Cantor SPAC’s $4B Bitcoin Deal

TAC Brings DeFi to Telegram | Pump Sets Sights on Replacing Twitch

📢Sponsor | 💡Telegram | 📰Past Editions

Good Morning.

Bitcoin nears record highs while institutions grab billions in BTC and ETH. Platforms like Pump turn livestreaming into tradable assets. Regulators and banks are stepping in. This is what an industry maturing and mutating at full speed looks like.

In Today's Email:

What Matters: Cantor SPAC’s $4B Bitcoin Deal 👀

Case Study: Pump Sets Sights on Replacing Twitch 🔎

Governance & Features: TAC Brings DeFi to Telegram 🚀

You read and share. We listen and improve. Send us feedback at [email protected].

Narratives: Institutions are all in

For daily market updates and airdrop alphas, check out our telegram!

WHAT MATTERS

Cantor SPAC’s $4B Bitcoin Deal

IMG: Bitcoin Magazine

State of play: Cantor Fitzgerald’s SPAC, Cantor Equity Partners, is in late-stage negotiations to acquire $3–$4B worth of Bitcoin from Adam Back, a Bitcoin pioneer and Blockstream CEO, according to the Financial Times.

The SPAC, which raised $200M in January, is set to complete its largest Bitcoin deal yet after smaller May transactions with Maple Finance and FalconX.

This move coincides with Bitcoin trading near record highs around $116,000.

Leadership at Cantor recently transitioned from Howard Lutnick, now US Secretary of Commerce, to his sons Brandon and Kyle Lutnick.

Why it matters: This would be one of the largest single Bitcoin acquisitions by a public market vehicle, signaling that institutional players are still aggressively accumulating despite record-high prices.

Our take: Cantor’s move suggests deep confidence that Bitcoin’s momentum will continue and highlights growing regulatory comfort with large-scale on-balance-sheet crypto holdings.

For builders and investors: Expect more large vehicles to mirror this strategy, especially as public-market mechanisms like SPACs provide faster paths to scale exposure.

CASE STUDY

Pump Sets Sights on Replacing Twitch

the moment you’ve all been waiting for

$PUMP is launching through an Initial Coin Offering on Saturday, July 12th.

airdrop coming soon.

our plan is to Kill Facebook, TikTok, and Twitch. On Solana.

learn more about $PUMP and how to get involved 👇

— pump.fun (@pumpdotfun)

2:01 PM • Jul 9, 2025

Pump.fun raised $600M in just 12 minutes through its ICO, selling 125B tokens at a $4B valuation. But beyond the record-setting fundraising, Pump’s core ambition is to “kill Facebook, TikTok, and Twitch” by merging social media with onchain trading.

The platform already generates significant revenue, with $786M since January 2024, and plans to share 25% of it with token holders.

Its strategy focuses on Solana-based livestreaming, which returned in April after being removed last year.

In this system, creators can earn a portion of all trading fees from tokens linked to their streams, providing a new way for influencers to monetize their audiences.

Pump believes this model, where communities speculate directly on creators, will unlock a new era of social media that is both participatory and profit-driven.

If successful, it could transform livestreaming into a trading ecosystem rather than just a content business.

Take a peek at our referral reward at the bottom of this issue. Share this newsletter and receive our list of 500 crypto VC individuals 👇

INSIGHTS

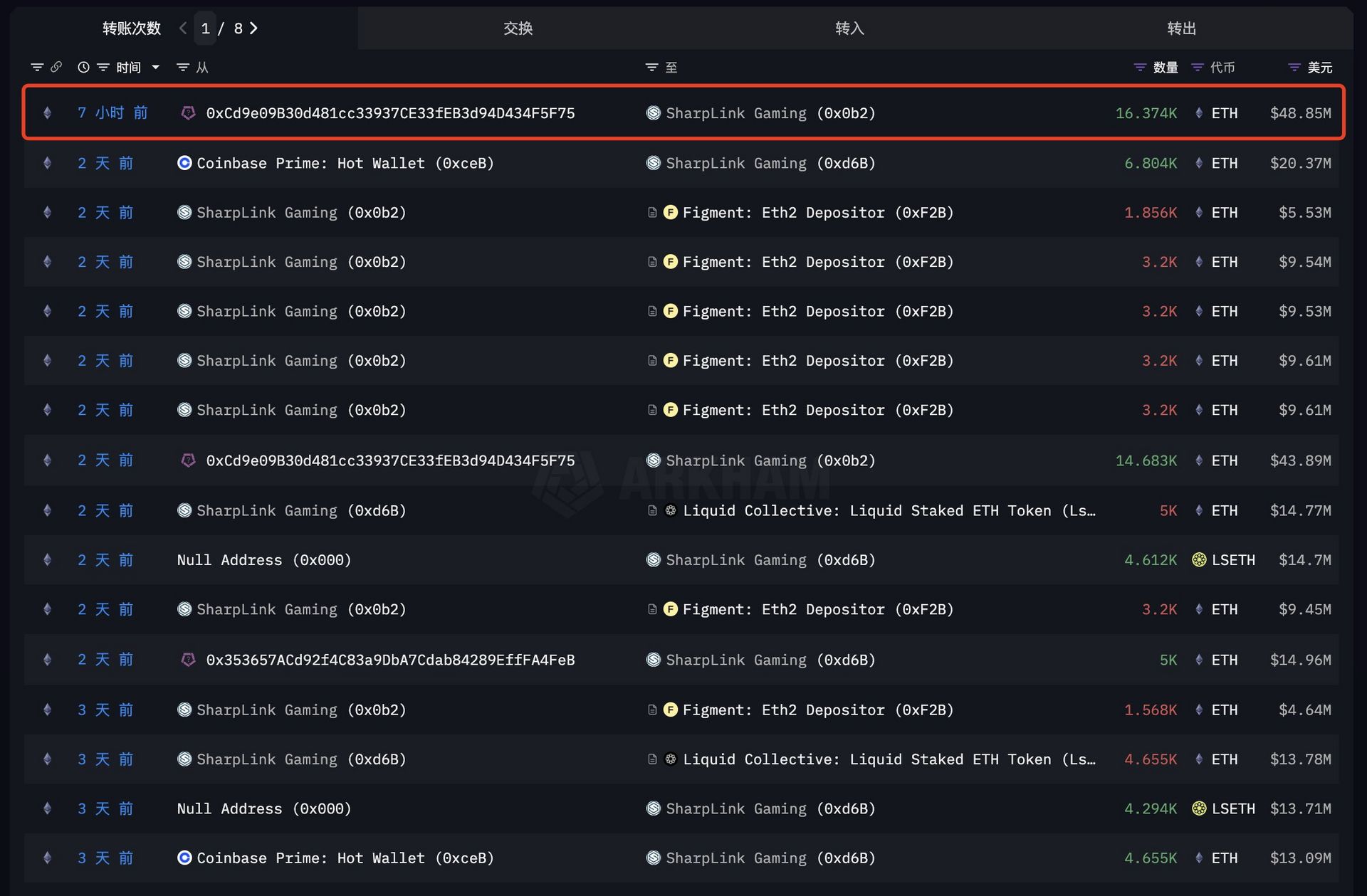

Source: Arkham

SharpLink Gaming has become the largest corporate holder of Ether after buying 74,656 ETH for $156M, bringing its total treasury to 280,706 ETH worth about $858M.

This surpasses the Ethereum Foundation’s holdings.

The Nasdaq-listed firm funded the purchases through an at-the-market share sale that raised $413M, with $257M still available for more acquisitions.

Since adopting ETH as its primary reserve asset, SharpLink has staked nearly all its holdings and earned 415 ETH in rewards.

FEATURES & GOVERNANCE UPDATE

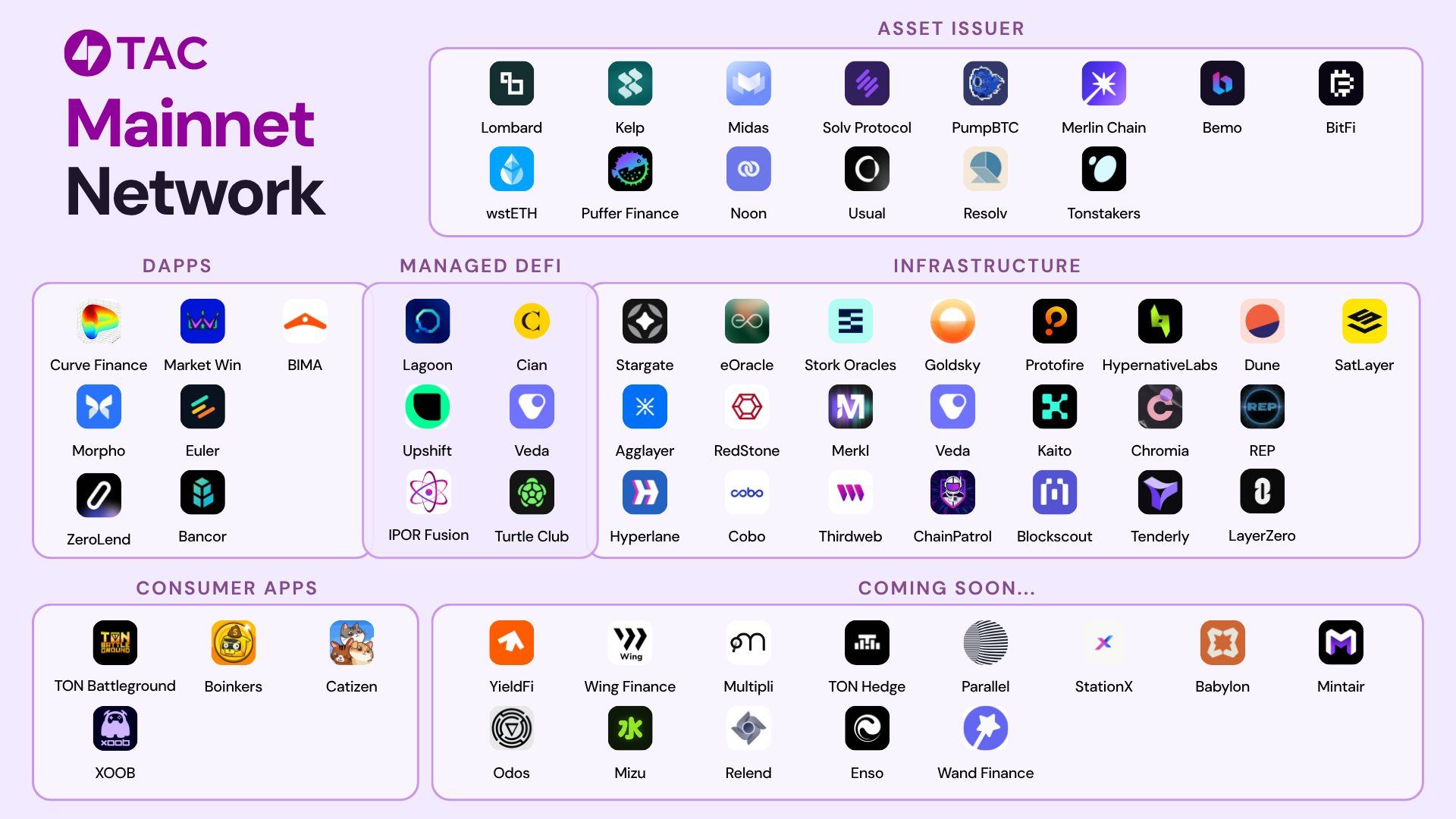

TAC Brings DeFi to Telegram

TAC has launched its public mainnet to connect Ethereum DeFi protocols like Curve, Morpho, Bancor, ZeroLend, and Euler with The Open Network (TON) and Telegram’s billion-user ecosystem.

Developers can now deploy dApps directly onto TAC.

This launch is aiming to make DeFi accessible within Telegram mini-apps.

Backed by $11.5M in funding and supported by The Open Platform, TAC plans to merge Ethereum composability with TON’s growing user base (40M AU).

Other notable feature updates:

Maple Finance is joining Converge.

Sky has integrated with Alchemy Pay.

Phantom has launched Phantom Perps.

MetaMask Mobile now supports Solana.

Etherscan has launched HyperEvmScan.

Aevo has launched the Aevo Degen PWA.

Lido has launched Dual Governance on mainnet.

Infinex has listed the International Meme Fund ($IMF).

Hyperdrive has launched the $HYPE Assistance Fund (HHAF).

QUICK BITES

Aave surpasses $50B in net deposits.

$3.5M exploit hits DeFi platform Arcadia on Base.

Metaplanet buys additional 797 BTC for nearly $94M.

JPMorgan CEO Dimon says bank will pursue stablecoins.

Bitcoin becomes world’s fifth-largest asset by market cap.

Trump urges GOP support for stablecoin, crypto clarity bills.

Fairshake amasses $141M war chest ahead of 2026 elections.

Strategy resumes BTC buys, acquires 4,225 BTC for $472.5M.

Fidelity subsidiary becomes largest shareholder of Metaplanet.

Grayscale confidentially files draft IPO paperwork with US SEC.

US Justice Department and CFTC close probes into Polymarket.

House scraps Tuesday votes on crypto bills after procedural failure.

Cantor Fitzgerald SPAC to close $4B Bitcoin deal with Adam Back.

SharpLink becomes largest corporate ether holder with 280,706 ETH.

Federal Reserve, FDIC and OCC clarify rules for banks holding crypto.

Standard Chartered launches spot Bitcoin and Ethereum trading service.

NOTEWORTHY READS & MEME

If you enjoy reading this issue, please consider subscribing. It takes 1 minute of your time, but it would mean the world to us 🙇

Disclaimer: All the information presented in this publication and its affiliates is strictly for educational purposes only. It should not be construed or taken as financial, legal, investment, or any other form of advice.