Citadel Urges SEC Crackdown on DeFi

Ostium Raises $24M to Scale RWA Perps | BTC's Next Direction Hinges on Strategy

📢Sponsor | 💡Telegram | 📰Past Editions

Good Morning.

Citadel just kicked off a fight with DeFi. The firm urged the SEC to regulate decentralized protocols like Wall Street exchanges whenever they handle tokenized stocks. Crypto leaders pushed back, saying Citadel is trying to box in open systems to protect its own turf.

Check out our latest episode with Yumi Finance!

In Today's Email:

What Matters: Citadel Urges SEC Crackdown on DeFi 👀

Founders Highlight: Kevin Pang of HumidiFi 👨

Deal Flows: Ostium Raises $24M 💰️

You read and share. We listen and improve. Send us feedback at [email protected].

Narratives: TradFi vs DeFi 2.0

For daily market updates and airdrop alphas, check out our telegram!

TOGETHER WITH

The $ZAMA Public Sale is Here

A fairer way to launch a token. A smarter way to discover price. A sale built for real users, not bots.

Zama is selling up to 10% of the $ZAMA supply through a sealed bid single price Dutch auction on Ethereum, powered by the Zama Protocol. It uses the same auction design as Google’s IPO, now done on-chain with confidential bidding through FHE.

Everyone gets a level playing field. No gas wars. No front running. No pressure to rush your bid. You simply bid what you think the token is worth and the system settles at one fair clearing price.

How it works in three moves:

You shield USDC, USDT or DAI so your real buying power stays private. Shielded funds remain in your wallet but the amounts become encrypted.

You place bids with public prices and private quantities, and you can update or cancel them anytime during the auction.

The protocol computes the clearing price privately through FHE, fills all bids above it, fills bids at the clearing price pro-rata and refunds the rest.

The result is a cleaner distribution, stronger price discovery and a launch that does not tilt toward whales.

Tokens unlock immediately. The auction runs January 12 to January 15 2026 and claims to be open on January 20 2026.

ZAMA powers the Zama Protocol. It pays for encryption and decryption fees, supports staking and delegation and secures FHE coprocessors and KMS nodes. Mainnet is expected by year end, with ZAMA live before the sale.

If you want to join one of the most transparent token launches in crypto, this is your moment.

Get notified at launch: http://auction.zama.org

WHAT MATTERS

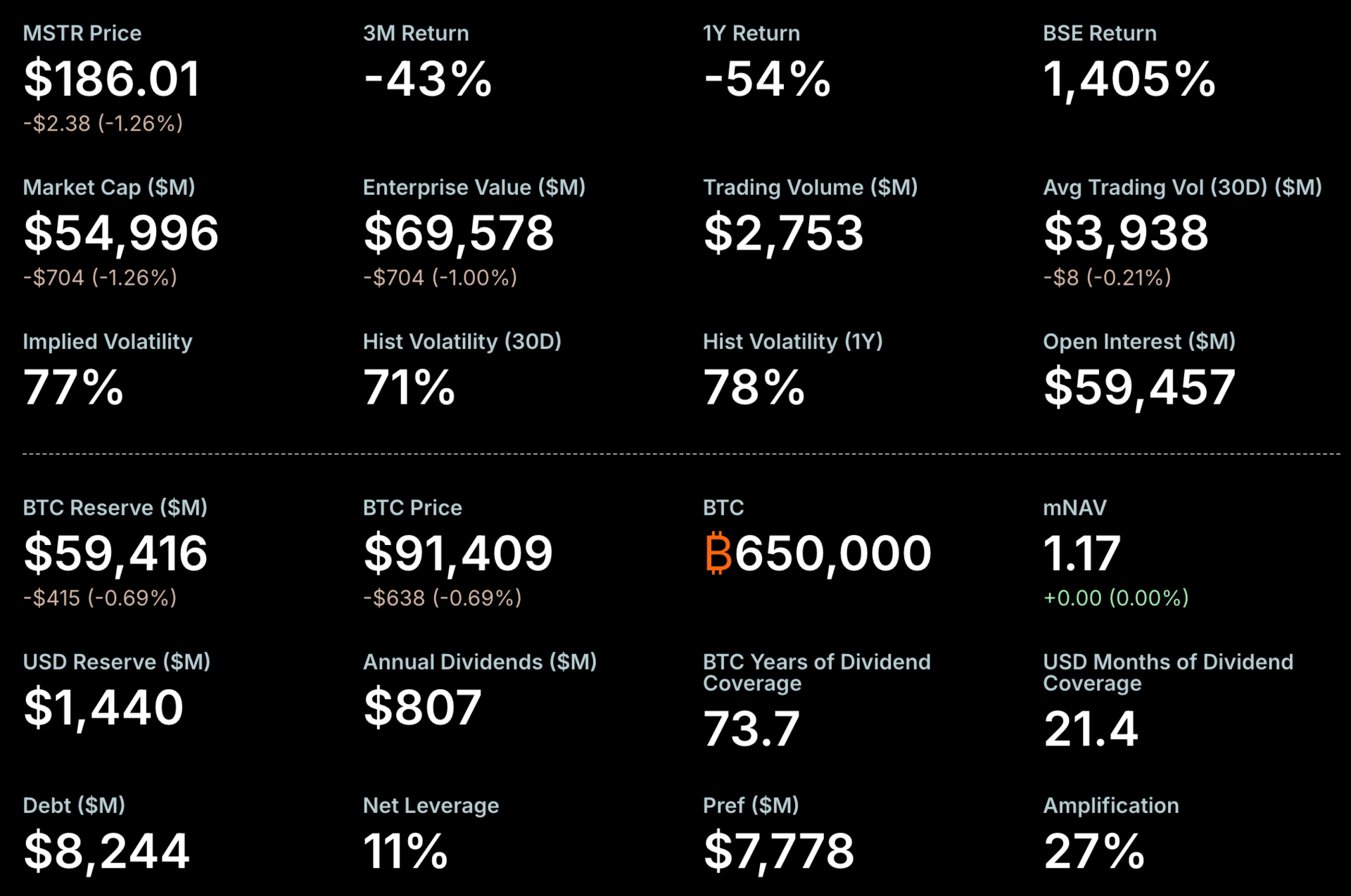

Citadel Urges SEC Crackdown on DeFi

State of play: Citadel Securities sent a letter urging the SEC to regulate DeFi protocols as full exchanges and broker dealers when they handle tokenized US equities.

The firm warned that giving DeFi broad exemptions would create two different rulebooks for the same securities and weaken protections.

The crypto community immediately pushed back:

Uniswap’s Hayden Adams accused Citadel of trying to clamp down on open, peer to peer systems that threaten TradFi market makers.

Blockchain Association CEO said the view is overbroad, unworkable, and ignores the basic difference of software devs and financial intermediaries.

She warned that treating DeFi builders like custodians would hurt US competitiveness and push innovation offshore.

Why it matters: Citadel is basically asking the SEC to pull DeFi into the same rulebook as Wall Street. If the agency bites, it could reshape how tokenized assets trade in the US and add real friction for open protocols.

Our take: This feels like Citadel protecting its turf. DeFi lowers barriers that TradFi relies on, so pushing for tighter rules is a predictable move.

For builders and investors: Stay ready for more scrutiny around tokenization.

BUILDER-INVESTOR HIGHLIGHT

Kevin Pang of HumidiFi

Intro: Kevin Pang is the Founder of HumidiFi, Solana's largest decentralized exchange (DEX) by volume.

Previous background: Prior to HumidiFi, Kevin was the head of trading at Paradigm and a trader at Jump Trading.

The big idea: Kevin’s and HumidiFi’s vision is to make Solana the home of the world’s most efficient, responsive, and transparent markets

Take a peek at our referral reward at the bottom of this issue. Share this newsletter and receive our list of 500 crypto VC individuals 👇

INSIGHTS

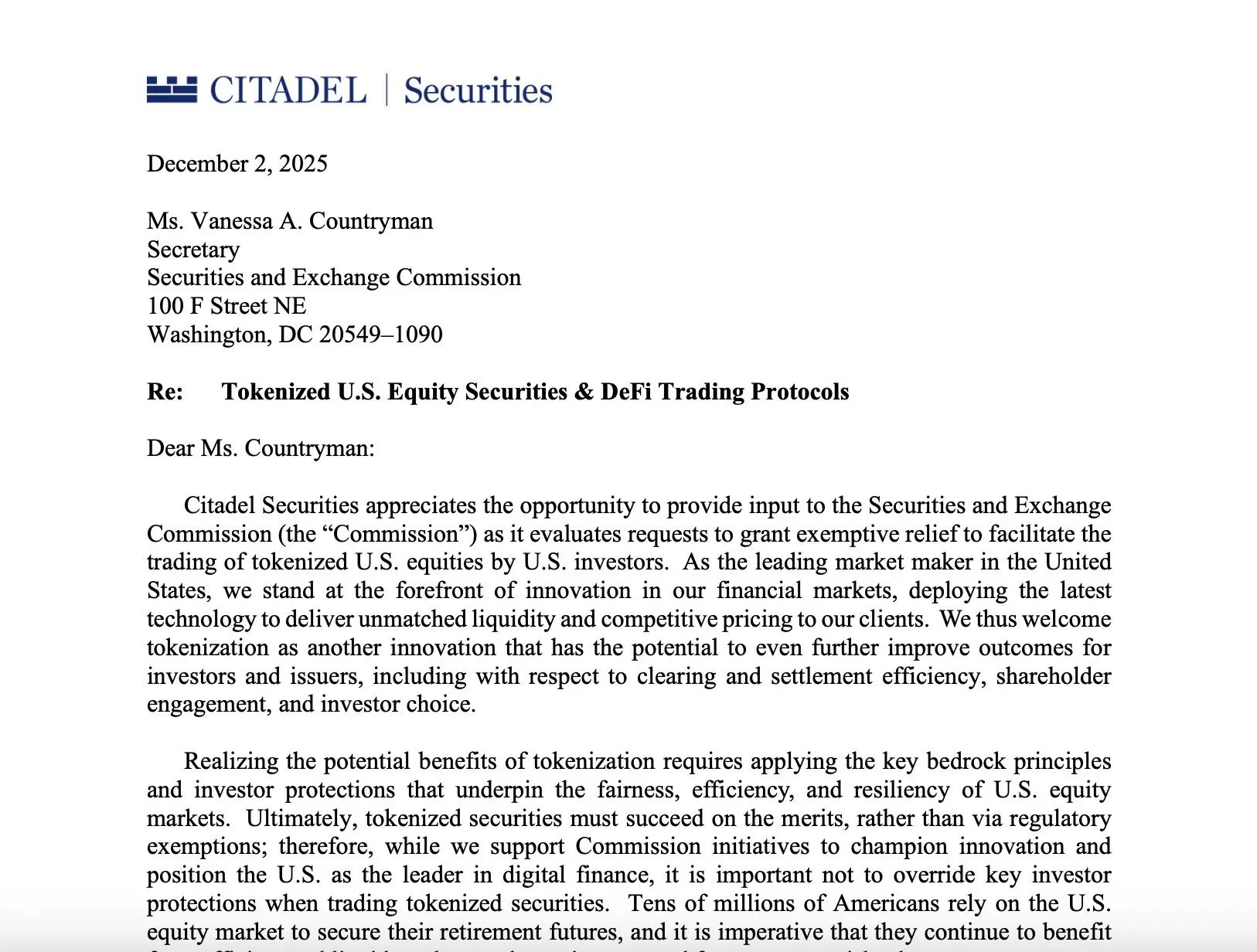

Bitcoin’s Next Direction Hinges on MicroStrategy

Source: Strategy

JPMorgan analysts say MicroStrategy’s ability to stay financially stable without selling its BTC is now the biggest factor shaping BTC’s short term price.

Miner selling pressure is rising as hashrate falls, energy costs stay high, and BTC trades below its production cost, which JPMorgan now estimates at $90K.

Even so, the analysts argue that miners are not the main driver right now.

MicroStrategy’s enterprise value to bitcoin ratio is still above 1, which signals it is unlikely to be forced into selling.

Its new $1.44B cash reserve also covers two years of obligations, further reducing liquidation risk.

Markets are watching whether MSCI removes MicroStrategy from its equity indices.

JPMorgan says the downside is mostly priced in after a 40% share price drop since October.

If MSCI keeps the company in the indices, both MSTR and BTC could rebound sharply.

DEAL FLOWS

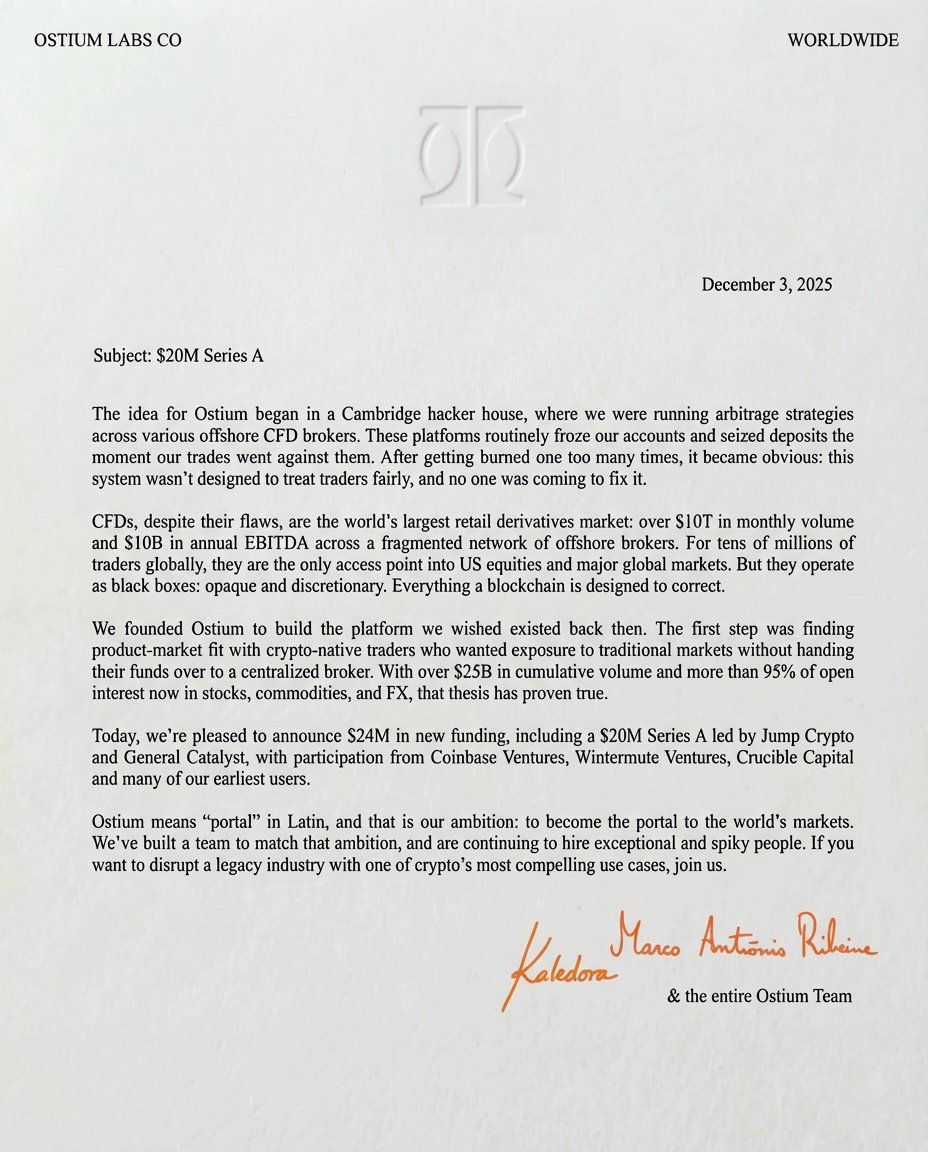

Ostium Raises $24M to Scale RWA Perps

Deal flows soared this week - we saw $150M+ in deals 💼

Ostium, an Arbitrum based exchange for real world asset perpetuals, raised $24M in new funding, including a $20M Series A led by General Catalyst and Jump Crypto. The round values the company at about $250M.

The platform lets users trade perps on stocks, commodities, indices, and FX directly from a self custodial wallet, using off chain liquidity.

Ostium has processed $25B in total volume, with over 95% tied to RWAs.

The new capital will help expand asset coverage and target non US investors who currently rely on offshore brokers.

Deal flows in the past week:

Haiku, $1M Pre-Seed Round

BitStack, $15M Series A

Ostium Labs, $24M Series A

Axis, $5M Strategic Round

Zoo Finance, $10M Strategic Round

Fin, $17M Strategic Round

Portal, $25M Strategic Round

Canton Network, $50M Strategic Round

Reya Network, $3M Public Token Sale

QUICK BITES

Solana Mobile to roll out native token in January.

IMF warns stablecoins may weaken central bank control.

Citadel asks SEC to regulate DeFi protocols as exchanges.

JPMorgan says Strategy's resilience is key to BTC price direction.

Spot Bitcoin ETFs see $195M exit, largest daily outflow in 2 weeks.

Crypto M&A deals hit an all-time high in 2025, blowing past $8.6B.

Italy warns crypto firms to meet year-end MiCA deadline or shut down.

Fusaka rollout kicks off Ethereum’s new twice-a-year hard-fork schedule.

International operation busts crypto fraud network that laundered $815M+.

NOTEWORTHY READS & MEME

If you enjoy reading this issue, please consider subscribing. It takes 1 minute of your time, but it would mean the world to us 🙇

Disclaimer: All the information presented in this publication and its affiliates is strictly for educational purposes only. It should not be construed or taken as financial, legal, investment, or any other form of advice.