Coinbase Buys Cobie’s Echo for $375M

The Death of “Big Bang” TGEs? | Aave Integrates Maple’s Institutional Yield Assets

📢Sponsor | 💡Telegram | 📰Past Editions

Good Morning.

Coinbase just bought Cobie’s onchain investment platform Echo for $375M, adding to its 2025 buying spree that already includes Deribit, LiquiFi, and a $25M UpOnly NFT.

Check out our latest episode with 0G!

In Today's Email:

What Matters: Coinbase Buys Cobie’s Echo for $375M 💰️

Case Study: The Death of “Big Bang” TGEs? 🔎

Governance & Features: Aave Integrates Maple’s Institutional Yield Assets 🍁

You read and share. We listen and improve. Send us feedback at [email protected].

Narratives: Token Launch Fatigue

For daily market updates and airdrop alphas, check out our telegram!

WHAT MATTERS

Coinbase Buys Cobie’s Echo for $375M

State of play: Coinbase has acquired Echo, the onchain private investment platform founded by Jordan “Cobie” Fish, for $375M in a mix of cash and stock, according to the Wall Street Journal.

The deal marks Coinbase’s eighth acquisition of 2025, following purchases of Deribit, LiquiFi, and a $25M NFT that revives Cobie’s crypto podcast UpOnly.

Echo will continue operating independently for now, though Coinbase plans to integrate its token sale product, Sonar, into its ecosystem.

Cobie confirmed the sale on X, saying he “didn’t think Echo would be sold to Coinbase.”

Why it matters: Coinbase’s $375 million Echo buy shows how far the exchange is willing to go to own the onchain narrative

Our take: Coinbase is turning from a neutral platform into a tastemaker, deciding which projects and creators get amplified. It’s smart business, but risks dulling the grassroots spirit that built crypto in the first place.

For builders and investors: Coinbase’s appetite for onchain brands could boost valuations, but it also narrows the field. Builders may gain exposure but lose independence.

CASE STUDY

The Death of “Big Bang” TGEs?

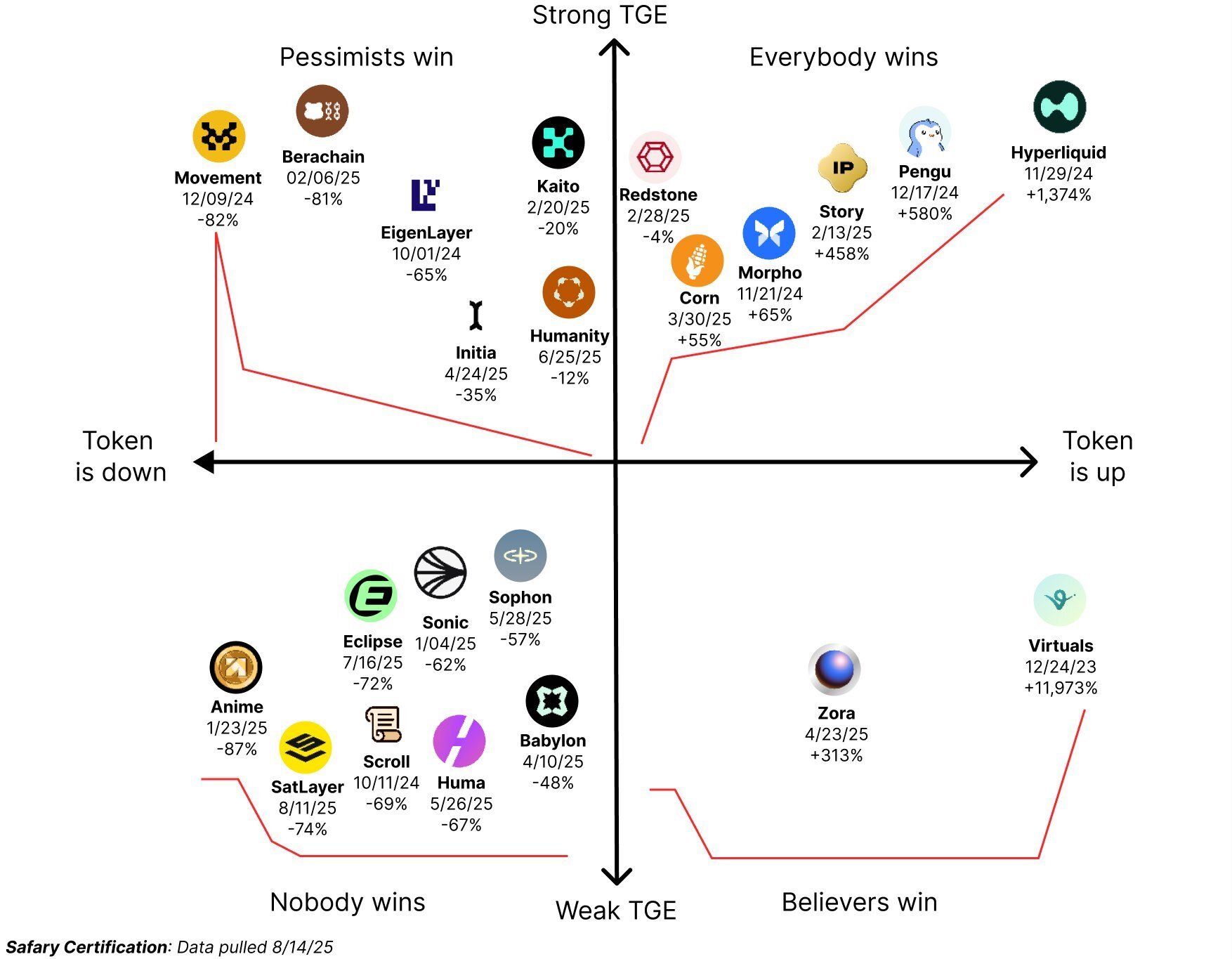

Justin Vogel from Safary claimed that “Big bang TGEs are dead,” arguing that most hyped token launches in the past 18 months crashed within days, while quieter, conviction-led launches like Virtuals or Zora performed better.

His takeaway: protocols should focus on adoption before launching and reward long-term believers.

Haseeb pushed back, saying the analysis is too shallow to prove anything. He noted that many successful tokens came from “strong TGEs,” and that the sample size ignores thousands of weak launches.

For him, “launch small and accrue value over time” isn’t a real strategy, it’s luck dressed as wisdom.

Still, both agree the current market favors fundamentals over frenzy. With liquidity flowing into equities, altcoin TGEs face tougher conditions.

Haseeb’s closing advice: stop treating token price as your scorecard, focus on users and products, and remember that good projects eventually find their moment, just not always right away.

Take a peek at our referral reward at the bottom of this issue. Share this newsletter and receive our list of 500 crypto VC individuals 👇

INSIGHTS

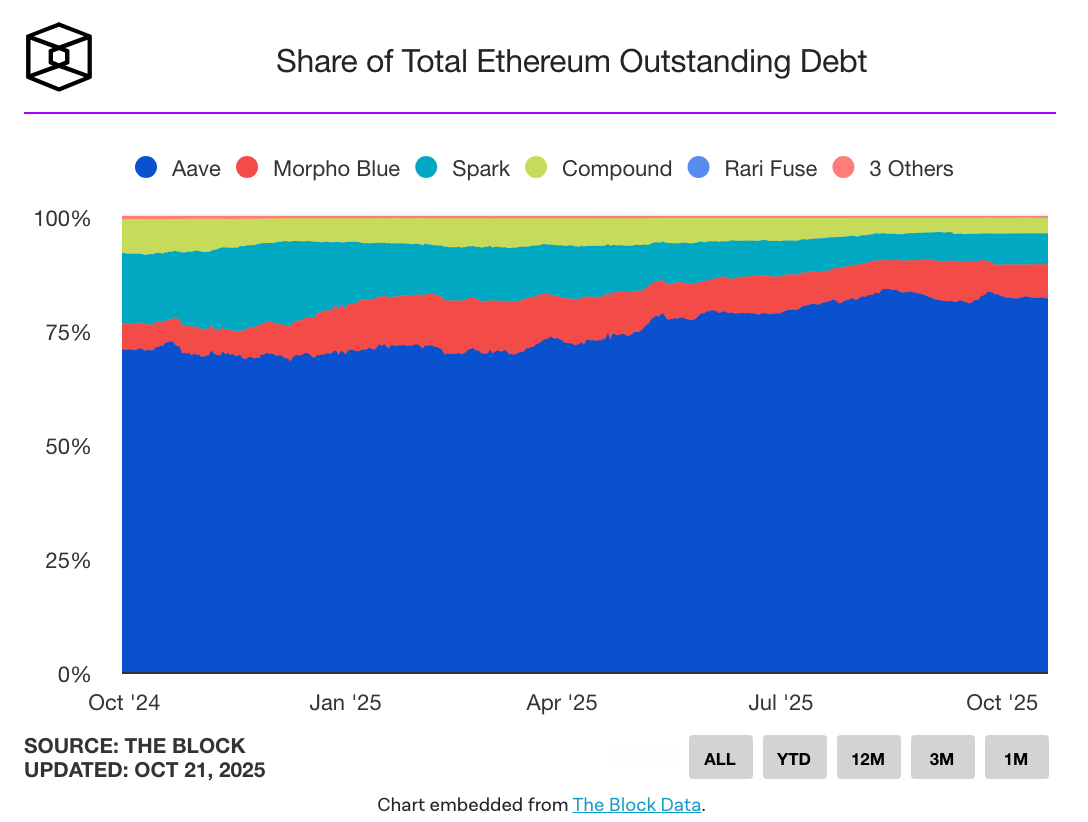

Aave Dominates Ethereum Lending with $25B in Outstanding Loans

Aave has tightened its hold on Ethereum’s lending market, now accounting for 82% of all outstanding debt with nearly $25B in active loans and around 1,000 daily borrowers.

The protocol’s total value locked has reached roughly $50B, underscoring its role as DeFi’s primary money market.

Aave’s dominance highlights a broader trend of consolidation across crypto lending, a “flight to quality” where users prefer protocols with deep liquidity and strong security over newer competitors.

Aave’s advanced features, such as flash loans and efficiency mode, have made it essential for leveraged trading and yield strategies.

FEATURES & GOVERNANCE UPDATE

Aave Integrates Maple’s Institutional Yield Assets

Aave, the largest decentralized lending protocol, is integrating Maple’s institutional-grade, yield-bearing assets into its markets through a new strategic partnership.

The collaboration starts with the launch of Maple’s syrupUSDT token on Aave’s Plasma instance, with plans to expand across core markets.

The move aims to stabilize borrowing demand, improve capital efficiency, and connect Aave’s deep liquidity with Maple’s network of institutional allocators and borrowers.

Aave founder Stani Kulechov said the integration “brings together Maple’s high-quality assets with Aave’s unmatched scale.”

Other notable feature updates:

QUICK BITES

Coinbase is buying Echo for $375M.

Aave now holds $25B in outstanding loans.

Aave to integrate Maple’s yield-bearing assets.

Kadena winds down operations, KDA token drops 60%.

Tether hits 500M users as stablecoin supply nears $182B.

Pump.fun generating $1M daily despite market slowdown.

Hong Kong's first spot Solana ETF starts trading on Oct. 27.

SpaceX moves $270M worth of BTC in first transfer since July.

EF moves $654M in ETH amid online scrutiny of group's transfers.

110-year-old US retail chain Bealls now accepts crypto payments.

Spot BTC ETFs log $477M in positive flows amid softening gold demand.

NOTEWORTHY READS & MEME

HAHAHHAHA😂😂😂

Last one.. time to go to bed

Gn fam

— WIZZ🥷 ( beware scammers ) (@CryptoWizardd)

9:24 PM • Oct 21, 2025

If you enjoy reading this issue, please consider subscribing. It takes 1 minute of your time, but it would mean the world to us 🙇

Disclaimer: All the information presented in this publication and its affiliates is strictly for educational purposes only. It should not be construed or taken as financial, legal, investment, or any other form of advice.