Chain Venturer: Mona Tiesler of Tokentus Investment AG

Conversations with a leading German Web3 VC firm.

📢 Sponsor | 💡 Telegram | 📰 Past Editions

Happy Weekend 🙋🏻♂️,

Welcome to Chain Venturer, a series of intriguing conversations with crypto investors. This week, we have Mona Tiesler from Tokentus.

Mona is an Investment Manager at Tokentus, a publicly listed German Web3 venture capital firm that specialises in blockchain-driven investments.

Prior to crypto, Mona began her career at Strategy&, the strategy consulting business unit of PwC. She was also a Managing Director at Crimson Education, an education technology unicorn; and served as the Chief of Staff of Bitwala (Nuri), a crypto-banking startup based in Berlin.

If you would like to participate in a future episode, DM me here.

-Marco

In case you don’t know…

We have a crypto investment syndicate. You can check out our beta site here, but here’s a quick pitch:

💡 Why Us?

Media arm: Newsletter with 15,000 subscribers including interview series with crypto investors that collectively manage $1 billion+

Unique network: We have unique network access to investors, entrepreneurs, and family-office conglomerates in the Southeast Asian markets — which is one of the most promising regions with respect to crypto adoptions.

Operational support: Relationships with a recruiting firm and offshore service providers that can help our portfolio companies scale while minimizing burn.

Anyway, enjoy this week’s conversation.

Again, he doesn’t miss.

Mona Tiesler, Investment Manager at Tokentus

Mona Tiesler is an investment manager at Tokentus Investment AG, a publicly listed German Web3 venture capital firm that specializes in blockchain-driven investments aimed at revolutionizing traditional business models. Their focus is on nurturing growth in pre-seed to Series A companies within the blockchain sector.

Mona began her career at Strategy&, the strategy consulting business unit of PwC, where she worked as a strategy consultant across the technology, media, telecoms, pharma, and healthcare industries.

She was the Managing Director at Crimson Education from 2018 to 2022. Crimson Education is the world's leading US/UK university admissions consultancy. From 2021 to 2022, she served as the Chief of Staff of Bitwala (Nuri), a crypto-banking startup based in Berlin.

Mona is also the co-founder of Timealy, a real-time, fully flexible, UK-based food click-and-collect marketplace. She mentors start-ups as part of the ZKAdvancer Accelerator with Brinc, which is a program focused on global startups in the blockchain and Web3 space.

She is also a part of the oNetwork at Saïd Business School, University of Oxford, oNetwork is a community of highly experienced entrepreneurs, and business and innovation leaders who share their expertise with Oxford Saïd students and alumni in one-to-one, small group, and workshop formats.

Mona earned her degree with honours in Management and Psychology as a double major from the University of St Andrews in 2014 and also holds an MBA from INSEAD.

Here’s my conversation with Mona Tiesler.

Quick takeaways:

Tokentus predominantly invests in the financial services sector within Web3 — the firm also diversifies via fund-of-funds investments.

DeFi credit can provide a bridge between the world of DeFi and the world of real assets.

Blockchain has the potential to create anonymous credential systems, especially in sensitive sectors like healthcare, where data privacy is paramount.

Finding equilibrium between regulation and innovation in crypto is crucial — there needs to be a balance between attracting new institutional capital without stifling the industry’s pioneering spirit.

MiCA framework as a precursor for other jurisdictions, like the UK, to develop a manageable crypto regulatory environment.

The following paragraphs are not verbatim quotes. These are paraphrases of our conversations optimized for written media formats. Some context and nuances might not have been conveyed properly in the process.

The author of this issue is not responsible for any misconstrued statements made in the issue.

All information presented in this publication and its affiliates is strictly for educational purposes only. It should not be construed or taken as financial, legal, investment, or any other form of advice.

IN PARTNERSHIP WITH

Copra Finance

Raising and maintaining liquidity for your protocol isn’t easy. The wrong move might mean disgruntled token holders, excessive dilution of your circulating supply, and other messy problems.

So what can you do? Take a look at Copra Finance, the on-chain bond market for protocol owned liquidity.

Protocols can efficiently and sustainably raise liquidity to promote growth.

Lenders can earn fixed organic yield on their ETH, BTC, and USDC from delta-neutral strategies.

All of this is secured natively onchain!

What was the defining moment that drew you into the world of crypto?

Mona's first encounter with bitcoin was during her university days in Scotland in 2013, from an article titled along the line of "Banking the Unbanked."

Intrigued by the concept, she read about bitcoin and its potential to transform traditional banking. This led her and her peers to organize an academic conference focused on Bitcoin and digital assets.

Although Mona didn't immediately delve into the crypto space post-university, this experience planted the seed of interest in digital assets.

The defining moment: During her MBA at INSEAD, which happened during the pandemic, Mona had time to reflect. This was her second defining moment, recalling her university experience with the article on digital assets in 2013. Post-MBA, she decided to pursue a career in crypto, ideally as an investor. She initially joined Bitwala and then, since January 2022, has been with Tokentus, a Web3 venture capital investor.

What is Tokentus?

Founded in 2019, Tokentus became a publicly listed company on the German Stock Exchange in 2021, deviating from the traditional venture capital fund model.

Tokentus's public listing stems from its backing by a substantial German banking network, with shareholders primarily comprising retail investors and those from the German banking and institutional sectors. Being publicly listed ensures Tokentus is fully compliant and regulated, which is essential given its shareholder base.

Tokentus primarily invests in Web3-related financial services and consumer-facing businesses, such as retail payment solutions.

Tokentus's investment strategy focuses on leveraging Tokentus's network to add significant value to its portfolio companies.

Tokentus aims not just to provide funds but also to create synergies and offer its extensive network to foster growth.

Tokentus predominantly invests in the financial services sector within Web3, steering clear of areas like gaming.

However, they diversify through fund-of-funds investments in entities like Gumi Cryptos, Lightspeed’s Faction, and Hydra Ventures.

Tokentus's investment range typically lies between $100K and $1.5M, focusing on pre-seed to Series A stages.

While they often don't lead investments due to their size, they are regarded as strategic investors, contributing significantly through business development and networking support.

Uniquely, as a publicly listed company, Tokentus operates differently from a typical fund.

They don't have a set fund size, and their share price fluctuates, likening their structure more to a token-based system than a conventional fund. This open-ended approach allows them distinct flexibility in their operations and investments.

What sectors are you and Tokentus most excited about these days?

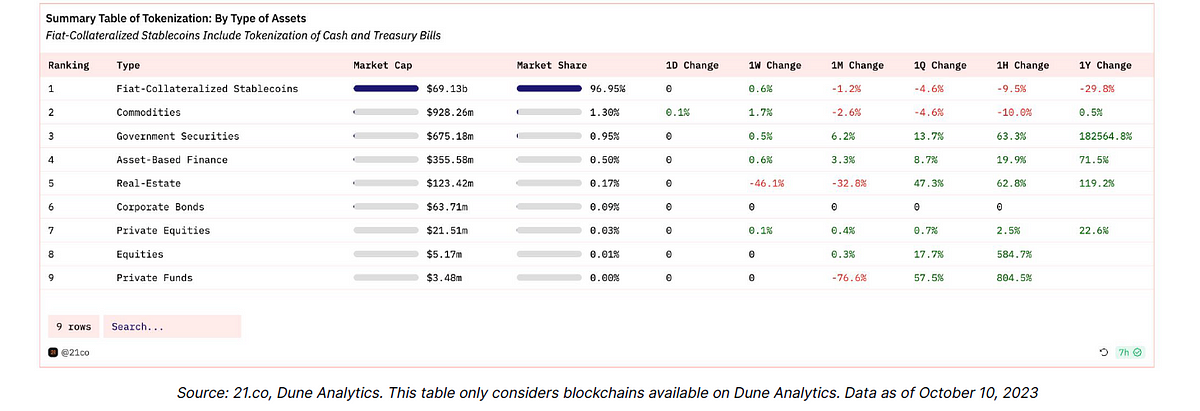

Tokentus is actively exploring several promising areas in the current market. For example, the tokenization of real-world assets. Tokentus also invests in companies developing a Web3 equivalent of the Swift Money Transfer Network. This initiative aims to serve as a backbone infrastructure for banks, potentially bridging gaps and enhancing liquidity in the Web3 space, despite some regulatory challenges.

Read more about Mona’s thoughts on RWA here:

Additionally, Tokentus is delving into DeFi credit, as Tokentus recognises its potential to revolutionize various aspects of the financial services sector.

Combining RWA with DeFi credit allows borrowers to use their existing real-world assets as collateral for DeFi loans. This increases capital efficiency in two ways. First, it doesn't necessitate overcollateralization on-chain, and second, it diversifies the capital. DeFi credit can provide a bridge between the world of DeFi and the world of real assets.

By tokenizing assets and placing them on the blockchain, investors can leverage their assets to access all that DeFi has to offer without having to sell something and convert the proceeds to crypto.

Once there are clear regulatory standards in place, it could unlock a wave of institutional capital into DeFi credit services.

Furthermore, Mona is particularly interested in the impact of these innovations on emerging markets.

Mona believes in providing equal access to financial opportunities globally, especially in terms of cross-border payments and the availability of financial products to anyone with an internet connection.

Mona sees the crypto space, including bitcoin, as a powerful enabler in this regard, offering new possibilities for financial inclusion and empowerment worldwide.

How can the crypto industry achieve a balance between integrating with real-world assets and maintaining privacy? What does the future hold for privacy in the cryptocurrency space?

Mona observes that blockchain technology, known for its immutability, transparency, and accountability, is a crucial tool for unveiling obscured data processes, like those in banking and data management.

This transparency is vital in combating fraud and ensuring transactional integrity.

However, Mona points out the inherent dilemma of too much transparency, especially when blockchain stores personal or sensitive data.

With Europe's GDPR and other data regulations, the challenge is to leverage blockchain's positives while addressing privacy concerns. To this end, privacy-centric technologies, like fully homomorphic encryption and zero-knowledge proofs, which allow for the validation of transactions without exposing all details, could work in preventing data breaches or double-spending attacks.

Mona also touches on blockchain's potential for creating anonymous credential systems, especially in sensitive sectors like healthcare, where patient data privacy is paramount.

Yet, she expresses reservations about the current state of ZK KYC technologies, questioning their adequacy for regulated traditional finance players. Despite rapid industry developments, she believes these technologies are not yet fully understood, generating hesitation in their broad-scale implementation.

Regarding real-world asset tokenization, Mona acknowledges regulatory uncertainties and the scarcity of large-scale successful pilot projects.

She believes, however, that tokenized real-world assets will play a critical role in shaping the future of finance, citing interests in sustainable yields, transparent investment sources, and new revenue opportunities for financial service providers. Mona references a report that predicts that the tokenized asset market could exceed $10T by 2030, indicating substantial growth potential.

Finally, Mona emphasizes the need for a balance between regulated opportunities and innovation in the blockchain space. While an unregulated environment fosters innovation and wider access, it also attracts negative elements. Finding this equilibrium, she asserts, is crucial for injecting liquidity into the cryptocurrency market without stifling its pioneering spirit.

Read more about Mona’s thoughts on data privacy in blockchain here:

How is the excitement around US ETFs influencing the crypto landscape in Europe?

Mona observes that the recent excitement around US ETFs, especially in October, has significantly influenced the crypto landscape. This anticipation for regulatory developments, such as the potential approval of a spot Bitcoin ETF, is attracting substantial institutional interest.

She notes the dramatic appreciation of Bitcoin's value, both month-over-month and year-to-date, underscoring the market's keen focus on the ETF movement. This interest, according to Mona, is likely to bring in more investment from professional investors beyond the traditional Bitcoin community, creating upward price pressure due to Bitcoin's scarcity and the predominant 'hodling' behavior of its holders.

The approval of a Bitcoin ETF could elevate Bitcoin to an institutional-grade asset, integrating it more closely with mainstream financial markets.

In Europe, the MiCA (Markets in Crypto-Assets) framework offers a regulatory starting point, primarily focusing on stablecoins. She sees this as a positive step towards regulated crypto asset offerings in Europe and potentially beyond.

Mona expresses optimism about the crypto market's future in Europe, viewing the MiCA framework as a precursor for other jurisdictions like the UK to develop a manageable crypto regulatory environment.

Such regulatory clarity, she believes, could lead to increased liquidity and growth in the crypto market. Overall, Mona is bullish about the positive movements in the crypto space and the potential for further market expansion.

Rapid Fire Questions

What's one piece of content every aspiring investment professional should read/watch

Fooled by Randomness: The Hidden Role of Chance in Life and in the Markets - Nassim Nicholas Taleb.

The Intelligent Investor - Benjamin Graham

What’s your biggest investment mistake?

Celcius.

What’s the most underrated use case of crypto?

NFTs, but not necessarily in the digital art PFP way.

What’s your most contrarian view in crypto right now?

We are not in a real bull market yet.

What’s the biggest risk that the crypto space is facing?

Regulatory.

If you enjoy reading this issue, please consider subscribing. It takes 1 minute of your time but it would mean the world to us 🙇

Disclaimer: All the information presented in this publication and its affiliates is strictly for educational purposes only. It should not be construed or taken as financial, legal, investment, or any other form of advice.