$8B AAVE Conglomerate Rebrands

Taproot Wizards $7.5M Seed | Ansem Soylana Manlets

📢 Sponsor | 💡 Telegram | 📰 Past Editions

Happy Friday. The crypto markets are pulling back a bit but Solana remains strong amidst the upcoming Jupiter aggregator and Pyth Network airdrop. Meanwhile, Ethereum Devconnect is still ongoing in Istanbul and the BlackRock spot Ethereum ETF filing is confirmed. Have a good weekend.

In Today's Email:

What Matters: Aave rebrands 👻

Founders Highlight: Ansem the OG 🐂

Deal Flows: Taproot Wizard 🧙

Narratives: Market is retracing, stay cautious as we can easily go down 30-40%, especially alts, if the upward momentum dissapears.

WHAT MATTERS

Aave Companies Rebrands to Avara

State of play: Aave Companies is rebranding to Avara. Aave will still exist but through Aave Protocol and Aave Labs, under Avara’s umbrella brand.

Aave Companies is known for Aave Labs, Aave Protocol, the GHO stablecoin, and Lens, a decentralized social network protocol.

$8.66B of liquidity is locked in Aave across 8 blockchain networks.

This is not the first time the company has changed its name; it was originally called ETHLend before becoming Aave. Stani Kulechov, Aave's founder, said this will be the final name change.

Avara has also acquired Los Feliz Engineering, creators of the Ethereum-based wallet Family; deal terms were not disclosed.

Avara intends to leverage its acquisition of the Family crypto wallet to facilitate user entry into the web3 ecosystem.

Family is currently in a beta phase.

Family is Avara’s second acquisition after Sonar, a metaverse mobile application, in December 2022.

Why it matters: Stani Kulechov said that the acquisition signifies the company’s desire to 'do more' and extend its focus beyond DeFi, aiming to bring web3 to 'all users globally with different kinds of use cases.'

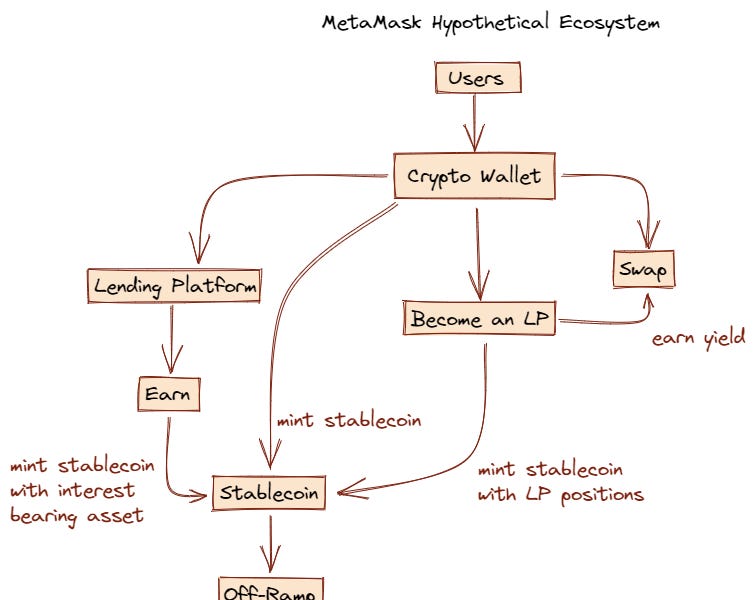

For builders and investors: I’ve said that DeFi protocols will continue to vertically integrate to own the entire user experience flow and receive more revenue.

This is just another step in that direction — also a crypto wallet is just insanely profitable.

This is insane. $340k PER DAY in swap fees by Metamask. That annualises to $120M yearly.

@MetaMask is probably one of the strongest native crypto businesses generating bigtech revenues right now. Yet, this is purely based on one revenue stream (swaps).

Kudos to @Consensys 🔥 twitter.com/i/web/status/1…

— cpt n3mo (@cptn3mox)

4:40 AM • Nov 17, 2023

IN PARTNERSHIP WITH

Raremints

Bear markets are the best time to find your next 10x crypto opportunity.

Subscribe to RAREMINTS to get daily Web3 insights straight to your inbox and stay ahead of the curve, for free.

Join 10,000+ investors and builders from Binance, KuCoin, Animoca Brands, and more 👇

BUILDER-INVESTOR HIGHLIGHT

Ansem, King of Soylana Manlets

Ansem is an extremely well-known crypto Twitter personality who has built a following by spotting trends early across the onchain ecosystem.

Now, he’s Head of Research at TCG Crypto, an extension of The Chernin Group (TCG) that invests in early-stage consumer crypto companies.

Note: we can’t confirm if Ansem is still at TCG as there’s no mention of him on TCG’s website page or LinkedIn, but we’re assuming that he’s given that there hasn’t been any follow-up announcement since he joined in October 2022.

Previous backgrounds: Before joining TCG Crypto, Ansem worked at Capital One as an Associate Software Engineer for four years from 2017-2021.

Ansem studied computer science at the Georgia Institute of Technology and graduated in 2017.

The big idea: Ansem believes that the three important themes that will shape crypto markets moving forward are modular architectures, mobile-focused applications, and optimizations of MEV in blockspace.

Take a peek at our referral reward at the bottom of this issue. Share this newsletter and receive our list of 500 crypto VC individuals 👇

INSIGHTS

TRON Strength in Emerging Markets

@DaveWangMIA said that Tron has been the dominant chain for real-world payments, especially in emerging markets e.g., Latin America, Africa, and Asia.

He also shares his analysis of why businesses prefer stablecoins on TRX:

In essence: Businesses value Tether's distance from the US as an advantage, not a weakness. Non-US customers think that USDC is more vulnerable to the action of US regulators such as the SEC and the Fed.

In terms of liquidity, TRC-20 USDT has amassed the largest pool at $47B, exceeding ERC20 and offering 23x more USDT compared to SOL and 94x more than on Polygon.

TRC-20 USDT offers direct on/off-ramps to major exchanges like Binance and OKEx, appealing to those unfamiliar with DEX.

TRC-20 USDT all-in transaction costs are comparable to a Solana Polygon or other L2s with a better user experience.

DEAL FLOWS

Taproot Wizards $7.5M Seed Round

Deal flows soared this week 📈 — we saw $295M+ in deals.

Taproot Wizards, a Bitcoin-focused Ordinals project, has raised $7.5M in a seed round led by Standard Crypto

Taproot Wizards co-founder Udi Wertheimer said that the project aims to “bring back the culture of building on Bitcoin.”

The money will be used to rebuild Bitcoin’s “wizard village,” which symbolizes the ecosystem’s desire to compete with other major blockchains like Ethereum and Solana.

Taproot Wizards has a limited mint of 2,121 wizards, the specific number paying homage to the total supply of Bitcoin: 21M.

In other news: Blockchain.com has raised $110M in a Series E round led by Kingsway Capital. It is now valued at less than half of its March 2022 valuation of $14B following its Series D.

Deal flows in the past week:

Napier, $1M Pre-Seed Round

Nirvana Labs, $1.2M Pre-Seed Round

EthXY, $1.6M Pre-Seed Round

Beoble, $2M Pre-Seed Round

Rho Protocol, $2.2M Pre-Seed Round

Glacier Network, $2.9M Seed Round

Union Labs, $4M Seed Round

Hinkal, $4.1M Seed Round

Taproot Wizards, $7.5M Seed Round

CFX Labs, $9.5M Seed Round

Ingonyama, $20M Seed Round

Kakarot, Undisclosed $ Seed Round

Modhaus, $8M Series A

Superstate, $14M Series A

Fnality International, $95M Series B

Blockchain, $110M Series E

Bazooka Tango, $5M Private Round

Sei, Undisclosed $ Strategic Round

Kenetix Network, Undisclosed $ Strategic Round

Arkham, Undisclosed $ Private Token Sale

Block Scholes, $3.3M Unknown Round

Kinto, $5M Unknown Round

QUICK BITES

Coinbase boosts commerce products.

MAS to start 'live' wholesale CBDC pilot.

Tether wants to become a major Bitcoin miner.

Pyth to airdrop 255M PYTH tokens to 90,000 wallets.

Tether and Bitfinex avoid facing appeal in a class action.

Anchorage launches custody and trading SMAs for RIAs.

CoinShares obtains the right to purchase Valkyrie’s ETF arm.

NYDFS releases guidance on crypto listing-delisting policies.

IOSCO publishes its crypto markets policy recommendations.

Binance & Thai Billionaire to start crypto exchange next year.

Aave Companies rebrands to Avara, acquired crypto wallet “Family”.

NOTEWORTHY READS

Conviction on a single prompt.

— BoldLeonidas 🧙♂️ (@boldleonidas)

1:23 PM • Nov 16, 2023

If you enjoy reading this issue, please consider subscribing. It takes 1 minute of your time but it would mean the world to us 🙇

Disclaimer: All the information presented in this publication and its affiliates is strictly for educational purposes only. It should not be construed or taken as financial, legal, investment, or any other form of advice.