a broader market correction, as Bitcoin consolidated below recent highs and overall participation remained cautious.

Analysts noted that structural trends such as rising DEX adoption and incentive driven trading continue to reshape market behavior.

Our take: December’s volume drop reflects low volatility and year end positioning, not a loss of long term interest. The rising DEX share is the more important signal, pointing to a steady shift toward onchain trading and self custody even as overall activity cools.

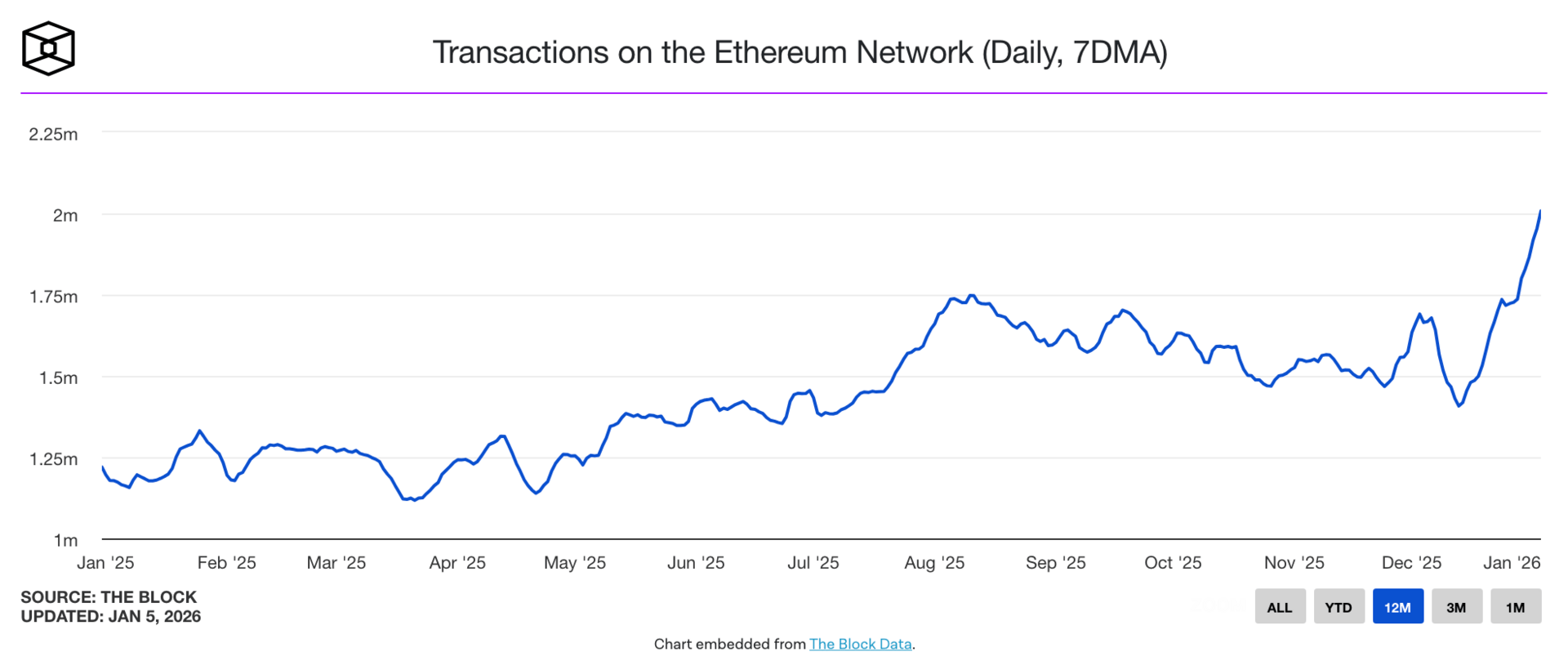

Ethereum Activity Hits Record High

State of play: Ethereum closed 2025 with record onchain activity, as daily transactions reached an all time high of 1.87M on December 31. This surpassed the peak seen during the 2021 NFT and DeFi boom.

The surge was accompanied by strong growth in participation. Active addresses climbed to nearly 729,000, the highest level since mid 2021, while new addresses hit their largest single day increase since early 2018.

Analysts attribute the rise to major network upgrades in 2025 that reduced fees, improved scalability, and made ETH more attractive for institutions, ETFs, and RWA tokenization.

Upgrades such as Pectra and Fusaka improved blob throughput, data availability, wallet usability, and validator efficiency, reinforcing Ethereum’s rollup focused roadmap.

Further upgrades planned for 2026 are expected to continue improving performance and decentralization, supporting ETH’s position as the dominant settlement layer for stablecoins, RWAs, DeFi, and EVM compatible applications.

Our take: Lower fees, better scalability, and institutional use cases are doing the work. If activity keeps rising, the gap between fundamentals and price may not last.

QUICK BITES

Crypto M&As and IPOs surged in 2025.

Visa crypto card spending soars 525% in 2025.

Rep. Torres targets prediction market 'insider trading'.

Whales move crypto to Binance, but buyers are missing.

Top crypto VCs share 2026 funding and token sales outlook.

PwC to deepen crypto engagement citing US regulatory shift.

Cumulative spot crypto ETF trading volume surpasses $2T.

TRUMP, ONDO, BGB, HYPE, lead $5.5B in token unlocks in January.

Ethereum powers $8T in stablecoin transfers in Q4, smashing record.

Japan's finance minister backs crypto integration across stock exchanges.

NOTEWORTHY READS & MEME

If you enjoy reading this issue, please consider subscribing. It takes 1 minute of your time, but it would mean the world to us 🙇

Disclaimer: All the information presented in this publication and its affiliates is strictly for educational purposes only. It should not be construed or taken as financial, legal, investment, or any other form of advice.