Coop Records Case Study

How incentives can shift billions overnight but not necessarily build lasting dominance.

📢 Sponsor | 💡 Telegram | 📰 Past Editions

Crypto thrives on primitives like stablecoins, NFTs, and perpetuals. These assets became the foundation of the onchain economy because they are liquid, composable, and widely used. Music has never fit that mold. Rights are fragmented, payouts are delayed, and demand is cultural rather than financial.

Coop Records is trying to close that gap. With over 175 artists and 750 releases since 2023, the label has shifted from collectibles to song coins that trade on Uniswap, pay artists in real time, and give fans governance power through COOP points. The model reframes music as more than digital merchandise. It treats songs as programmable assets with their own markets, staking systems, and community-driven release schedules.

The question is whether this can scale into a true primitive or if it is simply another speculative experiment. If Coop succeeds, it could establish music as a new category of tokenized asset, expanding crypto beyond finance into culture. If it fails, it will reinforce the view that music is too complex to standardize onchain.

What Makes Something an Onchain Primitive

A crypto primitive is more than just a token that people trade. It is a foundational layer that other protocols, applications, and users can reliably build on. Primitives matter because they provide stability and predictability in an ecosystem that thrives on experimentation.

For an asset to qualify as a true primitive, it usually needs to meet several conditions:

Liquidity that is durable. There must be a market deep enough for others to interact with the asset without constant incentives or subsidies. If liquidity disappears the moment rewards stop, the asset is not a primitive.

Composability across protocols. A primitive should plug into many different applications with minimal friction. Stablecoins are a classic example: they move across exchanges, lending markets, and payment rails without modification.

Clear and enforceable onchain rules. Supply, distribution, and transaction logic must be transparent and resistant to manipulation. Primitives are predictable, which makes them safe to integrate.

Demand that holds on its own. Incentives can help bootstrap adoption, but sustainable primitives must have real utility or cultural pull that keeps people using them even when rewards fade.

Reliable price discovery. Other protocols need to know what the asset is worth in real time. If the price can be gamed, it cannot serve as collateral, settlement, or reference.

Stablecoins, NFTs, and perpetuals all meet this bar. Stablecoins provide stable value for payments and settlement. NFTs became the standard for digital ownership. Perpetual futures established a core instrument for speculation and hedging. Each moved from novelty to infrastructure because they solved a real problem and others could safely build on top of them.

Music, however, still has to prove it belongs in this category. Most past attempts have been collectibles or fan tokens that lacked liquidity, utility, or consistency. Coop Records is testing whether songs, when structured as coins with clear rules and liquid markets, can reach the same level of reliability as other primitives.

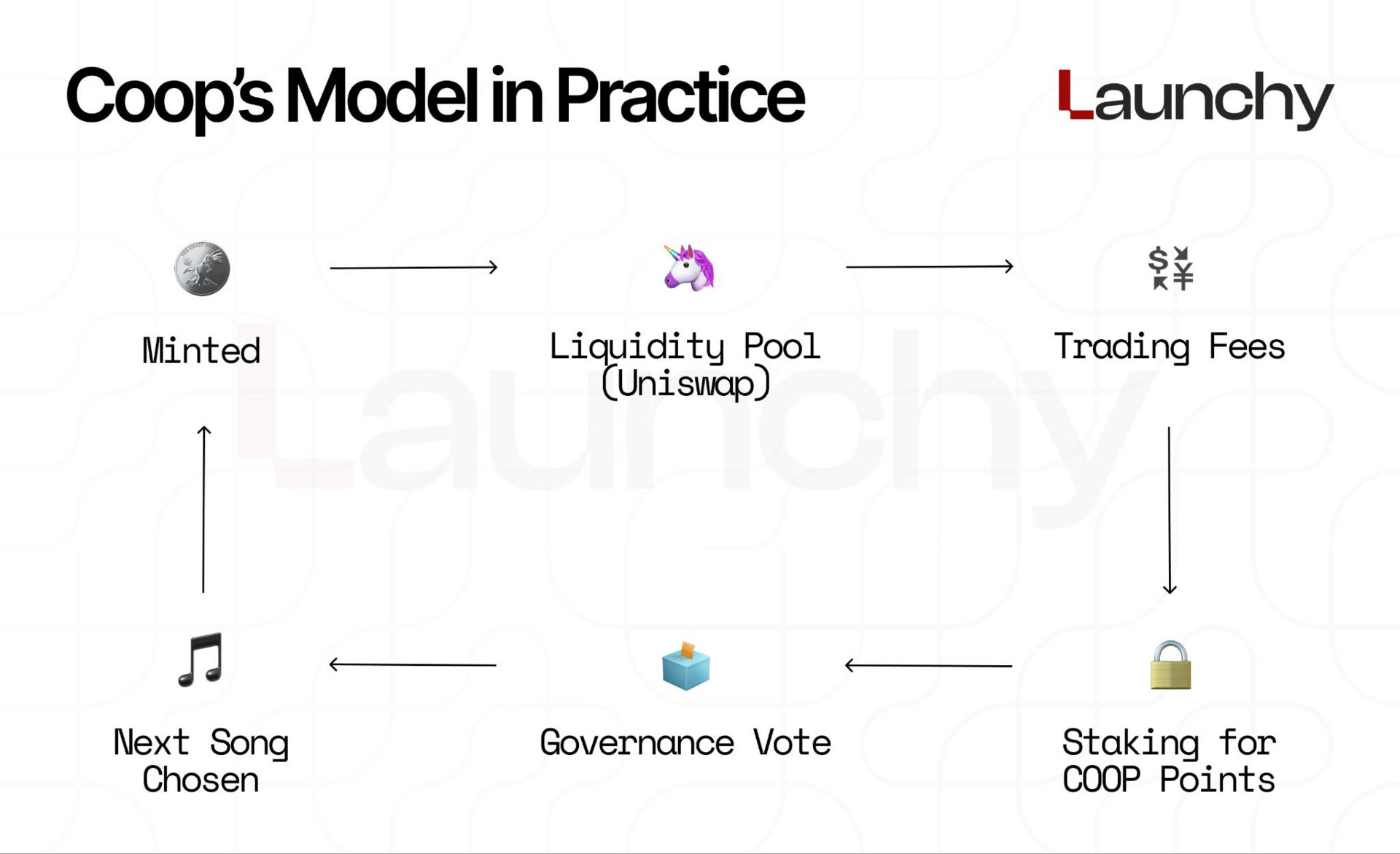

Coop’s Model in Practice

Coop started with low-cost collectibles, typically priced at about one dollar each. Buyers received COOP points and token rewards, introducing a gamified layer of participation. This helped onboard early fans and collectors, but the model still looked more like digital merchandise than a financial primitive.

In July 2025, Coop shifted to a bolder design: song coins. Each track is launched as its own token with the following structure:

Supply: every song is minted with a fixed supply of 1 billion coins.

Distribution: 5% to the artist, 5% to Coop Records, 10% for incentives, and 80% provided as liquidity.

Trading: coins list instantly on Uniswap through Doppler, giving immediate price discovery with a starting market cap of around $4,000.

Vesting: allocations for artists, Coop, and incentives unlock gradually over 90 days, balancing discovery with stability.

Fees: trades carry a 1% protocol fee plus an additional 1.5% front-end fee that funds Coop’s curated music experience.

Governance: collectors can stake their song coins to earn COOP points, which then determine which songs graduate to token status in future releases.

This design borrows heavily from DeFi playbooks. Liquidity pools, vesting schedules, trading fees, and governance points have all been applied to music, transforming songs into programmable assets with their own market dynamics.

Testing Coop Against the Primitive Bar

For Coop Records to position songs as true onchain primitives, its model needs to be tested against the same standards that made stablecoins, NFTs, and perps succeed.

Liquidity

Positive: Every song coin automatically lists on an AMM like Uniswap, which guarantees there is a live market from the very first purchase. That immediate tradability is a step forward compared to static collectibles, where secondary markets often remain thin or fragmented.

Weakness: Liquidity is spread across hundreds of individual tracks. Most pools are shallow, which means that even moderate trades can cause high slippage.

This makes it costly for larger buyers to enter or exit positions, limiting the appeal for market makers or protocols that require reliable depth. Without aggregated liquidity or index-like structures, song coins risk being too fragmented to compose against at scale.

Composability

Positive: Song coins are ERC-20 tokens, which means they can plug into the broader Ethereum ecosystem. They can be staked, pooled, or integrated into dashboards with minimal technical friction. COOP points add a governance dimension, creating a shared layer that could connect to external protocols in the future.

Weakness: The lack of formal revenue rights makes integration less attractive for DeFi protocols that rely on predictable cash flows. Stablecoins are composable because they hold value, NFTs because they represent ownership.

For song coins, the utility is cultural and community-driven, which is harder to quantify. Without clearer utility or rights metadata, adoption outside Coop’s own ecosystem may remain limited.

Clear Rules

This is where Coop is strongest. Issuance schedules, vesting timelines, and trading fees are all encoded onchain, making the system transparent and predictable.

Artists know exactly what they are receiving, collectors see the same mechanics across all songs, and governance rules are consistent. This level of rule-based clarity reduces the risk of manipulation and makes it easier for others to trust the system.

Independent Demand

So far, demand has leaned heavily on incentives such as COOP points and token rewards. That bootstraps activity but does not prove staying power. For Coop to graduate into primitive status, collectors must see value in holding song coins without farming rewards.

That could come from fan loyalty, status signaling, or gated experiences tied directly to ownership. If those drivers do not materialize, demand risks fading once incentives cool.

Price Discovery

Uniswap enables transparent price discovery from the moment a coin is minted, which is a clear advantage over opaque streaming royalty systems. Anyone can see the live valuation of a track in real time.

The problem is that thin liquidity makes these prices volatile and easy to distort. Speculative trading may send misleading signals about which songs are genuinely valuable, which in turn could undermine trust in the model.

Verdict

Coop has already proven it can deliver transparency and enforce clear rules, which are essential qualities for any primitive. Where it struggles is in sustaining liquidity, creating independent demand, and reaching composability beyond its own ecosystem.

Until those weaknesses are addressed, song coins remain an intriguing experiment rather than a foundation others can reliably build on.

Who Benefits, Who Risks

Artists

Upside: Coop solves one of the music industry’s biggest pain points by paying artists in ETH instantly. They no longer need to wait months or quarters for royalty checks. On top of that, artists receive a direct allocation of song coins that vest over 90 days, giving them a stake in their own market.

The governance process also allows them to engage fans more directly, since collectors have a say in which tracks get tokenized. In theory, this shortens the feedback loop between releasing music and capturing value.

Risk: If a song coin spikes and then collapses, the artist’s reputation could take a hit. Fans might feel exploited if they bought into a coin at the wrong time.

That pressure could push artists toward “coin-friendly” releases designed to attract speculation rather than authentic creative work. There is also the challenge of explaining the model to mainstream fans, which could alienate listeners who just want music without financial layers.

Fans and Collectors

Upside: For fans, Coop turns passive consumption into active participation. Collectors can earn COOP points that influence future releases, creating a sense of ownership in the label’s direction. Holding coins also gives fans a financial stake in the songs and artists they support, aligning cultural passion with potential upside. For early adopters, there is an appeal in being able to discover and back artists at the very start of their onchain careers.

Risk: The model does not grant collectors direct economic rights like streaming royalties or licensing revenues. Value is instead tied to culture, scarcity, and speculation, which can make it volatile. Fans who treat song coins as investments may be disappointed if prices crash.

This creates a tension: coins need to be valuable enough to matter but not framed as securities. If Coop cannot strike that balance, fans may see coins as risky chips rather than meaningful collectibles.

Coop Records

Upside: Coop captures protocol fees from trading, earns allocations in every release, and strengthens its brand as the first label to fully embrace onchain music primitives.

By curating songs and structuring token mechanics, Coop builds both cultural credibility and financial upside. If the model scales, Coop positions itself not only as a record label but as infrastructure for tokenized music.

Risk: Coop’s current growth depends heavily on incentives, from COOP points to staking rewards. If those incentives fade without strong organic demand, activity may stall.

There is also the operational risk of governance capture: if speculators dominate voting, Coop could lose its ability to curate effectively. And if rights disputes or regulatory pushback emerge, Coop could be forced to slow its release pipeline, weakening its momentum.

The Core Question: Music Market or Points Market?

The big test for Coop is whether it is really building a music economy or just another points game. Right now, both stories are possible, and the signals are mixed.

Signs of Fragility

Points in few hands: If most COOP points sit with a handful of wallets, then governance looks more like speculation than community curation.

Short-lived spikes: Trading that only jumps when there is a new campaign suggests people are chasing rewards, not the music.

Speculator control: If voters are mostly outsiders with no real tie to the artists, then the whole fan-led model breaks down.

Artificial activity: Thin pools make wash trading easy. Inflated numbers could trick artists into thinking their track is hot when it is not.

Signs of Durability

Fans who stick around: If collectors keep showing up for new drops, even when there is no big incentive, that shows the model has staying power.

Use beyond Coop: When song coins start showing up in vaults, playlists, or fan clubs outside the platform, it means they have real utility.

Fees that hold up: A growing share of fees that come from regular trading rather than rewards is a clear sign of health.

Artists committing real work: If bigger artists start putting main projects on Coop, not just side drops, it signals trust in the system.

If the fragile signals dominate, Coop risks being remembered as another farm-and-dump experiment. If the durable ones take root, it could prove that music can support its own onchain market, one where culture and capital grow together instead of pulling in opposite directions.

Rights and Regulation

One of Coop’s smartest choices has been to avoid promising direct revenue shares for each song coin. That keeps it away from looking like a security in the eyes of regulators, which lowers legal risk and allows the model to move faster.

The tradeoff is that without a clear revenue link, it is harder for collectors to anchor value. Coins rely on culture, scarcity, and community utility, not cash flows, which makes them trickier to price and easier to dismiss as speculative.

There is also the issue of rights. Songs are intellectual property, and ownership can be messy. If a track is challenged, flagged, or pulled from streaming platforms, the token tied to it does not disappear.

It still exists and trades onchain, creating a gap between what is legal offchain and what persists onchain. That gap could confuse fans, expose artists to disputes, and discourage other protocols from integrating song coins.

A solution would be standardized, onchain rights data. Clear attestations of who owns what, signed by collaborators, and visible to anyone interacting with the coin would reduce uncertainty.

If every token carried metadata showing license type, splits, and verified authorship, collectors and external builders could trust the asset more. It would not eliminate disputes entirely, but it would raise the bar for transparency and help protect both artists and fans.

Until that layer exists, rights management remains one of the biggest open questions for Coop. The music may be onchain, but the legal world around it is not yet fully aligned.

Stress Points and Fixes

Every new system shows its weak spots early. Coop is no different. If song coins are going to move from experiment to infrastructure, these are the main pressure points and possible fixes.

Liquidity Fragmentation

Right now, each song lives in its own pool. That spreads liquidity thin, which makes most coins hard to trade in size. A few tracks may build depth, but the long tail will always feel shallow.

Possible fixes: bundle songs into artist-level index tokens, create pooled vaults that spread liquidity across multiple tracks, or launch curated baskets where buying one token supports an entire genre or label segment. These tools could give markets more depth and reduce volatility.

Governance Capture

COOP points decide which songs get released as coins. If points end up concentrated in the hands of a few speculators, governance risks becoming detached from real fan support.

Possible fixes: adopt vote-escrowed COOP, where longer locks carry more weight, set quorum requirements so no single wallet can dominate, and add anti-sybil protections to prevent governance farming. This would keep decision-making closer to the community Coop is trying to serve.

Speculation Spikes

Like any token launch, songs can see sharp inflows when campaigns are active, followed by steep drop-offs. These boom-and-bust cycles make the system look more like a farm than a market.

Possible fixes: recycle trading fees into discovery funds for curators, co-marketing budgets for artists, or liquidity insurance that smooths volatility during heavy activity. This keeps the system from relying only on short bursts of speculation.

Fan Onboarding

For most listeners, buying a song coin is still complicated. Wallets, gas fees, and trading interfaces are intimidating. If Coop cannot make entry simple, mainstream fans will stay away.

Possible fixes: enable fiat entry points, abstract wallet management so fans do not need to think about seed phrases, and make the front-end experience worth the 1.5% fee by offering curation, rewards tracking, and social features. The easier it is to participate, the broader the potential audience becomes.

How to Value Song Coins

Song coins are not equities, so they cannot be judged by traditional cash flow models. Their value comes from other sources that tie culture and participation together.

Attention: The more active listeners and collectors a track attracts, the stronger its demand. Attention is the cultural driver that gives coins relevance.

Access: Holding coins may unlock specific perks such as gated content, remix rights, fan club membership, or presale access. The more useful these features are, the more value the coin carries.

Index Role: If coins are included in artist baskets, genre indices, or pooled vaults, they gain baseline demand from those structures. Being part of a larger bundle can stabilize value.

To measure these factors, analysts should look at:

Liquidity depth on both sides of the pool.

Median holding period of collectors.

Share of trading volume driven by incentives versus organic demand.

Number of external smart contracts or apps that hold or use the coin.

Breakdown of artist earnings between coins, collectibles, and fees.

These metrics help separate hype-driven price swings from genuine, sustained value.

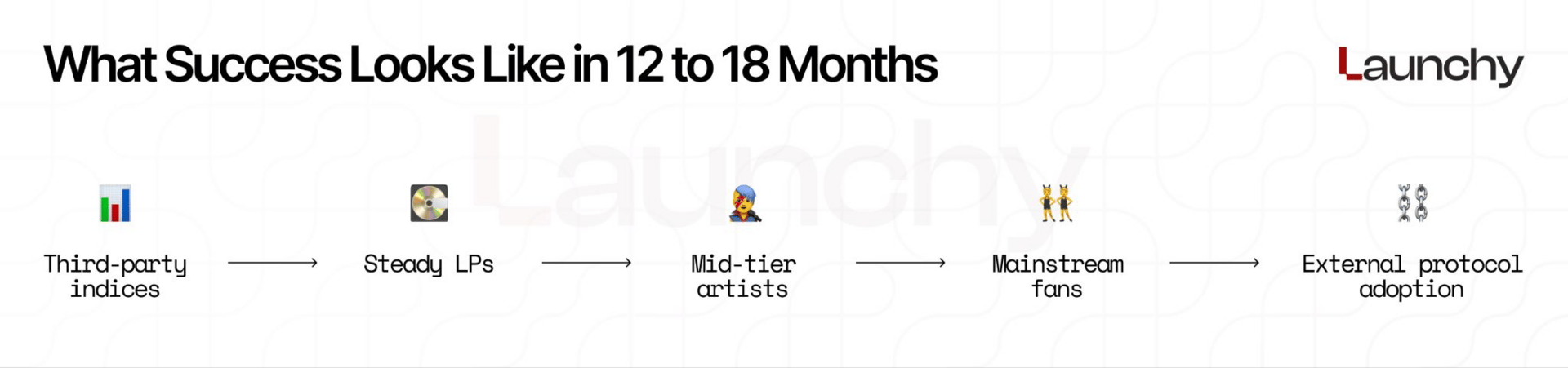

What Success Looks Like in 12 to 18 Months

To judge whether Coop is on track to becoming a real primitive, a few signals would stand out:

At least 25% of song coins included in third-party vaults, indices, or baskets.

Liquidity providers able to earn consistent returns without relying only on rewards.

Mid-tier artists releasing their main projects through Coop, not just experimental tracks.

Evidence of fan adoption outside the crypto-native crowd, with easier onboarding.

At least one external protocol integrating song coins for access, curation, or other utilities.

Scenarios

Bull Case: Song coins take hold as cultural assets. They have stable liquidity, real fan utility, and start appearing in external protocols. Artists see faster payouts and stronger fan relationships, making Coop a core part of their release strategy.

Base Case: Coop sustains itself as a niche platform. Releases continue regularly, but liquidity remains thin and most value comes from collectibles with added governance features. It appeals to crypto-savvy fans but struggles to break out further.

Bear Case: The system becomes dominated by incentives. Governance gets captured, artists lose interest after a few cycles, and external protocols avoid integrating coins. Once rewards fade, activity falls off and song coins are treated as short-lived experiments.

Our Take

Coop Records has made real progress where many Web3 music projects stalled. Instant payouts, transparent mechanics, and a structure that mirrors DeFi are meaningful steps forward. Artists do get paid faster, fans do gain influence, and every track has a live market from day one.

But solving pain points does not automatically make Coop a primitive. Liquidity is fragmented, demand leans heavily on incentives, and the absence of standardized rights leaves major gaps in trust. Without deeper aggregation, clearer fan utility, and reliable rights data, song coins risk looking like speculative collectibles dressed up in DeFi mechanics.

The next year will decide if Coop is building a foundation or just recycling incentive playbooks. If the system hardens, music could finally claim its place alongside stablecoins, NFTs, and perps as a cultural primitive. If not, Coop may be remembered as the most polished attempt yet to financialize music, but still short of proving the model works at scale.

If you enjoy reading this issue, please consider subscribing. It takes 1 minute of your time but it would mean the world to us 🙇

Disclaimer: All the information presented in this publication and its affiliates is strictly for educational purposes only. It should not be construed or taken as financial, legal, investment, or any other form of advice.