Criminal Probe Opens Into Fed Chair Jerome Powell

BNY Mellon Activates Tokenized Deposits | XRP ETFs See Record Volume

📢Sponsor | 💡Telegram | 📰Past Editions

Good Morning,

A reported Justice Department probe into Fed Chair Jerome Powell has triggered sharp reactions in Washington and markets, highlighting growing tension over the Fed’s independence and political pressure.

Check out our latest podcast episode!

In Today's Email:

What Matters: Criminal Probe Opens Into Fed Chair Jerome Powell 👀

Product of the Week: BNY Mellon Activates Tokenized Deposits 🚀

Charts: XRP ETFs See Record Volume, Iran’s IRGC Moved $1B of Crypto 📊

You read and share. We listen and improve. Send us feedback at [email protected].

Narratives: Policy risk rising

For daily market updates and airdrop alphas, check out our telegram!

WHAT MATTERS

Criminal Probe Opens Into Fed Chair Jerome Powell

IMG: Trump & Powell / The Boston Globe

State of play: The US Justice Department has opened a criminal investigation into Jerome Powell, he said on Sunday, citing subpoenas tied to Senate testimony on Federal Reserve building renovations and a possible criminal indictment.

Powell called the probe unprecedented and suggested it was tied to pressure from Trump over his refusal to cut interest rates more aggressively.

The Justice Department and the White House have not confirmed the probe.

Trump told NBC News that he had no knowledge of the investigation but again criticized Powell’s performance as Fed chair.

Lawmakers from both parties reacted strongly, with Republican Senator Thom Tillis vowing to block new Fed nominations and Democrat Senator Elizabeth Warren accusing Trump of undermining the Fed’s independence.

News of the investigation, combined with geopolitical tensions in Iran, pushed investors toward safe haven assets.

Gold and silver prices jumped to record highs, reflecting increased market uncertainty.

The case deepens concerns about the politicization of the Justice Department and mounting pressure on the Federal Reserve’s independence.

Why it matters: A criminal probe involving Jerome Powell puts the independence of the Federal Reserve under a spotlight. Even the appearance of political pressure can shake market confidence and complicate interest rate decisions.

Our take: This feels less about renovations and more about politics. Regardless of how it ends, the episode risks weakening trust in both the Fed and the Justice Department.

For builders and investors: Expect more macro noise and volatility. It is a reminder to plan for policy risk, not just economic data, when making long term decisions.

PRODUCT OF THE WEEK

BNY Mellon Activates Tokenized Deposits

BNY Mellon has activated a tokenized deposit service for select institutional clients, bringing an exploratory project live. The service represents interest-bearing bank deposits on blockchain, distinct from stablecoins.

The product is designed for payments, collateral, and margin use cases, with programmable features that enable faster and more automated settlement.

BNY is also working toward 24/7 operation, aiming to reduce frictions in legacy payment and treasury systems that currently handle trillions of dollars daily.

Initial users include major market infrastructure and trading firms such as Intercontinental Exchange, Citadel Securities, and Circle.

Other cool products:

Flair, a real-time custom data indexing for EVM chains.

Sharpe Labs, an AI-powered crypto intelligence terminal.

Bloom, a decentralized credit scoring powered by Ethereum and IPFS.

Wireshape, an open enterprise blockchain Network combined with AI tools.

Take a peek at our referral reward at the bottom of this issue. Share this newsletter and receive our list of 500 crypto VC individuals 👇

CHARTS OF THE WEEK

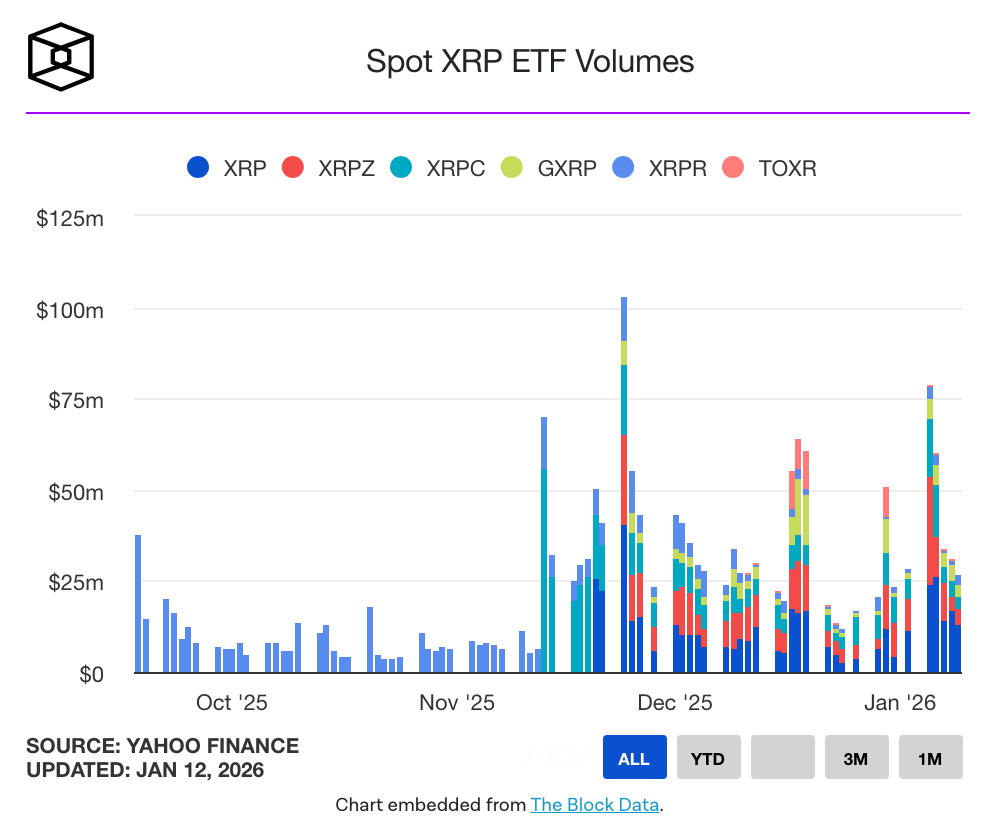

XRP ETFs See Record Volume as BTC & ETH ETFs Shed $750M

State of play: US spot BTC and ETH ETFs started 2026 under pressure, posting a combined $749.6M in net outflows during the first full trading week of the year, according to SoSoValue data.

Bitcoin ETFs led the decline with $681M in weekly outflows, while ether ETFs lost $68.6M, as early inflows were reversed by heavy selling later in the week.

Among bitcoin funds, BlackRock’s IBIT accounted for the largest single-day outflow, while Fidelity’s FBTC stood out as one of the few to record net inflows.

Ether ETFs followed a similar pattern, with BlackRock’s ETHA leading weekly losses.

In contrast, XRP ETFs continued to attract capital. The funds recorded $38.1M in weekly net inflows and hit a record $38.1M in weekly trading volume, signaling rising investor interest despite broader weakness in crypto ETFs.

Spot SOL ETFs also saw net inflows, reinforcing a shift in investor appetite toward newer crypto ETF products.

Our take: Money is moving out of bitcoin and ether ETFs and into newer products like XRP and SOL, where positioning is lighter and interest feels fresher.

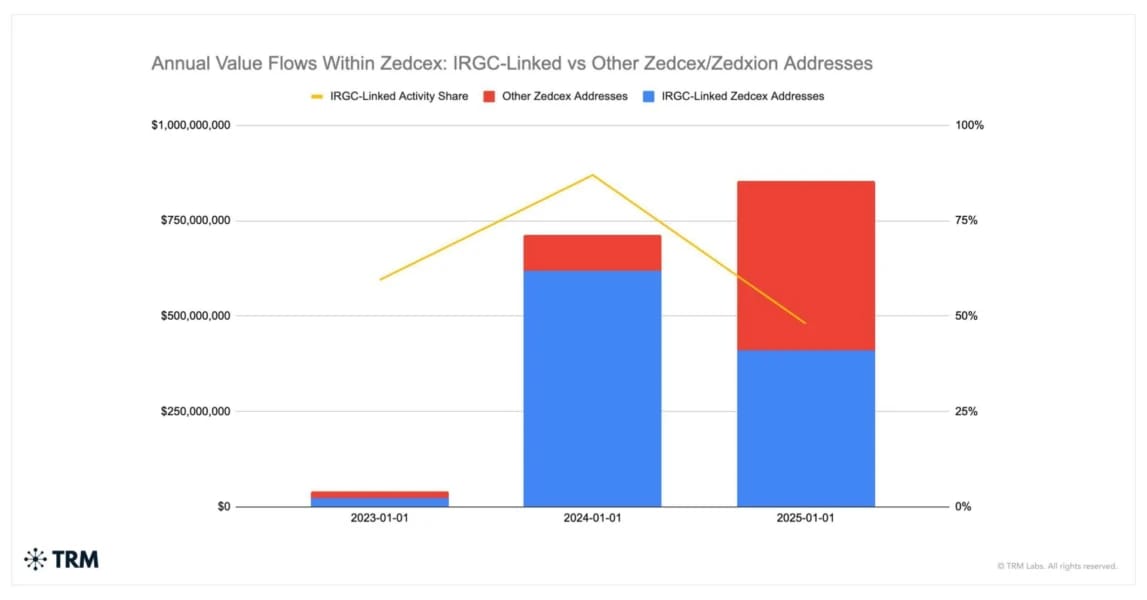

Iran’s IRGC Moved $1B via UK Crypto Exchanges

Source: TRM

State of play: A new analysis by TRM Labs found that Iran’s Islamic Revolutionary Guard Corps moved roughly $1B through two UK-registered cryptocurrency exchanges since 2023, largely to evade international sanctions.

The exchanges, Zedcex and Zedxion, were identified as operating as a single network under different brands.

According to the report, IRGC-linked transactions made up about 56% of the exchanges’ total volume between 2023 and 2025.

Most activity conducted in USDT on the Tron network.

Volumes rose sharply over time, pointing to a shift from isolated crypto use toward more structured sanctions-evasion infrastructure.

Investigators traced funds between IRGC-linked wallets, offshore intermediaries, and Iranian crypto firms tied to sanctioned individuals.

Our take: The findings raise renewed concerns about the use of stablecoins and lightly supervised exchanges in facilitating large-scale sanctions bypassing.

QUICK BITES

Tether freezes $182M in USDT tied to five Tron addresses.

Most US debanking cases stem from government pressure.

UK committee chairs push for crypto political donations ban.

Memecoins hit hardest in rough year that saw 11.6M tokens fail.

Iran's IRGC moved $1B through UK-registered crypto exchanges.

Weekly crypto ETP outflows reach $454M as hopes for Fed easing dim.

South Korean authorities seek 5% cap on corporate crypto investments.

Pumpfun overhauls creator fees as token launches hit post-September high.

XRP ETFs hit record weekly volume as BTC, ETH funds face $750M outflows.

NOTEWORTHY READS & MEME

If you enjoy reading this issue, please consider subscribing. It takes 1 minute of your time, but it would mean the world to us 🙇

Disclaimer: All the information presented in this publication and its affiliates is strictly for educational purposes only. It should not be construed or taken as financial, legal, investment, or any other form of advice.