Aster: The Hybrid Engine of Perpetual DeFi

Fusing Yielding Collateral, Hidden Orders, and TradFi Assets.

📢 Sponsor | 💡 Telegram | 📰 Past Editions

The Emergence of Aster in Perpetual DeFi

The perpetual swaps landscape within DeFi is undergoing a significant transformation. Once dominated by simple AMM models, the market is now shifting towards more sophisticated, on-chain order books. This new era for perpetual DEXs is exemplified by the recent successful launches of projects like Hyperliquid and Lighter. These new entrants have demonstrated the capacity to directly challenge CEXs, which have long held a monopoly on the perpetual futures market.

Among these new competitors, Aster has emerged as a notable player, even receiving praise from Changpeng Zhao (CZ), the former CEO of Binance. Aster aims to close the gap between the user experience of CEXs and the core tenets of decentralized platforms. An analysis of the protocol reveals a strategic approach to gaining market share, which is built on a foundation of unique architectural design, advanced capital efficiency models, and a strong emphasis on user protection and privacy.

A Strategic Merger: From Astherus & APX Finance to Aster

The foundation of Aster is the result of a deliberate strategic move: the late 2024 merger between two distinct protocols, Astherus and APX Finance. This union was designed to combine the core strengths of each project into a single, comprehensive platform.

Astherus, originally a multi-asset liquidity hub, contributed its yield-generating products, which have been integrated to form the Aster Earn component of the platform. APX Finance, on the other hand, provided its specialized infrastructure for decentralized perpetual contracts, which now serves as the technological backbone for Aster's trading services.

The platform's subsequent rebrand to Aster in March 2025 solidified its new identity and marked a clear shift toward becoming a leader in the decentralized perpetual exchange space. This origin story is a crucial part of Aster's strategy, allowing it to diversify beyond its primary perpetual trading service and build a multi-layered ecosystem

Aster is built to offer a seamless, powerful, and truly decentralized on-chain derivatives trading experience. The platform’s vision is a fusion of the efficiency found in centralized exchanges with the self-custody and transparency that are fundamental to DeFi. Its value proposition is centered on a design that provides both user-friendly and professional-grade tools. Key features include MEV-free execution and one-click trading to simplify the experience for all users, alongside advanced capabilities like a full suite of advanced order types and unique stock perpetuals. By offering a diverse range of functionalities, Aster aims to serve a broad audience, from beginners to professional traders, thereby enhancing its scalability and expanding its target market.

Foundational Infrastructure and Technical Architecture

The Aster Chain: A Purpose-Built, Privacy-Centric Layer-1

Aster's long-term strategy involves migrating to its own specialized Layer-1 blockchain, the Aster Chain. This decision is aimed at building a high-performance network specifically optimized for derivatives trading, a move that will grant the protocol greater autonomy and potential for expansion. This strategic direction is influenced by the success of platforms like Hyperliquid, which have demonstrated that a specialized Layer-1 can offer significant advantages in throughput and low-latency execution compared to general-purpose blockchains. By controlling its own infrastructure, Aster intends to overcome the limitations of building on multi-purpose chains and reshape the competitive landscape of on-chain derivatives.

A core component of the planned Aster Chain is the use of Zero-Knowledge Proofs (ZKPs). This technology is designed to enable private, non-custodial order book trading, which helps to minimize front-running risks and maximize transaction throughput. A key feature enabled by ZKPs is Hidden Orders, which remain invisible to the public until they are executed. This focus on on-chain privacy is a strategic effort to attract professional and institutional traders who prioritize discretion and protection from exploitative trading practices. The chain is currently in its beta phase, accessible only to a select group of traders.

Order Matching and Execution: Centralized Limit Order Book (CLOB) and MEV Resistance

Aster's core trading infrastructure is built on a Centralized Limit Order Book (CLOB) model. This design choice provides a significant user experience advantage, as it offers a familiar interface with a depth and liquidity that closely resembles centralized exchanges, all while maintaining the self-custodial nature of a decentralized platform. The protocol operates in two distinct modes to cater to a diverse range of users

Simple Mode: A user-friendly interface offering MEV-free, one-click execution with high leverage up to 1001x.

Pro Mode: Provides a full order book, advanced trading tools, and various order types for more experienced traders.

The implementation of a CLOB combined with a focus on MEV-free execution is a direct response to the inefficiencies and risks inherent in other DEX models. This technical architecture is a deliberate effort to attract both retail and professional traders by narrowing the experience gap between on-chain and CEX trading, thereby broadening the platform's user base and enhancing its scalability.

Liquidity and Capital Efficiency: The Cornerstones of Aster's Design

Aggregating Deep On-Chain Liquidity

Aster's liquidity strategy is a core component of its business model, stemming from its origin as a merger between a perpetual trading protocol and a liquidity hub. The platform's approach involves aggregating liquidity from multiple blockchain networks, which enables seamless cross-chain execution without requiring users to manually bridge their assets. This method is designed to provide the robust liquidity needed to support high-volume trading and has been cited as a key factor in Aster's rapid growth.

This strategy is an example of a self-reinforcing liquidity model. The platform's internal capital, or inside liquidity, is used to facilitate trading, which in turn attracts and draws in external capital, or outside liquidity, from other users. By allowing assets to be used as collateral, Aster effectively transforms its users' yield-bearing capital into a source of liquidity. This creates a continuous feedback loop that addresses the common DeFi challenge of inefficient asset utilization.

The Capital-Efficient Collateral Model

Aster's collateral model is built around accepting yield-generating assets as margin for perpetual trades, a significant innovation for on-chain trading. This includes assets like liquid-staking tokens such as asBNB, which are receipts for staked cryptocurrency that continue to earn yield. It also features its native stablecoin, USDF, which is fully collateralized and convertible 1:1 with USDT. USDF generates passive returns for holders by using delta-neutral strategies on its underlying collateral, which are designed to hedge against price volatility and create a low-risk return.

This mechanism creates unparalleled capital efficiency by allowing users to use assets that are already generating yield as collateral for leveraged trading. This means a user's capital is not idle, it is simultaneously earning yield from the collateralized asset and being actively used to support trading positions. This integration of the "earn" and "trade" functions distinguishes Aster from its competitors by pioneering a hybrid business model where liquidity provision and trading are tightly linked, forming a self-contained ecosystem.

Advanced Trading Features: Privacy and Strategic Order Types

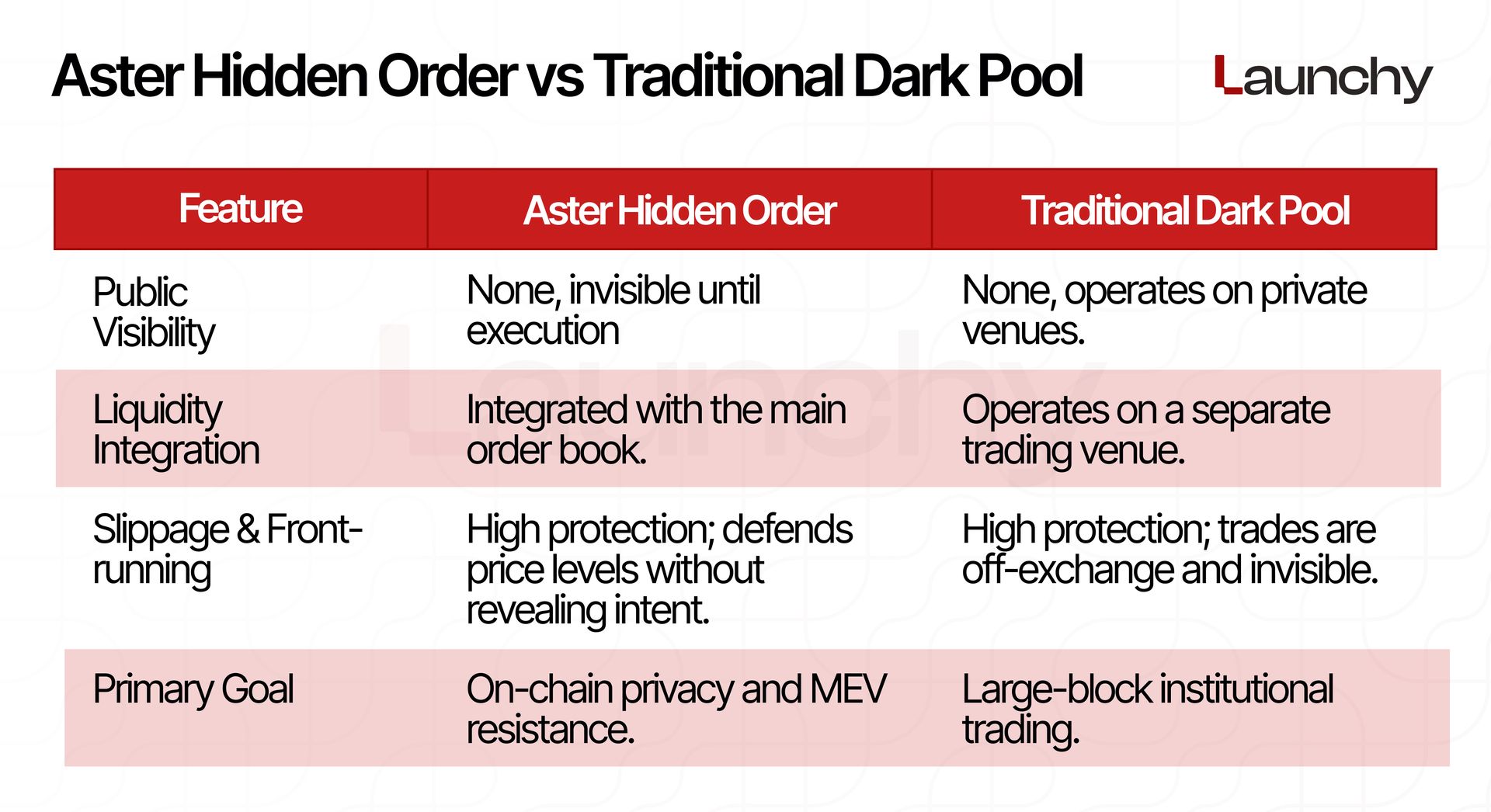

Understanding Dark Pools and Their Role in Traditional and Decentralized Finance

In traditional finance, dark pools are private exchanges that enable large institutional investors to execute significant block trades anonymously. The primary purpose of these venues is to prevent substantial orders from causing sudden shifts in public market prices. Dark pools operate by matching large buy and sell orders away from public order books, with bid and ask data remaining private and non-public. A notable drawback of this system, however, is the inherent lack of transparency and the potential for market fragmentation, as these trades are conducted on separate, non-public platforms.

Aster has introduced "Hidden Orders" as a feature for its Pro Mode, which represents a significant on-chain innovation. Unlike traditional dark pools, which operate on separate infrastructure, Aster’s Hidden Orders function directly within the main matching engine. A trader who selects this option places a limit order that remains completely invisible on the public order book, with its presence, price, and quantity only becoming apparent after execution.

This design choice is a direct response to the critical problems of front-running and MEV exploitation in decentralized trading. By fully concealing their intentions, high-volume traders can enter or exit large positions without signaling their moves to competitors or predatory bots. This functionality represents a clear advancement over traditional iceberg orders, which only hide a portion of the total order size, thereby compromising a degree of anonymity and strategic intent.

The technical and strategic superiority of Aster’s Hidden Orders lies in their integrated liquidity. Because they operate within the platform’s primary order book, they preserve deep, unified liquidity, effectively mitigating the liquidity fragmentation that is a known drawback of traditional dark pools. The introduction of this feature positions Aster as a leader in on-chain privacy for trading and a direct competitor to centralized venues that have historically held a monopoly on such tools

Competitive Landscape and Market Positioning

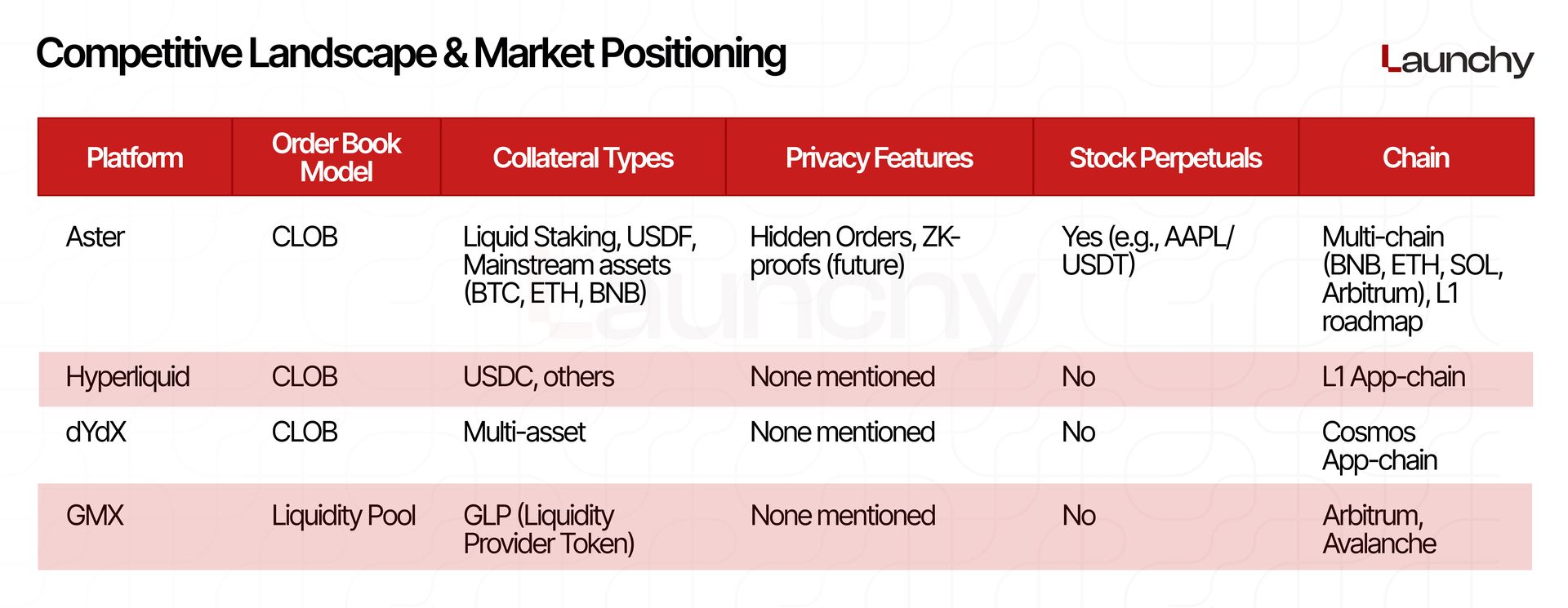

Aster's competitive strategy is multifaceted, positioning it against market leaders by addressing their weaknesses and introducing unique features.

Aster vs. Hyperliquid

Both platforms are high-performance, on-chain perpetual DEXs that use a CLOB model. However, Hyperliquid currently holds a dominant market position due to its single-chain L1 architecture, which gives it a significant advantage in speed and low-latency execution. Aster differentiates itself by:

Capital Efficiency: Aster offers a unique collateral model that accepts yield-generating assets, a feature that Hyperliquid lacks.

Traditional Finance Integration: Aster bridges the gap between traditional finance and decentralized finance by offering stock perpetuals, a feature not available on Hyperliquid.

Architecture: While Aster is currently a multi-chain protocol, its roadmap includes the development of its own L1, the Aster Chain, a move inspired by Hyperliquid's success.

Aster vs. dYdX

Both protocols utilize a CLOB model. dYdX operates as an app-chain on the Cosmos SDK, whereas Aster is building its own planned L1. Aster’s distinguishing features include:

Margin Flexibility: Aster offers a flexible single and multi-asset margin system that allows for greater capital efficiency.

Innovative Trading Tools: The platform has introduced innovative features like Hidden Orders and on-chain stock perpetuals, giving it a competitive edge in attracting professional traders.

Aster vs. GMX

This comparison highlights two fundamentally different architectural models. GMX uses a liquidity pool model, with its GLP token serving as a liquidity provider and the counterparty to all trades. This is distinct from Aster's order book model, which is designed to attract professional traders seeking tighter spreads and lower slippage. GMX remains a strong choice for users seeking passive yield from liquidity provision, while Aster's model appeals to those who prioritize an active trading experience that mirrors centralized exchanges.

Performance Metrics and Growth Trajectory

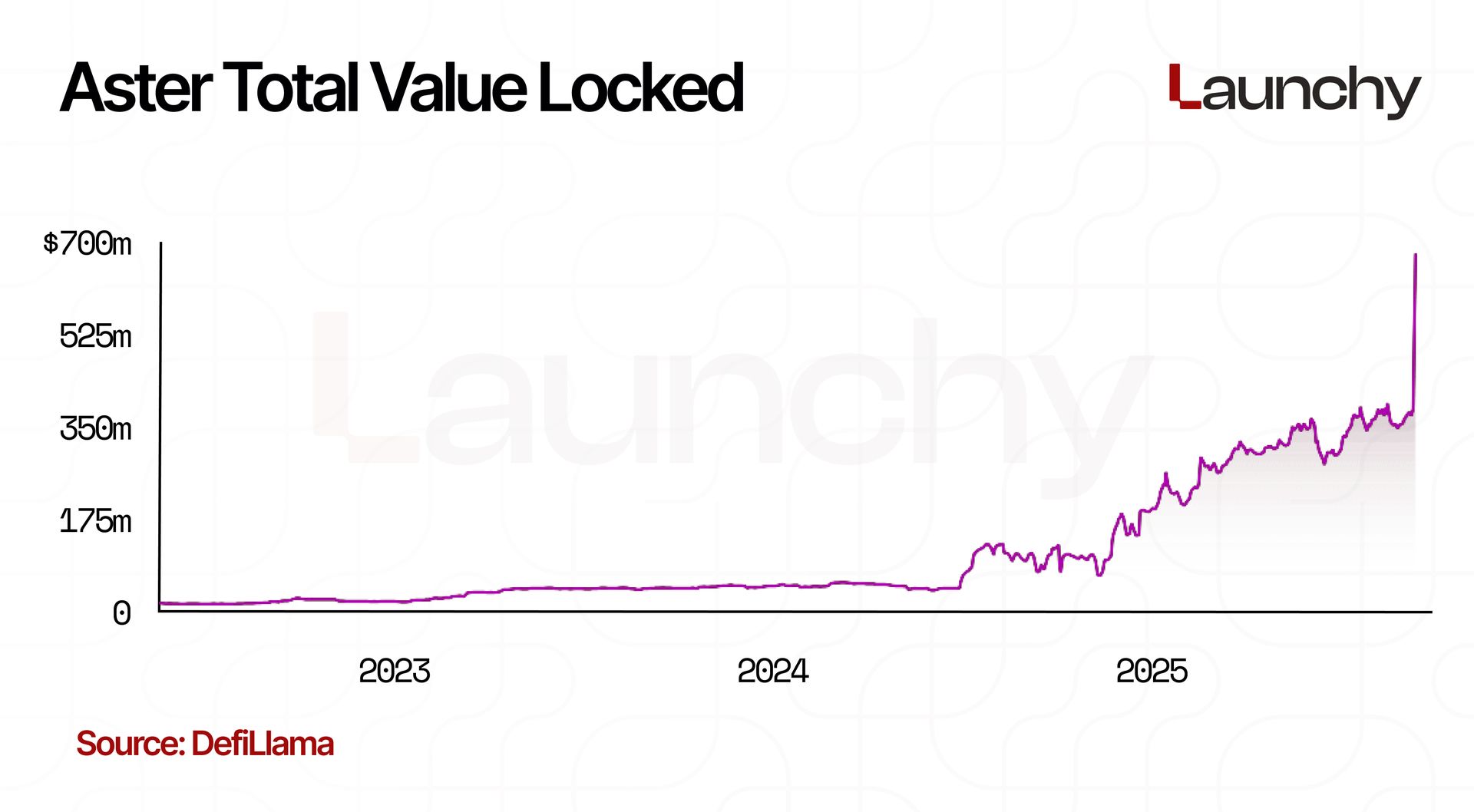

Total Value Locked (TVL)

Aster's TVL has demonstrated remarkable growth, particularly in recent months. The platform's TVL was below $100M before July 2024, but by December 2024, it had climbed to $187.18M, representing a growth of ~300%.

The momentum accelerated significantly in 2025. In the first nine months of the year, Aster recorded an additional TVL growth of ~260%, an increase that was largely attributed to a single tweet from CZ. Following CZ's tweet, Aster's TVL skyrocketed, experiencing a gain of ~76% in just two days. This event highlights the substantial influence that key figures can have on a project's market perception and capital inflows.

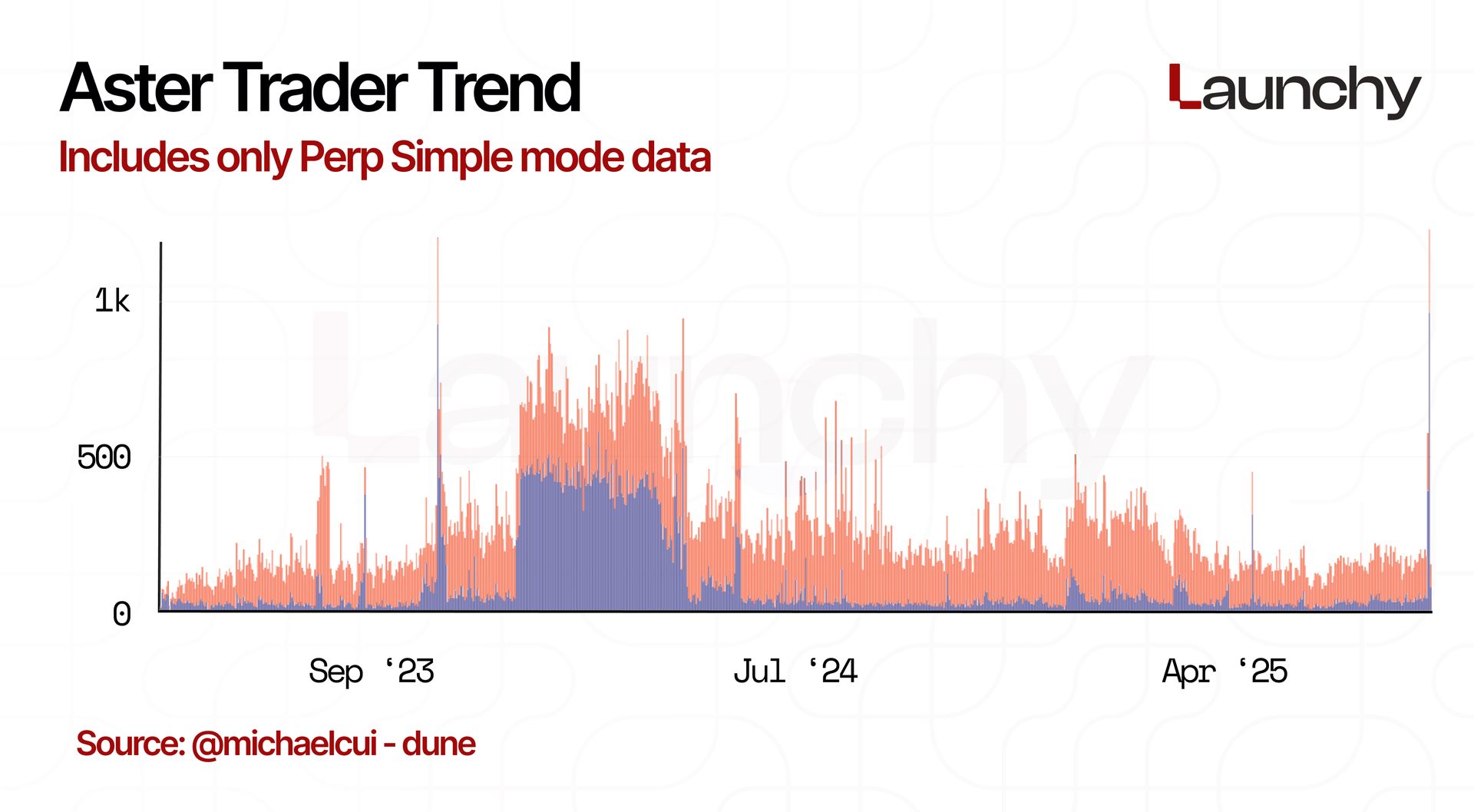

Trader

From the provided data, a clear picture of Aster's user base emerges, showing distinct phases of growth and activity. The period between December 2023 and April 2024 appears to have been a significant moment for the platform, with daily traders consistently ranging from 500 to 1,000. This influx of activity suggests a "golden era" dominated by new users exploring the platform.

However, a decline followed. In 2025, prior to a recent surge, the number of daily traders fell and largely remained in the range of 100 to 200, rarely exceeding 400. This period of lower user engagement was significantly interrupted by a tweet from CZ, which caused a sharp increase in trading activity. Following this event, the number of traders jumped to the 500 level, although it did not reach the higher peaks seen during the earlier "golden era." This indicates that while the external validation from CZ provided a major boost, it has yet to fully restore the platform's peak user participation levels.

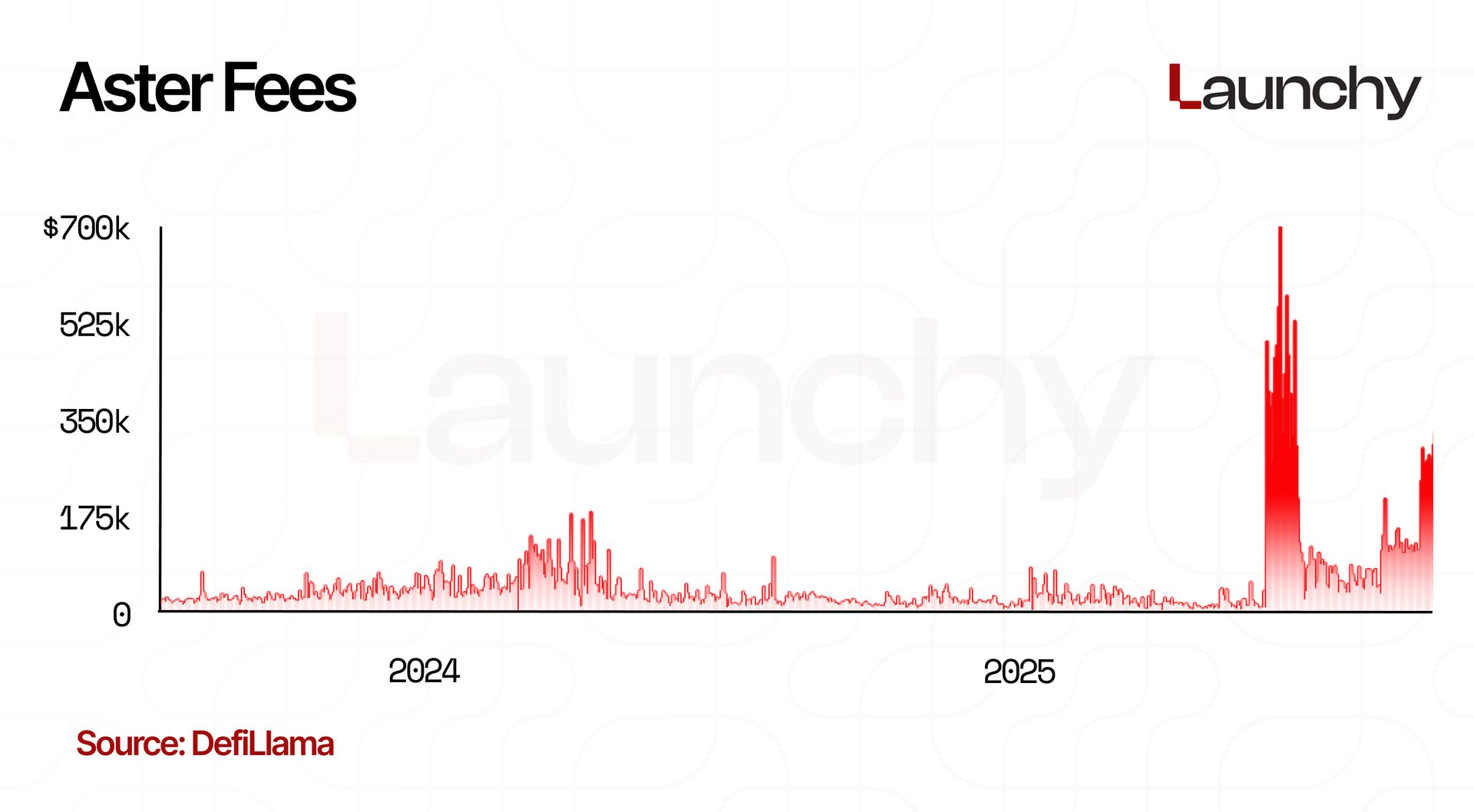

Fees

Fees generated on the Aster platform have shown a strong correlation with user activity and it came singlehandedly from perp fees.. In 2024, the "golden era" for traders, fees fluctuated between $10K and $100K. Following this period, fees saw a significant decline.

This trend was abruptly reversed in June 2025, when fees suddenly soared to $700K in a single day, largely driven by the Aster Spectra Stage 1 event, which concluded on June 22, 2025. After the event's conclusion, fee generation slowed down before beginning to rise again. The fees then saw another major spike, reaching a level of ~$500K, following a key tweet from CZ, demonstrating the profound impact external validation can have on platform activity and revenue.

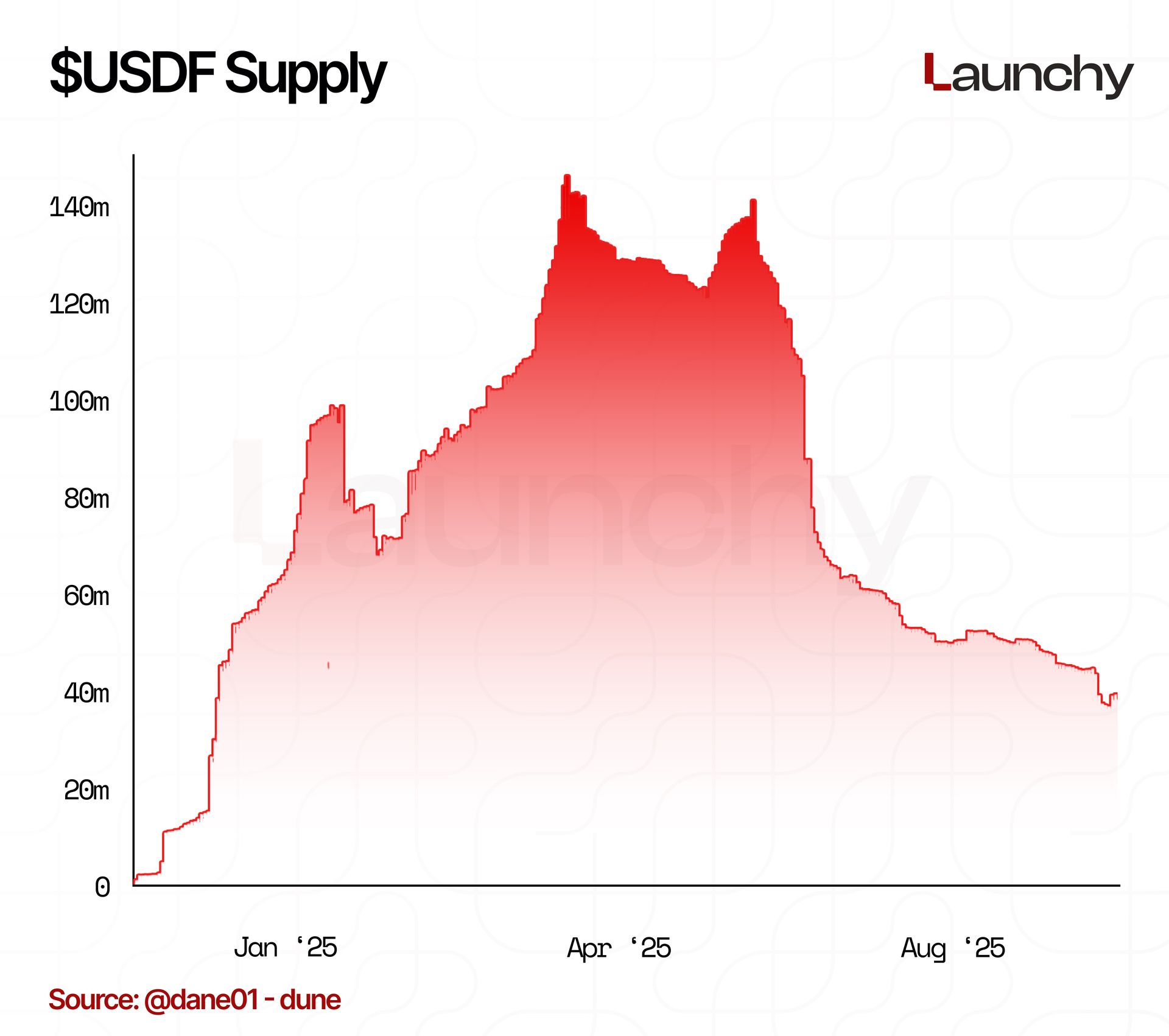

USDF Supply

The supply of USDF, Aster's native yield-bearing stablecoin, experienced a significant trajectory in the first half of 2025. Ending 2024 at ~$60.5M, the supply of USDF continued to grow, reaching an ATH of ~$146.5M on April 2, 2025. Following this peak, the supply has been in a sustained decline. The drawdown has been substantial, with the current supply decreasing to a level similar to early December 2024, representing a reduction of almost 75% from its ATH.

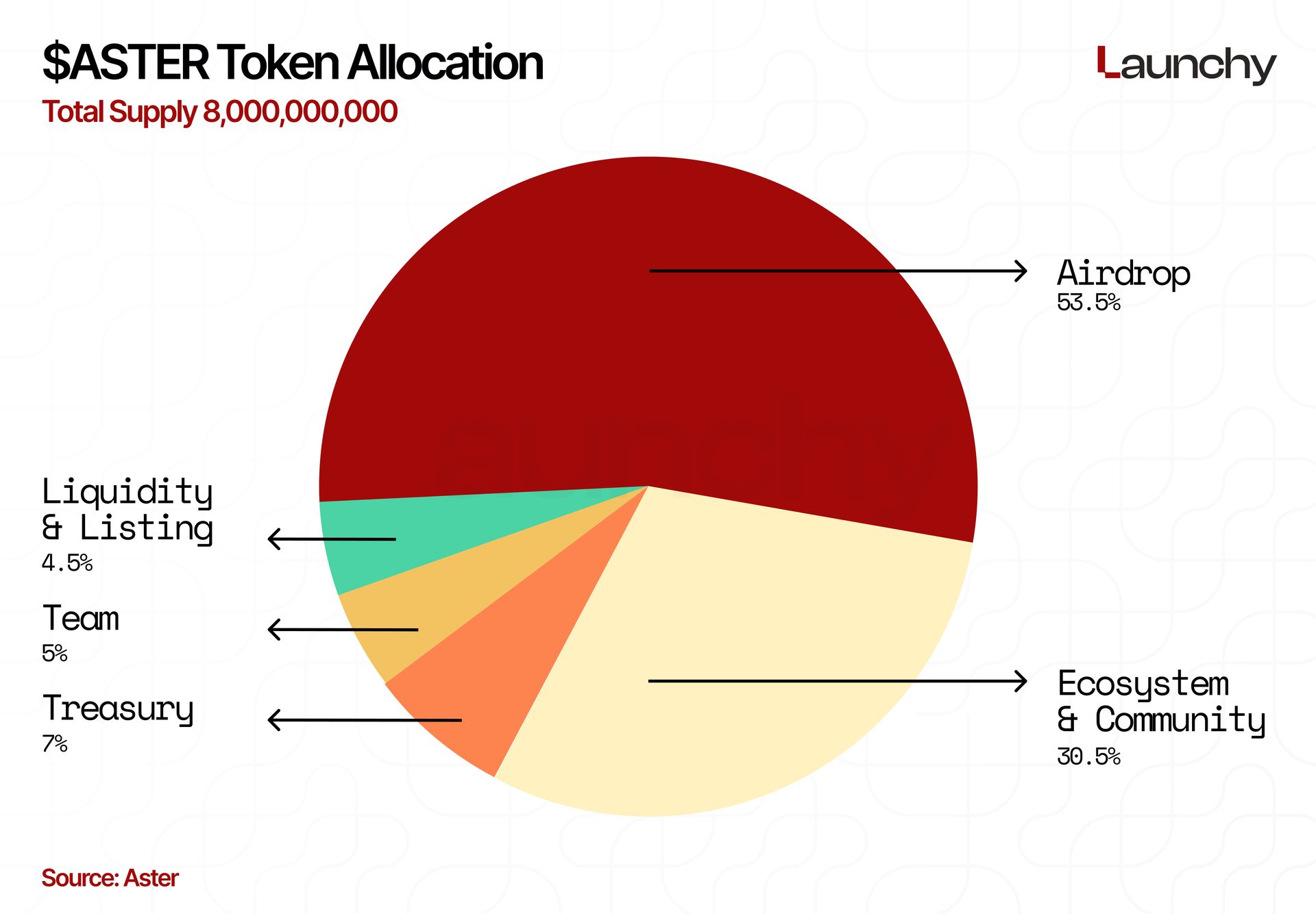

ASTER Tokenomics

The ASTER token is a central component of the platform's ecosystem, designed with a focus on community empowerment and decentralization. A core aspect of its tokenomics is a significant allocation of over 50% of the total 8B token supply to airdrops and community rewards. This strategy is a deliberate effort to bootstrap a loyal user base and foster long-term engagement, addressing a common challenge faced by new DEXs.

The token serves multiple utilities, including:

Governance: Holders of ASTER tokens can participate in decentralized governance, giving them a voice in decisions regarding protocol development, fee structures, and strategic direction.

Trading Fee Discounts: The token provides utility for traders by offering fee discounts, incentivizing its use and encouraging platform loyalty.

Staking Rewards: ASTER tokens can be staked to earn rewards, which aligns stakeholder interests and encourages long-term holding.

Final Thoughts

Aster's emergence in the decentralized perpetuals market is a strategic attempt to redefine the on-chain trading experience by fusing the best elements of CEXs with the core principles of DeFi. Its value proposition rests on three key pillars: a CEX-like user experience powered by a CLOB, an innovative capital-efficient collateral system that accepts yield-bearing assets, and a suite of advanced privacy features designed to attract professional traders.

While Aster enjoys strong backing (Yzi Labs) and has leveraged high-profile endorsements to achieve significant market momentum, it faces notable challenges. The protocol's long-term viability hinges on its ability to sustain user activity and liquidity beyond the initial hype from its TGE and airdrop campaigns. Its most ambitious and potentially risky undertaking is the development and migration to the Aster Chain. The success of this move will be the ultimate test of its ability to evolve from a hyped project into a core infrastructure provider capable of solving persistent industry issues like capital inefficiency and a lack of privacy in decentralized trading.

If you enjoy reading this issue, please consider subscribing. It takes 1 minute of your time but it would mean the world to us 🙇

Disclaimer: All the information presented in this publication and its affiliates is strictly for educational purposes only. It should not be construed or taken as financial, legal, investment, or any other form of advice.