$16B WLFI Ready For Token Transfer

Schwab's Spot BTC & ETH | UK’s $7B Seized BTC

📢Sponsor | 💡Telegram | 📰Past Editions

Good Morning.

Everybody and their washed-up L1 foundation is trying to launch a crypto treasury strategy. I’m not blaming them though. Remember that for the PIPE participants, worst they breakeven, best they profit. But retail buyers? Be careful!

Check out our latest episode with Elfa AI!

In Today's Email:

What Matters: WLFI Token Transfer Set for 6–8 Weeks 👀

Product of the Week: Schwab to Launch Spot Bitcoin, ETH 🚀

Charts: Bit Digital Adds 19.7K ETH, UK’s $7B Seized BTC Stockpile 🔎

You read and share. We listen and improve. Send us feedback at [email protected].

Narratives: ETH renaissance, watch ETH beta.

For daily market updates and airdrop alphas, check out our telegram!

TOGETHER WITH

Launch Your Brand with Pro-Grade Video, Without Breaking the Bank

We just launched something new in Launchy - a full-service video production agency designed specifically for your brand growth!

We specialize in:

🚀 Brand launch videos that highlight your products.

📱 Vertical & horizontal videos optimized for YouTube Shorts, TikTok, IG Reels, and more.

🎙️ Complete podcast production (video + audio), plus expert content repurposing.

✂️ Premium video editing for events and in-person moments.

We've already worked with over 20 clients and offer something rare in this space: pricing that's friendlier than any comparable offer you'll find.

If you have an upcoming video need or just want to learn more, we’d love to talk.

WHAT MATTERS

WLFI Token Transfer Set for 6–8 Weeks

State of play: World Liberty Financial plans to unlock WLFI token transferability within the next two months following a governance vote that passed with 99.94% approval.

The token, which has ties to Donald Trump through DT Marks DEFI LLC, currently trades at around $0.16 in pre-market activity.

The token has a fully diluted valuation of $16B, ranking it as the 11th-largest token by market cap.

Since launch, WLFI has seen $15M in pre-market volume, with pricing representing a 10x and 3x gain over previous sale rounds at $0.015 and $0.05.

The project, expected to be a white-labeled Aave fork, raised $550M by selling 25B tokens out of a total 100B supply.

The remaining WLFI tokens will be subject to a second community vote to determine their unlock and distribution.

Founders, team, and advisor tokens will be on a longer unlock schedule, including the 22.5B allocated to DT Marks.

As of last year, DT Marks held 15.75B WLFI, potentially valued at $3.6B at current prices.

Lawmakers have raised concerns about Trump's crypto affiliations, but World Liberty continues pushing forward with token plans, possible major exchange listings, and a potential airdrop of its USD1 stablecoin to early WLFI holders.

Our take: Despite one’s criticism of the project, at least they addressed the concern on insider vesting and token unlock transparently for the public.

For builders and investors: The success of WLFI will enable a more aggressive risk-taking behavior from other entities that have the ability to sell token.

PRODUCT OF THE WEEK

Schwab to Launch Spot Bitcoin, ETH

IMG: Investopedia

Charles Schwab CEO Rick Wurster announced that the firm will roll out spot BTC and ETH trading "sometime soon," viewing it as a major growth area. Wurster emphasized that Schwab clients already hold over 20% of all crypto ETFs in the industry.

Wurster also says that their clients are eager to consolidate crypto holdings from "digital native" platforms under Schwab's management.

The move follows the relaxation of crypto restrictions by US banking regulators in 2025, allowing institutions to offer crypto services without prior approval.

Schwab already provides access to Bitcoin and Ether ETFs, crypto-themed mutual funds, and Bitcoin options.

The firm currently manages $10.8T in assets, with crypto making up around $25B of that.

Wurster said Schwab aims to compete directly with exchanges like Coinbase by giving clients a trusted platform to buy and custody crypto assets.

Other cool products:

Take a peek at our referral reward at the bottom of this issue. Share this newsletter and receive our list of 500 crypto VC individuals 👇

CHARTS OF THE WEEK

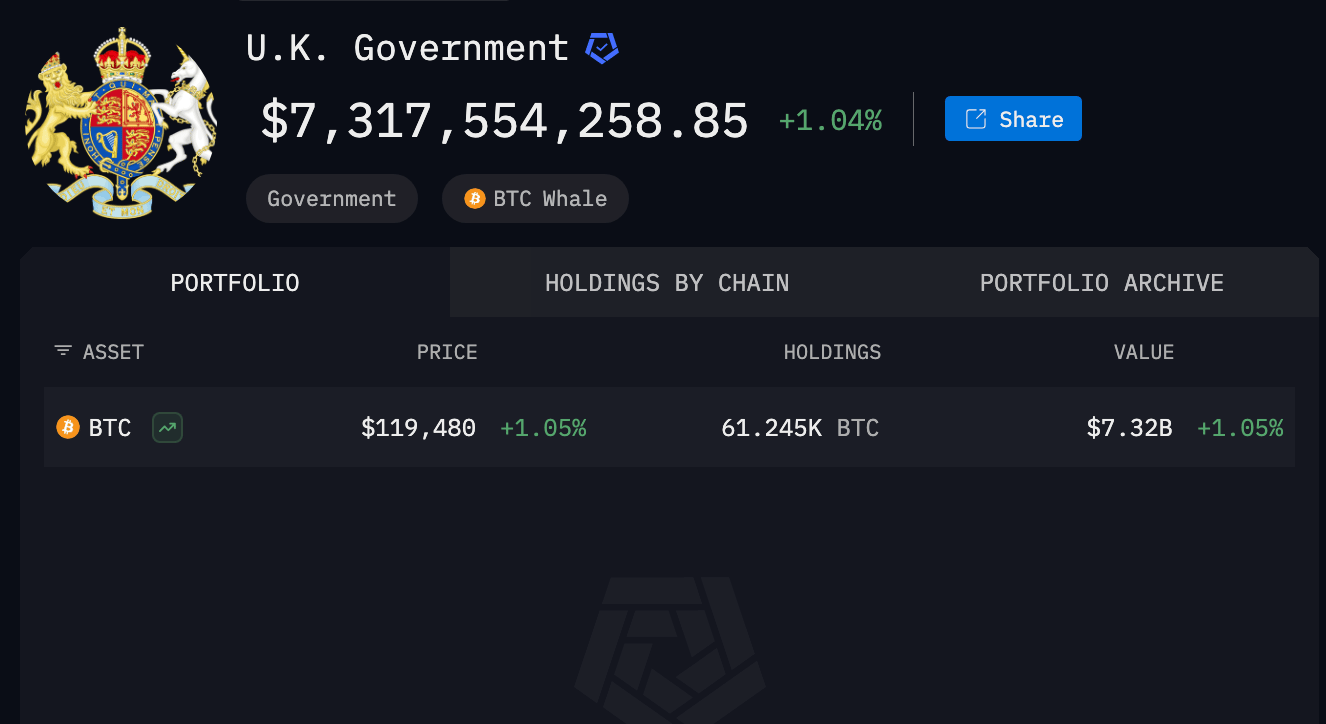

UK Plans Sale of $7B Seized BTC Stockpile

State of play: The UK Home Office is working with law enforcement to sell a large stockpile of seized Bitcoin, reportedly worth at least $7B based on a 2018 seizure of 61,000 BTC linked to a Chinese Ponzi scheme.

While victims are requesting the return of funds, the Crown Prosecution Service has asked the High Court for permission to retain the assets, which could then be transferred to the Treasury.

Chancellor Rachel Reeves, facing a budget shortfall, has expressed interest in leveraging seized crypto assets and in improving crypto regulations to foster fintech growth.

Meanwhile, the UK is offering a $53.7M, four-year contract to manage and liquidate seized digital assets, but has yet to receive suitable bids.

Legal timelines may delay the sale by up to four years in complex cases.

Our take: Government tends to sell directly so this is one to watch.

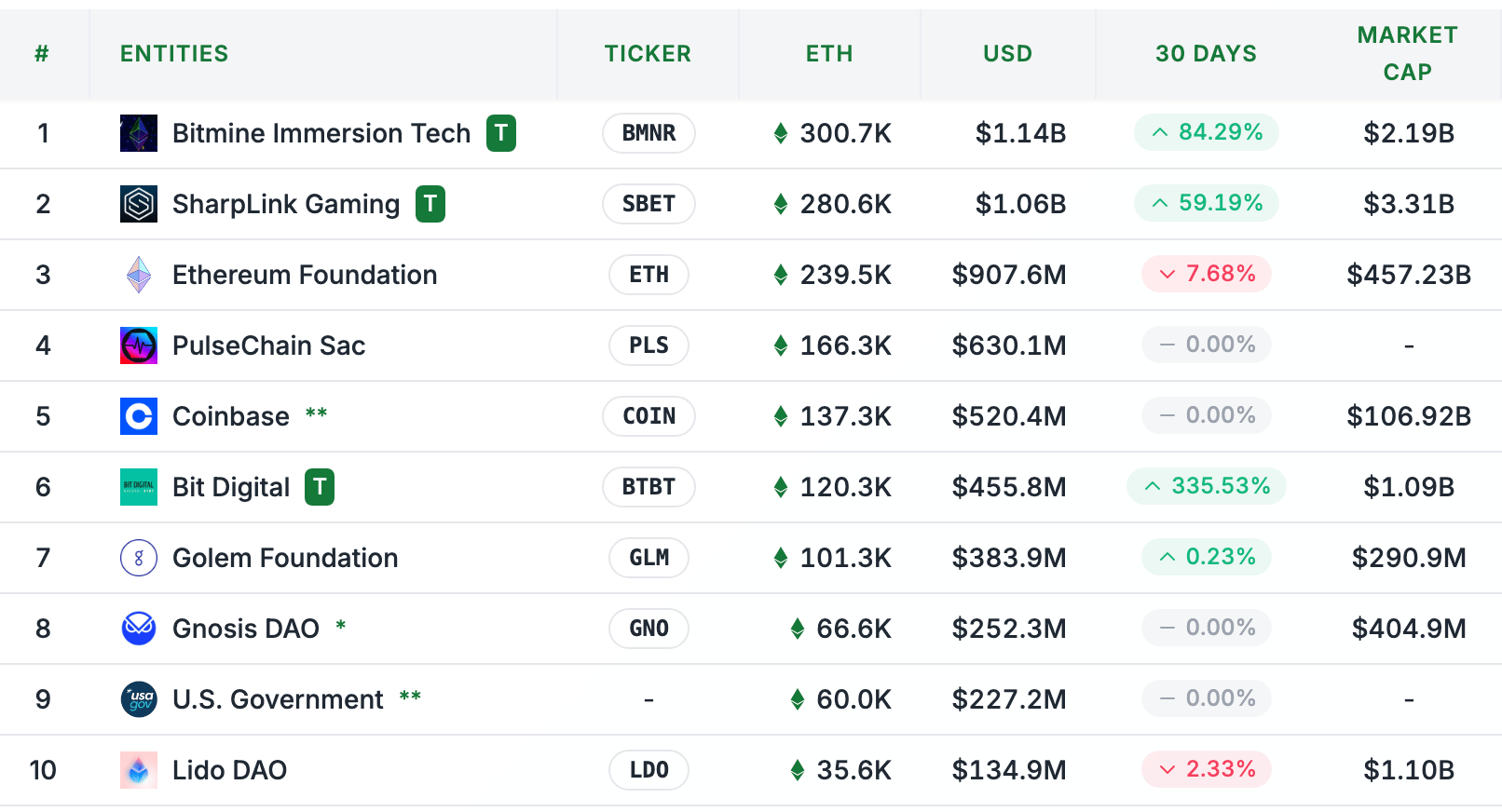

Bit Digital Adds 19.7K ETH

State of play: Bit Digital (Nasdaq: BTBT) has acquired an additional 19,683 ETH, bringing its total Ethereum holdings to 120,306 ETH, worth approximately $436M.

The purchase was funded through a $67.3M equity raise.

This move places Bit Digital among the top public ETH treasuries, behind only SharpLink Gaming and BitMine Immersion.

The acquisition comes amid surging interest from corporate treasuries and demand for spot ETH ETFs, which account for 10%+ of ETH market activity.

ETH recently topped $3,600, its highest price in six months, driven by institutional accumulation and improved staking yields.

Our take: ETH new ATH soon?

QUICK BITES

Trump signs the GENIUS Act.

Schwab to launch spot Bitcoin, ETH.

Block Inc. to join the S&P500 this week.

Conflux plans an offshore yuan stablecoin.

Total NFT market cap rebounds past $6B.

$PUMP erases gains less than a week after ICO.

Brahma taps Euler Finance for decentralized lending.

Aave DAO approves Ink Foundation to launch a white-label version.

Bit Digital acquires 19,683 ETH, growing treasury to 120,000+ ETH.

UK Home Office working towards the sale of $7B seized BTC stockpile.

Zora token rallies after Base App integrates its content tokenization tech.

World Liberty plans to unlock WLFI token transferability within two months.

NOTEWORTHY READS & MEME

everyone i met in crypto from this school is literally diddy or trying to become diddy

— Chang 🧪 (@chang_defi)

12:05 AM • Jul 21, 2025

If you enjoy reading this issue, please consider subscribing. It takes 1 minute of your time, but it would mean the world to us 🙇

Disclaimer: All the information presented in this publication and its affiliates is strictly for educational purposes only. It should not be construed or taken as financial, legal, investment, or any other form of advice.