Chain Venturer: Rain&coffee of Maven 11 Capital

Modularity and the future of blockchain infrastructure.

📢 Sponsor | 💡 Telegram | 📰 Past Editions

Happy Weekend 🙋🏻♂️,

Welcome to Chain Venturer, a series of intriguing conversations with crypto investors. For this week’s issue, we have Mads Mathiesen aka Rain&Coffee from Maven 11 Capital.

Rain is a researcher of Maven 11 venture, a leading crypto investment firm out of Europe.

Started in 2017, the firm was one of the earliest crypto-focused investment funds to be registered in Europe. Since then, the firm has evolved into the M11 Group, encompassing numerous services including multiple VC funds, credit pools, and asset management services.

I’m particularly excited about this one. Rain is a researcher like myself, although he’s significantly more entrenched in the blockchain infrastructure and scaling intellectual discussion around modularity vs monolithic.

If that sounds smart and important, trust your instinct.

If you would like to participate in a future episode, DM me here.

-Marco

Quick announcement: Launchy is launching (*ba dum tss*) a crypto investment syndicate.

The landing page will be released in a few weeks, but here are some quick facts:

💡 Why Us?

Media arm: Newsletter with 15,000 subscribers including interview series with crypto investors that collectively manage $1 billion+

Unique network: We have unique network access to investors, entrepreneurs, and family-office conglomerates in the Southeast Asian markets — which is one of the most promising regions with respect to crypto adoptions.

Operational support: Relationships with a recruiting firm and offshore service providers that can help our portfolio companies scale while minimizing burn.

We’re sector-agnostic and will invest in angel, pre-seed, and seed rounds. If you know anybody who’s raising, feel free to reply to this email or send a message to [email protected]. Cheers 🍻

Anyway, enjoy this week’s conversation.

Oh, Jason.

Humility and not taking credit is what he’s known for after all

— VCs Congratulating Themselves 👏👏👏 (@VCBrags)

4:48 PM • Nov 3, 2023

Rain&coffee, Head of Research of Maven 11’s Venture Team

Mads Mathiesen (aka rain&coffee) is the Head of Research at Maven 11’s venture team. Maven 11 is a pioneering crypto investment firm based in Amsterdam, Netherlands, which stands as one of the initial entrants in the European crypto investment space.

He joined the Maven 11 team in early 2022 and is currently responsible for Maven 11 research on technical infrastructure research and public-facing theses.

Having spent five years in Asia, Rain is fluent in both Chinese and Korean. He has conducted extensive research in various blockchain technologies, focusing particularly on Rollups, Zero-Knowledge, and MEV.

His academic journey includes studying Chinese at the University of Copenhagen in 2016, followed by an exchange program at Tsinghua University in 2018, where he explored topics like Sociology, Microeconomics, and International Development.

He also authors a newsletter called “The Depths,” which delves into emerging trends and developments in crypto and blockchain technologies.

Here’s my conversation with Mads.

Quick takeaways:

Monolithic blockchains’ one-size-fits-all nature imposes limitations, whereas Modular systems provide flexibility, allowing for specialization and customization tailored to specific applications.

Large-scale applications with specific alignment and optimization needs for a mature user base will see the opportunities and justifications for adopting modular solutions.

dApps should go through a phased approach, starting on a monolithic chain and gradually moving towards more modular solutions as they grow and their needs evolve.

Moving to an appchain could lead to a fairer distribution of value and better align the interests of everyone involved.

Although technical innovation is important, the power of marketing and community engagement in crypto is often underestimated for the success of a project.

The following paragraphs are not verbatim quotes. These are paraphrases of our conversations optimized for written media format. Some context and nuances might have not been conveyed properly in the process.

The author of this issue is not responsible for any misconstrued statements made in the issue.

All information presented in this publication and its affiliates is strictly for educational purposes only. It should not be construed or taken as financial, legal, investment, or any other form of advice.

IN PARTNERSHIP WITH

Raremints

Bear markets are the best time to find your next 10x crypto opportunity.

Subscribe to RAREMINTS to get daily Web3 insights straight to your inbox and stay ahead of the curve, for free.

Join 10,000+ investors and builders from Binance, KuCoin, Animoca Brands, and more 👇

What was the defining moment that drew you into the world of crypto?

Rain stumbled upon Bitcoin in 2013 during a casual browsing session on Reddit back in high school. The cypherpunk essence and the lively community on Bitcoin talk forums caught his eye, but it wasn’t until 2014-2015 that he dove headlong into exploring the crypto space.

As time passed, Rain found himself immersed in crypto, to the point where he almost traded his college education for a self-taught journey. Unlike many contemporaries hailing from prestigious university backgrounds in economics or computer science, Rain carved out a unique path that birthed a distinctive crypto viewpoint.

Rain holds the crypto industry's inclusivity in high regard, cherishing the emphasis on public work output over formal qualifications. His active online engagement and writing have become his key credentials.

One defining moment: Rain used Bitcoin for real-world transactions on the Just Eat food delivery app in Denmark around 2013-2014. This practical use of cryptocurrency during his high school days was one of the defining moments that drew him into the world of crypto.

What is Maven 11 Capital?

Established in 2015, Maven 11 stands as one of the more seasoned funds within the crypto landscape. Initially, the fund resembled a hedge fund, channeling investments into Bitcoin, Ethereum, early layer-one solutions, and Bitcoin mining ventures (as venture-backable sectors were scant back then). The fund was also primarily catered to affluent individuals in the Netherlands and across Europe.

Overall, Maven 11 encompasses various business lines, including a credit team specializing in underwriting under-collateralized loans, a liquid investment division, and a quant group engaged in market-making within their DeFi portfolio.

Fast forward to 2019, the venture capital sphere within crypto began to blossom, introducing a plethora of investment opportunities in emerging technologies such as Solana, Avax, and Celestia. Maven 11 seized this moment to articulate a clear investment thesis, emphasizing a belief in modular architecture. This philosophy was exemplified by their early investment in Celestia in 2019, setting the stage for their subsequent focus.

What sectors of investments are Maven 11 particularly interested in?

Rain, serving as the Head of Research of the venture team, contributes through in-depth technical infrastructure research and public-facing theses.

On the venture side, Maven 11 concentrates on infrastructure investments, but the firm retains its DeFi and RWA activities across the wider Maven 11 group, especially under the credit and liquid teams.

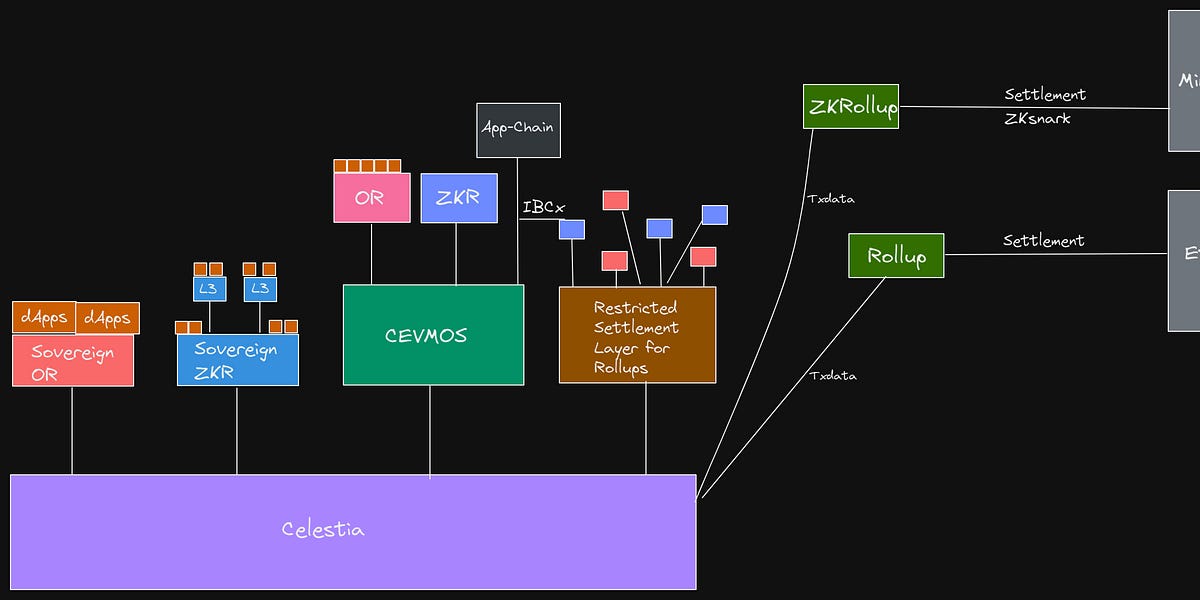

Maven 11 venture has a strong modular thesis, ranging from rollups and specialized layers for data availability (e.g., Celestia) to settlement solutions (e.g., Astria) and rollup SDKs (e.g., Sovereign Labs). The firm also explores unique applications of modularity, such as off-chain compute solutions.

Maven 11 places a significant emphasis on genuine modularity, ensuring that the term is not just a buzzword but a crucial aspect of project development. The team seeks projects that leverage a modular architecture to enhance functionality, not just those that claim to have a modular component.

The aim is to find innovations that utilize modularity out of necessity, leading to customizable and specialized solutions. For Maven 11, it is this thoughtful and effective application of modularity that makes a project genuinely compelling and worth the investment.

Here’s one of Rain’s write-ups that goes deeper into explaining the modular thesis:

What are your thoughts on the modular vs monolithic blockchain debate?

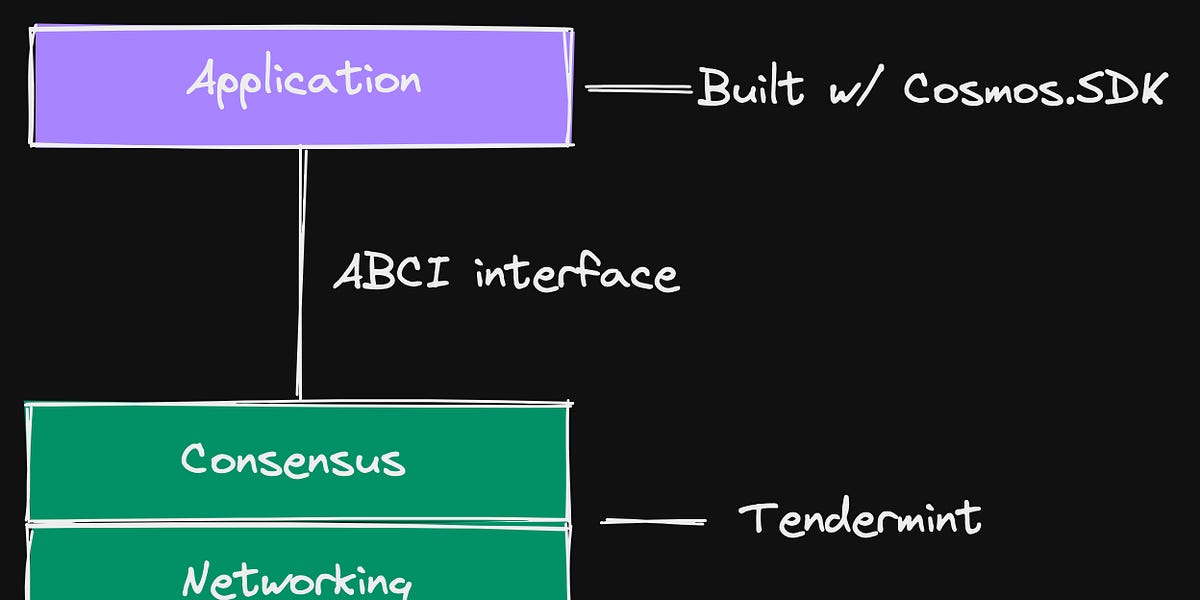

Rain emphasized the strengths of adopting a modular blockchain approach, contrasting it with the monolithic structures of Ethereum and Solana.

He highlighted that while Ethereum and Solana have unique qualities, their one-size-fits-all nature imposes limitations.

Modular systems, on the other hand, provide flexibility, allowing for specialization and customization tailored to specific applications, like decentralized exchanges.

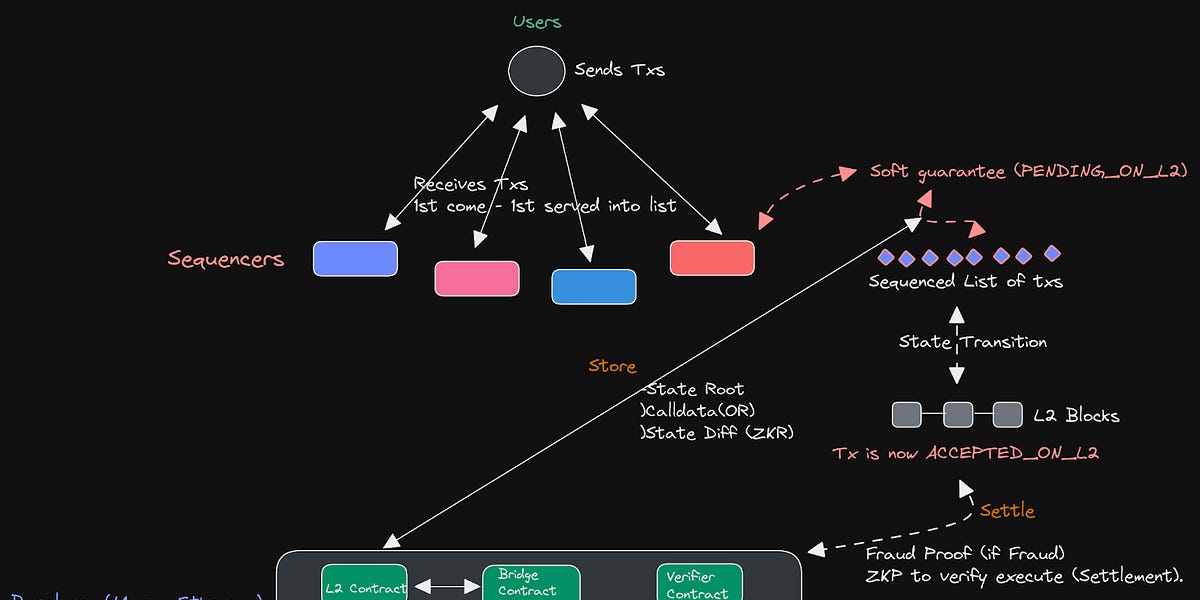

He illustrated these benefits by pointing to rollups, a Layer 2 scaling solution, emphasizing their capacity for improved execution and fair transaction ordering. He noted that modular architectures allow for innovations such as verifiable sequencing rules, ensuring favorable trading conditions within blocks.

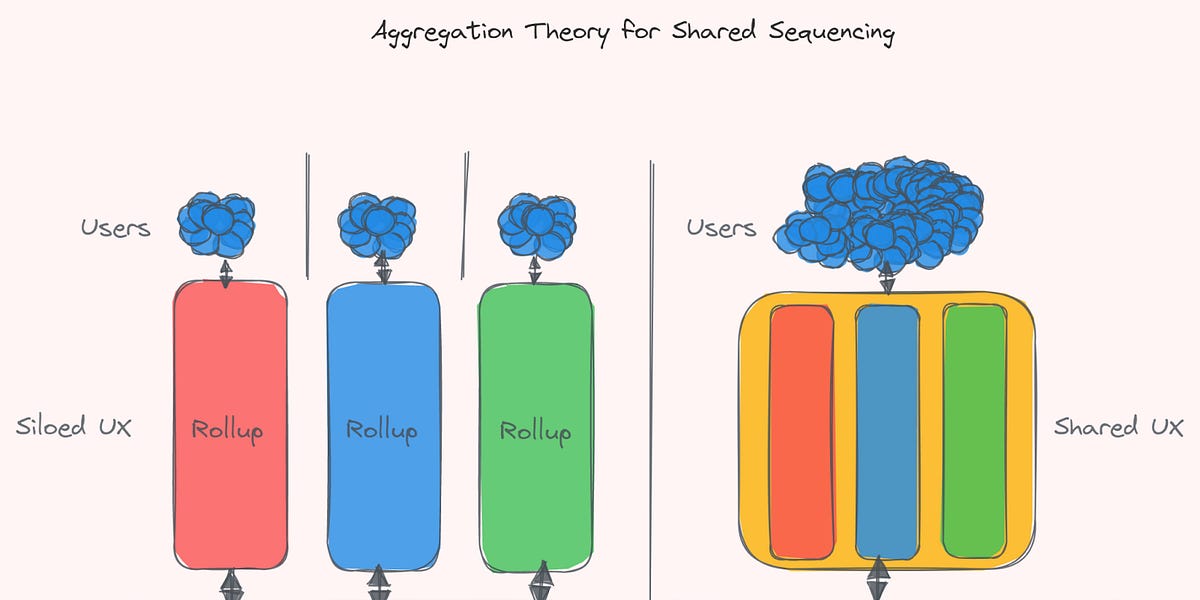

Our conversation also touched upon the evolving blockchain architecture, specifically the proposal builder separation in Ethereum and the concept of shared sequencing.

He drew parallels between a well-functioning blockchain ecosystem and a well-managed company, stressing the importance of optimized delegation and verification processes.

Rain further highlighted the scalability and decentralization potential of modular architectures, particularly mentioning data availability sampling as seen in the Celestia blockchain. He underscored that such an approach supports adding more nodes to the system, maintaining decentralization while scaling.

Here’s one of Rain’s write-ups that goes deeper into explaining shared sequencer:

How do you see this affecting liquidity fragmentation across different blockchains?

Rain highlights several challenges associated with the fragmentation of state, liquidity, and fees in modular blockchains, where functions are distributed across different layers or chains.

He emphasizes the benefits of monolithic blockchains like Ethereum and Solana, which offer atomic composability and global state settlements, providing a clear and consistent view of the current state to all participants.

However, he also acknowledges the potential of modular solutions, such as storage proofs, off-chain computation, and shared sequencing, to address these challenges, albeit with trade-offs in terms of operational complexity and reliance on infrastructure providers.

Rain also suggests a phased approach for applications, starting on a monolithic chain and gradually moving towards more modular solutions as it grows and its needs evolve.

He cautioned that most current chains, especially within the Cosmos ecosystem, may not be sufficiently large or mature to operate as independent appchains, highlighting the substantial costs and security challenges associated with this model.

He concludes by suggesting that as the user base and application ecosystem mature, there will be more opportunities and justifications for adopting modular solutions, particularly for large-scale applications with specific alignment and optimization needs.

Here’s one of Rain’s write-ups that goes deeper into explaining the appchain thesis:

Should new blockchain projects initially build on an established chain that aligns with their objectives and gradually transition to their appchain as they expand and develop?

When a new blockchain project starts, it's important to think about what it needs to succeed.

For example, gaming applications with a lot of on-chain actions might find Ethereum too expensive and not scalable enough. On the other hand, DeFi applications that need specific liquidity pools or financial tools would do well on Ethereum because everything they need is right there.

Being on Ethereum helps some applications, especially in DeFi, operate quickly and securely, which is crucial. However, as a project grows, it might make more sense to move to its appchain. This move can give the project more control and the ability to capture more value, especially in fees.

Take Uniswap as an example. It has a lot of liquidity and transactions, but Ethereum validators capture a significant portion of the value in MEV. This situation might not be the best for Uniswap or its liquidity providers.

Moving to an appchain could lead to a fairer distribution of value and better align the interests of everyone involved.

In summary, starting on an established chain like Ethereum gives immediate access to resources, but as a project grows, moving to an appchain can provide more control and benefits.

Here’s one of Rain’s write-ups that goes deeper into explaining MEV:

Rapid Fire Questions

What’s one book that any aspiring investment professional should read?

To delve into blockchain research and gain a technical understanding, Tim Roughgarden from a16z offers valuable insights through his extensive lectures and writings.

What’s your biggest investment mistake?

(On his personal investment) Biased towards technical innovation over the power of memetics or the vital roles of marketing and community engagement in crypto.

What’s the most underrated use case of crypto?

Provenance is a very powerful aspect of blockchains that people often forget and Zero-Knowledge Proofs (ZKPs) have the power to transform not just things we're doing in crypto, but even within traditional companies and traditional industries.

What’s your most contrarian view in crypto right now?

A merge of modular and monolithic infrastructure could be super powerful.

What’s the biggest risk that the crypto space is facing?

Attacks from regulators and state governments.

If you enjoy reading this issue, please consider subscribing. It takes 1 minute of your time but it would mean the world to us 🙇

Disclaimer: All the information presented in this publication and its affiliates is strictly for educational purposes only. It should not be construed or taken as financial, legal, investment, or any other form of advice.